Crypto 1099 Form: 1099-K vs. 1099-B vs. 1099-MISC

Most US taxpayers know how much the IRS loves tricky tax returns - and this is especially true when it comes to crypto taxes. Not only are the US crypto tax rules complicated, but the forms you need to report your crypto to the IRS only seem to increase each year! If your exchange has sent you a 1099-K, 1099-B, or even a 1099-MISC form - you’re probably wondering what you need to do with it. Here's everything you need to know about crypto 1099 forms including the differences between 1099-K, 1099-B, and 1099-MISC forms and what they mean for your crypto taxes.

What is an IRS 1099 form?

An IRS 1099 form is a record of income for an individual taxpayer. You can receive an IRS 1099 form for lots of different reasons. For example, freelancers and contractors may receive one from a client. It is merely a record of income from that client, business, or entity.

There are 20 different types of 1099 forms available for a variety of businesses to file to report different kinds of income paid, but only some 1099 forms are issued for crypto investors. Let's look at the 1099 forms used to report crypto.

What's a crypto 1099 form and will I get one?

Crypto exchanges began sending out IRS 1099 forms a few years ago in response to increasing pressure from the IRS to share customer data. So in the name of tax compliance, some exchanges issue a 1099 form to both their customers and an identical copy to the IRS.

Do you get a 1099 form for cryptocurrency?

Yes - but it all depends on the exchange you use. Coinbase is perhaps the most notable example of this. The IRS took Coinbase to court using a John Doe summons back in 2016 and won - meaning the exchange had to share customer data with them. Since then, the IRS has issued similar summons against both Kraken and Poloniex.

Other large exchanges - expecting impending audits - have done their best to comply with the IRS to avoid legal action. But the problem with this is that the IRS has lacked clear guidance around how they view crypto exchanges and the subsequent tax reporting requirements.

What does the IRS say about crypto 1099 forms?

The basic guidance for 1099 forms means any business that pays more than $600 to a payee in a single year must issue a 1099 form. But there are exceptions to this, as many financial service providers issue a 1099 form to any customers who earn more than $10 in interest throughout a financial year. This is why there are many 1099 forms available - but none of them are specifically designed for crypto tax reporting.

The IRS eventually advised crypto exchanges to issue 1099-K forms to users trading over a certain volume in 2018. As a result, Coinbase and other large exchanges began by issuing 1099-K forms. The issue here was that 1099-K forms report gross proceeds - not gains and losses. So the form reported the total amount transacted on a given crypto exchange in USD, but not necessarily the actual taxable amount when considering gains and losses.

A more ideal scenario

Crypto exchanges could issue 1099-B forms and a few like Uphold have. This form is used by traditional brokers to report gains from a capital asset on behalf of a client. However - the issue here is that crypto exchanges often don’t have the cost basis of a given crypto asset to use the 1099-B form. For example, if you’ve transferred 1 BTC into your crypto exchange wallet to trade it on that platform - the exchange doesn’t know the price you bought your 1 BTC for as you acquired it elsewhere.

To further confuse things - the Infrastructure Bill was signed into law in November 2021 and amends the definition of a broker to potentially include centralized crypto exchanges, decentralized crypto exchanges, crypto wallets, and many more crypto platforms. The IRS has given very little guidance on what this means from a tax reporting perspective for both crypto exchanges and investors so far - but is expected to clarify this in the near future.

In the meantime, many crypto exchanges have now changed to begin using form 1099-MISC instead of form 1099-K or 1099-B. So if you’re using a variety of exchanges - you may end up with multiple types of 1099 forms!

As part of the review of digital assets by the US government and the crypto infrastructure bill, the IRS has confirmed it is developing a dedicated crypto assets 1099 form - the 1099-DA, which looks likely to come into effect in 2025 as the draft form has finally been released in 2024.

To help, we’re looking at an example of each 1099 form, which exchanges are issuing each form, and what you need to do about it.

Crypto 1099-K Form Example

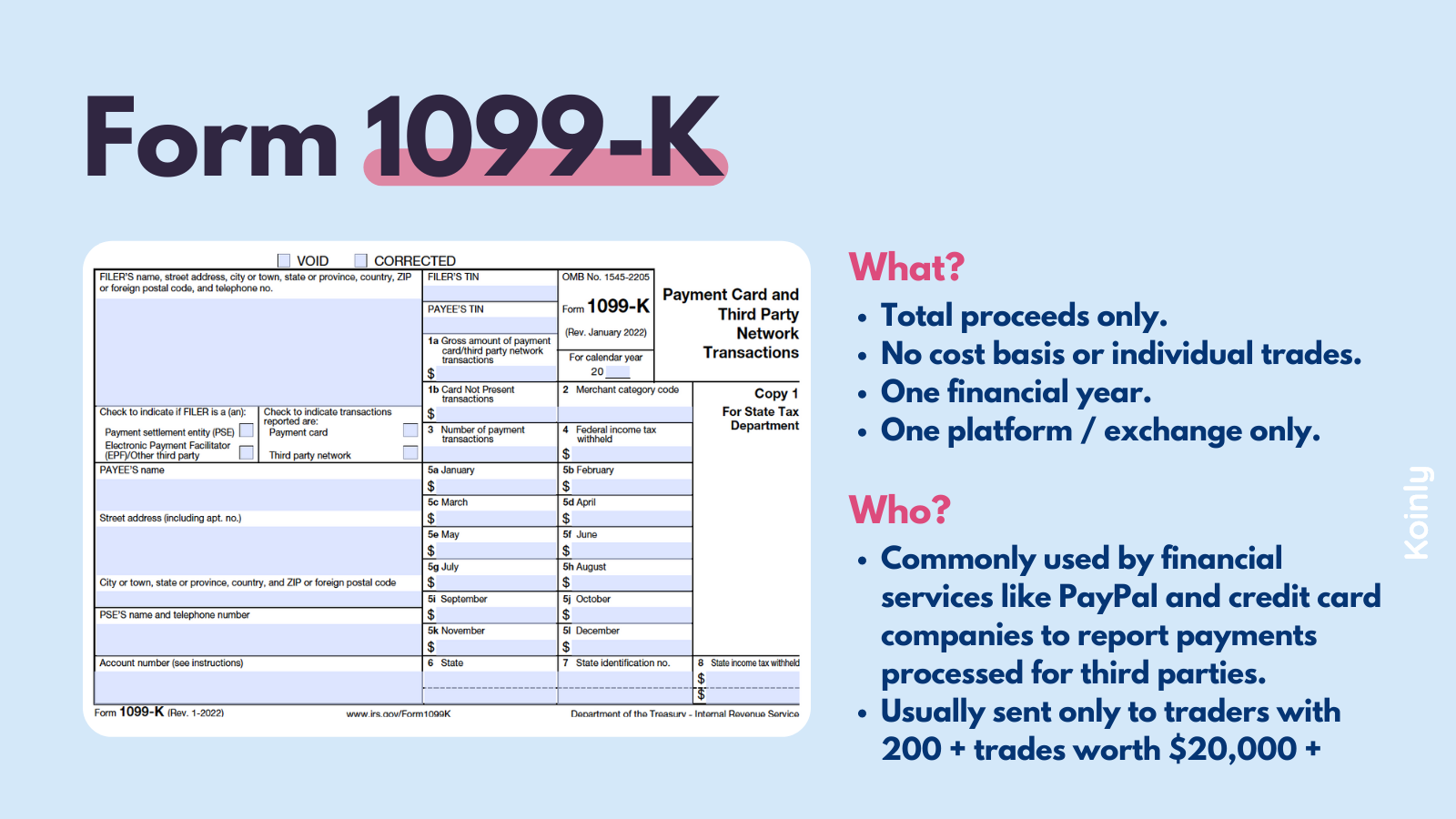

Up until the recent changes from the Infrastructure Bill, Form 1099-K was the most common form issued by crypto exchanges. Here’s an example of what a 1099-K form looks like:

A 1099-K form states the total amount traded by an individual in a single financial year - so from the 1st of January to the 31st of December. The 1099-K form is most commonly used by financial services like PayPal and credit card companies to report payments processed for third parties.

A 1099-K form states the total amount traded by an individual in a single financial year - so from the 1st of January to the 31st of December. The 1099-K form is most commonly used by financial services like PayPal and credit card companies to report payments processed for third parties.

In most instances - you would only receive a 1099-K form if you’d made 200 or more transactions on a platform, valued over $20,000.

One of the confusions surrounding 1099-K forms is that the form doesn’t represent your net capital gain or loss. Instead, it looks at your net proceeds from that exchange for the financial year. So the number you see on your 1099-K form may be a much higher figure than you’d expect as you may have a large trading volume.

Which crypto exchanges issue 1099-K?

As we said above, many crypto exchanges issued a 1099-K to their users throughout previous financial years. However, many of them have switched to 1099-MISC forms for the 2022 financial year. With this in mind, crypto exchanges that have previously issued 1099-K include:

Coinbase (now switched to 1099-MISC).

Binance (now switched to 1099-MISC).

Gemini.

Kraken.

Bitstamp.

eToro.

Crypto.com

Will I get a crypto 1099K form?

Potentially. Many crypto exchanges are switching to 1099-MISC forms, but some may be behind the curve. If you are issued a 1099-K for your crypto investments, you should receive it by the end of January of the following financial year. Remember - if you’re issued a 1099-K, the IRS got one too so you should never be tempted to underreport your crypto activities.

What do I need to do if I get a crypto 1099 K?

The 1099-K doesn’t report individual transactions, which is what the IRS is interested in knowing about your crypto. It merely informs them that you own and traded digital assets in the 2021 financial year.

What this means is you need to include the amounts reported on your 1099-K in your annual Individual Tax Return. You’ll report your crypto investments on Form 8949 and Schedule D for capital gains and losses and Schedule 1 for ordinary income.

If there are discrepancies between the income you report and the 1099-K reports - you may face an IRS audit.

Crypto 1099-B Form Example

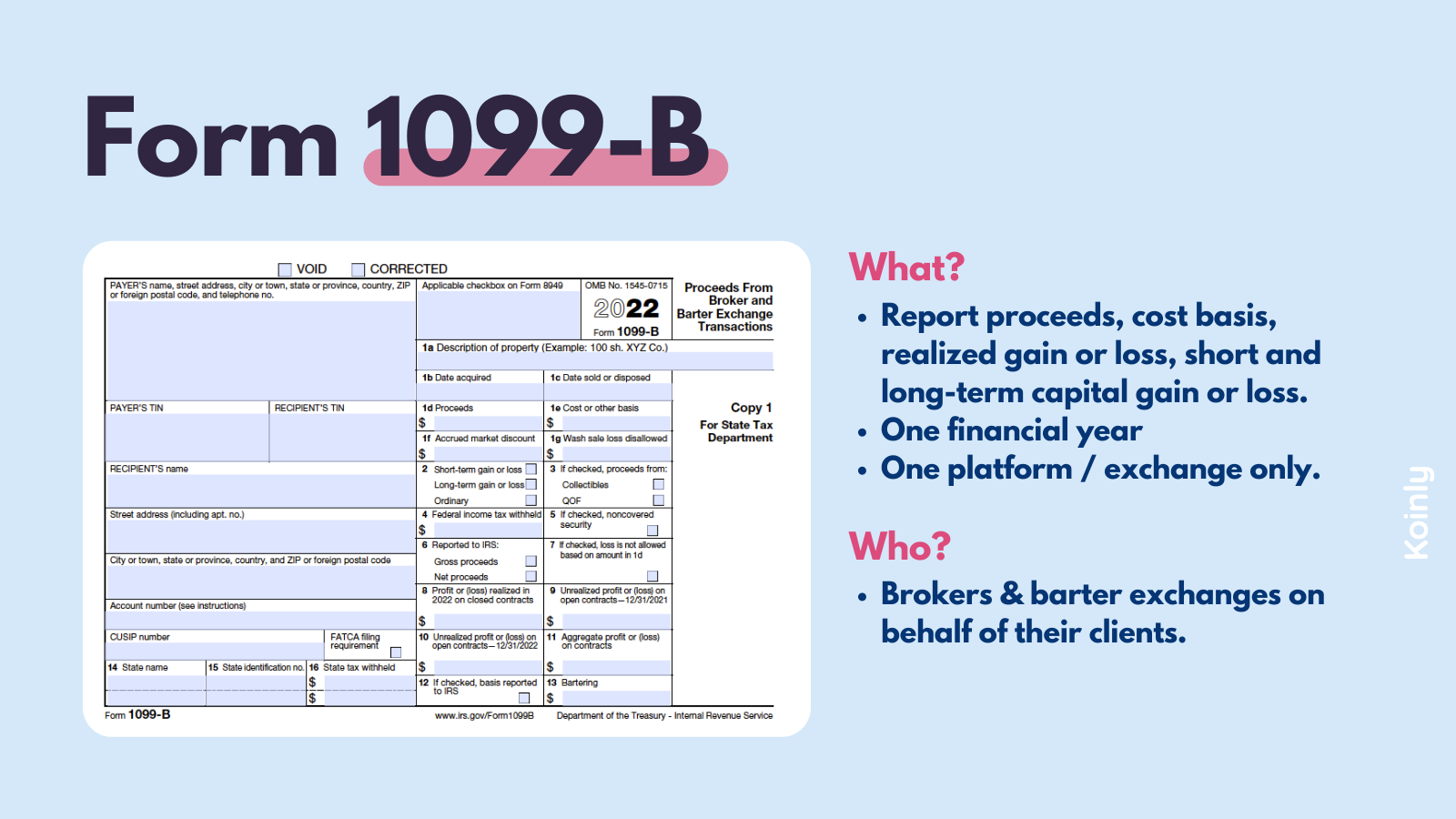

Form 1099-B is used by brokers (and barter exchanges) to report capital gains made from the disposal of a capital asset on behalf of their clients. Here’s what a 1099-B looks like:

As you can see, unlike the 1099-K form, the 1099-B form is much better for reporting capital asset transactions as it includes sections to report your proceeds, cost basis, realized gain or loss, and even whether that was a short or long-term capital gain or loss.

As you can see, unlike the 1099-K form, the 1099-B form is much better for reporting capital asset transactions as it includes sections to report your proceeds, cost basis, realized gain or loss, and even whether that was a short or long-term capital gain or loss.

Because the majority of crypto transactions are subject to Capital Gains Tax (although some are subject to Income Tax) - Form 1099-B is a better option for crypto exchanges to report transactions to the IRS.

But many crypto exchanges avoid form 1099-B due to the reporting challenges around it. With users using multiple crypto exchanges and wallets, keeping track of the cost basis of an asset, whether it has been disposed of or simply transferred and any resulting capital gains or losses is almost impossible.

Which exchanges issue 1099-B for cryptocurrency?

Despite these challenges, some crypto exchanges do issue 1099-B. Notably, Uphold and Bittrex confirmed they would issue their users with 1099-B forms. Other platforms that deal with crypto alongside other assets such as Robinhood and Cash App have also confirmed they will issue 1099-B forms to users.

Will I get a crypto 1099B?

Potentially. The impending announcement on tax reporting requirements from the Infrastructure Bill means many crypto platforms may soon be considered brokers and therefore must issue a 1099-B to users and the IRS. If you do receive a 1099-B form, you should receive it between January and February of the following financial year at the latest.

What do I need to do if I get a crypto 1099 B?

Individuals (or their accountants) use a 1099-B to fill out Form 8949 and Form 1040 Schedule 1 to be included in their annual tax return.

Of course, because of the issues highlighted above around crypto exchanges and other platforms issuing 1099-Bs to deal with digital assets, even if you do receive a 1099-B, it may contain incorrect information about your capital gains and losses. The best advice is to speak to an accountant if you receive a 1099-B form from a crypto exchange.

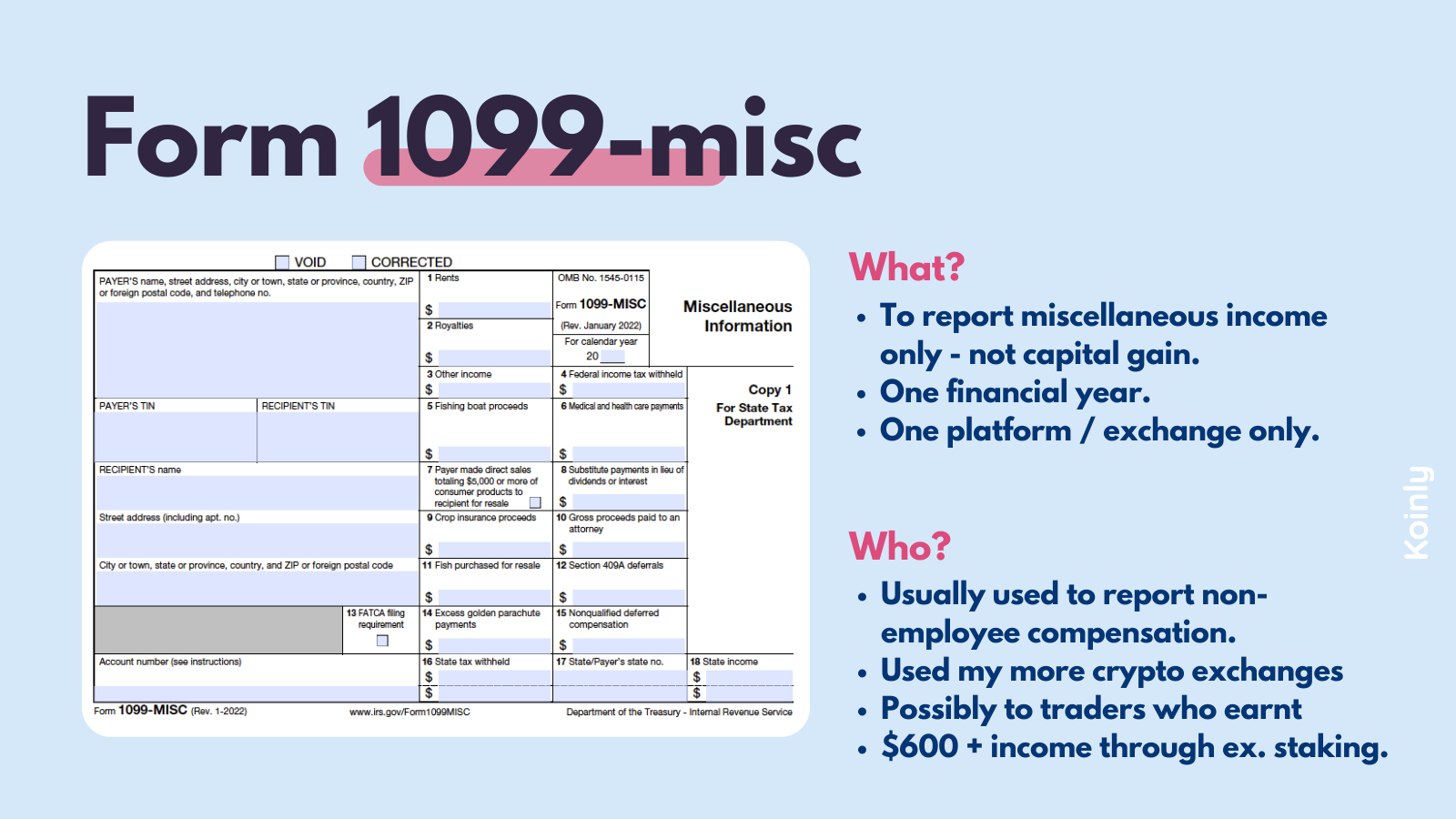

1099-MISC Form Example

Form 1099-MISC is the 1099 form designed to report miscellaneous income to the IRS. Many crypto exchanges have confirmed in the last year that they’re switching from issuing 1099-K to 1099-MISC forms. Here’s a form example:

Who gets one?

Who gets one?

Prior to the 2020 financial year, the 1099-MISC form was mostly used to report non-employee compensation. But many crypto exchanges have now begun to issue 1099-MISC forms to report gross income from rewards, staking, and other crypto transactions seen as income from a tax perspective.

Better suited to crypto

When a 1099-MISC form is used only to report crypto subject to Income Tax, it works well. It doesn’t have to deal with the same issues around tracking crypto assets across multiple exchanges or wallets because crypto subject to Income Tax is taxed based on the fair market value at the point you receive the asset. This is much easier for crypto exchanges to keep track of.

It also indicates to the IRS that the taxpayer is actively involved in crypto trading and may have other transactions relating to capital gains or losses that should be included in their annual tax return.

Which crypto exchanges issue 1099-MISC?

Many crypto exchanges have confirmed they’re now issuing 1099-MISC forms to users, including:

Coinbase

Coinbase Pro

Coinbase Prime

Binance US

Kraken

Celsius

eToro

Crypto.com

Will I get a crypto 1099-MISC form?

You may receive a 1099-MISC form if you’re a US resident who has $600 or more income through crypto activities like reward programs or staking. Remember - if you got a 1099-MISC form, so did the IRS.

What do I need to do if I get a 1099-MISC form?

Because 1099-MISC forms only deal with transactions subject to Income Tax, not Capital Gains Tax - this is actually a little more straightforward than the above. When the IRS receives a 1099-MISC form about a taxpayer, they expect that taxpayer to itemize and report that income in their annual tax return. This could be on the Schedule 1 or the Schedule C for self-employed individuals.

Failure to include these transactions and report your crypto income will increase the likelihood of you facing a crypto IRS audit.

Read next: What's a CP2000 notice?

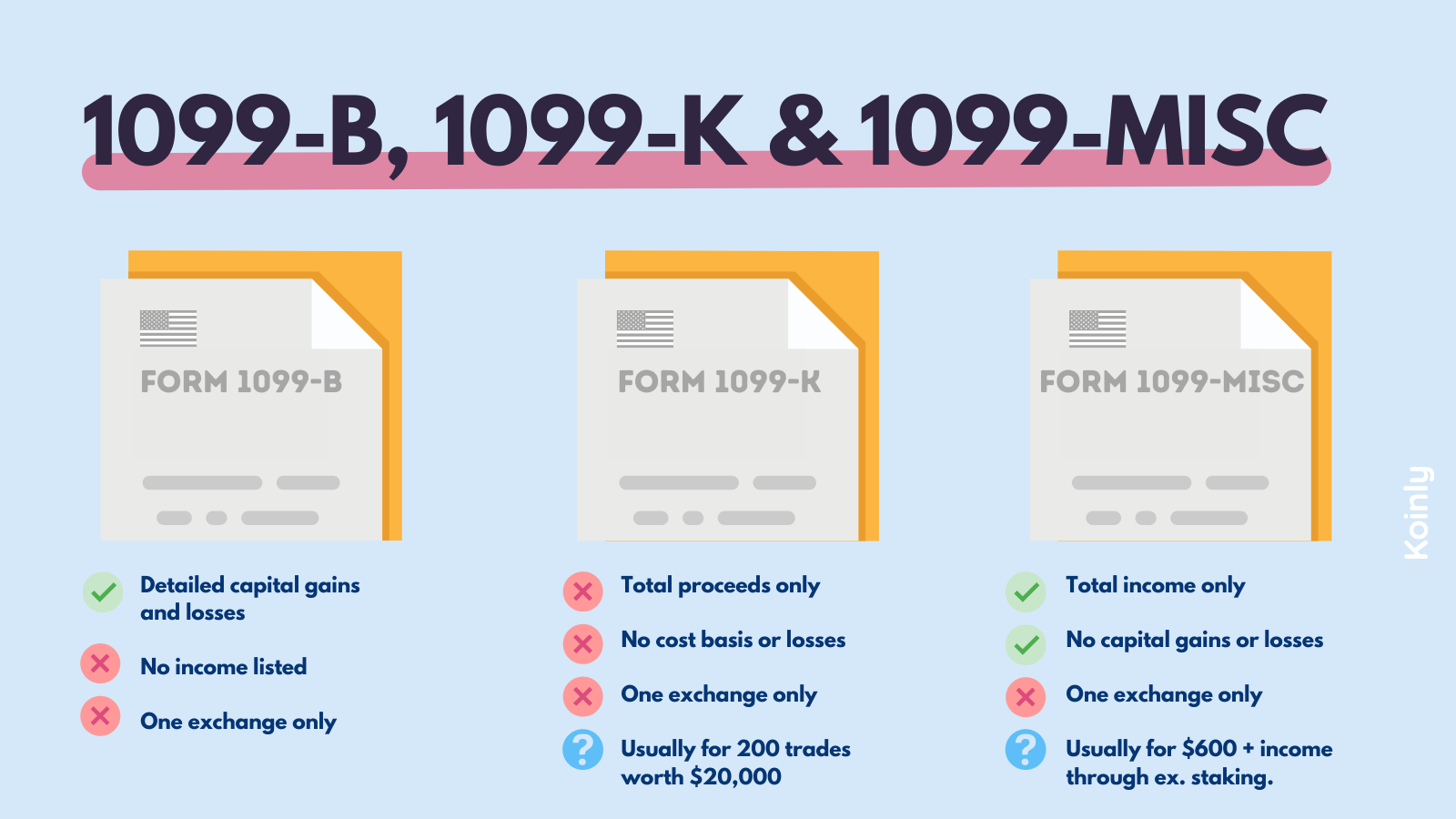

1099-B vs. 1099-K vs. 1099-MISC

Now you hopefully know the difference between each form - we’ve got some bad news. This may actually be set to change very soon. None of the 1099 forms are particularly suitable for crypto tax reporting.

The 1099-K is entirely inappropriate for reporting capital gains transactions. The 1099-B doesn’t take into account the fact that the vast majority of crypto investors use more than one crypto exchange. Meanwhile, the 1099-MISC only works for crypto transactions viewed as income.

The 1099-K is entirely inappropriate for reporting capital gains transactions. The 1099-B doesn’t take into account the fact that the vast majority of crypto investors use more than one crypto exchange. Meanwhile, the 1099-MISC only works for crypto transactions viewed as income.

The Infrastructure Bill has created more stringent regulations around tax reporting for crypto exchanges - and potentially other crypto businesses, starting from 2023. But the particulars around this bill - like which of the 20 kinds of 1099 forms crypto exchanges are expected to issue and even which crypto platforms are expected to issue them - haven’t yet been worked out. The only thing the IRS has confirmed so far is that a new dedicated digital assets 1099 form is coming - Form 1099-DA.

It is expected more guidance on crypto tax reporting will be issued in the coming months. Koinly keeps a keen eye on any publications from the IRS and we’ll update this article as soon as there is more clarity on crypto exchange tax reporting.

But what can you do in the meantime?

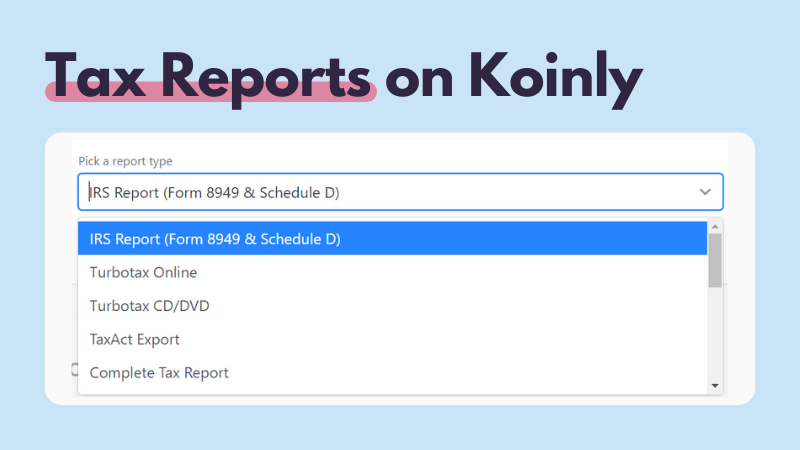

Use Koinly to calculate and report your crypto taxes

Koinly crypto tax software demystifies crypto tax. We follow the most up-to-date guidance from the IRS for US crypto investors and we solve the problem many crypto exchanges face by tracking your crypto assets across multiple exchanges and wallets by working with more than 400 exchanges and wallets.

All you need to do is sync the wallets and exchanges you use with Koinly. You can do this with API integration or by importing a CSV file of your transaction history. Once you’ve synced all the wallets and exchanges you use, Koinly can calculate your crypto taxes for you including your capital gains and losses, income, expenses, and more. All this information is available free in your tax summary. You can also download US-specific tax reports including a pre-filled Form 8949 and Schedule D directly from Koinly, ready to file in your annual tax return. Done!