Form 1099-DA: Expert Guide 2024

If you’re buying, selling, and trading crypto - a Form 1099-DA is in your near future. The IRS released the draft for the Form 1099-DA in April 2024, but there are still questionings remaining from industry experts. Find out what the Form 1099-DA is, what it includes, and when you’ll need to start using it in our expert guide.

What is a 1099 form?

A 1099 form is an IRS tax form used to report various types of income other than wages, salaries, and tips. It is typically issued by businesses or entities to individuals or other businesses to report income earned during a tax year. There are many different kinds of 1099 forms, with the most common for crypto investments previously being 1099-B, 1099-K, and 1099-MISC.

Read next: Crypto 1099 Forms Guide

What is Form 1099-DA?

1099-DA (short for 1099-Digital Asset) is the new IRS tax form designed for reporting cryptocurrencies.

Under the proposed rules, crypto brokers operating in the USA will be required to issue form 1099-DA from 2026, for transactions made in the 2025 financial year.

What’s in Form 1099-DA?

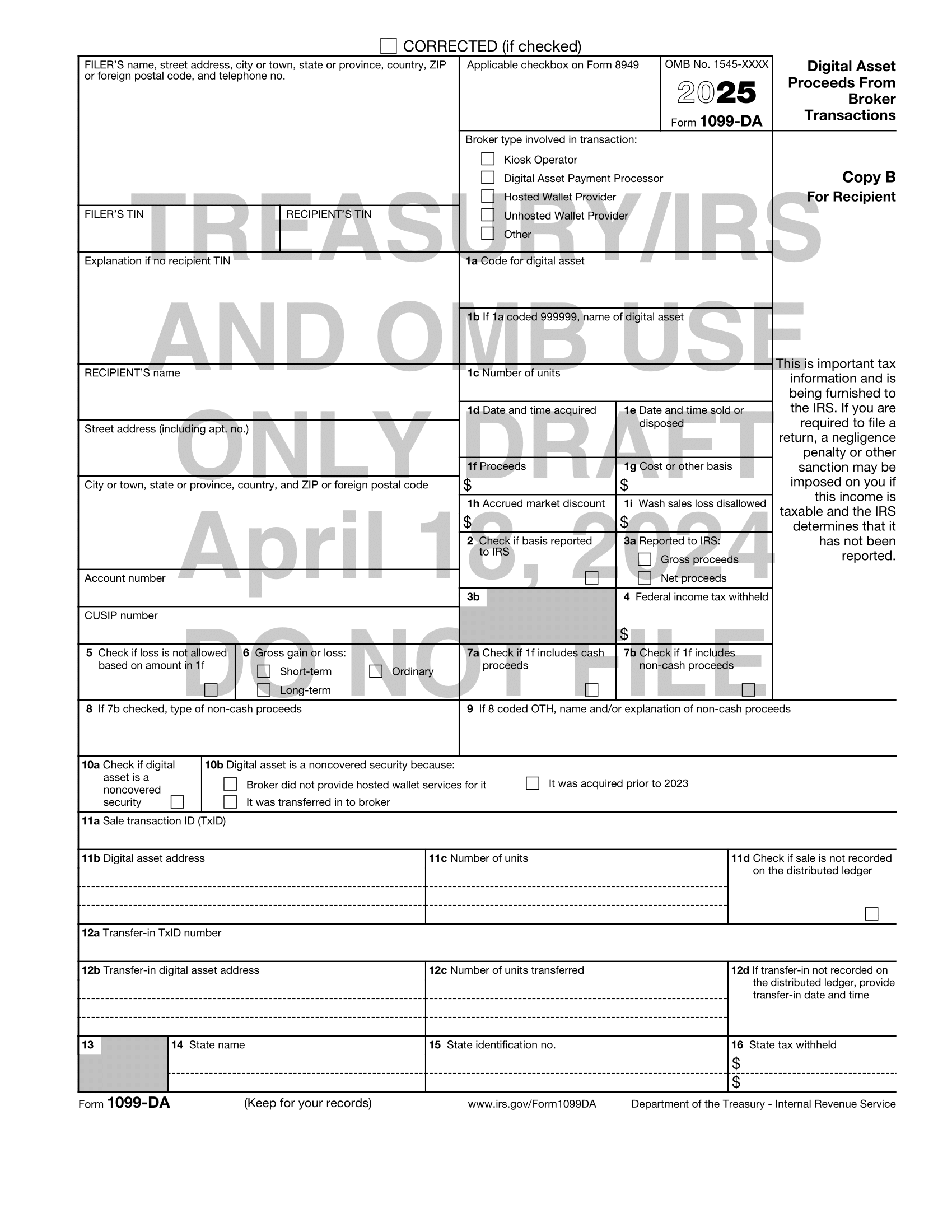

The IRS released the first draft of Form 1099-DA in April 2024 - and there's a lot to digest. You can see the draft 1099-DA below.

In summary, here's what we can glean from the current 1099-DA draft:

In summary, here's what we can glean from the current 1099-DA draft:

Brokers are required to report proceeds from digital asset dispositions to taxpayers and the IRS using Form 1099-DA.

Brokers must specify their type, such as kiosk operator, digital asset payment processor, hosted wallet provider, unhosted wallet provider, or other digital asset filer.

The 1099-DA form is designed to collect ID and transaction data from brokers, similar to stock brokers.

Centralized and certain decentralized exchanges, along with wallets, must generate this form for each sale transaction starting from 1/1/2025.

Required transaction data includes sale transaction ID (TxID), digital asset address, and number of units sold.

Transfer-related data points include transfer-in TxID number, transfer-in digital asset address, and number of units transferred in.

The new draft Form 1099-DA includes "unhosted wallet provider" as a checkbox, indicating the IRS's intention to include unhosted wallets under the broker definition.

This change may significantly impact how users interact with crypto platforms, in particular DeFi platforms.

Although 1099-DA is expected to be the new standard form issued by crypto exchanges and the like, exchanges may still issue other types of 1099 forms, for example, the 1099-MISC form for reporting miscellaneous income from crypto.

When will Form 1099-DA be released?

Under the current timeline, the reporting requirements for 1099-DA would take effect in the 2026 financial year. So the first 1099-DA investors will receive will cover their transactions in the 2025 financial year.

Much of this is due to the operational pressures that businesses defined as crypto brokers will face due to the new requirements. Many platforms will have to include more robust KYC protocols in order to collect the correct information to be able to issue 1099-DA forms to users.

Which exchanges will issue 1099-DA?

Under the current proposals, any business defined as a crypto broker will be required to issue a 1099-DA, both to users and the IRS - and the definition of crypto broker in the current proposal is broad. It includes:

Digital asset trading platforms

Digital asset payment processors

Digital asset hosted wallet providers

Under this definition, this would include both centralized and decentralized platforms.

Who will receive a 1099-DA?

Any US investor using a platform defined as a crypto broker will receive a 1099-DA - so this could include millions of investors using centralized and decentralized exchanges, and even some wallet providers. Form 1099-DA will only report capital gains and losses from crypto. So it’s anyone who has disposed of crypto (by selling, trading, or spending it) on any of these platforms will receive a 1099-DA form.

To further convolute things for investors, this means active investors using multiple exchanges, wallets, and other platforms could receive dozens of 1099-DA forms in a single year.

Why is the IRS creating Form 1099-DA?

In theory, to simplify crypto tax reporting for investors and businesses, as well as to encourage (or enforce) compliance.

Back in 2012, President Biden signed the American Infrastructure Bill into law. This bill brought in the requirement for crypto brokers to report users’ capital gains and losses to the IRS using 1099 forms.

As expected, this drew in a lot of criticism from industry figures as the existing 1099 forms are not capable of accurately reporting crypto investments. As such, the IRS introduced the idea of a new 1099 form - specifically for reporting digital assets, the 1099-DA.

But the 1099-DA form, although still in its infancy, isn’t without its problems.

What are the potential problems with Form 1099-DA?

Form 1099-DA has been met with harsh criticism from industry experts. Some of the largest criticisms include tracking cost basis, an unclear definition of crypto brokers, and creating an undue tax reporting burden for investors and businesses.

Cost basis

One of the main reasons that Form 1099-B wasn’t fit for purpose is because of cost basis.

Cost basis is simply what your asset cost you, plus any allowable fees. You need to know your cost basis, so you can subtract it from your proceeds when you dispose of an asset and calculate your subsequent gain.

If you only use one crypto exchange to buy and sell crypto, it would be easy for that exchange to issue an accurate 1099-DA that has the correct calculations for your capital gains and losses.

But for the majority of crypto investors, this isn’t the case and you’ll be using multiple exchanges, wallets, and other platforms to transact, and often transferring your crypto between these platforms. This is where tracking cost basis becomes difficult. As if you bought crypto on one platform, sent it to a wallet for storage, and then later sent it to another exchange to sell it, the exchange you sold your crypto on would not know the cost basis of your crypto.

So when that exchange is required to issue a 1099-DA, your capital gains and losses reported on the form would be inaccurate. Similarly, the other platforms you transferred your crypto between don’t know whether you disposed of your asset or not - are they then required to include your transfer in the 1099-DA reporting?

It’s a fair criticism that the 1099-DA doesn’t solve many of the issues traditional 1099 forms faced when attempting to deal with crypto tax reporting. A potential solution to this is for platforms to share data relating to cost basis, but putting in place a system that can do this accurately in the current time frame would be very difficult.

Crypto brokers definition

Under the current definition, crypto brokers include centralized and decentralized crypto exchanges, crypto payment processors, and even some hosted wallets.

At the moment, many of these platforms are non-custodial and simply don’t retain this information about users. For hosted wallets in particular, it’s unclear why this has been included in the current definition.

Many critics have said the current definition, and the subsequent reporting requirements that would come into force due to it, would effectively kill DeFi in the US as DeFi platforms and non-custodial wallets will simply withdraw services from the country.

Undue tax reporting burden

Finally, many critics state the 1099-DA will create an undue tax reporting burden both for businesses and individual investors.

For individuals, the sheer amount of potentially incorrect 1099-DA forms they may receive is an issue. Crypto investors will be required to reconcile any issues with these forms and still calculate their own crypto tax liability. But as the IRS receives these forms too, discrepancies from an individual’s calculations - even if correct - may result in more audits and questions from the IRS.

For businesses that fall under the definition of crypto brokers as well, the requirement to issue these forms will be too large an administrative burden for many to cope with.

Will Form 1099-DA contain everything I need to file crypto taxes?

No. It’s unlikely Form 1099-DA will contain everything you need to correctly file your crypto taxes. Even ignoring the potential missing or incorrect information around cost basis, it’s unlikely that Form 1099-DA will include other kinds of income from crypto, like miscellaneous income from staking, mining, and so on.

Will Form 1099-DA make it easier to file crypto taxes?

Looking at the current draft for the 1099-DA Form, no. The issues that previously existed regarding 1099 forms and cost basis for crypto still exist, and the form itself doesn't seem fit for purpose when it comes to reporting a multitude of disposals, as many crypto investors will have on a single exchange or platform. As such, it's unclear whether users would be issued with a 1099-DA for every disposal they make on a given platform, or whether the form will somehow include all disposals despite not being designed to do so.

The government is currently hearing feedback from industry experts, and may still change course to heed their warnings on the potential issues.

How do I prepare for Form 1099-DA?

The best way to be prepared for the changes to crypto tax reporting in the US is to keep excellent records and remain compliant with the existing crypto tax reporting requirements until it changes.

Koinly can help you with both. Koinly keeps historical records for users’ and helps you calculate your crypto tax liability according to the existing IRS guidance. Try Koinly free today.