Prepare your US Crypto Taxes Before EOFY

The EOFY for US taxpayers is the 31st of December. Here's what you need to know and do to prep your crypto taxes for the IRS.

Crypto investors who fail to file their taxes with the IRS by the 18th of April face steep penalties of up to 25% of their tax bill, a maximum of 3 years in prison, and a $250,000 fine.

So what’s the best way to avoid an unwelcome IRS audit?

Prep your crypto taxes. Follow these steps:

Know the key IRS crypto tax dates

Optimize your crypto portfolio before the EOFY

Know how the IRS taxes crypto

Gather all the information you need for your crypto taxes

Calculate your crypto taxes

Report your crypto taxes to the IRS

Let's dive in.

IRS Crypto Tax Dates

The US financial year runs from the 1st of January to the 31st of December every year. You need to report your crypto transactions for the previous financial year by the 18th of April the following year. This is usually the 15th of each year but may be extended in light of national holidays.

Act before the end of the financial year to pay less tax

It’s important to understand that if you want to optimize your tax position and pay less tax, you need to do this before the end of the financial year. Any transactions you make after this point won’t count towards your next tax bill but the following tax bill instead.

You'll find more advice on how to pay less crypto tax in this guide, but here are a few tips to prep your crypto taxes before the EOFY:

Hold assets for a year to benefit from a lower long-term Capital Gains Tax rate.

Pick the best cost basis method for your assets.

Utilize the standard tax deduction or itemize your tax deductions

Offset capital gains with up to $3,000 in capital losses per year.

Carry forward capital losses to future tax years to offset future gains.

Identify unrealized losses to realize and offset against gains.

Gift up to $17,000 of crypto per person tax free.

Donate crypto to registered charities to deduct it from your taxes.

Invest in an IRA or opportunity zone fund.

Seek out DeFi investments that grow your crypto asset in value, rather than pay you interest. You’ll pay Capital Gains Tax, which is a lower tax in general, instead of Income Tax.

How does the IRS Tax Crypto?

Crypto isn't actually seen as a currency by the IRS. Instead, it's seen as an asset - similar to a stock or a rental property. This makes your crypto subject to one of two possible taxes - Capital Gains Tax or Income Tax.

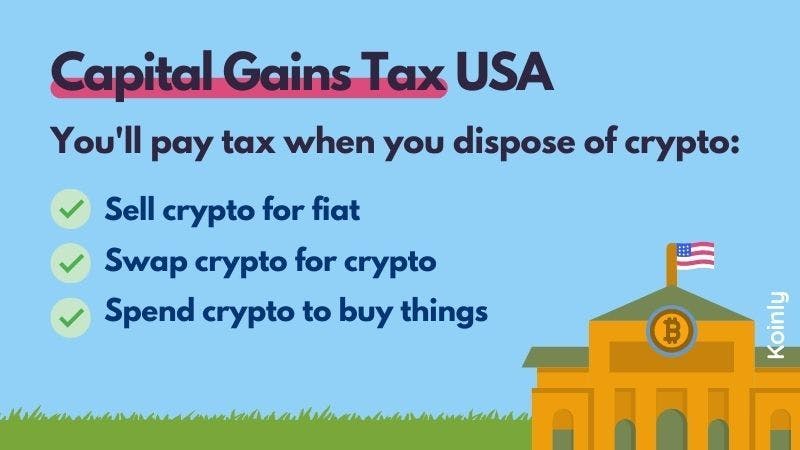

You'll pay Capital Gains Tax on any profit you make from 'disposing' of an asset.

Meanwhile, you'll pay Income Tax when you're earning crypto from the likes of staking, liquidity mining, airdrops, and so on.

Meanwhile, you'll pay Income Tax when you're earning crypto from the likes of staking, liquidity mining, airdrops, and so on.

You can find out more about how crypto is taxed in our US Crypto Tax Guide.

You can find out more about how crypto is taxed in our US Crypto Tax Guide.

What does the IRS need to know about crypto investments?

The IRS wants to know anytime you've made a taxable crypto transaction - whether you made a profit or a loss is irrelevant.

This is why it's vital that crypto investors keep accurate records of all their crypto transactions - for as long as they've been trading ideally.

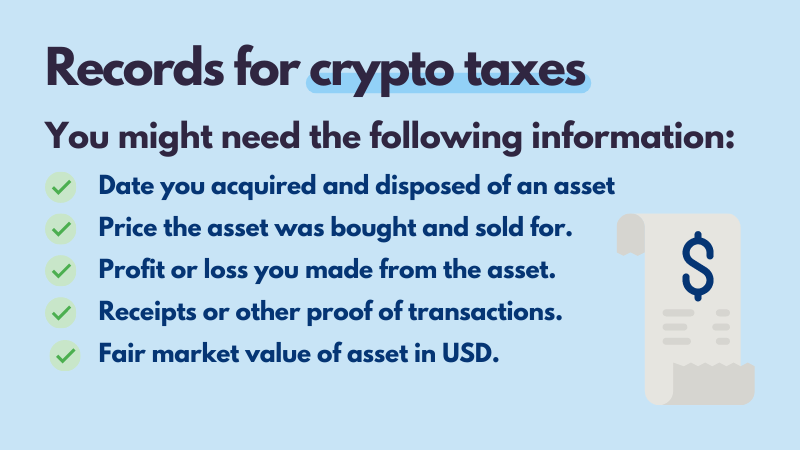

As a minimum, you'll need the following information about each of your crypto transactions:

The date you acquired an asset.

A description of the asset.

How much it cost you to acquire the asset (in USD).

The date you disposed of the asset.

The fair market value (in USD) of the asset the day you disposed of it.

The gain or loss you made from disposing of the asset.

Receipts, records, or other proof of transactions.

Of course, for crypto investors with a lot of transactions - keeping these records in itself is a challenge. But a crypto portfolio tracker and tax software can help.

How do I get my crypto tax information?

There are two ways you can go about getting the information you need to complete your IRS tax returns.

First, you can export files of transactions from all the crypto exchanges and wallets you use. These could be in the form of statements, transaction history, reports, etc.

You can then manually create one 'master' spreadsheet of all your crypto transactions.

This is quite a bit of work for investors who use multiple exchanges and have hundreds of transactions. As well as this, many exchanges don't offer a complete transaction data file. So you'll often have to combine multiple files from one exchange together to give an accurate reflection of your complete transaction history.

The second way to get the information you need is to use crypto tax software like Koinly. Koinly supports all major crypto exchanges, wallets, and blockchains, with step-by-step instructions on how to connect each:

And hundreds more!

Here's how simple it is...

Sign up for your free Koinly account.

Select your home country (United States), your base currency (USD), and your cost basis method (FIFO, LIFO, or HIFO).

Connect Koinly to all the crypto wallets and exchanges you use through API or CSV file import. Koinly integrates with more than 300 different exchanges, wallets, and blockchains. See all here.

Let Koinly crunch the numbers.

Your data is collected and your full tax report is generated, including specific IRS tax forms.

To download your crypto tax report - upgrade to a paid plan from $49 a year. See our price plans.

File your tax return yourself, through a tax app or hand your crypto tax report over to your accountant.

Where can you find more resources?

As a leading crypto tax company - it's our job to know the IRS crypto tax rules. We've got a variety of guides for US crypto investors to help you understand your crypto taxes better, including:

Our blog is also full of helpful advice on different crypto transactions and how they're taxed.

How do you report crypto to the IRS?

You need to declare all your crypto activity from January 1st to 31st December by the 18th of April the following year.

You declare your crypto activity in your Individual Income Tax Return (Form 1040). There are several other forms you'll need to do this. You can see our full how-to file guide, but in brief:

For crypto capital gains and losses - you'll need to complete Form 8949. This is a record of your taxable transactions. You'll attach this to Schedule D (Form 1040), which declares your net capital gain or loss.

For crypto income, there are a couple of IRS tax forms you may need. For income from airdrops, forks, or hobby mining - you'll need Schedule 1 (Form 1040). For income from staking rewards, liquidity pools, or other interest - you'll need Schedule B (Form 1040).

If you're self-employed or operating a crypto business - use Schedule C (Form 1040) to declare all your crypto income instead.