How Crypto Fees Can Lower Your Tax Bill

When it comes to taxes, gas are one of the things that investors are allowed to deduct from the final sale price of an asset. However, fees come in various forms in the world of cryptocurrency. Let's take a closer look at how crypto fees are handled when it comes to taxes.

What are cryptocurrency fees?

Crypto fees are the processing fees built into the networks that maintain the cryptocurrency network. The money you pay acts as an incentive for the people operating the computers that keep the network alive. That's how the blockchain network works. You can think of crypto fees as similar to transaction fees.

If you're investing in crypto, you'll come across three major types of fees: exchange fees, network fees, and transfer (wallet) fees.

Exchange fees

Most crypto trades take place on exchanges like Coinbase, Binance, Kraken, Gemini, and many more. For an exchange to make money, it needs to attach to some of the financial momentum flowing through it. In most cases, that means assessing fees for common transactions, such as:

Trading fees: Fees associated with buying and selling crypto on an exchange.

Conversion fees: Exchanges may charge a fee to convert one fiat currency into another before a trade can be made.

Withdrawal fees: Withdrawals can be made up of blockchain transaction costs and an additional fee based on your country or the type of withdrawal, like crypto vs fiat.

Interest/Borrowing/Liquidation Fees: Some exchanges like Binance, Aave, and Uniswap offer crypto margin trading: the ability to borrow additional funds to increase your position and create leverage. These exchanges typically charge additional fees based on the amount borrowed on margin and an interest rate determined by the supply of funds available. Additionally, if your trade crashes and the position is liquidated you may be charged an additional fee.

Deposit Fees: Cryptocurrency deposit fees vary based on the type of deposit but are less common than withdrawal fees since exchanges want to incentivize users to fund their accounts.

Network transaction fees

Network fees, also known as mining fees or gas fees, are paid to the blockchain network involved in the trade, like Bitcoin or Ethereum for example. These fees reward miners and forgers for the work they do to validate the blockchain via consensus methods like Proof of Work, Proof of Stake, and Delegated Proof of Stake.

On the Ethereum network gas is the pricing mechanism used and traders must pay a gas fees in order to make a transaction or execute a smart contract. Fees are paid in GWEI — a denomination of Ether.

The Bitcoin network charges fees in Satoshis — the smallest unit of a bitcoin.

On the Binance Chain and dex transaction fees are paid in BNB.

Transfer fees

Transfer, or wallet fees, occur when investors withdraw or send cryptocurrency from one wallet to another.

How much are crypto transfer fees?

Cryptocurrencies give rise to some challenging fee scenarios. You might be paying trading fees in another cryptocurrency, such as a BTC/ETH ticker. If so, you will usually pay a fee in BTC. It is also becoming commonplace to pay fees in an exchange's own coin. For example, Binance allows users to pay with BNB, while Kraken has the Kraken Fee (KFEE). When users use an exchanges native coin, they are often given discounts on their transfer fees.

So the answer to the question is that it varies from each exchange, and even within exchanges, depending on whether you're using a native coin or not.

So, how can crypto fees lower your Income Tax?

Crypto fees are often tax deductible. This means that when you buy, sell, or exchange crypto, any fees associated with the transaction should be deducted from the sale price. Confused? It is pretty complicated, to be fair.

Let's look at an example.

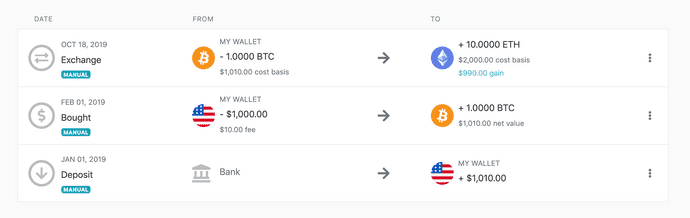

John bought 1 BTC for $1000 and paid a fee of $10. His cost basis for his 1 BTC is $1,010. He later exchanged 1 BTC for 10 ETH with the market price of 1 ETH being $200 at the time of this trade.

Koinly adds this fee to your cost basis calculations. To calculate his capital gain for this transaction, it subtracts his BTC cost basis from the fair market value of ETH in USD on the day he made the trade.

Koinly adds this fee to your cost basis calculations. To calculate his capital gain for this transaction, it subtracts his BTC cost basis from the fair market value of ETH in USD on the day he made the trade.

So, the capital gain for John is 2000 - 1010 = $990.

John pays capital gain for $990 rather than $1,000. Although in this example the amount is small, for those making hundreds, or even thousands, of transactions, these fees really add up. If you remember to deduct them from your report, this would save you a truckload in tax.

The technical way to look at the above example is that whatever trading fee is needed to make a transaction, together with the value of the asset, becomes the asset's cost basis. As said before, the fee counts as part of the cost.

How does transfer fee tax work?

Transfer fees are also subject to tax conditions. Let's look at a different scenario:

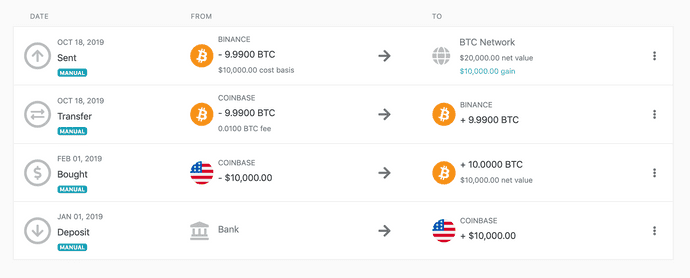

Hillary buys 10 BTC for $10,000 on Coinbase and later transfers these BTC to her Binance wallet. She pays a fee of 0.01 BTC in the process, and thus receives 9.99 BTC on Binance. She later sells the 9.99 BTC for $20,000.

There are a few ways of handling the transfer fee here.

1. No realized gains

The simplest way is to reduce Hillary's holdings by 0.01 and keep the value the same. This would mean that the remaining 9.99 BTC is still worth $10,000, so when she sells the 9.99 BTC, her gains are $10,000. The 0.01 BTC vanishes from her account and no taxable gains are realized on the transfer.

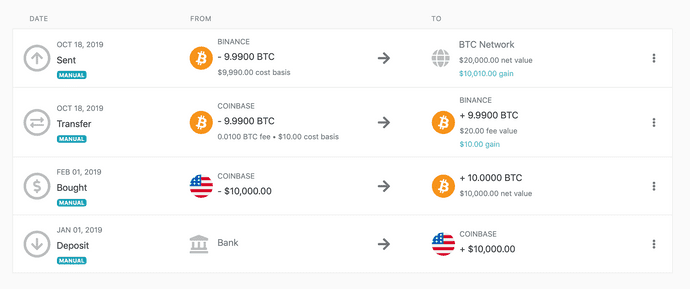

2: Gains realized same way as payment for goods

2: Gains realized same way as payment for goods

The second way is to treat the 0.01 BTC fee as a Payment or Withdrawal and realize gains accordingly. Let's say the value of BTC at the time of the transfer has increased to $2000 per BTC— this would make the 0.01 BTC worth $20. Since the original price of the BTC was 0.01 x 1000 = $10, Hillary will realize a profit of $10, which will be visible in her tax report. The value of the remaining holdings will be decreased by $10 to $9,990. Therefore, her final gains will be $10,010, as seen in the screenshot below.

3: Gains realized the same way as trading fees

3: Gains realized the same way as trading fees

There is a third way of handling this, similar to how trading fees work. We could realize a gain and then reinvest that gain into the remaining holdings, so the value of holdings after transfer becomes $10,010.

What is the best way to sort your crypto fees for tax?

In general, option 1 is preferred. However, some tax accountants believe that transfer fees are not strictly related to the acquisition cost of an asset and shouldn't be deducted from the final sale price. In such cases, you can switch to option 2 by enabling 'Treat transfer fees as disposals?' in the settings on Koinly:

Is there an easier way to sort your crypto taxes?

Koinly is a crypto tax tool that calculates your crypto taxes for you, meaning you don’t have to go through the hassle of sorting every single transaction yourself. Although we may miss a few (if you make thousands of trades), these can easily be fixed. There's a manual setting that makes things very clear for you to change things.

Not only does the software integrate with your exchange's transaction history, but it also calculates your taxes in a format that makes sense for your country’s tax office. Essentially, Koinly does all the boring tasks that would cost you hours and hours sitting at a computer.

As a quick breakdown, here’s a short summary of what Koinly does:

Imports all your trades including purchases, sales, swaps, and rewards.

Converts your transactions into your country’s currency at fair market value (this in itself is a massive time saver).

Helps you decipher which of your fees are tax deductible.

Allows you to submit a clean and accurate report to your tax office.