How to file your Trust Wallet taxes with Koinly - 2023 Guide

Whatever your crypto investments, Koinly can help you do your Trust Wallet taxes safely, quickly, and accurately.

Follow these steps to sync your Trust Wallet data automatically to Koinly:

- Open your Trust Wallet wallet app

- Copy the public address for every coin that you have on it (even the ones with a zero balance)

On Koinly:

- Create a free account on Koinly

- Complete onboarding until you get to the Wallets page and find Trust Wallet in the list

- Select API > Paste the public address/key you copied above in the appropriate box

- Hit Import and wait for Koinly to sync your data. This can take a few minutes

- Review your transactions on the Transactions page to ensure everything is tagged correctly and no missing data

- Go to the Tax Reports page to view your tax liability!

- Head over to our help center

- Hit up our discussion boards - we might have already answered your question

- Ask us on social media - we're on Twitter and Reddit

- Contact us on email or live chat

- Got a feature request? Give us feedback on Canny

The Trust Wallet app has single sign on to Koinly! If you're using the Trust Wallet App, just select discover, then Koinly, then connect to Koinly by selecting generate your tax report. If you're new to Koinly, you can sign up using your Trust Wallet account. If you have a Koinly account already, connect to that by selecting Already have a Koinly account? Sign in. If you've already created an anonymous account you'll need to delete this first in order to sign in to your existing Koinly account from Trust Wallet.

What is Trust Wallet?

Trust Wallet is a versatile crypto wallet that works natively with the Binance dex and Binance Smart Chain, as well as many other dApps. The official mobile wallet for Binance and a firm favorite for Ethereum investors, Trust Wallet lets you send, receive, and store cryptocurrencies and tokens as well as other digital assets like NFTs. Although the wallet is popular for Ethereum and Binance Chain investors, Trust Wallet supports more than 50 blockchains, allowing users to explore numerous DeFi ecosystems.

Is Trust Wallet safe?

Yes. Trust Wallet is widely regarded as a secure, hot wallet and is used by millions of investors around the world. However, your crypto is only as safe as you are. This means you should follow best security practices by using a strong, unique password, making sure to set up and store your seed phrase securely, and always keeping crypto you're not actively trading in a secure, cold wallet.

How to get your Trust Wallet tax documents

You can connect directly to Koinly using your Trust Wallet account to do your taxes come tax time and get your Trust Wallet tax documents in a snap. Do I pay taxes on my Trust Wallet transactions?

Yes. Your Trust Wallet transactions may be taxable if you have gains or income from your Trust Wallet investments. Crypto tax varies depending on where you live (so check out our country tax guides), but generally speaking, you'll pay either Capital Gains Tax or Income Tax on your Trust Wallet transactions:

Capital Gains Tax: If you sell, swap, or spend crypto on Trust Wallet then you've disposed of a capital asset and any gain may be subject to Capital Gains Tax. This includes other crypto assets like tokens, stablecoins, and NFTs.

Income Tax: If you earn new crypto - for example, from staking rewards, airdrops, or DeFi investments - then it is likely this will be viewed as additional income and subject to Income Tax upon receipt.

Does Trust Wallet report to the IRS?

It's very unlikely that Trust Wallet reports to the IRS currently. Trust Wallet is a non-custodial wallet and does not enforce KYC processes, so they'd have very little information to share if they did! At the time of writing, the IRS has been focused on getting crypto exchanges to share customer data to ensure tax compliance. This said, in the future as part of the changes brought about by the Infrastructure Bill, the reporting requirements may change to include tax reporting requirements for crypto wallets.

Can the IRS view my Trust Wallet transactions?

Yes, your Trust Wallet transactions are public - all the IRS needs is a wallet address to view all the transactions you've made. Almost all blockchains, including Ethereum and Binance Chain, are public ledgers. It means anyone - the IRS included - can look at the transactions a given wallet has made. The IRS has previously partnered with blockchain analyst firms like Chainalysis to match wallets to individuals.

How to get tax info from Trust Wallet

You need to report any gains, losses, or income from crypto investments to your tax office, including from your Trust Wallet account. Generally, this is done as part of your annual tax return.

You can do this yourself by identifying all your taxable transactions, the kind of tax that applies, your capital gains and losses for each disposal, and the fair market value in your fiat currency of any crypto income… but it’s time-consuming.

This is why most investors opt to use crypto tax software like Koinly. Koinly does all this for you and generates your tax report, ready to file with your tax office. Here’s how it works…

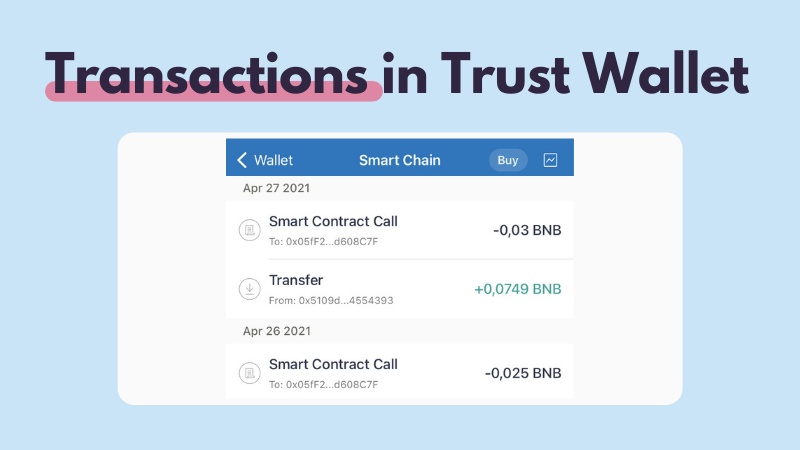

Koinly works by importing your Trust Wallet transaction data. Let's look at an example - here are some transactions in a Trust Wallet account.

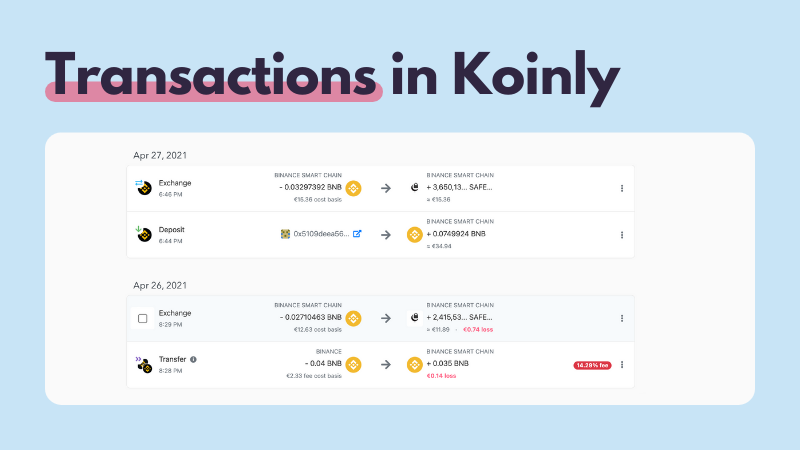

You can import your Trust Wallet transaction history via API integration which will sync your Trust Wallet transaction history automatically. Once you've done this, you'll be able to see your Trust Wallet transactions in Koinly - like this. Koinly can import all the data you need for Trust Wallet tax reporting including Trust Wallet staking rewards, sales, trades, liquidity pool transactions, and more.

You can import your Trust Wallet transaction history via API integration which will sync your Trust Wallet transaction history automatically. Once you've done this, you'll be able to see your Trust Wallet transactions in Koinly - like this. Koinly can import all the data you need for Trust Wallet tax reporting including Trust Wallet staking rewards, sales, trades, liquidity pool transactions, and more.

This lets you manage all your crypto transactions - from Trust Wallet and any other exchanges, crypto wallets, or blockchains you use - from one single platform, making crypto tax simple.

This lets you manage all your crypto transactions - from Trust Wallet and any other exchanges, crypto wallets, or blockchains you use - from one single platform, making crypto tax simple.

Is MoonPay on Trust Wallet?

Yes! Trust Wallet just announced a new partnership with MoonPay and Ramp. This partnership will let Trust Wallet users convert their crypto to fiat directly in the app.

Can I use TrustWallet for Pancake Swap?

Yes! Trust Wallet works perfectly with the popular dex PancakeSwap. All you need to do is head over to the PancakeSwap app, select connect wallet, and then select Trust Wallet. You'll then be able to make transactions on PancakeSwap using your Trust Wallet account. A word of warning though - your PancakeSwap transactions may be taxable. Find out more in our PancakeSwap tax guide.

Which should I use TrustWallet vs. Ledger?

Fortunately, if you're weighing up Trust Wallet vs. Ledger, you don't actually need to. Trust Wallet integrates with Ledger hardware via the browser extension, letting you store your crypto as securely as possible.

Which should I use Trust Wallet, MetaMask, Coinbase Wallet, or Exodus?

Trust Wallet vs. MetaMask, Trust Wallet vs. Coinbase Wallet, Trust Wallet vs. Exodus... the list goes on. How do you know which is the best crypto wallet to use? The answer is that it'll all depend on the right wallet for you. Each has its pros and cons and a lot of it will depend on the blockchains and dApps you want to interact with. But we've got a whole guide to help you pick out the best crypto wallet for you.

Your frequently asked questions

Does Trust Wallet send tax forms?

No. Trust Wallet does not issue tax forms to users. You’ll need to calculate your Trust Wallet taxes yourself or use crypto tax software to do it for you.

How to get tax info from Trust Wallet?

The easiest way to get your tax info from Trust Wallet is to connect automatically to crypto tax software like Koinly. All you need to do is get your public address from Trust Wallet and enter it into Koinly.

Does Trust Wallet require KYC?

No. You don't need to complete any KYC verification in order to use Trust Wallet.

Is Trust Wallet decentralized?

Trust Wallet is a non-custodial wallet with a built-in decentralized exchange where you’re responsible for your keys and crypto. However, it is owned by Binance.

Is Trust Wallet a cold wallet?

No. Trust Wallet is a hot wallet. As per best practices, we recommend you only store crypto in your Trust Wallet when you’re actively trading, otherwise, use a cold wallet.

Who owns Trust Wallet?

Binance Holdings Limited owns Trust Wallet.

Can Trust Wallet be hacked?

While Trust Wallet is a secure, hot wallet - your wallet is only as secure as you are. If you’re not following best practices for wallet security, your crypto may be at risk.

Can I do Trust Wallet taxes on TurboTax?

TurboTax doesn’t support crypto wallets directly. However, you can use Koinly to connect to Trust Wallet and generate a TurboTax Report, which you can upload straight to the platform to report your crypto taxes.

Does Trust Wallet provide CSV exports?

No, Trust Wallet does not provide CSV reports. But you may be able to use a blockchain explorer to get a CSV file of your Trust Wallet transaction history.

Does Trust Wallet provide financial or end of year statements?

No, Trust Wallet won't provide you with an EOFY statement, but if you integrate with crypto tax software, they can provide this for you.

Does Trust Wallet send 1099 forms?

No. Trust Wallet does not send 1099 forms to users. Currently, non-custodial wallet providers are not required to issue 1099 forms under existing US regulations. However, this looks set to change soon under new IRS guidance.

Is Trust Wallet an exchange?

No. Trust Wallet is not an exchange, it's a non-custodial hot wallet. But you can use Trust Wallet to swap and invest on decentralized exchanges like PancakeSwap.

Can you buy and sell Safemoon on Trust Wallet?

Yes. You can buy and sell Safemoon (SFM) on Trust Wallet, but you should DYOR before investing in any cryptocurrency. At the time of writing, there is a class action lawsuit filed against SafeMoon, alleging the company is a pump and dump scheme.

Is Koinly a Trust Wallet staking calculator?

Yes. Koinly isn't just a tax calculator! Koinly can calculate your gains, losses, and income - including the fair market value of any staking rewards in your fiat currency. Best of all, it's totally free to use.

How to get a Trust Wallet statement?

As Trust Wallet doesn't have a CSV export feature, the easiest way to get a Trust Wallet statement is to connect to crypto tax software like Koinly using your public address. Koinly can then import your transaction data, and you can export a variety of Trust Wallet statements for tax and accounting purposes easily.