Tax When Getting Paid in Crypto?

Are you getting paid in crypto? Whether you’re being paid in Bitcoin or any other currency, you need to know the crypto tax rules.

Getting paid in Bitcoin and other cryptocurrencies is becoming more commonplace around the world. Especially with the recent bull run, employees are more willing than ever to take the gamble and get paid in something other than fiat currency.

But if you’re getting paid in crypto, you need to know the tax rules in your country to avoid an unwelcome visit from your local tax office.

The good news is that the tax when getting paid in crypto is pretty straightforward - wherever you live. The bad news? You might not like the rules!

What tax do I pay when getting paid in crypto?

Wherever you live and whatever cryptocurrency you’re getting paid in - the tax rule around getting paid in crypto is the same.

Getting paid in crypto is seen as the same as getting paid in fiat currency. It’s viewed as ordinary income and it’s subject to Income Tax.

This means you’ll be taxed at your normal Income Tax rate for your crypto earnings. To figure out how much you owe, you need to calculate the fair market value of your crypto income on the day you received it.

For example, let’s say you get paid 0.1 BTC a month as your salary. On the day you’re paid, 0.1 BTC is worth $5,000. You’d need to pay Income Tax at your normal Income Tax rate on $5,000.

Simple enough - but there’s some bad news. This often isn’t the only kind of tax you’ll pay on your crypto.

Simple enough - but there’s some bad news. This often isn’t the only kind of tax you’ll pay on your crypto.

When you later sell, swap, spend, or (sometimes) gift your crypto, it will also be subject to Capital Gains Tax. These transactions are seen as a disposal of an asset from a tax perspective, so you’ll pay tax on any profit you make from the disposal.

We’ll use the example above again. So you’ve already paid Income Tax on your 0.1 BTC. A few months later, you notice the price of 0.1 BTC has risen to $6,000 so you decide to sell it for USD. To figure out how much you’ll pay in Capital Gains Tax, you need to know how much you’ve made from the sale.

To do this, just subtract your cost basis (the price of the asset on the day you received it + any fees related to disposing of it) from the price you sold the asset for. In this instance, $6,000 - $5,000 = $1,000. You’ll pay Capital Gains Tax on $1,000. The amount you pay will be based on how much you earn and where you live.

Of course, in some countries - your income is also subject to other levies. So in some instances, you’ll also need to pay these too. Let’s take a look at how a few countries deal with tax when getting paid in cryptocurrency.

Of course, in some countries - your income is also subject to other levies. So in some instances, you’ll also need to pay these too. Let’s take a look at how a few countries deal with tax when getting paid in cryptocurrency.

Getting paid in crypto taxes in the USA

The IRS is very clear that when you get paid in crypto, it’s viewed as ordinary income. So you’ll pay Income Tax. This is the case whenever you exchange a service for virtual currency. So even if you’re not an employee, if you’re being paid in crypto for any kind of service, you’ll pay Income Tax.

In most US states, US taxpayers will also need to pay state Income Tax on any income, as well as Federal Income Tax. So you'll need to consider this for your crypto income too.

You’ll also pay Capital Gains Tax any time you later sell, swap, or spend your crypto. Gifts under the value of $15,000 are tax free. You can also offset up to $3,000 in capital losses against your income if you have some leftover after you've offset your capital gains.

Learn more about US Crypto Tax Rates and how crypto is taxed in the US.

Getting paid in crypto taxes in the UK

HMRC has clear guidance for taxpayers getting paid in crypto. Getting paid in crypto is seen as ‘money’s worth’. Money's worth refers to any kind of benefit from employment that doesn't take the form of money - in this instance crypto.

When you get paid in crypto in the UK, it will be subject to Income Tax. You'll also need to pay National Insurance contributions on the value of the asset.

As in most countries, you'll owe Capital Gains Tax any time you later sell, swap, spend or gift your crypto. Gifts to your spouse are tax free and each taxpayer gets a Capital Gains Tax Free Allowance of £12,300.

Learn more about UK Crypto Tax Rates and how crypto is taxed in the UK.

Getting paid in crypto taxes in Australia

The ATO is clear that in Australia, getting paid in crypto is viewed as either ordinary income or a fringe benefit - specifically a property fringe benefit. This depends on the type of agreement you have with your employer.

If you’re getting paid entirely in crypto - it’ll be viewed as ordinary income and you’ll pay Income Tax at your normal tax rate.

If you’ve agreed to a salary sacrifice in exchange for crypto - this would be viewed as a fringe benefit instead. So it would be subject to Fringe Benefit Tax instead. This is much higher than Income Tax rates (at up to 47% tax!) You can find out more here.

You’ll also pay Capital Gains Tax any time you later sell, swap, spend, or gift your crypto.

Learn more about Australian Crypto Tax Rates and how crypto is taxed in Australia.

Getting paid in crypto taxes in Canada

The CRA hasn't actually issued specific guidance on crypto salaries just yet. However, they are clear that crypto is taxed as income or a capital asset depending on the transactions you’re making. For any transactions viewed to be business-like activities, you’ll pay Income Tax. With this view, it is almost definite that you’ll pay Income Tax when you’re getting paid in crypto.

Like in the US, you’ll be liable to pay both Federal and Provincial Taxes on any crypto income.

You’ll also pay Capital Gains Tax any time you later sell, swap, spend or gift your crypto.

Learn more about Canada Crypto Tax Rates and how crypto is taxed in Canada.

Koinly can calculate your crypto income taxes

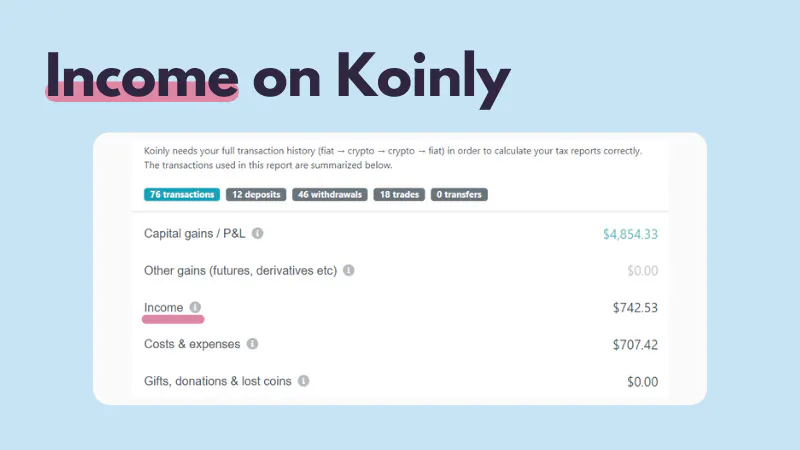

Koinly can help you calculate your crypto income and report it to your local tax office.

Whenever you receive crypto - Koinly calculates the fair market value of your crypto, in your chosen currency and on the day you receive it. This lets you keep track of your total earnings throughout the financial year.

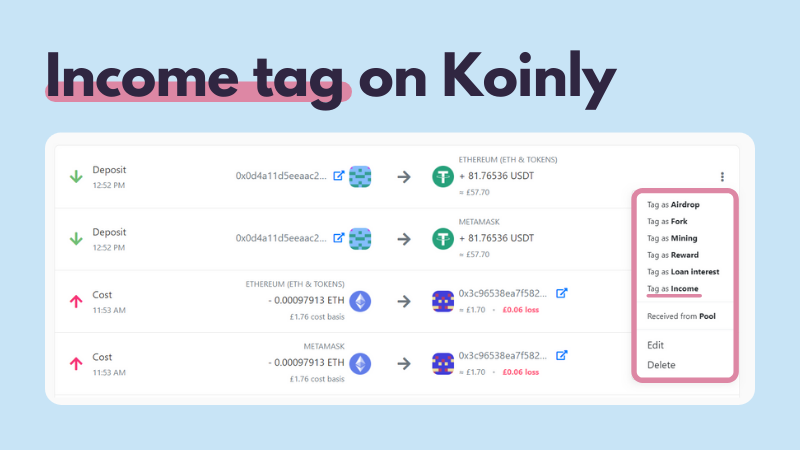

When it comes to getting paid in crypto, you can simply tag these transactions as income. When you head into the tax report page, these transactions will be included in your tax summary as ‘income’.

When it comes to getting paid in crypto, you can simply tag these transactions as income. When you head into the tax report page, these transactions will be included in your tax summary as ‘income’.

You can then download our crypto Income Tax report and use this when filing your tax return, or hand it over to your accountant.

You can then download our crypto Income Tax report and use this when filing your tax return, or hand it over to your accountant.

Summary:

You'll pay Income Tax whenever you're paid in crypto.

You'll also pay Capital Gains Tax when you later sell, swap, spend, or gift your crypto earnings.

You may also need to pay additional levies on your crypto income depending on where you live.