How To Do Your TurboTax Crypto Taxes in 2024

Millions of U.S. taxpayers rely on TurboTax for their income tax filings, but crypto reporting is not TurboTax' strong point. There's a solution! Follow our step-by-step guide on how to boost your TurboTax crypto reporting with Koinly!

What is TurboTax?

TurboTax is a tax software program developed by Intuit that enables individuals and small business owners to prepare and file their taxes electronically. It offers a range of features such as step-by-step guidance, a user-friendly interface, and tools to help users identify tax deductions and credits. TurboTax is one of the most popular tax preparation software in the United States and is used by millions of taxpayers each year to help them file their state and federal taxes online, either solo or with the help of an accountant.

Does TurboTax do crypto?

Simple question, difficult answer. Yes, TurboTax Online somewhat supports cryptocurrency transactions, but the software isn't specifically designed to calculate or file crypto taxes and while the platform supports some popular exchanges and wallets, the integrations offered are far too limited for most crypto investors. As well as this, the automatic crypto import options for TurboTax are only supported for TurboTax Online, not TurboTax CD/Download (desktop).

Overall, if you have very basic transactions from crypto exchanges that TurboTax supports, you may be able to do your crypto taxes using TurboTax. But for most crypto investors, the current integrations are too limited (both in number and the data automatically imported) to calculate your crypto taxes accurately.

This is why most investors opt to use TurboTax with a crypto tax calculator like Koinly - and this guide covers exactly how to file using TurboTax and Koinly.

Skip ahead for instructions on how to file with TurboTax and Koinly.

Which crypto exchanges does TurboTax support?

TurboTax supports 10+ of the most popular crypto exchanges to varying degrees. Users can either connect using API, or upload a CSV file - but often the CSV file types are not supported by TurboTax and you'll need to manually edit them, or the API is limited in the data it returns. Here's a full list of the exchanges supported currently, and how they're supported:

Robinhood: Users can import tax forms automatically using their Robinhood ID and document ID

Coinbase: Single sign-on

Binance US: CSV

Bitstamp: API

Gemini: API

Crypto.com: CSV

Kraken: API (margins & futures not supported)

KuCoin: API (margins & futures not supported)

Gate.io: CSV*

Bittrex: API* (margins & futures not supported)

BlockFi: CSV*

Celsius: CSV*

Voyager: CSV*

eToro: CSV*

*These CSV files are not supported. Users will need to manually edit their data to fit the universal TurboTax CSV format. Find out how.

As well as this, there are a number of other platforms that allow crypto trading, but aren’t dedicated crypto exchanges, that TurboTax also supports to a certain extent, including:

SoFi

CashApp

Webull

PayPal

Which crypto wallets does TurboTax support?

TurboTax supports a limited number of popular non-custodial wallets, including:

MetaMask: Enter ETH or BTC key

Trust Wallet: Enter ETH, BCH, DOGE, or LTC key

Coinbase Wallet: Enter BTC, DOGE, LTC, or BCH key

Exodus: Enter LTC, DOGE, BCH, or ETH key

It's worth noting - TurboTax only supports a limited amount of automatic integration for these wallets. For example, you can automatically import your Ethereum or Bitcoin transactions on your MetaMask wallet using your public address or xpub key, but if you were using MetaMask to interact with Binance Chain or Polygon - these transactions would not be supported by TurboTax.

As well as this, for those adding their Ethereum public address to TurboTax, DeFi, margin, and futures trades are not supported currently.

Which cryptocurrencies does TurboTax support?

TurboTax supports a limited number of popular cryptocurrencies, by letting users add their public address or xpub key, or alternatively upload a CSV file. This includes:

Bitcoin: Enter public address

Ethereum: Enter public address, but DeFi, margin, and futures trades are not supported currently

Bitcoin Cash: Enter public address

Dogecoin: Enter public address

Litecoin: Enter public address

Tezos: CSV only

Ripple: CSV only

Polkadot: CSV only

Solana: CSV only

As you can see, for many Ethereum investors, the current integration on TurboTax will not be able to import DeFi transactions and more. For integrations where CSV is the only data import method supported, many wallets do not support CSV file export. You may be able to use a blockchain explorer with a CSV export option to get around this, but you will need to format your CSV file to fit the TurboTax universal CSV file format. If you're using multiple wallets for the same cryptocurrency (i.e. Phantom and Atomic for Solana), you'd need to combine multiple CSV files and format them to the TurboTax universal CSV format before you could upload them.

As well as this, there are a number of popular wallets where exporting your xpub key is difficult. We have a help guide on how to export your key from these wallets for Koinly users.

Can TurboTax track the cost basis of cryptocurrency?

TurboTax says its software can track the cost basis of cryptocurrency for supported exchanges. So for example, if you had bought crypto on Coinbase and then transferred it to Gemini to sell it, as these are both supported exchanges in TurboTax, then the software will be able to track your cost basis.

However, let's look at another example where TurboTax would struggle to track your cost basis. Let's say you bought ETH on Gemini, then moved it to MEXC to stake it, before moving it over to Coinbase to later sell it. In this example, TurboTax would not be able to track the cost basis of this crypto as you would have moved it to an unsupported integration.

As well as this, TurboTax cannot automatically handle any crypto income - from mining, staking, airdrops, and so on. What we mean by this is that TurboTax cannot identify the fair market value of crypto tokens considered income in USD on the day you received them. So you'll either need to do this yourself or use crypto tax software to save yourself hours of searching through price aggregators like CoinMarketCap.

Can I upload a crypto 1099 to TurboTax?

You can, and indeed sometimes these are the CSV files that TurboTax supports for some crypto exchanges. For example, for Robinhood, TurboTax asks you to connect to Robinhood and get your crypto 1099-B form. However, 1099-B forms are problematic for crypto as they cannot track cost basis if you've transferred crypto in from another exchange, or transferred crypto off to another exchange. As such, if you've transferred crypto on or off Robinhood (or any other crypto exchange issuing 1099-B forms), your 1099-B form may be incorrect and you may end up over or underpaying tax on your crypto investments.

Can TurboTax handle NFTs?

Good question. TurboTax says it supports NFTs for most of the blockchains it supports - for example, Ethereum.

Can TurboTax report crypto income from staking, mining, and airdrops?

Yes - but not automatically via any of the routes mentioned above as you don't report your crypto income in the same section. TurboTax can currently identify and calculate your disposals (that is when you sold, swapped, or spent crypto) for supported exchanges, wallets, or blockchains only. As such, you'll need to calculate any income yourself (or use a crypto tax calculator to do it for you) by identifying the fair market value of any crypto tokens on the day you received them in USD and reporting these figures in TurboTax. We've got steps on how to do that below.

With the big TurboTax crypto questions out the way, let's take a look at how to do your TurboTax crypto taxes with the help of Koinly.

How to report crypto taxes on TurboTax with Koinly

Koinly calculates your crypto gains and losses for tax reporting purposes and lists everything you need in a dedicated TurboTax report. Once you've downloaded your report, you'll need to upload it to TurboTax Online or TurboTax Desktop.

TurboTax & Koinly video tutorial

Watch our video to see how to file crypto taxes with TurboTax, or follow the instructions for reporting crypto taxes on TurboTax below.

Get set up on TurboTax & Koinly

To get started, you'll need to get set up and get the reports you need from Koinly, as well as get your account set up on TurboTax.

On Koinly

Sign up and set up your Koinly account by connecting all your wallets, exchanges, and blockchains. Make sure your settings are correct for the USA and select an allowable cost basis method.

Download the TurboTax Export from the tax report page in Koinly. If you have income or other allowable expenses, or if you'd like to compare your totals in TurboTax to ensure accuracy (we recommend doing this), you may also want to download the Complete Tax Report from Koinly.

On TurboTax

Sign up or log in to your TurboTax account. Please note you'll need the Premier Plan or higher on both the online and desktop versions to do your crypto taxes.

Fill out your personal information for your TurboTax account as it relates to your circumstances. We'll only be covering how to file your crypto taxes in this guide. If you need help learning how to file using TurboTax generally, you can find more information on the TurboTax site.

Where to enter crypto in TurboTax

There are two different sections you may need to head in your TurboTax account to do your crypto taxes:

Capital gains and losses

Crypto income

Let's look at each.

If you need a quick refresher on how crypto is taxed in the US - check out our US crypto tax guide.

How to report crypto capital gains in TurboTax

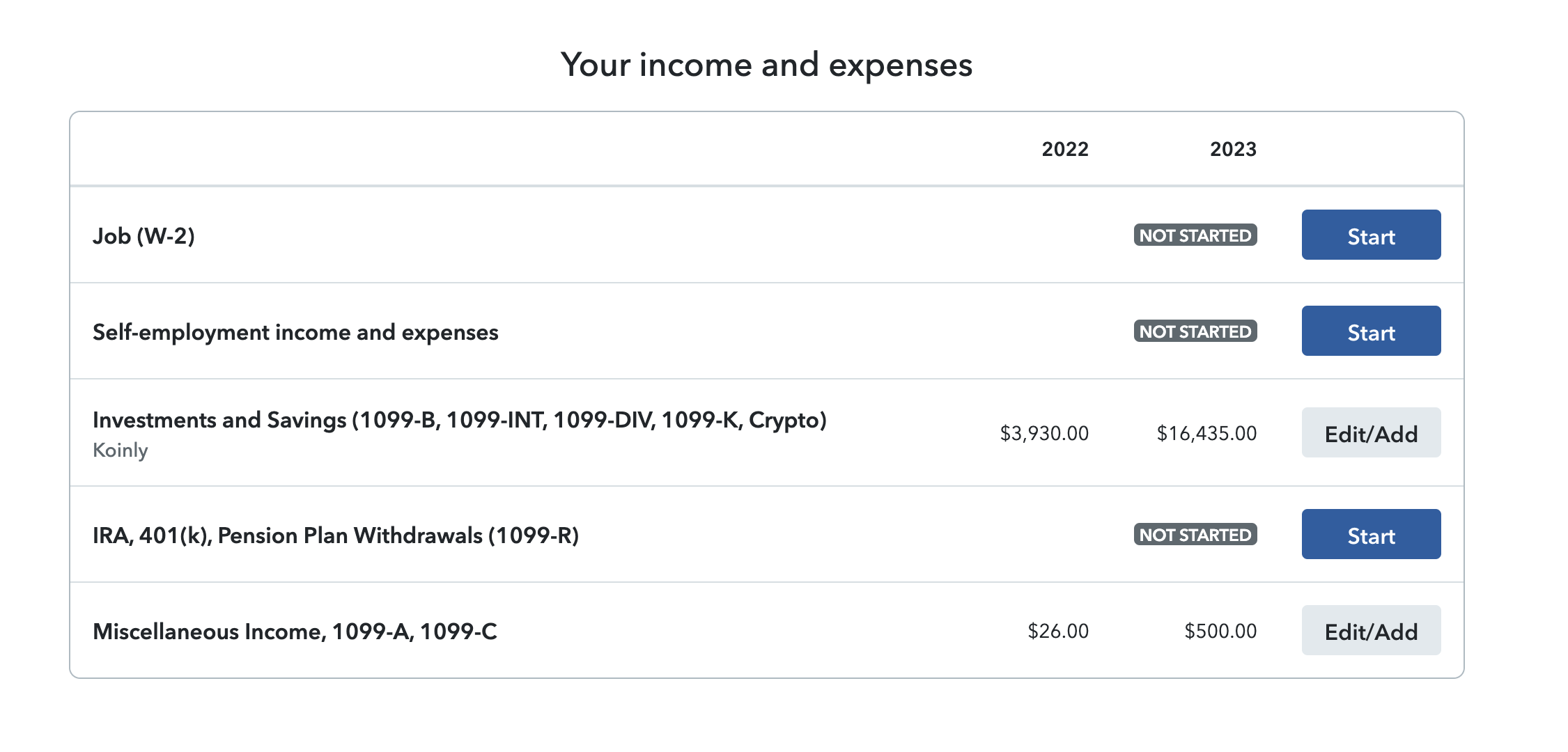

1. Under income & expenses (or wages & income), select review/edit (or start if you've not touched this section yet).

2. Select add/edit (or start) next to investments and savings (1099-B, 1099-INT, 1099-DIV, 1099-K, Crypto).

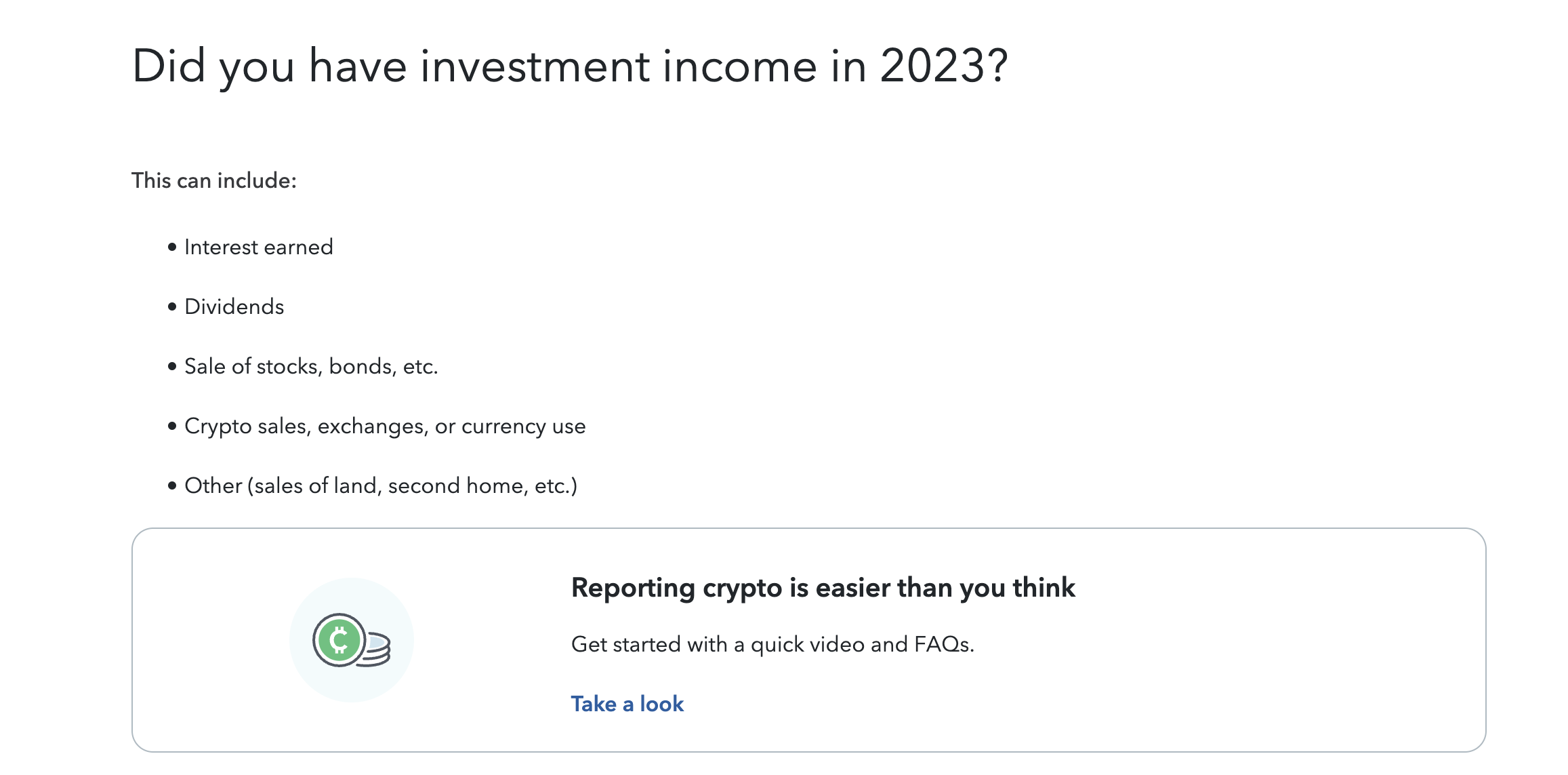

3. On the page with the question "did you have investment income in 2023?", select yes.

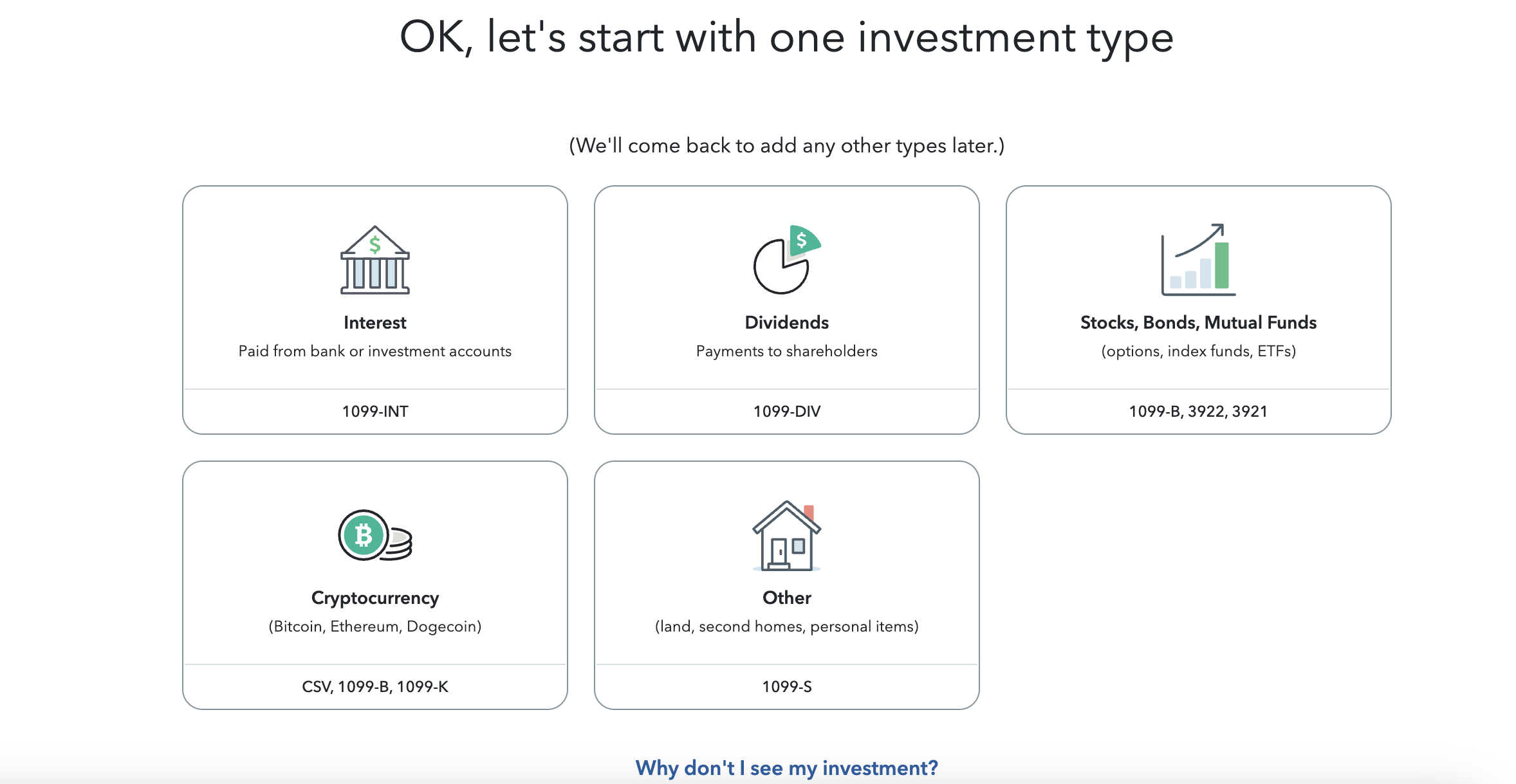

4. Select enter a different way on the following page.

5. Select cryptocurrency on the following page, then continue.

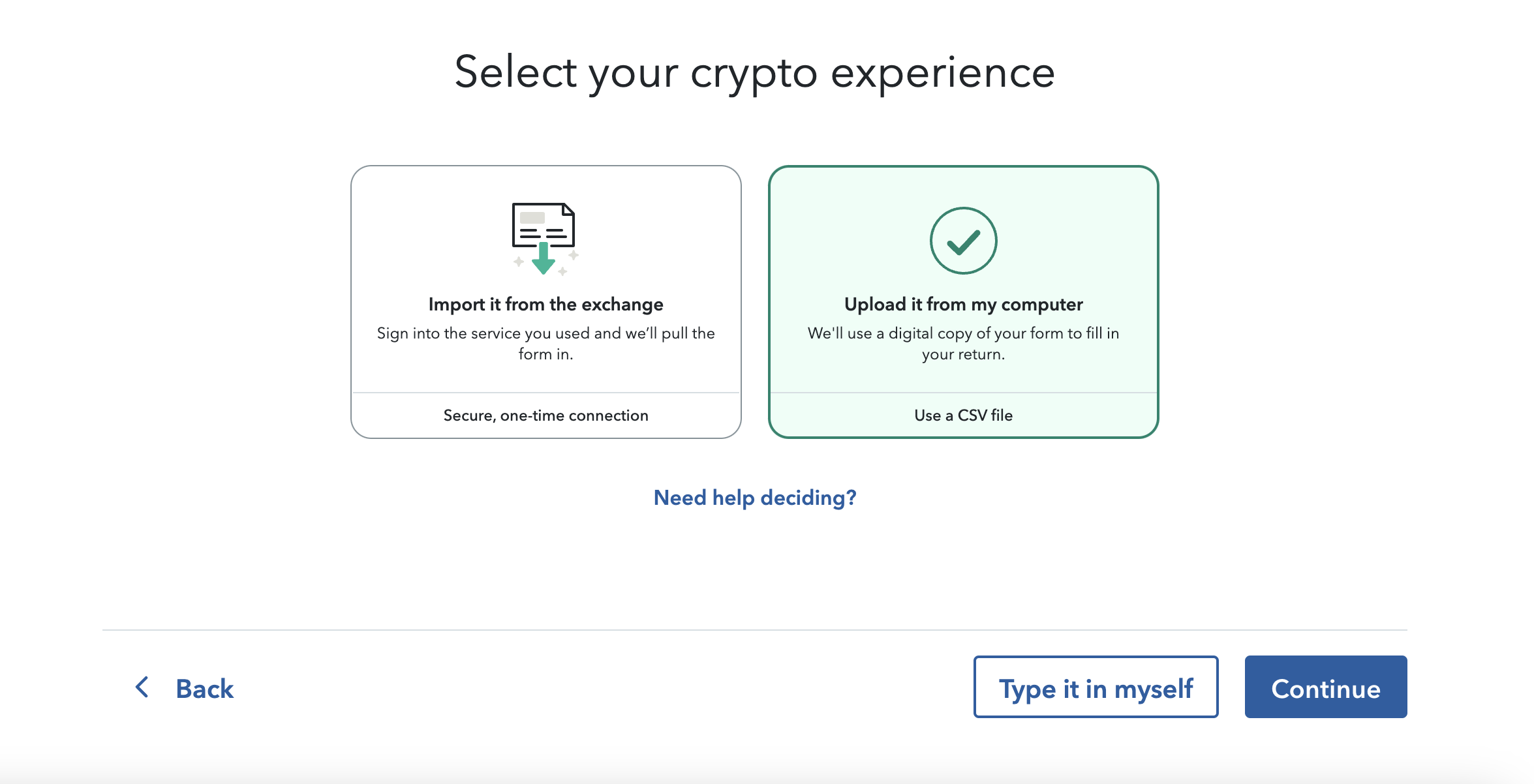

6. Under select your crypto experience, select upload it from my computer, then continue.

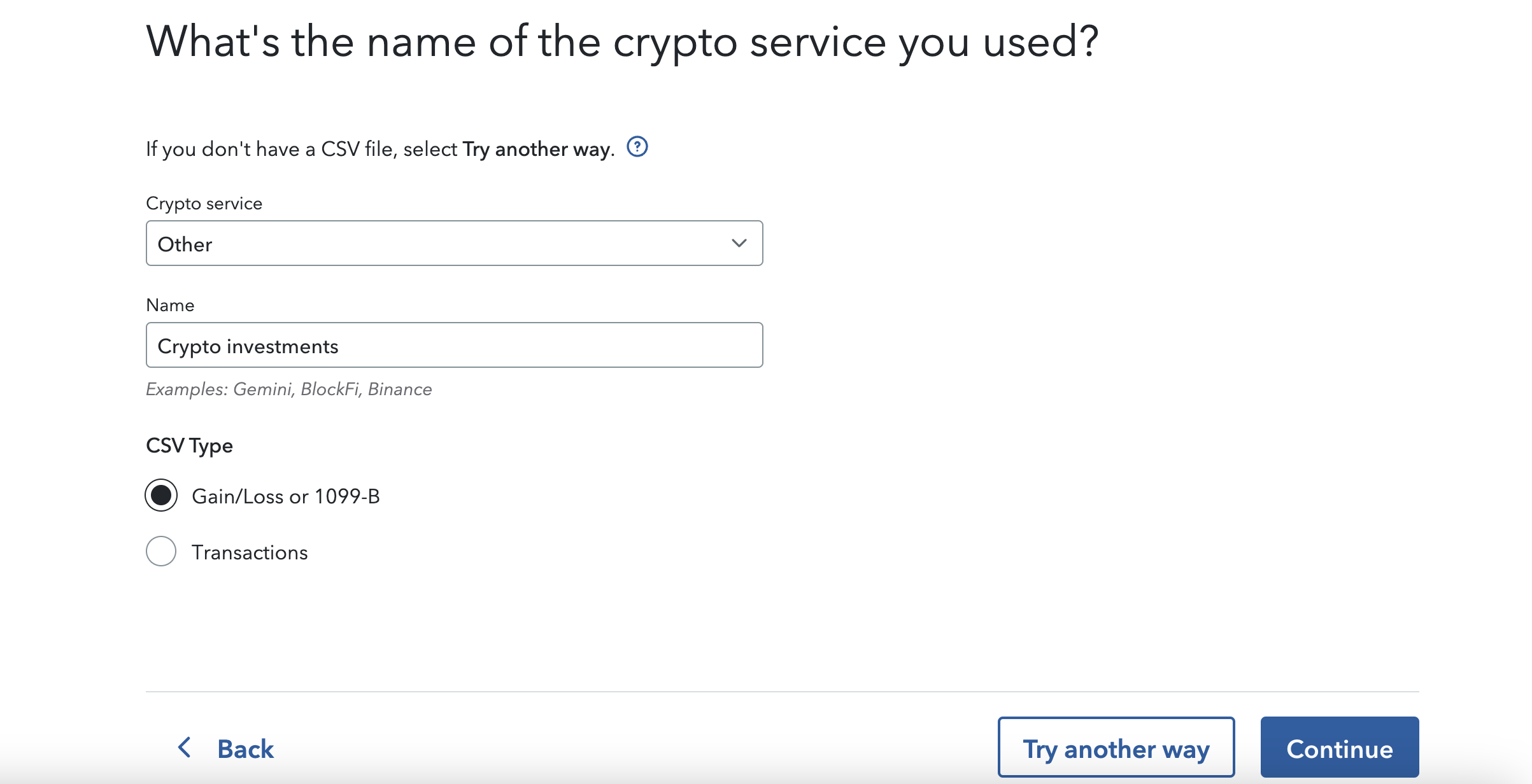

7. From the drop-down menu under "what's the name of the crypto service you used?" select other.

8. Under name, enter a relevant description for your crypto, for example, "crypto investments."

9. For CSV type, select gain/loss or 1099-B.

10. Select continue.

10. Select continue.

11. Upload the Koinly TurboTax Report you downloaded earlier.

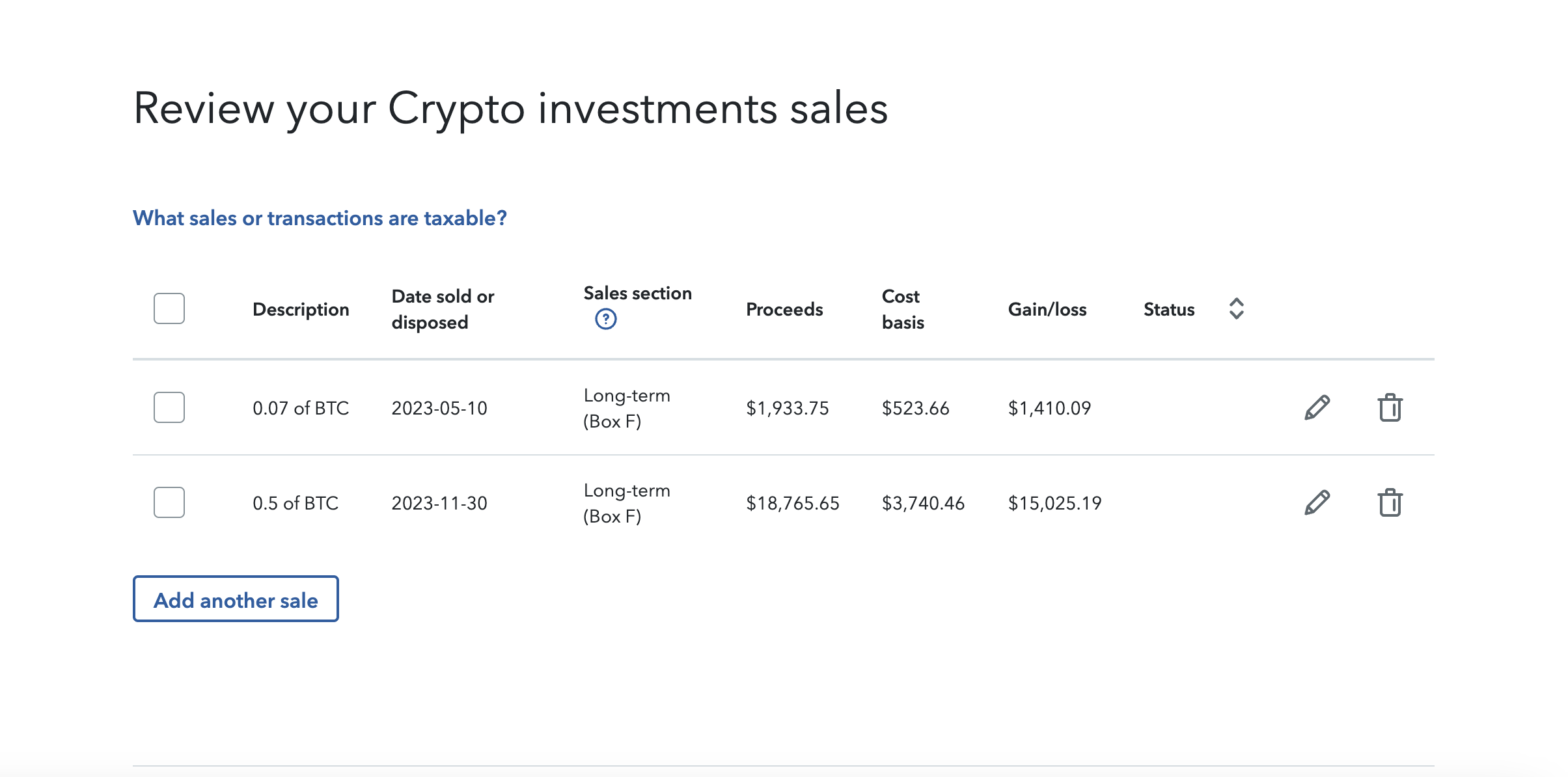

12. Select review, then continue on the next page.

13. Compare the totals of your Koinly Complete Tax Report against the totals recorded in TurboTax. If there is a small difference, this is normal, it's because TurboTax rounds your figures.

14. Once you're happy with everything, select continue, then confirm, and then next to continue your tax return.

You're done reporting your crypto capital gains and losses, so let's move on to income!

How to report crypto income in TurboTax

Your TurboTax Online report only covers assets (so capital gains) - so to report your crypto income you'll need to use the figure in your Koinly Tax Summary. If you want to split your crypto income into the different types of income you've had - for example, mining, staking, airdrops, etc. - then you'll need to download the Koinly Complete Tax Report to get this information.

1. Under wages & income, select less common income.

2. Select start (or revisit) next to miscellaneous income, 1099-A, 1099-C.

3. Select start (or revisit) next to other reportable income.

4. On the page titled "any other taxable income?" select yes.

5. Enter a description of your income as it's relevant to your investments, for example, crypto mining or crypto airdrop. You don't need to break your crypto income down into different sources, you can just report the total figure.

6. Under amount, enter the total amount from the income summary section of your Koinly Complete Tax Report.

7. Select continue.

8. Review your miscellaneous income summary section and select done once you're happy with it.

9. You can now finalize and submit your return!

Please note other deductions may be possible like charitable donations, allowable expenses, and tax planning deductions for self-employed workers. You should include these as relevant to your circumstances.

How to report crypto with TurboTax desktop

As we said before, the instructions above are for TurboTax online. If you're using TurboTax Desktop the steps are slightly different.

Start by signing up and setting up your Koinly account by connecting all your wallets, exchanges, and blockchains. Check you're happy with the calculations and then download the Koinly TurboTax Export. Once you've got it, head over to TurboTax and follow these steps:

Log in to TurboTax and go to your tax return

In the top menu, select file

Select import

Select upload crypto sales

Under what's the name of the crypto service you used?, select other from the dropdown. If more fields appear, enter a description, select gain/loss or 1099-B, then continue

Select upload it from my computer and upload your TurboTax Export file

You should see a message saying crypto sales uploaded successfully!

Review your transactions to make sure you're happy with the figures you're reporting

You're done!

FAQs

Got more burning questions about TurboTax & crypto? Here are some of the questions we get asked most frequently:

Where do I enter crypto in TurboTax?

Wondering where to enter crypto in TurboTax? You report crypto gains and losses under investments and savings (1099-B, 1099-INT, 1099-DIV, 1099-K, Crypto) and crypto income under less common investments as miscellaneous income. You can find more detailed steps above.

How can I deduct costs related to crypto in TurboTax?

Koinly already includes allowable costs in your cost basis calculations - for example, purchase or trading fees. However, there are other costs - for example margin trade fees, margin interest fees, transfer fees, and more that Koinly does not include in your cost basis calculations (but does calculate for you and include in your Complete Tax Report). This is because the IRS may not allow these as deductible costs. You should speak to an experienced crypto accountant for advice on this. Find US crypto accountants in our directory.

How long does TurboTax take?

This very much depends on your personal circumstances and how complex your financial situation is. For most taxpayers with a simple enough financial situation, using the right tools for the job, your TurboTax return should take no longer than an hour.

What's the best crypto tax software for TurboTax?

So we might be biased here - but Koinly is purpose-built to help you file your TurboTax tax return easily. You can download an online or desktop TurboTax Tax report from Koinly and upload it to TurboTax to report in minutes. Not convinced? See our 1000+ glowing Trustpilot reviews.

How much does TurboTax online cost?

TurboTax has many pricing options - from free to $89 for the premier plan or $119 for self-employed taxpayers (plus state filing costs). The plan you'll need depends on how complicated your tax return is. For crypto investors, you'll need TurboTax Premier.

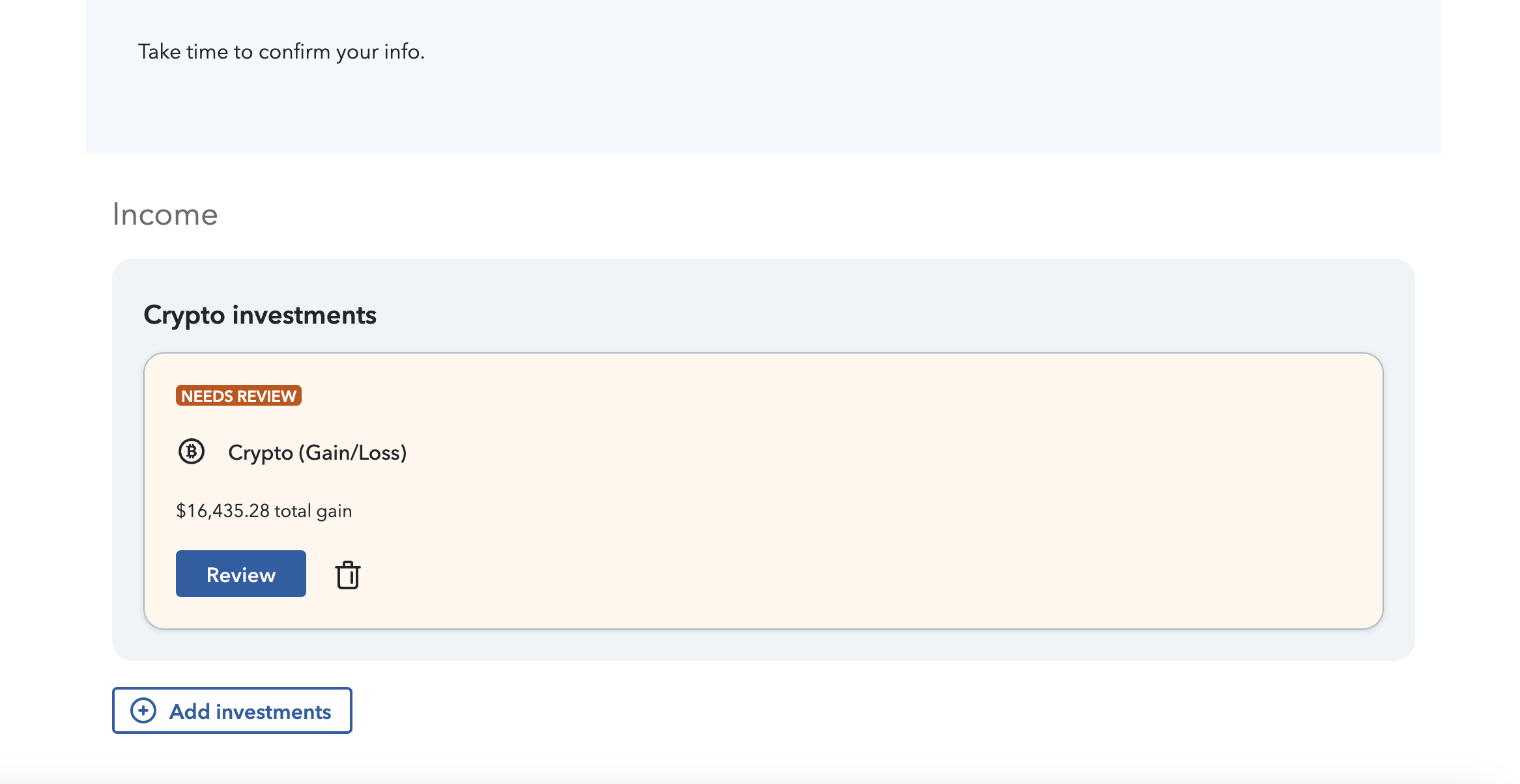

Why does TurboTax say needs review?

Once you've reported your crypto taxes on TurboTax, you'll be given the option to review every transaction. You do not need to do this - especially if you're pushed for time.

What's the transmission trouble error in TurboTax?

The transmission trouble error in TurboTax generally appears for one of two reasons. Either the CSV file you've uploaded of your transactions is too large, or the TurboTax import capabilities are struggling.

Does TurboTax have a limit for transactions from a CSV import?

Yes. TurboTax is limited to a maximum of 4,000 transactions for CSV files. You'll need to aggregate transactions for any CSV files with more than 4,000 transactions.

Can Koinly aggregate my TurboTax CSV file transactions?

Yes. Koinly can aggregate your transactions if you have more than 4,000 transactions and need to upload a file to TurboTax. You can see more about how Koinly aggregates transactions for TurboTax in our help guide. Please note if you use an aggregated file, you may also need to mail your complete 8949 form to the IRS.

How to report Robinhood crypto on TurboTax?

Robinhood crypto investors can log in to TurboTax and upload their Robinhood crypto tax documents by providing their user ID and document ID to TurboTax. TurboTax can then import your report. A word of warning though - Robinhood 1099-B forms may not be accurate for crypto if you've transferred crypto on or off the platform as Robinhood cannot track the cost basis of crypto in this instance. You should check your 1099-B form carefully to ensure it's correct. Learn more about crypto 1099 forms.

What's the correct TurboTax CSV format?

TurboTax has a universal CSV template you can use to create custom CSV files. See the template.

How can I file crypto taxes for free?

Some taxpayers may be able to use the FreeFile USA service from the IRS to file crypto taxes for free. To do this, you'll need the patience to fill out forms (although Koinly can still generate your Form 8949 and Schedule D for you!), as well as the confidence to fill out your tax return without the aid of a tax app or accountant. Crypto tax can get complicated, so proceed with caution.