How to Report Cryptocurrency to HMRC

Your self-assessment tax return is due by the 31st of January 2025. Whether you've got gains or income from crypto, you'll need to file this with HMRC by the deadline using the Government Gateway Service and forms SA108 and SA100 - or face penalties. Find out how to report your crypto taxes to HMRC before the deadline.

HMRC has made it very clear that UK crypto investors need to report and pay taxes on their crypto investments. They’re sending warning letters to investors they believe to be wrongly reporting their crypto gains or income.

If you’re a UK taxpayer and you’ve traded crypto - you need to report your crypto gains and any income accurately. But as most UK residents are taxed at source through their tax code, many investors have never needed to complete a Self Assessment Tax Return.

This can leave UK crypto investors with a lot of questions- like how do you report money made from crypto to HMRC? Or what is the HMRC tax form for crypto and what information does HMRC need about crypto assets?

Don’t worry - we’ve done the research to get all your UK crypto tax questions answered. Learn how to report your crypto to HMRC in 5 simple steps.

How to report crypto to HMRC

You’ll report all your crypto as part of your Self Assessment Tax Return. You’ll report income from crypto in the Self Assessment Tax Return (SA100) and you’ll report any capital gains or losses from crypto in the Self Assessment: Capital Gains Summary (SA108).

You need to file your Self Assessment Tax Return online with the HMRC by the 31st of January 2025. The deadline for paper tax returns is the 31st of October 2024.

Any crypto investor who made more than £1,000 in crypto income or more than £6,000 in crypto capital gains for the 2023 - 2024 financial year must submit a Self Assessment Tax Return to HMRC.

To report your crypto tax to the HMRC, follow 5 steps:

Calculate your crypto tax. You need to know your capital gains, losses, income, and expenses.

Register to file taxes online with the Government Gateway service by the 5th of October 2024 if you’re not already registered.

Fill out the Self Assessment Tax Return (SA100). Report any income from crypto over in box 17.

If you made crypto capital gains, check yes on box 7. Fill out the supplementary Self Assessment: Capital Gains Summary (SA108).

Submit your Self Assessment Tax Return online to the HMRC by midnight on the 31st of January 2025. You’re done!

This all sounds straightforward enough - but knowing how to fill out these forms can get confusing, so either watch our video or follow our step-by-step guide below.

Calculate your crypto taxes

Before you can report your crypto tax to HMRC - you need to do the maths. This means you’ll need to calculate your crypto totals for:

Capital gains from crypto

Capital losses from crypto

Income from crypto

Any allowable expenses relating to your investments

Crypto tax software like Koinly makes this step simple. Just sync your crypto wallets and Koinly does all the work for you using the UK share pooling cost basis method.

If you’re not using Koinly - you’ll need to do this step manually. You can use our UK crypto tax guide to learn how crypto is taxed in the UK, our guide on how to pay less UK tax on crypto, and our UK crypto tax rate guide to figure out how much you’ll pay.

Once you’ve got your figures ready, it’s time to register and fill out your Self Assessment Tax Return.

Register to file crypto tax with HMRC online

If you’re submitting your Self Assessment Tax Return by post - you can skip this step and go straight to step 3. Keep in mind you have an earlier deadline of the 31st of October.

If you’ve registered to file a Self Assessment Tax Return online before - you don’t need to do this again. Just sign in.

For crypto investors who haven’t filed a Self Assessment Tax Return online before - you need to register by the 5th of October 2024. The steps are slightly different depending on whether you’re self-employed or not.

Self-employed?

If you're self-employed, sign into your business tax account and add Self Assessment. You'll need your Government Gateway user ID and password to do this - so you might need to create one. You'll get a letter with your Unique Taxpayer Reference within 10 days (or 21 days if you're abroad). You'll get a second letter with the activation code for your account. Once your account is activated, you can file your tax return anytime before the 31st of January 2025.

Not self-employed

If you’re not self-employed, register using form SA1. Once you've registered, you'll get your UTR within 10 days (or 21 if you're abroad). Create your online account using your UTR and sign up for Self Assessment online. You'll get an activation code sent to you in the post within 7 days of signing up (or 21 days if you're abroad). Once your account is activated, you can file your tax return anytime before the 31st of January 2025.

Though the deadline to file your taxes online is the 31st of January 2025 - this is also the deadline to pay your balancing payment and your first payment on account. Your balancing payment covers any taxes you haven’t paid already throughout the year.

For this reason, we recommend that you file your taxes well ahead of the 31st of January to ensure you’re not left in the lurch with a large tax bill!

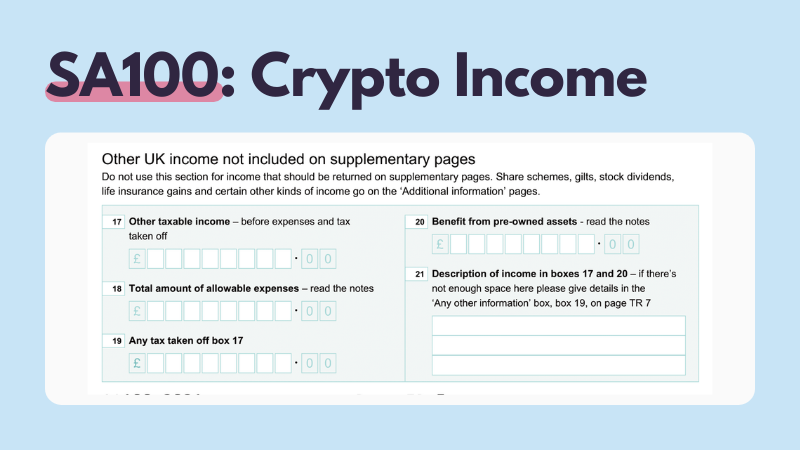

Report income in SA100

The Self Assessment Tax Return (SA100) is where you’ll report your crypto taxes. Let’s go through it step-by-step.

Report any crypto income in box 17.

Report any allowable expenses related to your crypto income in box 18.

Give a description of the income in box 21. For example, "Airdrop of 1000 TWT tokens on the 7th of August 2023.” This box is quite small - if you need more space, use box 19 - any other information.

SA100 Example

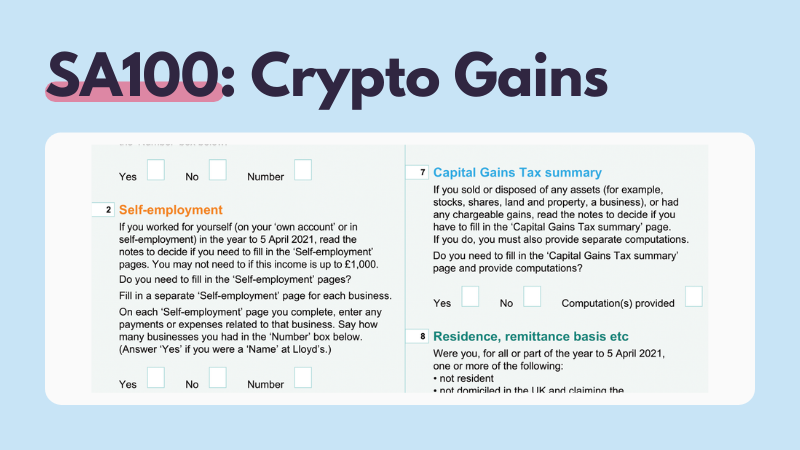

If you’ve made any capital gains or losses, you’ll also need to check yes on box 7. You’ll also need to fill out the Self Assessment: Capital Gains Summary SA108 supplementary form.

If you’ve made any capital gains or losses, you’ll also need to check yes on box 7. You’ll also need to fill out the Self Assessment: Capital Gains Summary SA108 supplementary form.

SA100 Example

Fill out the rest of the Self Assessment Tax Return as it relates to your circumstances and income.

Fill out the rest of the Self Assessment Tax Return as it relates to your circumstances and income.

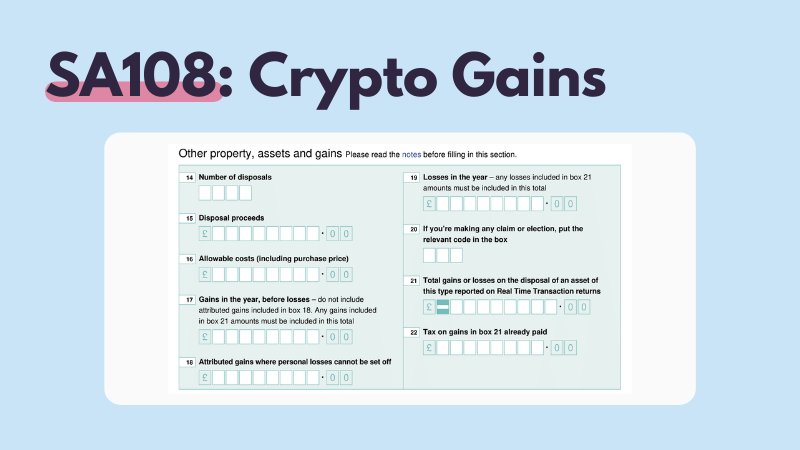

HMRC Self Assessment: Capital Gains Summary SA108 for Crypto Tax Reporting

The Self Assessment Capital Gains Summary SA108 is where you’ll report your crypto capital gains and losses. It's a supplement to the Self Assessment Tax Return, so you’ll submit both together.

The Capital Gains Tax Summary is split into 7 sections. You'll report your crypto disposals in the second section - between boxes 14 to 22.

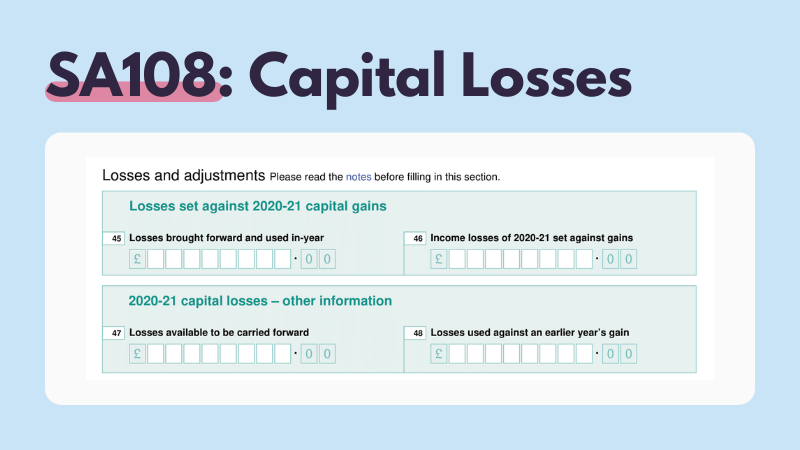

You'll report any losses or adjustments in section 5 - between boxes 45 to 52.

We’ll break down each section.

SA108 Example

Report the number of disposals of crypto you made in box 14.

Report your total proceeds from your crypto disposals in box 15.

Report your total allowable costs (including your purchase price) in box 16.

Report your total capital gains before subtracting losses from crypto disposals in box 17.

Report your total capital loss from crypto disposals in box 19.

Box 21 and 22 are only relevant if you've used the real time Capital Gains Tax service.

SA108 Example

In box 45, report any capital losses you've carried forward and used this year.

In box 46, report any income losses used this year.

In box 47, report any capital losses you're carrying forward to future tax years.

Fill out the rest of the Self Assessment Capital Gains Summary SA108 form as it relates to your circumstances and investments.

Submit your Self Assessment Tax Return to HMRC

Once you’ve filled out both these forms, you’re done. All you need to do is press submit and your crypto taxes for the year are complete!

After you’ve submitted HMRC will calculate your taxes and let you know how much you need to pay.

If you’re up to date with your tax bill, you’ll be able to do this in installments. If you’re behind on your taxes, you’ll have to pay this amount upfront before you can set up a Self Assessment Tax installment plan.

Report crypto to HMRC with Koinly

Reporting crypto taxes to the HMRC is simple with Koinly.

Just import your crypto transaction history from all the crypto wallets, exchanges, and blockchains you use using API integration or by importing CSV files.

Koinly then calculates all your capital gains, losses, crypto income, and expenses for you. Once it’s done, head to the tax report page in your Koinly account.

You’ll find a simple summary of your crypto taxes, as well as a variety of tax reports you can download and use to file your taxes with the HMRC - like the HMRC Capital Gains Summary form.

Koinly makes crypto tax easy. Get started for free today.

Koinly makes crypto tax easy. Get started for free today.