Kryptovaluta Skat Danmark: 2024 Guide

Wondering how cryptocurrency is taxed in Denmark? The Danish Tax Agency - Skattestyrelsen - has given clear guidance on Denmark's crypto tax. The exact tax you’ll pay on your cryptocurrency depends on your specific investments, how much you earn, and the municipality in which you live. Read on to learn more about the Danish crypto tax rules for 2024.

This guide is regularly updated

Before we start - the rules on crypto tax in Denmark are always changing. At Koinly, we keep a very close eye on the Danish Tax Agency’s crypto policies and regularly update this guide to keep you informed and tax-compliant.

19 December 2023: Updated for 2024

23 February 2023: Updated to include guidance on stablecoins, staking rewards, and more.

8 February 2022: Welcome to the Danish Crypto Tax Guide! (Velkommen til den Danske kryptoskatteguide!)

Is crypto taxed in Denmark?

Yes. Cryptocurrency is taxed in Denmark if you’re investing in crypto for ‘speculative purposes’. That includes most crypto investors.

How is crypto taxed in Denmark?

The Danish Tax Agency - Skattestyrelsen - is quite clear that they don’t view Bitcoin and other cryptocurrencies as a fiat currency, like the Danish Krone.

Instead, they view cryptocurrency as a kind of personal asset.

Personal assets in Denmark are only taxed under two specific circumstances:

Personal assets in Denmark are only taxed under two specific circumstances:

If the asset is part of an individual's business

If the asset is owned for speculative purposes

This in itself isn’t hugely helpful, so let’s break down what ‘for speculative purposes means’.

What does speculative purposes mean?

You might think as a HODLER, you might get away with paying no tax on your crypto from the above - but it's not the case.

In general, crypto holdings are seen as speculative assets by the Danish Tax Agency. This makes the profits and losses taxable as a result.

If you're unsure whether you own crypto for speculative purposes, the Danish Tax Agency can make an assessment of your personal investments. They will ask things like:

What currency did you buy - bitcoins for example?

What can it be used for?

Is the currency suited for speculation - for example, a rise or fall in the exchange rate

Is it possible to sell the currency with a profit?

Why did you buy the currency?

Are you the owner of the currency?

We can refer back to some previous cases to see how stringent the Danish Tax Agency is about when crypto is held for speculative purposes. One Dogecoin investor tried to claim they bought the memecoin for humorous purposes - and even then the Danish Tax Agency found that the purpose was speculative due to the ability to resell the asset for a profit.

Which taxes apply to crypto in Denmark?

According to the Danish Tax Office - crypto may be subject to Personal Income Tax or Capital Gains Tax, depending on the specific crypto asset and the transactions you're making and whether it's viewed as personal income or a financial contract.

Specifically, Skattestyrelsen distinguishes between Bitcoin & other altcoins and stablecoins, so let's break it down.

Generally, when you're trading with Bitcoin & altcoins, any profits will be viewed as personal income (subject to a tax of up to 52%). Transactions with Bitcoin & altcoins that may be a taxable event include:

Selling Bitcoin & altcoins for fiat currency like Danish Krone.

Trading Bitcoin & altcoins for another cryptocurrency.

Spending Bitcoin & altcoins on goods and services.

Airdrops of crypto.

Mining and staking rewards from crypto - although there are some specific rules about when you'll realise income from staking rewards we'll cover shortly.

Getting paid in crypto.

Meanwhile, if you're selling or trading stablecoins specifically, this is viewed as trading in financial contracts and as such any gain (although generally minimal) is viewed as capital income and subject to a tax of up to 42%.

How to calculate crypto gains, losses, and income

You can calculate whether you’ve made a profit or lost by subtracting your cost basis (what it cost you to acquire the asset plus any fees) from your sale price/the fair market value of the asset at the point you disposed of it.

If you have a profit, you have a gain and you’ll pay Income Tax on that gain. If you have a loss, you won’t pay tax on it - but you may be able to offset it against your gains if you meet specific conditions (more on this later).

Meanwhile, if you have income - like from airdrops or mining rewards - you'll need to identify the fair market value of your tokens in DKK on the day you received them in your portfolio.

Personal Income Tax rate

For general income, your Personal Income Tax rate in Denmark is made up of:

Bottom-bracket tax (state tax).

Top-bracket tax (state tax).

Municipal tax (local tax).

Labour market tax (state tax) - this does not apply to crypto

Every taxpayer in Denmark pays the labour market tax and municipal tax. Labour market tax is set at 8%, while municipal tax varies - the average rate is around 25%. The 8% market tax is not applicable to crypto assets, but it is useful to know for your general taxation strategy.

The bottom-bracket tax applies to anyone with an income in Denmark and is a flat rate of 12.11%. This is however calculated after you've already subtracted your personal allowance and 8% labour market tax.

The top bracket tax is an additional tax of 15% on any income over 552,500 DKK. Again, this is calculated after labour market contributions.

It's a lot of tax. However, there is a rule that the sum of your bottom-bracket tax, top-bracket tax, and municipal taxes cannot exceed 52.06% of your income.

For crypto tax, you'll pay your normal salaried tax rate, excluding the 8% labour market tax. The 8% market tax is not applicable to crypto assets.

Capital Gains Tax on crypto

As we mentioned above, there are specific instances - when you're selling or trading stablecoins - where the transaction will be viewed as a financial contract and any gain will be viewed as a capital income and subject to Capital Gains Tax. In Denmark, the Capital Gains Tax rate is 42%.

Crypto tax breaks Denmark

Denmark doesn't have any specific crypto tax breaks, but there are a couple of tax laws that help you pay less tax on your crypto.

Non-speculative purposes: In some instances, you may not need to pay any tax on crypto gains if you're not seen to be investing in crypto for speculative purposes. You can ask the Danish Tax Agency to assess your individual investments.

Personal tax allowance: Each individual taxpayer over the age of 18 gets a personal allowance of 46,700 DKK tax free. Where a spouse cannot utilise the whole personal allowance, this is transferred to the other spouse.

Crypto capital losses Denmark

Denmark's tax office has very specific rules when it comes to crypto losses. If you have profits and losses, you should generally report profits in box 20 of your tax assessment notice, excluding capital income from selling or trading stablecoins - which should go in box 346. Losses generally go in box 58, excluding losses from selling or trading stablecoins which should go in box 85.

Generally, you should not offset a loss against any profit, but there are some key exceptions to this rule that allow you to offset losses against gains of the same kind of cryptocurrency, provided you have not purchased more of that cryptocurrency in between your transactions.

So for example, if you owned 10 BTC, and sold several throughout the same financial year, and created both gains and losses, you may offset your BTC loss against any BTC gain and make (and report) a net calculation. But only if you had not bought any more Bitcoin in between your transactions.

So in our example above, if you'd sold 5 BTC at a loss and 5 BTC at a profit, you would make a net calculation as to whether you had a net profit or loss. If you have a net profit, you'll report this profit in box 20, if you have a net loss, you'll report this loss in box 58.

However, if you had bought more BTC after selling 5, you should not make your net calculation. Instead, you'll need to calculate each transaction individually using the FIFO (First In First Out) cost basis method.

As well as this, you cannot offset the loss against profit from different kinds of cryptocurrency that were bought in several transactions and sold in the same income year. So, for example, you cannot offset losses from ETH against gains from BTC.

Tax free crypto Denmark

There are a few crypto transactions that are tax free in Denmark, including:

Buying crypto with fiat currency - like DKK

HODLing crypto.

Transferring crypto between your own wallets.

Donating crypto.

Lost or stolen crypto Denmark

The Danish Tax Agency has previously ruled that losing access to crypto is not seen as a disposal and is therefore not tax deductible. However, if you feel you can prove you’ve lost your access to your asset permanently, you can request a binding ruling.

Can Skattestyrelsen track crypto?

Yes. As far back as 2019 - the Danish Tax Agency confirmed they were working with crypto exchanges operating in Denmark to share KYC information and sending out letters to crypto investors they believed to be avoiding taxes.

Do you pay tax when you buy crypto in Denmark?

It depends on what you buy it with. If you buy your crypto with fiat currency - it's tax free. Meanwhile, if you buy crypto with another crypto, this is seen as a trade and any profits are subject to Income Tax.

Buying crypto with DKK

TAX FREEBuying crypto with a fiat currency like DKK, euros or USD is tax free. However, you should keep track of your cost basis to later calculate any gains or losses when you sell or trade your crypto.

Buying crypto with crypto

INCOME TAXBuying crypto with crypto is taxable. Any profit you make as a result of a trade is subject to Income Tax. For example, if you bought ETH with BTC, you'd need to calculate whether you made a profit on your ETH. Just subtract the cost basis of your ETH from the fair market value of ETH on the day you traded it. If you have a profit, you'd pay Income Tax on that profit.

Remember, if you're trading stablecoins - this is viewed as a financial contract and Capital Gains Tax applies instead.

Buying and HODLing crypto

TAX FREEBuying and HODLing crypto is tax free. It's only when you make a specific transaction that you trigger a taxable event.

Do you pay tax when you sell crypto in Denmark

Yes. You'll pay Income Tax when you sell crypto in Denmark.

Selling crypto

INCOME TAXRegardless of whether you sell your crypto for fiat currency like DKK or another crypto - you'll pay Income Tax on any profit.

Remember, if you're selling stablecoins - this is viewed as a financial contract and Capital Gains Tax applies instead.

Do you pay tax when you transfer crypto in Denmark?

No. You won't pay tax when you transfer crypto around your own wallets or the exchanges you use. Transfer fees however are a little trickier from a tax perspective.

Moving crypto between wallets

TAX FREEMoving crypto between your own wallets is tax free! However, you need to keep good records of your crypto transactions - including transfers - because the tax treatment of transfer fees isn’t quite so clear-cut.

Transfer fees

INCOME TAXWhenever you transfer crypto - you’ll normally pay a fee to do so, whether that’s a gas fee or a fee from the exchange or wallet provider.

If that fee is paid in fiat currency - it would be tax free. However, in most instances, when you pay a transfer fee you’ll pay it in cryptocurrency. This could be seen as spending your crypto and therefore any profit would be subject to Income Tax.

The Danish Tax Agency hasn't yet given specific guidance on transfer fees, but we recommend a conservative approach to crypto tax. One of the safest approaches is to treat transfer fees as a cost with no realised gain or loss. Your cost basis remains the same, but you don’t have as much crypto as you had previously.

Adding or removing liquidity

INCOME TAXIf you’re using DeFi protocols - there’s a good chance you’re investing in liquidity pools as part of this.

Like above, the Danish Tax Agency hasn't yet given any guidance on liquidity pool transfers so it is not clear how these would be treated from a tax perspective. However, when you add and remove liquidity from the majority of liquidity pools you'll get a liquidity pool token in return. This could be seen as a crypto-to-crypto trade and therefore any profits may be subject to Income Tax. To further complicate things, if you're adding stablecoins to a given liquidity pool, any profit may potentially be viewed differently from a tax perspective.

How are airdrops and forks taxed in Denmark?

Hard forks have clear guidance from the Danish Tax Agency, while airdrops don't as of yet. However, we can infer tax treatment on airdrops based on the tax treatment of gifts.

Hard forks

TAX FREE ON RECEIPTThe Danish Tax Agency was clear in a previous ruling on crypto disposals that when it comes to hard forks, these are only subject to Income Tax at the point you dispose of the asset (by selling it, trading it, or spending it). However, you should use 0 DKK as the cost basis.

Airdrops

INCOME TAXAirdrops are generally viewed as a "promotional gift" and as such taxable as personal income. You should report the fair market value in DKK of your tokens on the day you received them and report this in box 20 of your tax return.

Crypto gifts and donations tax Denmark

Gift Tax is complicated in Denmark - it all depends on how much you're gifting and who you're gifting it to. Meanwhile, donations may be tax deductible.

Gifting crypto

TAX FREE UNDER 69,500The Danish Tax Agency ruled on this previously, stating that crypto gifts may be tax free when they are speculative and of low value.

In general, gifts in Denmark are tax-free up to a maximum of 69,500 for 2022. But this only applies if you're the recipient is your child, stepchild, grandchild, parent, stepparent, or someone you've lived with for at least two years.

For any value above this amount, you'll pay 15% in gift tax.

Donating crypto

TAX DEDUCTIBLEDonations are tax deductible provided you donate to an approved charity. You should automatically receive your tax deduction if you give the charity your civil registration number. The maximum deduction for 2022 is 17.200 DKK.

Crypto mining tax Denmark

INCOME TAXThe Danish Tax Agency ruled that crypto mining constitutes a hobby business and that mined coins should be considered business income and subject to Income Tax. You'll need to pay Income Tax on your mined coins based on the fair market value at the point you receive them. You'll also pay Income Tax on any profit when you later sell, trade, or spend your mined coins.

You need to declare profits from non-commercial business activities in box 20 of your tax return.

Staking crypto

INCOME TAXStaking rewards are seen as personal income and as such subject to Income Tax. You should report staking rewards in box 20 of your tax return.

However, an important note here - your staking rewards are only taxable at the point you receive them to your portfolio and you can use them. This has big implications for ETH staking as you'll only be liable to pay tax on your staking rewards at the point you're able to dispose of them or otherwise transact with your tokens.

If you later dispose of staking rewards, any gain is subject to tax as well.

What kind of records will the Danish Tax Agency ask for?

The Danish Tax Agency says you should keep the following documents to prove your profit/loss calculations:

Vouchers on orders, purchases, sales, and payment

E-mails and other correspondence

Information about your wallet provider

Basis of agreement with your wallet provider

Information about the number of your wallet, meaning the public code

Basis of agreement in force at the time of purchase and possible subsequent changes

Printout of your cryptocurrency holdings

Bank account statements related to purchases and sales of cryptocurrencies

Printout of your transactions

Possible other relevant documentation of your purchases and sales to verify your ownership

Using crypto tax software like Koinly ensures you have excellent records of your crypto transactions.

Denmark Cost Basis Method

The cost basis method in Denmark is FIFO.

When do you need to report your crypto taxes?

You report your crypto taxes in your annual tax return.

The Danish tax year runs from the 1st of January to the 31st of December each year. The deadline to file and submit your tax return is the 1st of May each year (or the 1st of July for non-Danish income). This means the current tax year you're reporting on is the 2023 financial year and the deadline is the 1st of May 2024. The online portal (E-tax) to report your taxes opens from mid-March 2024.

How to calculate your crypto taxes

Calculating your crypto taxes so you can report them to the Danish Tax Agency is time-consuming. You can do it all manually, or you can use a crypto tax calculator like Koinly to save you hours.

If you want to calculate your crypto taxes manually, follow these steps:

Identify all your taxable crypto transactions for the entire financial year you're reporting on.

Identify which transactions are subject to Income Tax.

Identify the cost base for each transaction using the FIFO method.

Calculate your subsequent capital gains and losses, income, and expenses.

Report your capital gains, losses, and income to the Danish Tax Agency in your annual tax return by the 1st of May.

How to report crypto taxes to Skattestyrelsen

Once you've done all your crypto tax calculations and the E-Tax portal is open, you can submit your taxes online. You'll need your civil registration number and E-Tax password to access the portal (you can find this on your tax return).

You'll report your crypto on your tax return as follows:

Gains from disposals of Bitcoin & altcoins: Box 20.

Losses from disposals of Bitcoin & altcoins: Box 58.

Gains from stablecoins: Box 346

Losses from stablecoins: Box 85

Airdrops: Box 20

Staking rewards (but only at the point you receive them in your portfolio): Box 20

Mining rewards: Box 20

Other interest from crypto: Box 20.

How to use a crypto tax app like Koinly

Don't get stuck in busy work. Don't get it wrong. Don't rely on your accountant to know where to look. Use Koinly to generate your HMRC crypto tax reports. Here's how easy it is:

1. Sign up for a FREE Koinly account. It only takes a minute!

2. Select your base country and currency. In this instance, Denmark and Danish Krone.

3. Select your accounting method. Koinly supports FIFO.

4. Connect Koinly to your wallets, exchanges, or blockchains. Koinly integrates with more than 350 crypto exchanges, wallets, and blockchains (see all). If you can't find yours, let us know - we're always adding more.

4. Connect Koinly to your wallets, exchanges, or blockchains. Koinly integrates with more than 350 crypto exchanges, wallets, and blockchains (see all). If you can't find yours, let us know - we're always adding more.

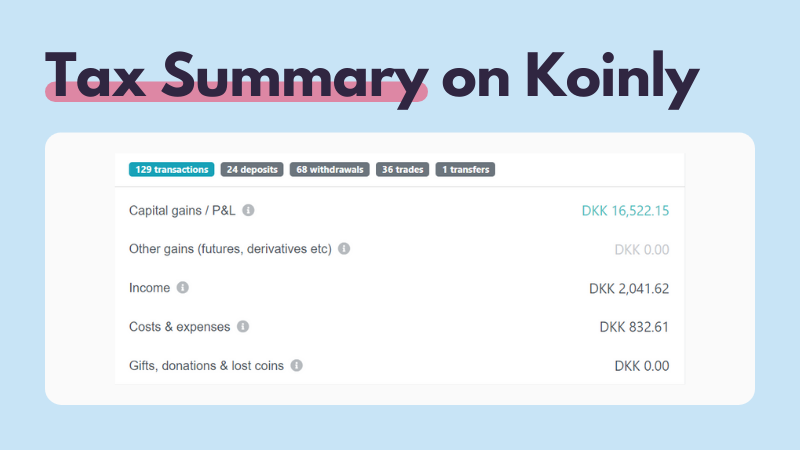

5. Let Koinly crunch the numbers. Make a coffee. Koinly will calculate your cost basis for each crypto asset like ETH, ADA, Bitcoin, and much more. Koinly will calculate each capital gain or loss from your sales, as well as your crypto income and expenses.

6. Ta-da! Your data is collected and your full tax report is generated! Head to the tax reports page in Koinly and check out your tax summary. This includes your net capital gains, other gains, income, costs, expenses, and any gifts, donations, or lost crypto.

7. To download your crypto tax report, upgrade to a paid plan. Download what you need, when you need it. For our Danish users, we offer the Fortjeneste og tab report.

7. To download your crypto tax report, upgrade to a paid plan. Download what you need, when you need it. For our Danish users, we offer the Fortjeneste og tab report.

8. Send your report to your accountant, or complete your Self Assessment Tax Return yourself. Use the generated file to complete your annual tax return or send it over to your accountant. Done!

8. Send your report to your accountant, or complete your Self Assessment Tax Return yourself. Use the generated file to complete your annual tax return or send it over to your accountant. Done!