10 Ways to Avoid Crypto Taxes in US

Want to pay less tax on your crypto? Here are the top strategies to legally avoid crypto taxes in the US.

Crypto investors in the US need to pay Capital Gains Tax or Income Tax on their crypto investments - in fact, sometimes you'll even pay both!

Not to worry - here are 10 top strategies to pay less crypto tax in the US.

HODL to avoid short-term Capital Gains Tax

There are actually two different IRS Capital Gains Tax rates - one for short-term gains and one for long-term gains.

Short-term gains tax rates apply to any asset you’ve held for less than a year. Your short-term capital gains tax rate is the same as your normal Income Tax Rate. Of course, for some investors, this can be quite a steep rate if you’re in a high-income tax bracket.

Long-term gains on the other hand are taxed at a much lower rate. Any asset you’ve held for more than a year will be taxed as a long-term capital gain. You’ll pay between 0% to 20% in tax on long-term capital gains.

All this to say, know which assets to HODL onto. If you have two similar assets - for example, 2 BTC - and you’ve held one for a year and one for less than a year, you’ll pay less tax on the long-term asset. Similarly, if you’re only a couple of weeks or months away from having held an asset for a year, you could benefit from HODLing on just a little longer.

You can find out more about short and long-term Capital Gains Tax rates in our US Bitcoin and Crypto Tax Rates Guide.

Make the most of US tax deductions

The IRS offers many tax deductions and credits for US taxpayers - so make sure you know which ones you can use and make the most of them to reduce your tax bill. You can either take the standard tax deduction or you can itemize your deductions instead, but you can’t do both.

Which approach you choose will depend on which benefits you most.

The standard tax deduction is processed faster by the IRS which is why many taxpayers opt to use this. However, there are many other tax deductions available so if you qualify for several of these, you might be better off itemizing your deductions in your tax return instead. There are hundreds of these deductions available, but some of the more common ones include:

Student loan interest deduction - up to $2,500 off taxable income

American opportunity tax credit - claim the first $2,000 spent on tuition, books, and equipment, plus 25% of the next $2,000 spent.

Lifetime learning credit - claim 20% of the first $10,000 spent on tuition and other school fees.

Child tax credit - up to $3,600 per child and up to $500 per non-child dependent.

Child and dependent care tax credit - up to 50% of daycare costs under $8,000 per child aged less than 13.

Medical expenses deduction - deduct unreimbursed medical expenses that are more than 7.5% of your adjusted gross income.

Mortgage interest deduction - cuts federal Income Tax for qualified homeowners by reducing taxable income by the amount of mortgage interest paid.

IRA contributions deduction - deduct contributions to a traditional IRA.

401(k) contributions deduction - funnel up to $19,500 into a 401(k) and deduct this amount.

Health Savings Account contributions deduction - all contributions and withdrawals from HSAs are tax deductible when used for qualified medical expenses.

These are just a few examples of many. Those who are self-employed or running a small business have even more tax deductions available. As you can see, if a few of these tax deductions apply to your circumstances, you may be better off itemizing your deductions instead of taking the standard tax deduction. You should speak to an accountant for further advice.

US Capital Gains Tax Break

As well as the tax deduction above, those on a lower income won’t pay any Capital Gains Tax on short or long-term capital gains.

For single taxpayers, if you earn under $44,626 a year - you’ll pay no tax on capital gains.

If you’re married and filing taxes jointly, this is $89,25 a year.

If you’re the head of the household, this goes up to $59,751 a year.

Use your capital losses to reduce your tax bill

You’ll only pay Capital Gains Tax on any profit made from selling, swapping, or spending your crypto. You won’t pay any tax on capital losses.

But this doesn’t mean you should just ignore your taxes and not bother reporting losses. For starters, you have a legal obligation to report all taxable crypto transactions - regardless of the outcome.

More importantly, though, reporting your capital losses actually benefits you.

If you’ve made a capital loss throughout the financial year, you can offset these against your gains to reduce your overall tax bill. Better still, you can offset an additional $3,000 of capital losses against ordinary income each year.

You can also carry capital losses forward to future tax years. This is why it’s so important you keep a record of your capital losses, so you can use them to reduce your future tax bills. Capital losses have no expiration date, so you can carry them forward for as long as you need to.

Identify unrealized losses and gains

At the point you sell, swap, spend, or gift an asset is the point when you’ll ‘realize’ a profit. Before this point, although the price of your asset may have increased or decreased, you’ll have what’s known as an unrealized gain or loss.

Don’t worry - unrealized gains or losses aren’t subject to Capital Gains Tax - but you should absolutely keep track of them with a crypto portfolio tracker (like Koinly).

As the EOFY draws closer, chances are you’ll have a good idea of your net capital gain or net capital loss. If you’ve got a large net capital gain with minimal capital losses to offset, you should look through your unrealized losses. If you have assets that are underperforming - and unlikely to improve - it might be better to sell these, realize a capital loss, and offset this against your capital gains for the year.

Avoid crypto tax by gifting crypto

The IRS lets you gift crypto to your friends, family, or whoever else you want tax free. You can gift up to $17,000 per person tax free.

For those in marriages or civil partnerships, this is a great way to make the most of your personal tax allowances. For example, if your partner is on a lower income than you, they’ll pay a lower tax rate on short-term capital gains if they dispose of assets.

Deduct crypto donations

Donations of crypto to registered charities are tax deductible. So you can do good for the world by donating to a worthy cause and reducing your tax bill in the process. You’ll need to report this in Form 8283 if you donate over a certain amount. Depending on the amount you donate, you may need receipts from the charity too - as well as a qualified appraisal for donations over $5,000.

Invest in an IRA

Investing in an Individual Retirement Account is a great way to pay less in tax. There are various Bitcoin IRAs available to choose from that will allow you to HODL your assets long-term, tax free. Any trades of crypto assets held in IRAs are also tax free.

Invest in an opportunity zone fund

Want to do good for your community and your taxes? Invest in an opportunity zone fund.

Taxpayers who invest in opportunity zone funds can defer and reduce their capital gains taxes if they put the proceeds from their sold asset into an opportunity zone fund. You can defer your Capital Gains Tax until 2026 by doing this. If you hold the investment beyond this point, you'll reduce your tax bill by up to 10%.

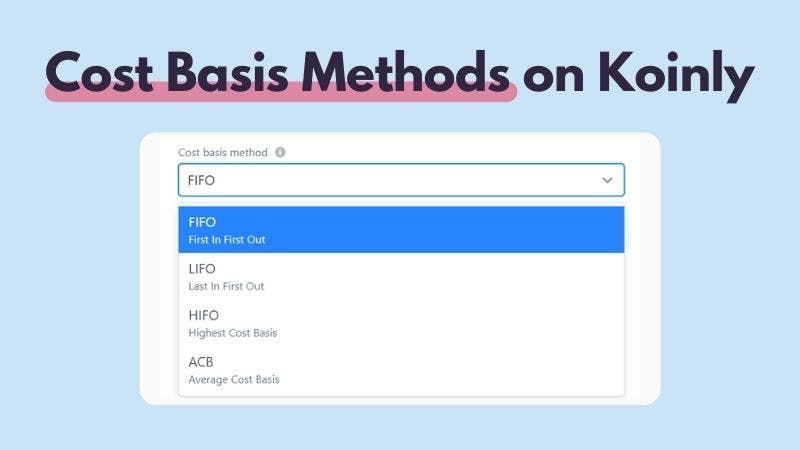

Pick your cost basis method

The IRS lets taxpayers choose their cost basis method. This is the method you use to calculate how much your assets cost you and which you sold and when.

This might not sound like a big deal - but the cost basis method you choose can make a huge difference to how much tax you’ll pay. US taxpayers can pick from:

Spec ID

FIFO

LIFO

HIFO

There is no best cost basis method. It will all depend on your crypto assets and transactions. You can only choose one cost basis method to use for the year and you'll need to stick with it, so it's well worth taking the time to do this to figure out which is best for you. Better yet, use crypto tax software that supports various cost basis methods (like Koinly) to compare them and save yourself hours.

You can find out more about each cost basis method in our How to Calculate Cost Basis Guide.

Optimize your taxes before the EOFY

For individual taxpayers, the US financial year runs from the 1st of January to the 31st of December every year. You then need to file your tax return for that financial year by April 15th of the following year.

With the end of the financial year fast approaching - if you want to pay less tax in April, you need to optimize your tax position now.

With the end of the financial year fast approaching - if you want to pay less tax in April, you need to optimize your tax position now.

Minimize crypto taxes with Koinly

Koinly can simplify your crypto taxes. Not only can it calculate your crypto taxes for you including your capital gains, losses, income, and expenses - but it can also help you optimize your tax position with a variety of features.

You can use Koinly to track your unrealized gains and losses, helping you better understand when to HODL and when to fold.

Koinly also supports a variety of cost basis methods - including FIFO, LIFO, and HIFO. You can change these in the settings and see how they affect your crypto taxes.

Koinly also supports a variety of cost basis methods - including FIFO, LIFO, and HIFO. You can change these in the settings and see how they affect your crypto taxes.

Koinly doesn’t just save you hours of spreadsheets and math - it also saves you hours you’d spend filling out forms. For US investors, Koinly can generate pre-filled forms, ready to submit to the IRS or your tax portal, including:

Koinly doesn’t just save you hours of spreadsheets and math - it also saves you hours you’d spend filling out forms. For US investors, Koinly can generate pre-filled forms, ready to submit to the IRS or your tax portal, including:

IRS Form 8949 & Schedule D

TurboTax Report

Tax Act Report