What is a Cryptocurrency Disposal?

Wondering how your cryptocurrency gets taxed when you sell it? What about when you swap it for another cryptocurrency? To understand when you need to pay tax on crypto you need to first understand what is meant by 'disposal'.

Crypto is taxed as property

Cryptocurrencies are considered property in most parts of the world, and property is an ‘asset’ for tax purposes.

An asset is anything - tangible or intangible - of value that can be converted into cash. An asset is typically acquired as some sort of investment, with the intention to cash out one day in the future.

Capital Gains Tax

A capital gain is the profit you make from trading or selling any asset, including crypto:

Capital gain = selling price - buying price - fees

Your buying price + associated fees are also known as the cost basis.

For example, if you bought 1 BTC for $1,000 and also paid a fee of $10, then your cost basis is $1,010. If you later sell the Bitcoin for $1,500 then you will realize a capital gain of $1,500 - $1,000 - $10 = $490. You will have to pay a capital gains tax on this amount.

When is an asset taxed?

You'll need to pay Capital Gains Tax on your crypto investment when that asset changes hands - either by sale, swap, or as a gift (in certain countries only) - this event is what's known as a disposal. If there is a profit at the point of disposal, the profit can be taxed as a capital gain. Before you can arrive at a profit, you need to know what your cost basis was - in essence what the cost of the crypto asset was.

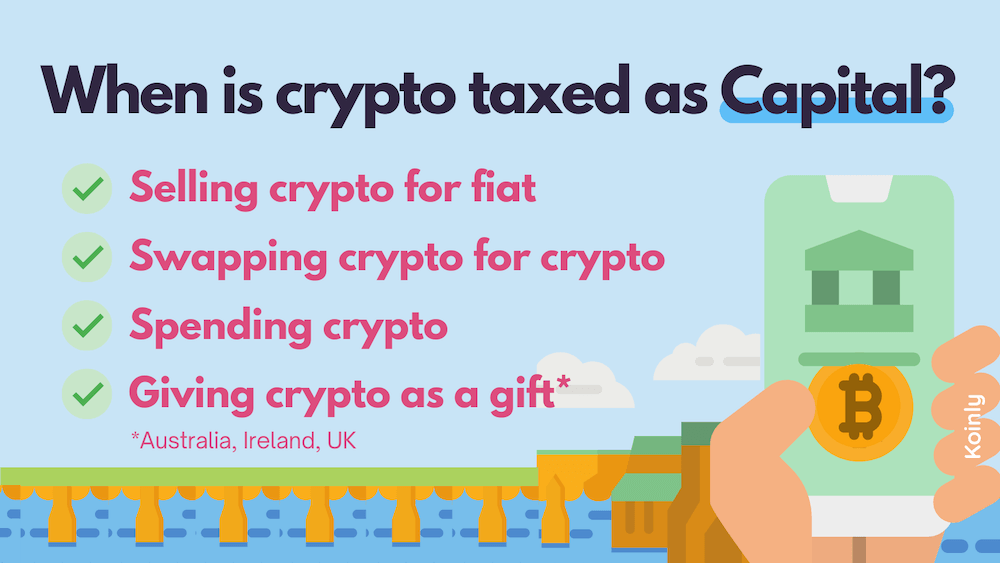

What are common crypto disposals?

In order to pay Capital Gains Tax you need to realize a gain, which typically happens when you sell your crypto asset and make a profit. But a sale is not the only way that you might realize a gain. Each time an asset changes ownership it triggers a taxable event called a disposal. CGT kicks in at the point of disposal - when there's a profit.

In most, but not all countries, you could pay CGT on your crypto disposals in these situations:

Selling: Profits from selling crypto for Fiat = CGT

Swapping: Profits from swapping crypto with crypto = CGT

Spending: Using cryptocurrency to purchase goods and services = CGT

Gifting: Perceived profits made from gifting crypto = CGT

How is the sale of crypto into fiat taxed?

Disposing of crypto for any fiat currency triggers a capital gains event. The gain or loss is determined by the difference in dollars of the crypto's value at acquisition, compared to the crypto's value at disposal.

The cost base is the fair market value in fiat of the crypto at the time of acquisition plus any costs involved like transaction fees.

EXAMPLE

Craig purchased 1 Bitcoin in Jan for $1,000 at a fee of $100.

In May of the same year, he sold his 1 Bitcoin for $2,000 at a fee of $100.

To buy his initial $1000 worth of Bitcoin, he paid a fee of $100. His cost base is thus $1,100.

To sell, he had to spend $100 in fees.

Craig's capital gain is $2,000 - $1,100 - $100 = $800

How is a swapping crypto for crypto taxed?

Swapping - or trading - one coin for another coin triggers a capital gains event because you are disposing of the first coin. The gain or loss is the difference in dollars between the initial crypto's value at disposal and the new crypto's value at acquisition.

The cost base is the fair market value in fiat of the crypto at the time of acquisition plus any costs involved like transaction fees.

EXAMPLE

Kim purchased 1 BTC in January for $1,000, plus a fee of $100.

In May of the same year, she exchanged 1 BTC for 2 ETH. The value of 1 BTC at this time is $4,000. She pays a $100 fee for the trade.

To buy her initial $1,000 worth of Bitcoin she paid fees of $100. Her cost base is thus $1,100.

To swap her Bitcoin for Ethereum she has to spend $100 in fees. This fee would go towards your Ethereum cost basis.

Kim's capital gain is $4,000 - $1,100 - $100 = $2,800

How is gifting crypto taxed?

If you gift a cryptocurrency, you're taken to have received its market value at the time of the disposal as capital proceeds, and you'll need to work out whether you have made a capital gain or a capital loss on the transaction.

The cost base is the fair market value in fiat of the crypto at the time of acquisition plus any costs involved like transaction fees.

EXAMPLE

In January, Jeff buys 1 BTC for $1,000 at a $100 fee.

Jeff sent a gift of 1 BTC to his mother for Mother's Day in May, on which date his 1 BTC is worth $6,000. He pays $100 in fees. Although he gives the coin away, he is seen to have made a gain.

On the day he gives BTC away, it is worth $6,000.

Jeff's capital gain is $6,000 - $1,100 = $4,900

How is spending crypto on goods and services taxed?

Paying with cryptocurrency for services and goods is considered a taxable event. It becomes non-taxable when personal use asset exemption applies. The capital gains/losses can be calculated by subtracting the cost basis from the fair market value of the coins you send.

How much do you pay?

In most countries, the amount of capital gains tax owed on disposed crypto depends on how long you’ve held your assets, and in which income tax bracket you are. Typically, the higher your income, the greater the percentage of tax you'll pay on capital gains.

In most countries, any gain made from the disposal of a crypto asset - held less than a year - is taxed at the same rate as your personal income tax rate. Many countries allow special treatment for gains made on assets that were held for at least one year for example Australia, where taxpayers can save 50% on CGT after holding for a year.

Crypto disposals in the USA

In the United States, Capital Gains Tax is paid on these crypto disposals:

Profits from selling crypto for fiat like USD.

Profits from swapping crypto with crypto.

Using cryptocurrency to purchase goods and services.

Crypto disposals in Australia

In Australia, Capital Gains Tax is paid on these crypto disposals:

Profits from selling crypto for fiat like AUD.

Profits from swapping crypto with crypto.

Perceived profits made from gifting crypto.

Using cryptocurrency to purchase goods and services (unless as a Personal Use Asset).

Crypto disposals in the UK

In the United Kingdom, Capital Gains Tax is paid on these crypto disposals:

Profits from selling crypto for fiat like GBP.

Profits from swapping crypto with crypto.

Perceived profits made from gifting crypto (excluding to spouse).

Using cryptocurrency to purchase goods and services.

How do you report your crypto disposals?

A crypto tax calculator like Koinly will show you gains from coins that were sold after 1 year of purchase as long-term capital gains in your tax report. This makes it easy to apply a reduced capital gains tax rate or discount on such asset disposals. Koinly can also track disposals that were made as gifts or even as donations.