Crypto Tax Unrealized Gains Explained

Whenever you sell a crypto asset, you'll have a realized gain or loss. Before you sell, any change in an asset's value is an unrealized gain or loss. Learn everything you need to know about unrealized gains and losses and how they can help reduce your tax bill.

Realized gains vs. unrealized gains

Before we jump into what an unrealized gain is, you need to understand what a realized gain is.

Anytime you dispose of a crypto asset - like selling it or using it to buy something - you’ll have a realized gain or loss. This is also known as a profit or loss, as well as a capital gain or loss.

This doesn’t just apply to crypto, it applies to any asset, for example, stocks or rental properties. Individuals need to keep track of their realized capital gains and losses because they are subject to Capital Gains Tax and must be reported to your relevant tax authority.

What is an unrealized gain or loss?

Gains and losses are realized at the point of sale. So an unrealized gain or loss is when the value of an asset has increased or decreased, but you haven’t actually sold it yet. These are also known as paper profits or losses, as well as running profits or losses.

EXAMPLE

Realized Gain: You buy 0.5 Bitcoin for $30,000. You later sell your 0.5 BTC for $32,000. You have a realized gain of $2,000.

Unrealized Gain: You buy 0.5 Bitcoin for $30,000. The price of BTC has increased by $3,000, but you haven’t sold your asset. You have an unrealized gain of $3,000.

Realized Loss: You buy 1 ETH for $4,000. You later sell your ETH for $3,500. You have a realized loss of $500.

Unrealized Loss: You buy 1 ETH for $4,000. The price of ETH has dropped to $3,000, but you’ve not sold your asset. You have an unrealized loss of $1,000.

How to calculate unrealized gains and losses

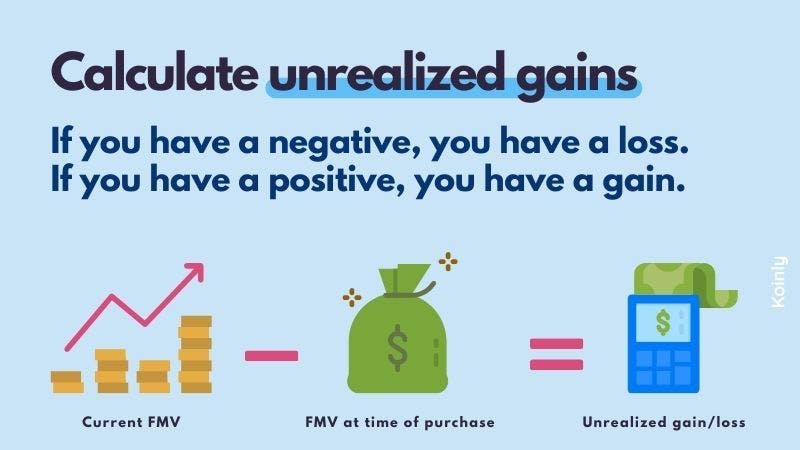

To calculate unrealized gains or losses, you can use the following formula:

Current FMV - FMV at time of purchase = Unrealized Gain/Loss.

If the resulting number is positive, it’s an unrealized gain. If it’s negative, it’s an unrealized loss.

How are unrealized gains and losses taxed?

They aren’t!

It is when a gain is realized that it is subject to Capital Gains Tax. Once your gain is realized, the amount you’ll pay in Capital Gains Tax depends on where you live and how long you’ve owned your asset.

While realized losses aren’t taxed, it’s still important you keep records of them as this can benefit you by reducing your tax bill. This is because many countries allow you to offset net capital losses against capital gains. Some countries also let you carry net capital losses forward to future tax years to offset them later on.

Why are unrealized gains important?

Tracking your unrealized gains and losses lets you get strategic about your crypto investments, as well as reduce your tax burden.

For starters, keeping track of unrealized gains and losses helps you follow price fluctuations in the market. You can set clear goals for both unrealized gains and unrealized losses, for example, selling at a 20% profit or loss. This helps you minimize risk for your investment - though, of course, never entirely removes risk altogether!

HODL

Tracking both your unrealized gains and losses is also a great way to make a more informed decision about when to HODL. This helps you track short and long-term volatility to give a more comprehensive overview of how an asset is performing.

Holding can also help reduce your Capital Gains Tax Bill. Many countries like the US, Germany, and Australia offer long-term capital gains discounts for assets held over a year. So, weighing up the risk of holding an asset and possible depreciation vs. selling it and paying more tax on it is always worth some consideration.

Offset Losses

If you’ve got a high Capital Gains Tax Bill on the horizon, look at your unrealized losses. If you’ve got assets that are underperforming and are unlikely to do anything but continue to plummet, you can sell at a loss. This turns them into realized losses, which you can offset against your capital gains to reduce your tax bill. This is also known as tax loss harvesting.

In some countries, you can also offset losses against ordinary income up to a certain amount. Make sure to check your country’s crypto tax laws to see if this is the case where you live.

How does Koinly deal with unrealized gains and losses?

Koinly isn’t just a crypto tax calculator, it also works as a portfolio tracker. Sync all the crypto wallets and exchanges you use with Koinly and you’ll be able to view your entire crypto portfolio from one place. This includes your balance, transactions, holdings, and both your realized and unrealized gains or losses.

Once you’ve synced your data, all you need to do is head to your Koinly dashboard to find all this information and more.

Summary

Any time you sell a crypto asset, you’ll have a realized gain or loss.

Before you sell, you’ll have an unrealized gain or loss.

Only realized gains are subject to Capital Gains Tax.

You can offset realized losses against realized gains.

Track unrealized gains/losses to make more informed investments and reduce your tax burden.