Pay Less Crypto Tax in 2024 (Legally!)

Crypto has taken many investors to the moon, but what goes up inevitably comes down, and in the case of crypto gains, tax is the dark side of the moon. Fortunately, there are ways to strategically - and legally - pay less crypto tax... without facing the wrath of the IRS. Here's how to pay less crypto tax in 2024.

How to pay less crypto tax

You can't legally outright avoid your tax liability (without facing steep crypto tax evasion penalties), but there are simple steps you can take today to help reduce your tax bill ahead of the end of the financial year, including:

Track your gains & losses

Harvest unrealized losses

Offset losses against gains

Pick the best cost basis method

Use crypto loans to spend

Utilize tax free thresholds

Gift & donate crypto

Invest in an IRA

Take profits strategically

Want to know more about how crypto is taxed? Check out our USA Crypto Tax Guide.

Track your gains & losses

If you've had a great year when it comes to gains, there's a tax bill coming for you - yet many investors don't track their gains or losses throughout the financial year to keep on top of their tax liability.

Using a tax calculator and portfolio tracker like Koinly makes this easy. Once you've set it up, you'll be able to see a complete overview of your realized gains and losses, all from your dashboard. So you'll always know what your tax liability from your crypto investments will be.

As well as this, you can also keep track of your unrealized losses on a macro and micro level - which is important as you can use these strategically to reduce your tax bill.

Harvest unrealized losses

There are two kinds of losses: realized and unrealized. A realized loss is a loss you've made as you've disposed of an asset by selling, swapping, or spending it for a price lower than you acquired it for. Meanwhile, an unrealized loss is an asset that has decreased in value since you acquired it, but you've not yet realized that loss as you still hold the asset. For example, if you bought BTC for $20,000 and it's now valued at $16,000, but you're still hodling, you have an unrealized loss. You'll only realize your loss if you sell, swap, or spend your BTC.

All this matters, because these losses can help you reduce your tax bill if you realize them. Once realized, you can offset your losses against your gains and pay less tax overall.

There's no simple answer to when you should realize a loss - it all depends on your personal circumstances. But in the current market, your unrealized losses are likely wracking up. The NFT boom in particular has left many investors with huge losses due to crashing prices. In these instances, it can often be more beneficial to you to sell your NFT at a loss and use that loss to reduce your tax bill.

Similarly for coins with no value, whether that's due to a rug pull or a crash like with LUNC, you may be better off realizing these losses by selling, swapping, or sending them to a burn wallet if the former options are not available to you.

Offset gains with losses

As with any investment, you can take advantage of crypto gains by also claiming losses on other investments the year you realize your profit. That means if you made $30,000 for selling Bitcoin but lost $30,000 for selling Ethereum, you wouldn’t owe any tax since you broke even.

These losses aren’t limited to other forms of cryptocurrency, though. If you are about to cash in a large crypto investment, look through the rest of your portfolio to see if there are other losing investments you could sell to offset your gains.

In even better news, if your capital losses exceed your capital gains, the amount of the excess loss that you can claim to lower your income is the lesser of $3,000 ($1,500 if married filing separately) or your total net loss shown on line 21 of Schedule D (Form 1040). If your net capital loss is more than this limit, you can carry the loss forward to later years. If you consciously use this to your advantage, this is called tax-loss harvesting.

Hold on

The easiest way to pay less tax? You simply need to HODL for the long run.

There are actually two different IRS Capital Gains Tax rates - one for short-term gains and one for long-term gains.

Short-term gains tax rates apply to any asset you’ve held for less than a year. Your short-term capital gains tax rate is the same as your normal Income Tax Rate. Of course, for some investors, this can be quite a steep rate if you’re in a high-income tax bracket.

Long-term gains on the other hand are taxed at a much lower rate. Any asset you’ve held for more than a year will be taxed as a long-term capital gain. You’ll pay between 0% to 20% in tax on long-term capital gains, excluding long-term gains from NFTs deemed collectibles which may be taxed at up to 28%.

All this to say, know which assets to HODL onto. If you have two similar assets - for example, 2 BTC - and you’ve held one for a year and one for less than a year, you’ll pay less tax on the long-term asset. Similarly, if you’re only a couple of weeks or months away from having held an asset for a year, you could benefit from HODLing on just a little longer.

You can find out more about short and long-term Capital Gains Tax rates in our US Bitcoin and Crypto Tax Rates 2024 Guide.

Pick the best cost basis method

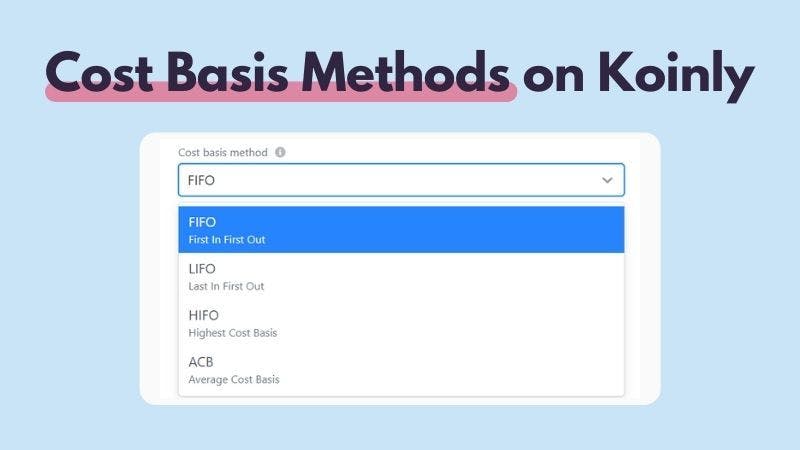

A cost basis method is the method you use to calculate how much your assets cost you and which you sold and when, when dealing with multiple assets of the same kind, like cryptocurrencies or stocks.

This might not sound like a big deal - but the cost basis method you choose can make a huge difference to how much tax you’ll pay.

According to the IRS, US taxpayers can use the Spec ID cost basis method, which means you specifically identify each unit sold. Thanks to its flexibility, Spec ID can accommodate other cost basis methods including

FIFO

LIFO

HIFO

There is no best cost basis method. It will all depend on your crypto assets and transactions. You can only choose one cost basis method to use for the year and you'll need to stick with it, so it's well worth taking the time to do this to figure out which is best for you. Better yet, use crypto tax software that supports various cost basis methods (like Koinly) to compare them and save yourself hours.

You can find out more about each cost basis method in our How to Calculate Cost Basis Guide.

Get a crypto loan

Low on cash and contemplating cashing out some crypto quickly? It's a great way to get an injection of cash when you need it, but it comes with a tax bill.

To lower your tax bill - consider a crypto loan. You can put your crypto up as collateral to get cash when you need it, and pay back the loan over time, so you never cash out your crypto.

A caveat though - the IRS hasn't given any guidance as to how crypto loans are taxed. As you (excluding some DeFi loan protocols) don't receive any tokens in exchange for your collateral nor dispose of your crypto, taking out a loan should be viewed as a non-taxable event. It's a way to get cash flow when you need it, without giving up any of your hard-earned gains to the IRS.

You should, of course, calculate the interest rate for your repayments to ensure this is worth it for your personal circumstances. Find out more in our crypto loans guide.

Utilize tax free thresholds & deductions

The IRS offers many tax deductions and credits for US taxpayers - so make sure you know which ones you can use and make the most of them to reduce your tax bill. You can either take the standard tax deduction or you can itemize your deductions instead, but you can’t do both.

Which approach you choose will depend on which benefits you most.

The standard tax deduction for the 2023 tax year you're currently filing for is:

$13,850 for single taxpayers and married individuals filing separately.

$27,000 for married couples filing jointly

$20,800 for heads of households.

This means however you're filing, you'll pay no Income Tax on the amount listed above.

The standard tax deduction is processed faster by the IRS which is why many taxpayers opt to use this. However, there are many other tax deductions available so if you qualify for several of these, you might be better off itemizing your deductions in your tax return instead. There are hundreds of these deductions available, but some of the more common ones include:

Student loan interest deduction - up to $2,500 off taxable income

Lifetime learning credit - claim 20% of the first $10,000 spent on tuition and other school fees.

Child tax credit - up to $2,000 per child.

Child and dependent care tax credit - up to 50% of daycare costs under $8,000 per child aged less than 13.

Medical expenses deduction - deduct unreimbursed medical expenses that are more than 7.5% of your adjusted gross income.

Mortgage interest deduction - cuts federal Income Tax for qualified homeowners by reducing taxable income by the amount of mortgage interest paid.

IRA contributions deduction - deduct contributions to a traditional IRA.

401(k) contributions deduction - funnel up to $19,500 into a 401(k) and deduct this amount.

Health Savings Account contributions deduction - all contributions and withdrawals from HSAs are tax deductible when used for qualified medical expenses.

These are just a few examples of many. Those who are self-employed or running a small business have even more tax deductions available. As you can see, if a few of these tax deductions apply to your circumstances, you may be better off itemizing your deductions instead of taking the standard tax deduction. You should speak to an accountant for further advice.

As well as the tax deduction above, those on a lower income won’t pay any Capital Gains Tax on short or long-term capital gains.

For single taxpayers, if you earn under $44,625 a year - you’ll pay no tax on capital gains.

If you’re married and filing taxes jointly, this goes up to $89,250 a year.

If you’re the head of the household, this goes up to $59,750 a year.

Gift & donate crypto

Giving never felt better, because when it comes to crypto, it benefits you too.

American taxpayers enjoy an annual $17,000 (for 2023) gift tax exclusion, which applies to each person to whom you give a gift. Gifts valued at more than $17,000 would potentially subject you to gift taxes of 40% - but only if you're over the lifetime gift tax exemption of $12.92 million (for 2023). By gifting cryptocurrency, you can dispose of crypto without creating a Capital Gains Tax event.

You can also donate crypto and reap the tax benefits. When you donate crypto, you’ll get a deduction worth the full value of your crypto, including any capital gains - provided the charity is registered.

In the United States, you can check a charity's 501(c)3 status with the IRS' exempt organization database. A charity must have 501(c)3 status if you plan to deduct your donation from your federal taxes.

An admin note though, you’ll need to report any donations in Form 8283. Depending on the amount you donate, you may need receipts from the charity too. As well as this, donations valued over $5,000 must be appraised by an independent and qualified party.

Invest in an IRA

One of the most effective strategies to optimize your tax position is to invest as part of a retirement, pension, or annuities investment.

We've got a complete guide on the best Bitcoin IRAs and how they work - but in brief, an IRA is a self-directed individual retirement account. Depending on the kind of crypto IRA you choose, you'll get significant tax breaks. Traditional IRA contributions are tax-deductible (up to a limit) so you can reduce your tax bill by deducting your IRA contributions and pay no tax until you withdraw your funds when you're in a much lower tax bracket as you'll be retired. Meanwhile, contributions to a Roth IRA aren't tax deductible, but you'll pay no tax when you withdraw your funds later on.

Take profits strategically

If you have the luxury of time on your side, you can always try to wait out a lower tax rate.

Whether that's to hodl long-term, switch jobs, or even if you know you're moving to a lower Income Tax state - holding off on realizing your gain until a lower income year can pay off big time.

Check out our state crypto tax rate guide.

Minimize crypto taxes with Koinly

Koinly can simplify your crypto taxes. Not only can it calculate your crypto taxes for you including your capital gains, losses, income, and expenses - but it can also help you optimize your tax position with a variety of features.

You can use Koinly to track your unrealized gains and losses, helping you better understand when to HODL and when to fold.

Koinly also supports a variety of cost basis methods - including FIFO, LIFO, and HIFO. You can change these in the settings and see how they affect your crypto taxes.

Koinly also supports a variety of cost basis methods - including FIFO, LIFO, and HIFO. You can change these in the settings and see how they affect your crypto taxes.

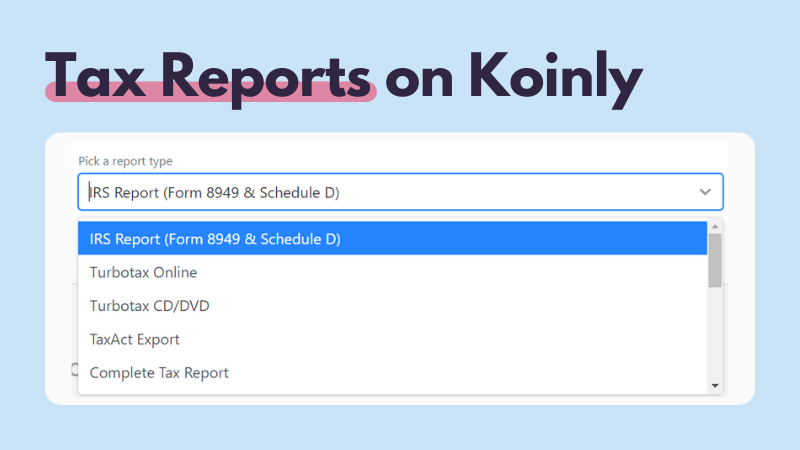

Koinly doesn’t just save you hours of spreadsheets and math - it also saves you hours you’d spend filling out forms. For US investors, Koinly can generate pre-filled forms, ready to submit to the IRS or your tax portal, including:

Koinly doesn’t just save you hours of spreadsheets and math - it also saves you hours you’d spend filling out forms. For US investors, Koinly can generate pre-filled forms, ready to submit to the IRS or your tax portal, including:

IRS Form 8949 & Schedule D

TurboTax Report

Tax Act Report

Complete Tax Report