Share Pooling Crypto: How to Calculate Crypto Gains in the UK

Not sure how to calculate your crypto gains to report to HMRC ahead of the January tax deadline? HMRC is very clear that crypto investors must use the share pooling cost basis method to calculate their crypto gains and losses. Learn how share pooling crypto works and how to calculate your crypto gains easily.

Before we dive in, we're only covering the basics you need to know to calculate your gains & losses - if you need to know more about how crypto is taxed in the UK, see our Ultimate UK Crypto Tax Guide.

Share pooling crypto

HMRC calls pooling the section 104 rule, but it's better known as an average cost basis method. Pooling crypto works like this - when you have identical assets, you pool those assets and take an average cost basis for each of those pools.

So, for example, if you had 3 ETH, with a cost basis of £2,000, £800, and £1,500 - you'd add up each cost base for a total of £4,300 and then divide it by the total amount of coins/tokens held in that pool, so 3. This would give you an average cost basis of £1,433. If you dispose of your ETH by selling, swapping, spending, or gifting it (excluding to your spouse) then you'd use this cost basis to calculate any capital gain or loss to report to HMRC.

You'll need to do this for each kind of crypto asset you own, so you'd have a pool, known as a section 104 pool, for ETH, BTC, DOGE, and so forth.

Crypto Wash Sales

If you haven't already noticed - the average cost basis is easily manipulated.

Investors can purposefully purchase assets at a much lower cost basis to artificially reduce their average cost basis and sell them quickly to reduce their gains and therefore their tax bill, and even buy back assets quickly after to continue holding long-term investments.

To stop UK investors from doing this - the HMRC has laid out very specific cost basis rules that define how you calculate the average cost of assets - including the Same Day Rule, Bed and Breakfasting Rule, and finally, the Section 104 Rule we covered above.

Read next: Crypto Tax Loss Harvesting UK Guide

How to calculate crypto taxes using the share pooling cost basis method

There are three rules you need to follow to calculate your crypto taxes

The same-day rule - TCGA92/S105 (1)(a)

The 30-day rule (AKA the bed and breakfasting rule) - TCGA92/S106A(5) and (5A)

Section 104 rule - s.104 pool

You need to work through each of these three rules, in order, as they apply to your assets to calculate your crypto gains and losses. Let's take a look at each in depth.

Same-day rule

If you buy and sell coins on the same day, use the cost basis on this day to calculate your gains or losses. If you've sold or traded more than you bought on that day, move on to rule 2.

The same-day rule is the first rule you need to consider. The same-day rule states if you buy and sell coins on the same day - you'll use the cost basis from the tokens or coins you purchased that day to calculate any subsequent gain or loss, not your average cost basis from a Section 104 pool.

When you've bought and sold tokens of the same kind on a given day, all the tokens are treated as being purchased in a single transaction, and then sold in a single transaction - so even if you bought some tokens in the morning, and some in the evening at a lower price, you'd use the average cost basis and average sale price for all your tokens to calculate your gain or loss.

If you sold or traded more tokens than you bought in a single day, you'll move on to the bed and breakfasting rule.

Bed and Breakfasting Rule

Also known as the CGT 30-day rule, the bed and breakfasting rule states that if you sold tokens and then repurchased tokens of the same kind within 30 days, you'll use the cost basis of the tokens you purchased within 30 days as your cost basis to calculate your gains or losses.

If you sell and then repurchase the same tokens within a 30-day period, you'll use the FIFO (First In, First Out) cost basis method to calculate your cost basis for disposals from that period, not the cost basis from your Section 104 pool.

If you sell more tokens than you bought within the last 30 days, you'll move on to the Section 104 rule.

Section 104 Rule

The Section 104 rule, also known as pooling, says investors should use the average cost basis method to calculate an average cost for a given pool of assets. To do this, add up the total amount paid for a pool of assets and divide it by the total amount of coins/tokens in the pool. Then use this cost basis to calculate subsequent gains or losses.

Let's look at some examples to better understand how each rule works.

Example 1

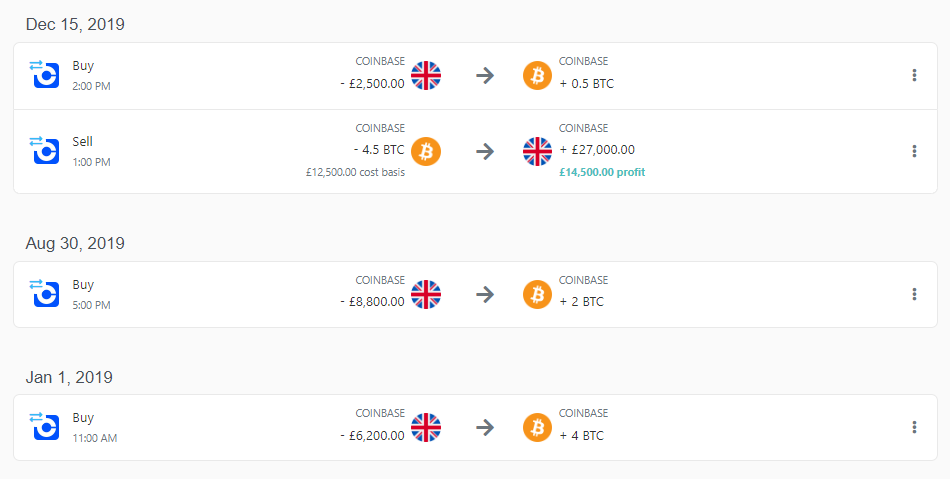

Ryan carried out the following transactions for Bitcoin:

1 Jan 2019: Purchased 4 BTC for £6,200

30 Aug 2019: Purchased 2 BTC for £8,800

15 Dec 2019: Sold 4.5 BTC for £27,000

15 Dec 2019: Purchased 0.5 BTC for £2,500

In this example, the disposal is first matched with the purchase made on the same day, then against the share pool.

The main reason why you have to use the 30 day rule is to prevent a practice known as bed and breakfasting where a person sells shares when they are trading at a low price to generate a tax loss and later buys the assets back to maintain his position in that asset. This is also known as a wash-sale as it is not a genuine sale. The 30 day rule makes this much more difficult as the person will not be able to buy the assets back within 30 days if he wants to use the losses.

Example 2

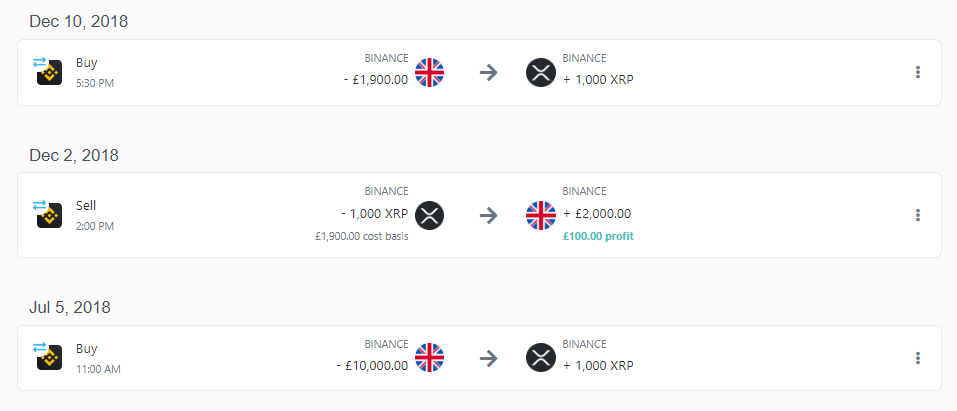

Douglas purchased 1,000 XRP on 5 July 2018 for £10,000. The price of XRP has fallen in value, so he would like to establish a capital loss. So, he sells the shares on 2 December 2018 for £2,000 and purchases them back on 10 December 2018 for £1,900.

Douglas’s transactions are caught by the 30 day rule. The disposal on 2 December 2018 will be matched with the purchase on 10 December 2018, and for 2018–19 he will therefore have a chargeable gain of £100 (2,000 – 1,900).

It's not just sales of crypto that are subject to the Same Day and Bed and Breakfasting Rule. Any disposal of crypto is subject to the Same Day and Bed and Breakfasting Rules - this includes crypto to crypto trades, spending crypto, and gifting crypto (excluding to your spouse or civil partner which is tax free).

Calculate UK crypto taxes with Koinly

Of course, for crypto investors trading large volumes - these rules pose challenges. You could have hundreds - if not thousands - of transactions. This is why Koinly has developed a sophisticated crypto tax software tool that can reliably calculate the cost basis for each of your crypto transactions and generate your final capital gains.

Koinly supports the share pooling cost basis method for UK investors. You can find this in settings.

This means Koinly can do all the calculations for you. All you need to do is head to the tax reports page and download the tax reports you need. Koinly can generate UK-specific tax forms like the HMRC Capital Gains Summary.

Hopefully, you now have a better idea of how capital gains are calculated in the UK according to HMRC's share pooling rules. If you want to learn more, you can check out Koinly's UK crypto tax guide which goes over the tax rules for different types of crypto transactions as well as ways of reducing your taxes.