Can the IRS Track Crypto in 2024?

Wondering if your Bitcoin transactions are traceable by the IRS and whether the IRS can track crypto? You've come to the right place. In this guide, we're looking at whether cryptocurrencies can be tracked by the IRS, how the IRS tracks crypto, which crypto exchanges report to the IRS, which crypto exchanges don't report to the IRS, and more.

Is Bitcoin traceable by the IRS?

Yes, Bitcoin is traceable. Here's what you need to know:

Blockchain transactions are recorded on a public, distributed ledger.

This makes all transactions open to the public - and any interested government agency.

Centralized crypto exchanges share customer data - including wallet addresses and personal data - with the IRS and other agencies.

The IRS has dedicated agents trained to connect wallet addresses to users.

Under new regulations, soon both centralized and decentralized exchanges operating in the US will be required to issue 1099-DA to the IRS detailing users' transactions.

Watch: Can the IRS track crypto?

How is cryptocurrency traceable?

For many investors, the appeal of crypto comes down to anonymity. After all, cryptocurrencies are often touted as decentralized, anonymous, untraceable, and tamper-proof assets. But it's not quite that simple in reality.

Bitcoin and other cryptocurrencies are built using blockchain technology. One of the key tenets of blockchain technology is transparency - which is upheld by the public digital ledger. Anyone can access these ledgers and view any transaction on that blockchain. Moreover, all transactions are permanently stored on the ledger.

So, any interested party can use a transaction ID and a blockchain explorer to find corresponding wallet addresses - or vice versa to see what transactions a given wallet has made. Interested parties can include any government agencies, including the IRS, FBI, and more.

Of course, there is still a sense of anonymity, after all - your wallet address doesn't include any of your personal details... or does it?

Linking your wallet address to you is becoming increasingly easy for the IRS and other agencies, in part, due to the pressure crypto exchanges have faced from the government to collect and share customer data.

How does the IRS track crypto?

The IRS is gaining increasing amounts of data about crypto transactions. In fact, as of 2022, the IRS was granted a huge budget increase in order to tackle tax evasion. More than 87,000 agents are being hired to enforce tax compliance... and crypto was singled out as a key focus for these agents.

All major crypto exchanges now need to complete Know-Your-Customer (KYC) checks on new and existing customers in order to operate in the US.

KYC checks were previously quite simple and only asked for basic personal data like your name, address, and sometimes your social security number (though that’s still plenty for the IRS to identify you with). But KYC checks have evolved alongside ID technology, with many crypto exchanges now adopting various KYC verification methods such as:

Biometric identification.

Asking users for short videos of themselves.

Taking photos alongside their ID.

As well as this, crypto exchanges collect other information about you - including your banking information, your phone number(s), and employment details.

Crypto exchanges also have the visibility of crypto addresses you withdraw funds to. This means they can effectively identify your custodial wallets - like if you’re withdrawing funds to a MetaMask wallet for example.

As well as this, under new proposed guidance from the IRS in August 2023, crypto brokers will be required to issue Form 1099-DA to both users and the IRS. Currently, the definition of crypto brokers (as defined by the IRS) includes both centralized and decentralized exchanges, as well as even potentially some online wallets. This guidance may come into effect as early as 2025. However, if you want to find a no KYC crypto exchange - check out our guide.

Do crypto exchanges report to the IRS?

Yes. A variety of large crypto exchanges have already confirmed they report to the IRS.

Back in 2016, the IRS won a John Doe summons against Coinbase. A John Doe summons compels a given exchange to share user data with the IRS so it can be used to identify and audit taxpayers, as well as prosecute those evading taxes. Since 2016, the IRS has issued similar summons against both Kraken and Poloniex.

In 2023, the IRS once again filed a court document seeking permission to enforce a summons for information against Kraken. Kraken exchange will now share data for more than 42,000 users with the IRS in November 2023 and some of these users will likely be audited.

The success of these summons, alongside the various regulations they must follow in order to operate in the US lawfully, has compelled many crypto exchanges to comply with the IRS to avoid a similar summons in the future.

As well as this, Operation Hidden Treasure was launched in March 2021. It’s a partnership between the Civil Office of Fraud Enforcement and the IRS and is made up of a specialized team trained in cryptocurrency and virtual currency tracking. The aim of the game? To root out tax evasion from crypto investors.

Which crypto exchanges report to the IRS?

It’s impossible to say for certain how many crypto exchanges are reporting to the IRS or precisely which crypto exchanges are reporting to the IRS. Many exchanges rightfully don’t want to advertise this to their users as one of the core tenets of crypto is anonymity.

This said, in an effort to stay in the good books of the IRS, many crypto exchanges are sending out 1099 forms. 1099 forms are a record of income or an individual taxpayer. 1099 forms come in a variety of shapes and sizes (which you can learn about in our crypto 1099 form guide) - but what you need to know is that whenever you get a copy of a 1099 form, so does the IRS.

Crypto exchanges that are sending out 1099 forms include:

Coinbase

Coinbase Pro

Coinbase Prime

Binance US

Gemini

Kraken

Bitstamp

eToro

Crypto.com

Uphold

Bittrex

Robinhood Crypto

PayPal Crypto

Celsius

With proposed changes to crypto tax legislation, this year - including the new dedicated digital assets 1099 form - all crypto exchanges operating in the US, including decentralized exchanges, will be required to report to the IRS using the new Form 1099-DA.

Which crypto exchanges do not report to the IRS?

There are a number of crypto exchanges that do not issue 1099 forms nor collect KYC data for most small traders including:

Bisq

Hodl hold

Pionex

TradeOgre

ProBit

Decentralized exchanges like Uniswap, PancakeSwap, and more.

You can see a full list of the best crypto exchanges with no KYC, but there's a catch. First up, many platforms with no KYC have limits to the transactions you can make - for example, popular no-KYC exchanges like MEXC or CoinEx do not allow US residents due to the harsh regulatory environment. Only recently, platforms like OKX and KuCoin brought in KYC processes that effectively prevent US residents from using their services.

Many of these exchanges aren't legally allowed to operate in the US and many other countries as they don't meet regulation requirements. As such, they may freeze accounts and need to withdraw services from users flagged with certain IP addresses quickly - meaning your funds could be frozen on the platform. Many Gate.io users reported this issue when the exchange withdrew services from the US some years ago and had little option but to cut their losses.

In other words, while the major exchanges all collect KYC and report to the IRS - this often protects you as a consumer. While the regulations are far from perfect, a tax bill is a small price to pay to know your assets are better protected with compliant and regulated exchanges.

When do crypto exchanges report to the IRS?

Regarding 1099 forms, the taxpayer and the IRS will generally receive these in January or February of the following year.

However, the IRS is probing many crypto exchanges currently - including Binance. It’s impossible to say if or when these crypto exchanges will share data with the IRS and when.

Can I be linked to a wallet address?

Non-custodial wallets are increasing in popularity, especially in the wake of the FTX Group collapse. There's a huge range of wallets to pick from, and better still, the vast majority of these wallets don't collect KYC data or personal data of any kind - meaning even in the unlikely scenario they faced a John Doe summons from the IRS, they'd have very little information to share, right?

Not quite.

There are a few ways you can get linked to your wallet address, even if you've stored no personal information on it.

First, some wallets let you link a credit or debit card to let you buy crypto easily - for example, Trust Wallet. It's super convenient for when you want a quick purchase, but it also creates an easy way to link a personal bank account to a given wallet. Your banking provider is legally required to share information with the IRS and other government authorities - and you can bet if you're making crypto purchases, the IRS is going to take an interest in what other crypto transactions you've made.

As well as this, if you're transferring crypto between your non-custodial wallet and centralized exchanges that do share data with the IRS... that data might include your wallet address.

Furthermore, your wallet might be collecting more data than you think. MetaMask's parent company, ConsenSys, just updated its privacy policy to state that MetaMask user's IP and Ethereum addresses may now be tracked when they complete a transaction. While there are no guarantees this information is being shared with any party outside ConsenSys - this is potentially a matter of time.

Finally, in the current IRS definition of crypto brokers - some online wallets may potentially be included - meaning in the future, some wallets may be required to collect customer data in order to issue 1099-DA forms to the IRS to report on user transactions.

As you can see, it's become increasingly difficult for crypto investors to truly remain anonymous, regardless of the exchange, wallet, or blockchain they're using. The best thing you can do is report your crypto accurately and pay your tax liability - or face far steeper penalties than a tax bill.

Not sure what you need to report? Here's what they want to know...

What do I need to report about crypto to the IRS?

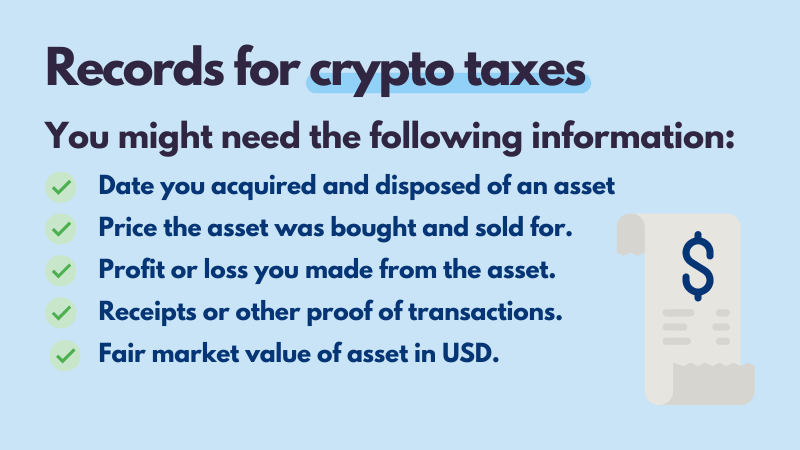

The IRS wants a lot of information about your crypto assets, including:

The date of each transaction.

Your cost basis or the fair market value of your crypto in USD the day you acquired it.

The fair market value of your crypto in USD the day you disposed of it.

The capital gain or loss you made from each transaction.

What the transaction was and the parties involved.

Receipts of purchase and sale.

Records of transfers and transactions from all your crypto wallets and exchanges.

You’ll need to report all this on Form 8949 and Schedule D, as well as any crypto income on Schedule 1 as part of your annual tax return, by April 15 each year. You can learn more about reporting your crypto taxes in our complete US crypto tax guide.

You’ll need to report all this on Form 8949 and Schedule D, as well as any crypto income on Schedule 1 as part of your annual tax return, by April 15 each year. You can learn more about reporting your crypto taxes in our complete US crypto tax guide.

How does the IRS verify cost basis?

Tempted to tweak your cost basis in order to pay less tax?

It’s tax evasion and it’s not worth the risk. While the IRS might not be able to prove anything from one single tax return - they can compare cost basis and the cost basis methods for crypto from your previous tax returns. If there are discrepancies, the IRS can and will audit you.

The usual statute limit for an IRS audit is three years. But when it comes to overstating cost basis by 25% or more, the IRS has 6 years to audit those tax returns.

I forgot to report cryptocurrency on taxes - what do I do?

Whether you forgot or you “forgot” - if the IRS believes you've committed tax fraud, there's no limit to how far back they can audit you. Fortunately, you have a couple of routes available for you to avoid a crypto tax evasion penalty.

The best thing to do in this scenario is to amend your tax return for the years you forgot to report crypto. You have three years from the date you originally filed to file an amended return. The IRS is far more likely to be lenient to those who make the effort to go back and correct their taxes.

To amend your tax return - you'll need to file an IRS Form 1040X. Don't worry, you won't need to file all your taxes again, only the missing information.

Alternatively, if you've deliberately underreported or avoided reporting crypto on your taxes altogether, the IRS just updated Form 14457 to include a section on reporting virtual currency. Form 14457 is a voluntary disclosure application that allows taxpayers who may be facing criminal prosecution for violation of tax laws to voluntarily disclose information to the IRS they previously failed to disclose. By filing Form 14457, you agree to comply with the IRS and pay any due taxes.

How Koinly crypto tax calculator can help

We get it. Crypto taxes are time-consuming, that’s why we made Koinly crypto tax calculator. We make it easy to get your crypto taxes done in no time at all and ensure you remain tax compliant.

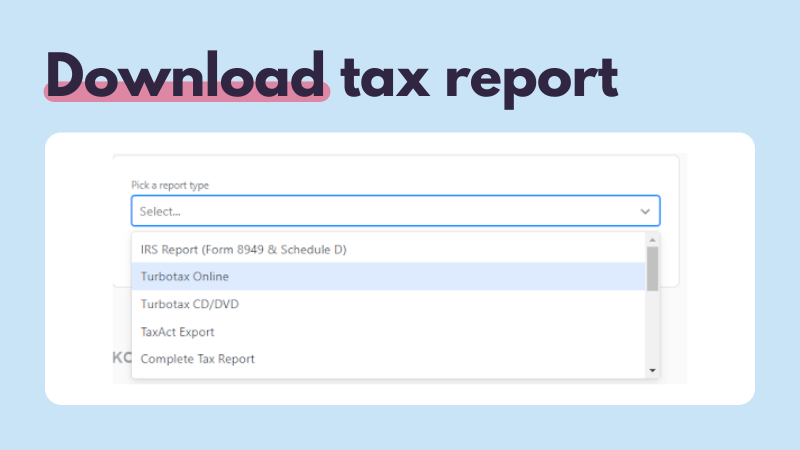

All you need to do with Koinly is sync all the crypto exchanges, wallets, and blockchains you use (we support a lot!) using API or by importing a CSV file of your transaction history. Once you’ve done that, Koinly will calculate your capital gains, losses, income, expenses, and more and fetch your crypto tax report, ready for you to download.

For US investors, Koinly can generate a pre-filled Form 8949 and Schedule D, the Complete Tax Report (for crypto income), and a variety of tax reports for tax apps like TurboTax and TaxAct.

For US investors, Koinly can generate a pre-filled Form 8949 and Schedule D, the Complete Tax Report (for crypto income), and a variety of tax reports for tax apps like TurboTax and TaxAct.

FAQs

Got more burning questions? Here are the answers to our most frequently asked questions about tracking Bitcoin and crypto transactions:

Can the IRS track cryptocurrency?

Yes, the IRS can track cryptocurrency, including Bitcoin, Ether, and a huge variety of other cryptocurrencies. The IRS does this by collecting KYC data from centralized exchanges. The IRS will soon have more tools at its disposal to track more data, as centralized and decentralized exchanges will have to start issuing the 1099-DA form starting from the 2026 financial year (for transactions in 2025).

Can the government track Bitcoin?

Yes, the government (and anyone else) can track Bitcoin and Bitcoin transactions. All transactions are stored permanently on a public ledger, available to anyone. All the government needs to do is link you to your wallet or transaction.

Will the IRS catch a missing 1099?

Yes. Any time you receive a 1099 form - the IRS receives an identical copy. So if you avoid reporting your transactions relating to a given 1099 form, the IRS will absolutely know about it.