🇮🇳

Koinly , the best free crypto tax calculator for India

, the best free crypto tax calculator for India

Koinly connects to 750+ crypto platforms to track your transactions and calculate your ITD crypto taxes. Fast, simple, reliable and FREE!

Import your trades

Preview your crypto income

Download your crypto tax report

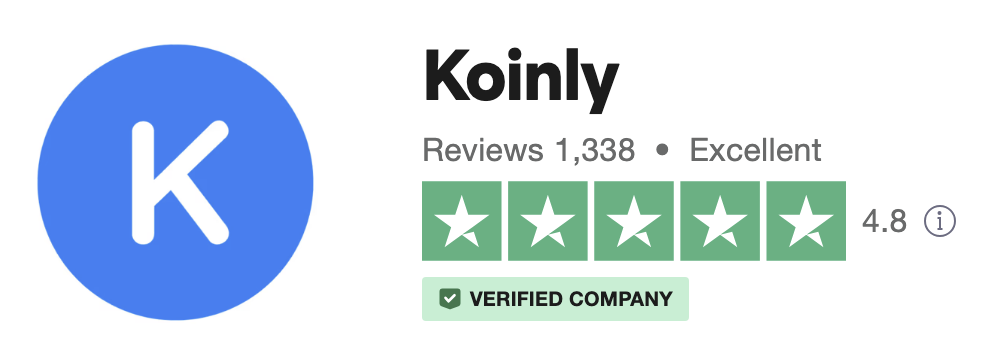

Trustpilot's top rated crypto tax tool

Koinly is consistently reviewed as the ultimate free crypto tax calculator for India.

"Koinly is great for helping to track your gains and losses and supports most all blockchains and wallets. Best of all, they are very helpful with questions which are usually answered with in 24 hrs."

"Koinly is a well-built product, with really helpful API-connections, so one can stay up-to-date automatically without having to upload CSV-files"

"Koinly made making my crypto tax report (which is quite complex) very easy! I could tweak everything easily for my situation to be perfectly represented."

Track, calculate and report. Koinly does it all

Wondering how to calculate taxes on cryptocurrency? Koinly is a cryptocurrency tax calculator trusted by investors in over 20 countries including India. Koinly integrates with 750+ exchanges, blockchains & wallets to securely track your crypto and calculate your taxes. File your crypto taxes fast with a report from Koinly.

Easily import your crypto trades

No more crazy spreadsheets! Koinly is a crypto tax calculator that imports your crypto transactions for free. Binance, WazirX, CoinDCX, Coinswitch? Koinly supports them all! Simply connect your exchanges, wallets, and blockchains and let Koinly calculate your crypto tax liability.

Import data from 750+ platforms

Integrate automatically or by CSV file

DeFi, NFTs, mining, staking & more!

Preview your crypto income for free

Koinly’s super power? We understand India's crypto tax rules! Koinly knows if a transaction was income, a loss, or a non-taxable event. And the best part? Koinly calculates your Income Tax, for free!

Preview your income & losses

Report your crypto accurately

Pay the right amount of tax

Track your portfolio for free

Koinly is a cryptocurrency portfolio tracker and a cryptocurrency calculator in one. Use Koinly's powerful portfolio tracking tools to watch your portfolio growth over time.

Track trades from 750+ platforms

View gains and losses

See historical crypto & fiat spot prices

Koinly, the crypto tax calculator India needs

Don't waste time and money with crypto tax calculators that are expensive and complicated. Choose India's best crypto tax calculator and simplify the process!

🔌 750+ Integrations

Koinly integrates with 750+ crypto platforms including 350+ exchanges, 90+ wallets, 150+ blockchains. Plus support for thousands of coins and tokens.

🤑 Value for Money

Koinly gives you more for less, with a generous free plan that imports 10,000 transactions, supports 750+ integrations, and provides a free preview of your taxable crypto gains.

🧠 Free Portfolio Tracker

Enhance your cryptocurrency portfolio performance by keeping track of your real-time realized and unrealized profits and losses with Koinly.

⭐️ ⭐️ ⭐️ ⭐️ ⭐️ Support

Koinly stands out as the highest-rated crypto tax software on Trustpilot, thanks to our unbeatable combination of exceptional product features and legendary user support.

Your frequently asked questions

Does cryptocurrency attract tax in India?

Yes, in India, crypto is subject to tax. In 2022, the Indian authorities acknowledged cryptocurrencies in India by classifying them as Virtual Digital Assets (VDAs) and introducing a taxation framework for VDAs - aka crypto and NFTs.

What is the tax rate on crypto in India?

In India you’ll pay 30% tax on profits from trading, selling, or spending crypto and a 1% TDS tax on the sale of crypto assets exceeding more than RS50,000 (RS10,000 in certain cases) in a single financial year. You may also pay Income Tax upon receipt at your individual tax rate if you’re seen to be earning other income in crypto, for example, through staking or mining.

Does Koinly calculate income from crypto

Yes, Koinly can calculate cryptocurrency gains for you. Koinly is a cryptocurrency tax calculation and reporting platform that can help you calculate your capital gains and losses from your cryptocurrency transactions. Use Koinly to connect your cryptocurrency wallets and exchanges and import your transaction history. Koinly will then use this information to calculate the difference between your cost basis (the amount you originally paid for the cryptocurrency) and the sale price to determine your capital gains and losses.

What about TDS?

TDS is a form of tax collected at the source in India. You’ll pay a 1% TDS on the transfer of a crypto asset. The primary reason the 1% TDS has been introduced is to capture transaction details and keep track of investments being made in crypto assets by Indian Investors. 'Transfers means a change of ownership, so a sale, trade, or spend - not transferring from one wallet to another.

Is DeFi taxed in India?

The ITD has not released specific guidance on DeFi transactions. Instead, we need to refer to the existing provisions of the Income Tax Act for guidance. The following DeFi transactions may be taxed at your Individual Tax Rate upon receipt: Earning new liquidity mining tokens, governance, or reward tokens, referral rewards, play to earn income, browse to earn platforms like Permission.io or Brave. Learn more about DeFi and tax in India, here.

Does Koinly calculate DeFi taxes?

Yes, Koinly can calculate DeFi taxes for Indian crypto investors. Koinly is a cryptocurrency tax calculation and reporting platform that can help you calculate the taxable income from your DeFi transactions. With Koinly, you can connect your DeFi wallets and exchanges and import your transaction history. Koinly calculates the taxable income from your DeFi transactions, such as yield farming, staking, and liquidity provision. Koinly supports a wide range of DeFi protocols and platforms, so you can be confident that your DeFi taxes will be calculated accurately and in compliance with the latest tax laws.

Is Koinly a free platform?

Koinly offers a free plan that lets you import 10,000 transactions from 700+ integrations, and provides a free tax preview. To download your personalised crypto tax report, you'll need to upgrade your plan to one of Koinly's affordably paid subscriptions.

Crypto question? Browse our extensive resources for investors