Lower IRS Taxes with Crypto Donations via The Giving Block

Facing a high crypto tax bill can be daunting, but there's a strategic solution that not only eases your financial burden but also contributes to a good cause. Donating cryptocurrency to licensed charities is a win-win, offering you tax relief while supporting charitable work. Koinly has partnered with The Giving Block to delve into how crypto donations can be a savvy move to mitigate your tax expenses in 2025. Join us as we explore this beneficial intersection of philanthropy and financial planning.

According to guidelines from the IRS, donating cryptocurrency is one of the most tax-efficient ways to support a charitable cause. The primary reason is that the IRS treats donated crypto like donated stock.

Instead of selling your crypto and ending up with a Capital Gains Tax bill, you can donate your crypto and create a tax-deductible benefit, all while doing a good deed.

Who can you donate to for tax cuts?

Charitable donations are tax-deductible in the US - but there are a few rules you’ll need to follow to ensure you can deduct your donation:

The charity you donate to must have a 501(c)3 status. You can check that in the IRS database.

If you’re donating more than $500, you’ll need to file Form 8283 when filing your annual tax return.

If you’re donating more than $5,000, you’ll need a qualified appraisal in order to apply a deduction.

As crypto is property - you can deduct between 20% and 50% of your adjusted gross income (the amount varies depending on the type of organization you donated to).

Simplify Crypto Donations with The Giving Block

How does The Giving Block make it easy to donate crypto to charity? For the past six years, The Giving Block has helped crypto donors make secure charitable donations of their assets to thousands of organizations. Organizations available on The Giving Block cover everything from animal welfare to health research and childhood education, offering a chance for every type of cause to get much needed support.

If you are interested in making a tax-efficient cryptocurrency donation, here are a few pointers to help you make an impactful and financially savvy charitable gift:

1. Choose the right asset in your crypto portfolio.

To make a highly tax-efficient gift, you will need to donate an asset that you have held long-term and has appreciated in value. That’s because you do not have to pay capital gains tax on donated crypto that has been held for at least one year.

2. Give before the year-end charitable contributions deadline.

Keep in mind that the deadline to make charitable contributions is December 31.

3. Identify a registered 501(c)3 charitable organization.

Donations to these organizations are not only tax-deductible according to IRS guidelines. These organizations are also able to provide you with a donation acknowledgment letter upon request—and most will generate one automatically once your gift has been processed.

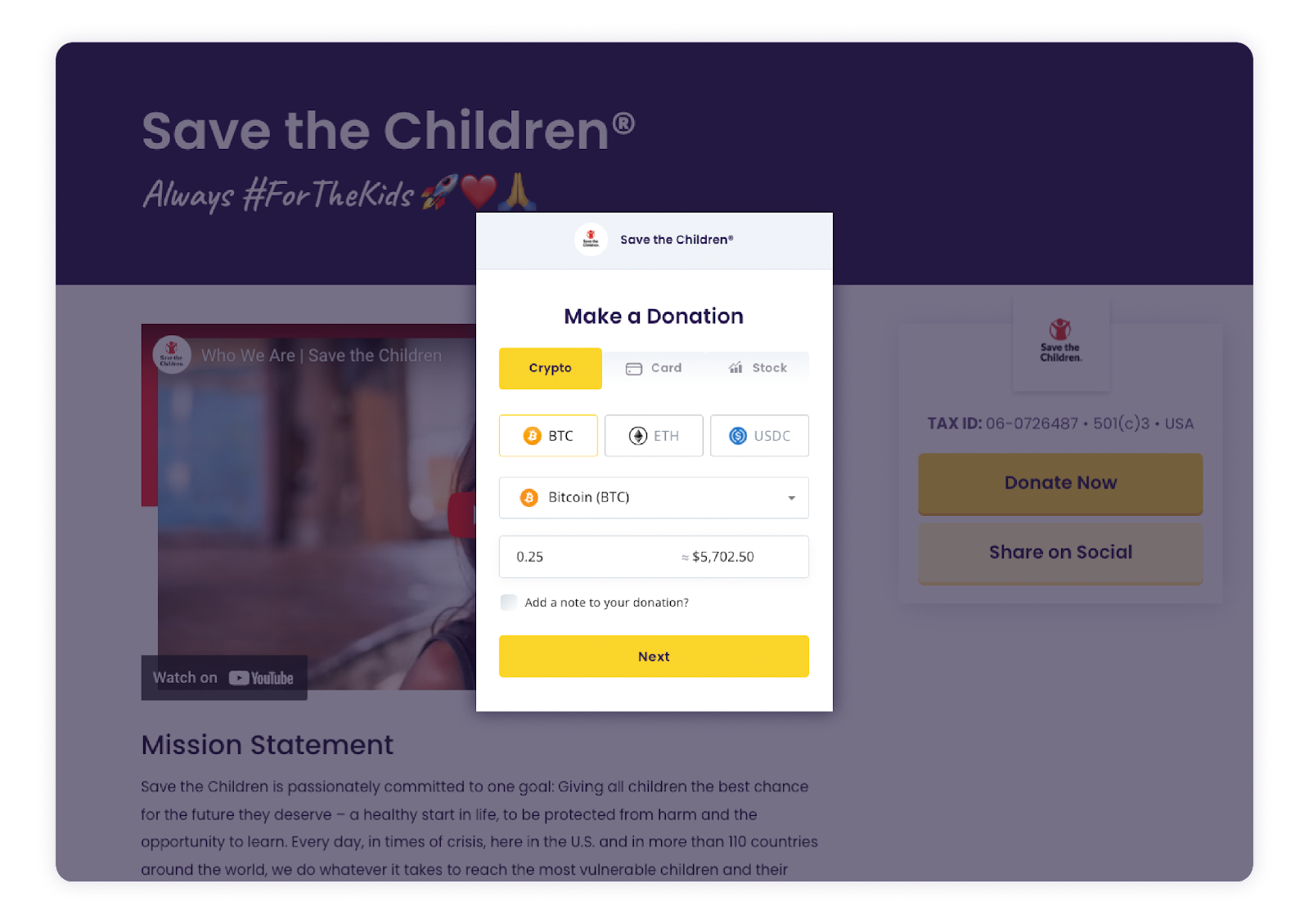

4. Input the donation amount and any personal details you would like to charity to see.

The Giving Block’s crypto donation form has a “give anonymously” option for donors who don’t want to share details like their name or mailing address.

6. Provide an email address and make your donation.

Whether or not you give anonymously, be sure to include a working email address in order to receive a donation acknowledgment letter for tax purposes. Follow the prompts to make your donation and wait for a confirmation to appear.

The best part of donating crypto is using your crypto gains to support a worthy cause. Plus, you’ll be joining a crypto philanthropy movement that includes figures like Vitalik Buterin, Meltem Demirors, and Cameron and Tyler Winklevoss.

About The Giving Block

Thousands of 501(c)3 organizations accept crypto donations with The Giving Block. To find a charity and make a tax-efficient cryptocurrency donation, get started by exploring The Giving Block’s donor marketplace.

Read next: How to use charitable donations as part of your tax strategy