What to include in a UK Crypto Tax Report?

HMRC has made it clear UK crypto investors need to report their crypto investments and pay Capital Gains Tax on their gains and Income Tax on any additional income from crypto. UK taxpayers need to report and pay their crypto taxes by the 31st of January 2024 - so the deadline is looming. But what do you need in a crypto tax report and what makes a good crypto tax report? We’re covering everything you need to know about HMRC crypto tax reporting and how a Koinly UK crypto tax report can help.

What goes into a UK crypto tax report?

HMRC has set out strict guidelines for crypto tax reporting in its crypto assets manual. Of course, we don’t all have time to dig through pages of this to figure out what we need to include in our crypto tax report - so we’re here to break it down for you. We also recommend reading our UK crypto tax guide if you’re totally new to this but in summary…

You’ll need to report your crypto taxes for the previous financial year by the 31st of January the following year unless HMRC gives an extension. The UK financial year runs from the 6th of April until the 5th of April the following year.

So that means you’ll currently be reporting gains and income made from crypto investments between the 6th of April 2022 and the 5th of April 2023. You need to report your crypto taxes to HMRC and pay any due taxes by the 31st of January 2024. In 2022, this was extended to the 28th of February 2022 in light of the pandemic, but there is no indication so far that this will be the case for 2024. You’ll do all of this in your Self Assessment Tax Return - which you can file online through the Government Gateway service (as long as you’re registered).

But what do you need to include?

As a minimum, HMRC will want to know about:

Any additional/miscellaneous income from cryptocurrency.

Any allowable expenses related to your additional income.

The source/a description of your miscellaneous income.

Whether you made any capital gains from crypto.

Your net capital gain for the financial year from crypto.

Your net capital loss for the financial year from crypto.

The number of disposals of crypto assets - from selling, trading, spending or gifting crypto.

Your total proceeds from your disposals.

The capital losses you’re offsetting against your capital gains from crypto.

The capital losses from crypto that you’re carrying forward to future tax years.

It’s a lot of information to get together in time for January! But it doesn’t end there, HMRC may also want to see records of your crypto transactions to ensure you’re reporting your crypto investments accurately. This means HMRC may also want:

A detailed breakdown of any sources of income from crypto.

A breakdown of crypto assets, including your acquisition costs, receipts of disposals, and the types of disposals (i.e. sale, trade, gift, etc.).

A breakdown of allowable expenses.

Records of the crypto exchanges, wallets, or other platforms you used.

Suffice it to say - if you haven’t already started prepping your crypto tax report for January, you might want to get to it ASAP.

How to create a crypto tax report for HMRC

There are two ways to do this:

DIY crypto taxes: Load up a spreadsheet and start inputting all the information you need from every crypto exchange, wallet, etc. that you use. You’ll need to include all your income, capital gains, capital losses, and expenses for each transaction. You’ll also need to calculate your cost basis and subsequent capital gains and losses using the share pooling cost basis method prescribed by HMRC.

Use crypto tax software: Using crypto tax software like Koinly automates all this for you. All you need to do is sync the wallets, exchanges, or blockchains you use with Koinly and it’ll calculate your crypto income and expenses, as well as your capital gains and losses using the share pooling cost basis method. Once it’s done all this (in mere minutes!), it’ll fetch your crypto tax report with all the information you need to report your crypto taxes - including all the extra information HMRC may need. All you need to do is press download.

Let’s look at a Koinly UK crypto tax report to see how it ticks all the boxes to meet HMRC requirements for crypto tax reporting.

Setting up Koinly UK for crypto tax reporting

When you sign up for your (free!) Koinly account - you’ll pick your home country and base currency and Koinly will automatically apply the correct cost basis method to calculate your capital gains and losses from crypto.

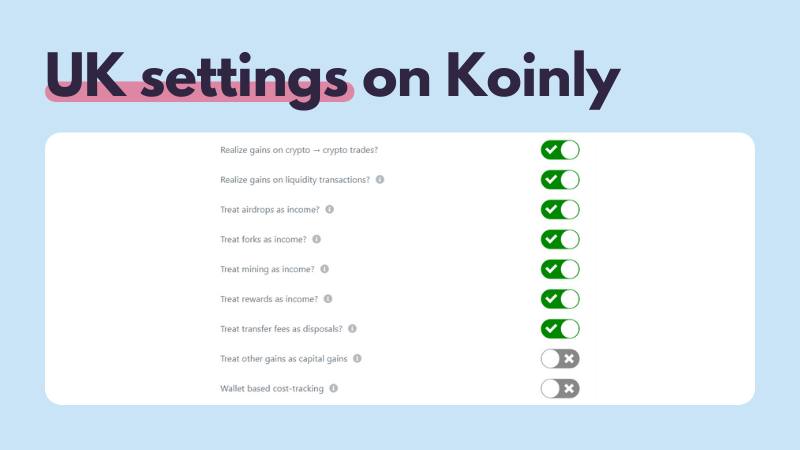

You’ll also have a variety of settings that should be automatically set up for the UK crypto tax rules, like so:

You’ll also have a variety of settings that should be automatically set up for the UK crypto tax rules, like so:

You then need to sync all the crypto wallets, exchanges, or blockchains you use with Koinly to import all your crypto transactions. This is really easy to do through API or by using CSV files. For more detailed instructions see how to get started with Koinly. Once this is done, Koinly can get to work calculating your crypto taxes and generating your crypto tax report. Just head to the tax reports page in Koinly, sign up for a paid plan if you haven’t already, and download your Complete Tax Report.

You then need to sync all the crypto wallets, exchanges, or blockchains you use with Koinly to import all your crypto transactions. This is really easy to do through API or by using CSV files. For more detailed instructions see how to get started with Koinly. Once this is done, Koinly can get to work calculating your crypto taxes and generating your crypto tax report. Just head to the tax reports page in Koinly, sign up for a paid plan if you haven’t already, and download your Complete Tax Report.

What’s in your Koinly UK crypto tax report?

Your Koinly crypto tax report contains everything HMRC needs to know about your crypto investments.

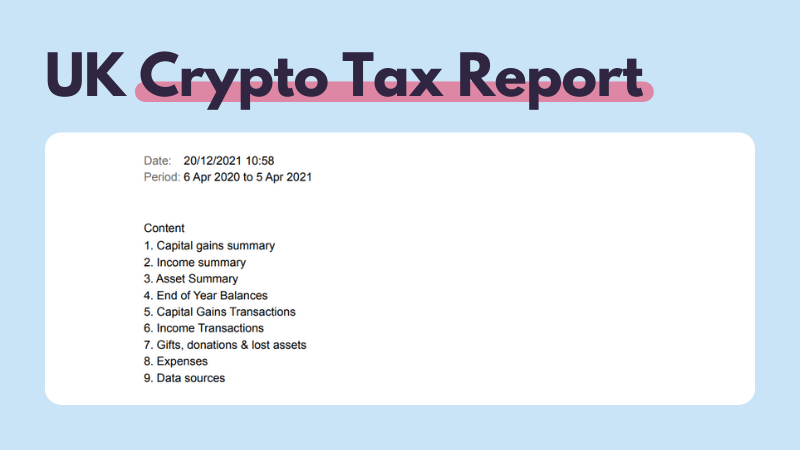

From your settings, Koinly should know the financial year you’re reporting on automatically - from the 6th of April 2022 to the 5th of April 2023. It’ll also have a summary of the contents of your tax report. Here's an example of a report from a previous financial year:

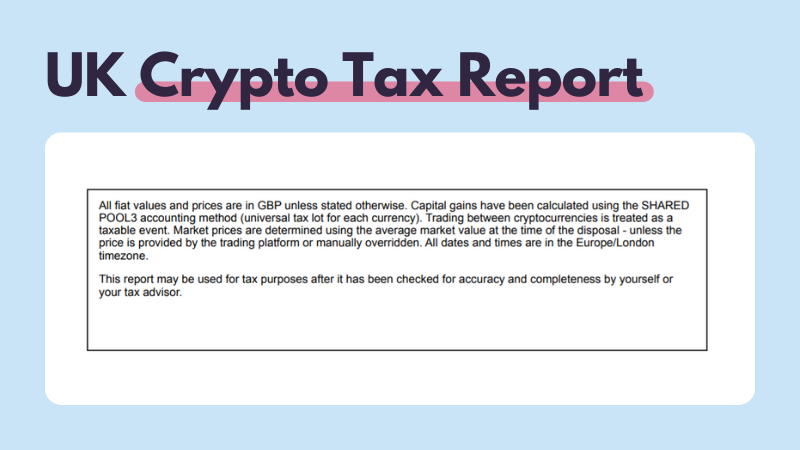

As we mentioned above, Koinly also knows how to calculate your cost basis, capital gains, and losses using the HMRC share pooling cost basis method. This is also confirmed in your tax report.

As we mentioned above, Koinly also knows how to calculate your cost basis, capital gains, and losses using the HMRC share pooling cost basis method. This is also confirmed in your tax report.

The contents of your UK crypto tax report include:

The contents of your UK crypto tax report include:

Capital gains summary

Income summary

Asset summary

End of year balances

Capital gains transactions

Income transactions

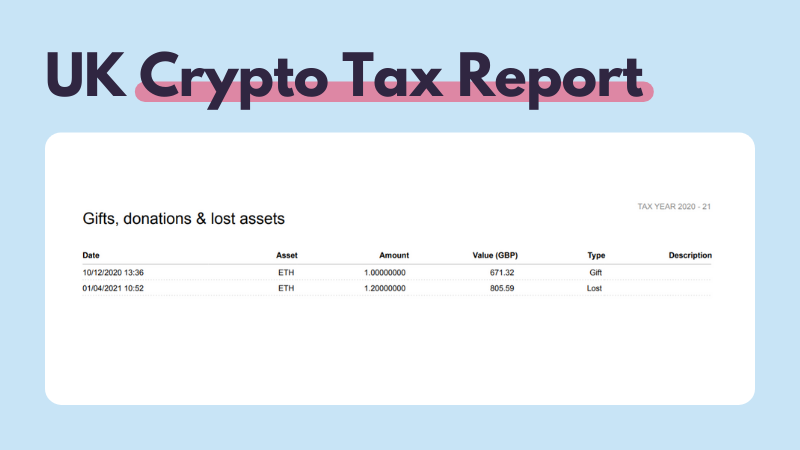

Gifts, donations and lost assets

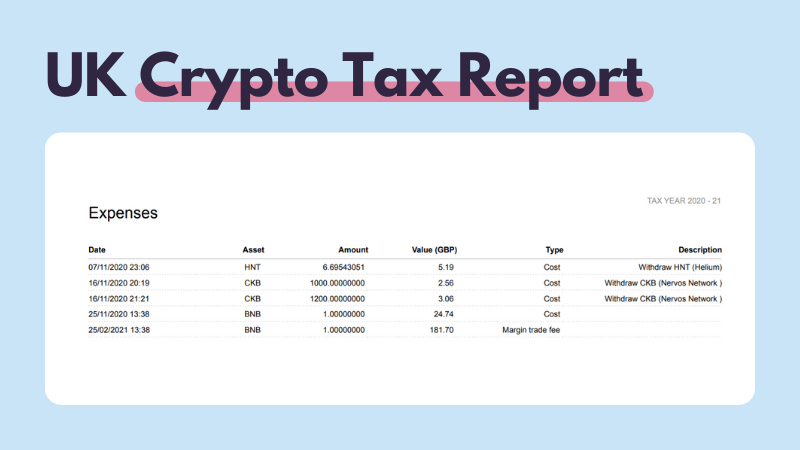

Expenses

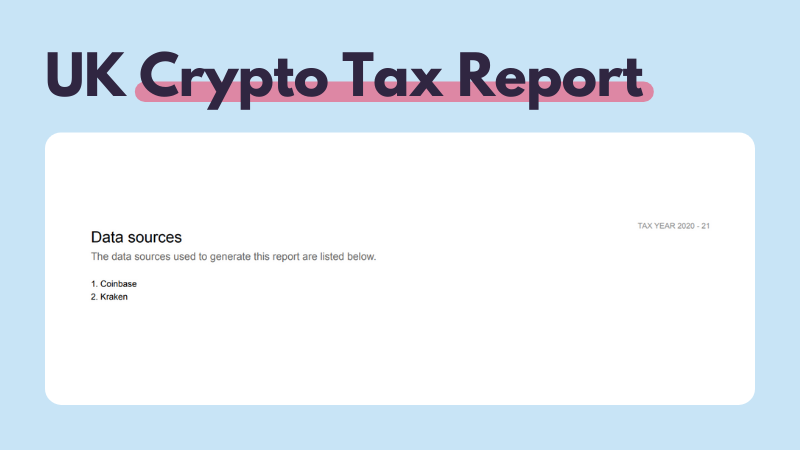

Data sources

Let’s take a more in-depth look at each with our crypto tax report example.

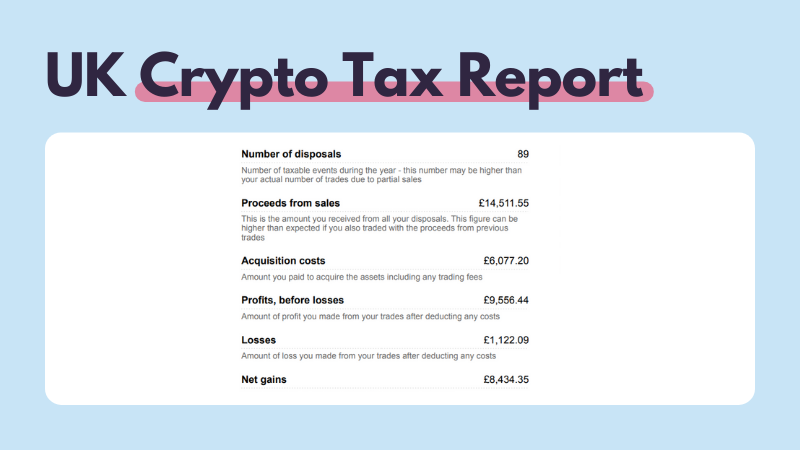

Crypto tax report: capital gains and other gains

Not only does Koinly include the basic information you’ll need when filing your Self Assessment Tax Report such as the number of disposals, your proceeds, your capital gains before losses, your capital losses, and your net capital gains with losses subtracted - but it’s also got a lot of other helpful information in this section of your crypto tax report.

As you can see your Koinly crypto tax report also includes your acquisition costs.

As you can see your Koinly crypto tax report also includes your acquisition costs.

There is also a separate section for other gains. ‘Other gains’ usually refers to crypto transactions like futures or other derivatives, options, CFDs, and other leveraged activities (of course, some of these products like crypto futures are now banned in the UK by the FCA). This is because the tax treatment of some of these products is different - it all depends on the scale at which you’re trading. Splitting them out allows you to easily report these as a separate type of transaction with a separate tax treatment to HMRC should you need to.

Crypto tax report: income, expenses, and other transactions

The income summary section of your tax report includes all the basic information HMRC needs in your Self Assessment Tax Return, including total income, total expenses, and a description of the sources of income.

The income section breaks down your income into different categories - including:

The income section breaks down your income into different categories - including:

Airdrops

Forks

Mining

Staking

Loan interest

Other income

Koinly tallies this up for you to show your total income, as well as your expenses just below.

Your expenses don't refer to any expenses related to your cost basis - for example trading or transaction fees. These are all included in your acquisition costs. These expenses are separate - for example, margin trade fees - and may in some instances be tax deductible.

Your expenses don't refer to any expenses related to your cost basis - for example trading or transaction fees. These are all included in your acquisition costs. These expenses are separate - for example, margin trade fees - and may in some instances be tax deductible.

You’ll also find a section here that summarizes any gifts, donations, or lost coins.

Gifts of crypto - excluding to spouses - are taxed in the UK under Capital Gains Tax, so you should only tag transactions as gifts if you’re gifting to your spouse as this is tax free and you won’t realise any capital gain or loss. Similarly, you’ll realise no capital gain or loss from donations or lost coins - though you can’t claim these as a tax deduction. For more money saving tips read our guide on how to pay less tax on crypto in the UK.

Gifts of crypto - excluding to spouses - are taxed in the UK under Capital Gains Tax, so you should only tag transactions as gifts if you’re gifting to your spouse as this is tax free and you won’t realise any capital gain or loss. Similarly, you’ll realise no capital gain or loss from donations or lost coins - though you can’t claim these as a tax deduction. For more money saving tips read our guide on how to pay less tax on crypto in the UK.

The rest of your Koinly crypto tax report contains more detailed information that HMRC may request if they’re auditing your crypto investments. Let’s break it down.

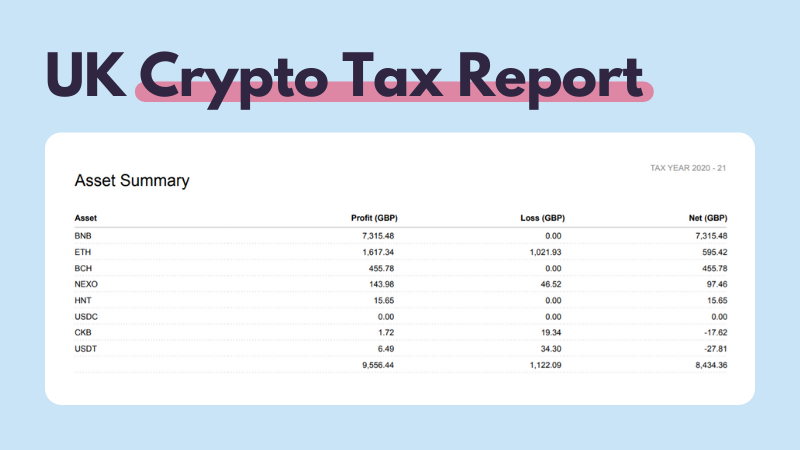

Crypto tax report: asset summary and EOY balance

Your asset summary is a more detailed breakdown of the crypto assets you sold, pooled according to the asset type - as per the share pooling cost basis method.

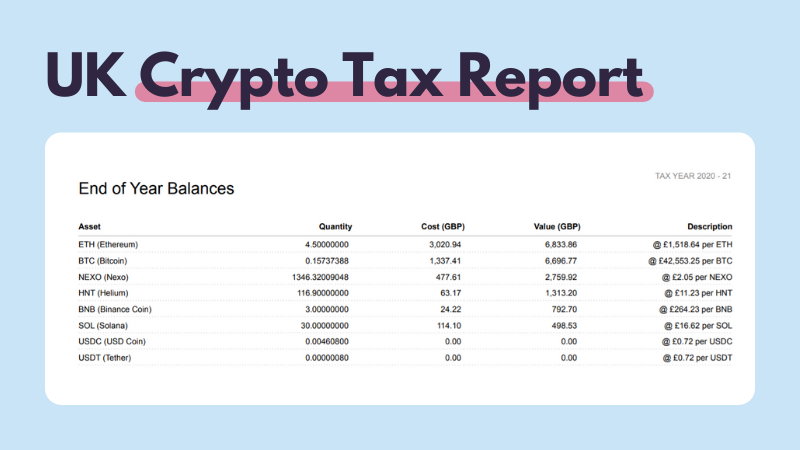

Meanwhile, your end of year balance shows the assets you still hold, their cost, and their value at the end of the financial year. This can help in reporting crypto taxes for future financial years.

Meanwhile, your end of year balance shows the assets you still hold, their cost, and their value at the end of the financial year. This can help in reporting crypto taxes for future financial years.

Crypto tax report: breakdown of transactions

Your Koinly crypto tax report also includes a detailed breakdown of all your crypto transactions throughout the financial year including:

Capital gains transactions.

Income transactions.

Gifts, donations, and lost assets transactions.

Expenses transactions.

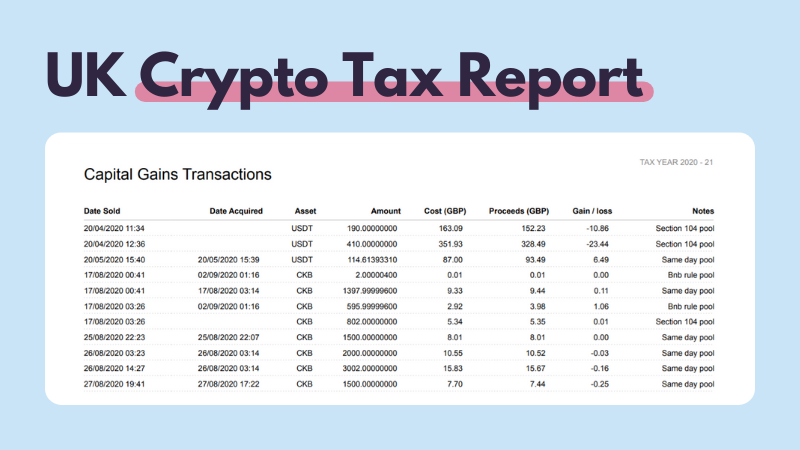

These are incredibly useful documents that include all the information HMRC may want should they wish to take a closer look at your crypto investments. For example, for capital gains transactions - each transaction includes:

The date you acquired the asset.

The date you disposed of the asset.

The name of the asset.

The amount of coins/tokens you disposed of.

The cost of the asset (based on the fair market value of the asset on the day you acquired it plus any fees).

The proceeds from the disposal of the asset.

The subsequent capital gain or loss.

The applicable share pooling rule (i.e. Section 104, Same Day or Bed and Breakfast Rule).

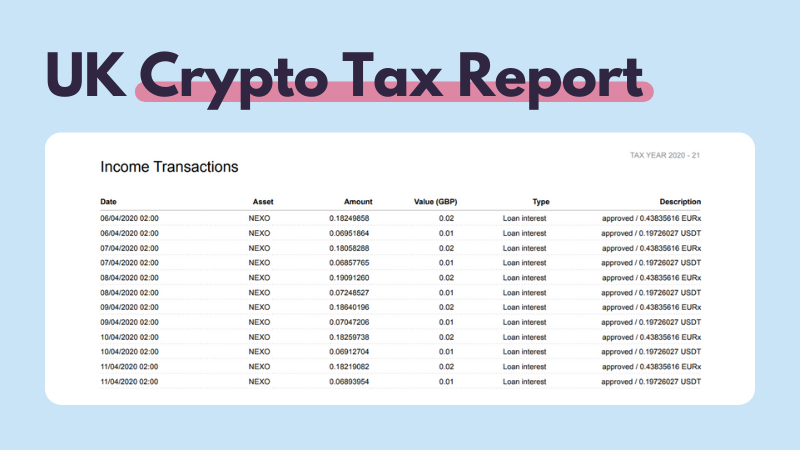

Similarly, your income transactions include a breakdown of each income transaction with the following information:

Similarly, your income transactions include a breakdown of each income transaction with the following information:

The date of the income.

The type of crypto asset you acquired.

The amount of coins/tokens received.

The fair market value of the asset in GBP on the day you received it.

The type of income (i.e. loan interest, staking, airdrop, mining or other income).

A brief description of the transaction.

Your gifts, donations, and lost assets transactions include similar information:

Your gifts, donations, and lost assets transactions include similar information:

As do your expenses transactions:

As do your expenses transactions:

Crypto tax report: data sources

Finally, your crypto tax report also includes the sources of information Koinly used to compile your tax report. This includes all the crypto wallets, exchanges, or blockchains you synced with Koinly.

Crypto taxes made simple

As you can see, your Koinly UK crypto tax report contains everything you need to easily complete your Self Assessment Tax Return, as well as any additional information HMRC may request about your crypto investments. Koinly also offers HMRC Capital Gains Summary if you're only looking to report on capital gains from your investments. Just upgrade from your free Koinly account to the plan you need, pick the report you want and download.

Koinly can generate this information in minutes, compared to the hours it would take you to create a crypto tax report yourself. Better still, you won’t pay a penny to use Koinly until you want to generate your crypto tax report.

Koinly can generate this information in minutes, compared to the hours it would take you to create a crypto tax report yourself. Better still, you won’t pay a penny to use Koinly until you want to generate your crypto tax report.