Crypto tax reports in under 20 minutes

Koinly calculates your cryptocurrency taxes and helps you reduce them for next year. Simple & Reliable.

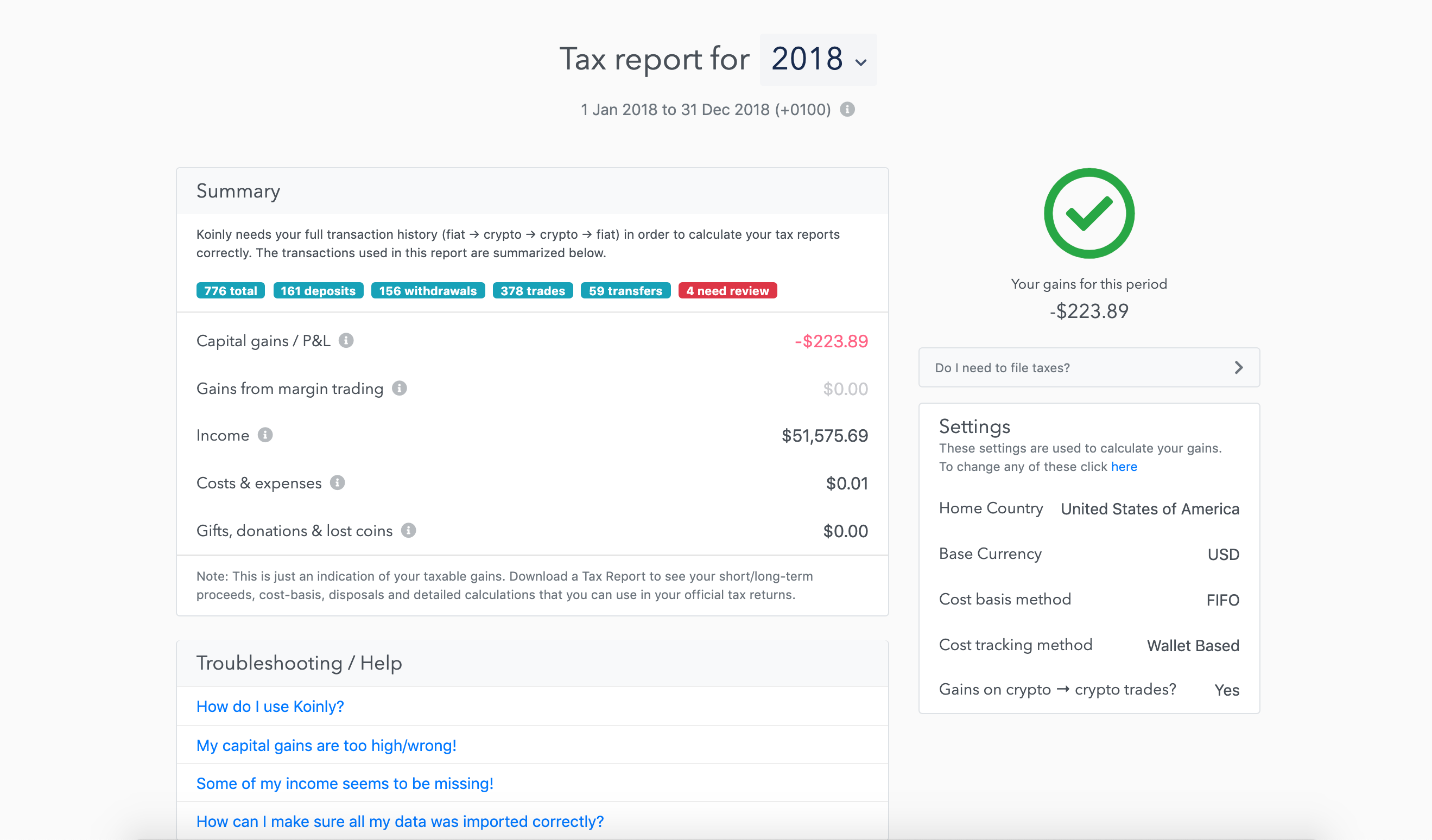

Available in 20+ countries

Form 8949 & Schedule D

TurboTax, HR Block

Free report preview

Feeling clueless?

✅ Traded on lots of exchanges? ✅ involved in DeFi, staking, liquidity? ✅ no record of anything? We've been there too and that's why we built Koinly!

No more wasting hours downloading CSV files, formatting data, figuring out market prices, getting the tax calculations right etc.

No more. ✌

With Koinly you can import your Bitcoin, Eth, Solana and other transactions directly from the blockchains, sync all your exchange trading history in one-click and get a ready-to-file tax report - all in a matter of minutes!

The platform is excellent."The API sync process was seamless and the user interface is incredibly easy to navigate. I was recommended by a friend (also in the US), after struggling with other platforms. The TurboTax formatted report was imported instantly. I couldn't have asked for a better experience. Thanks!"

How Koinly Simplifies Your Taxes...

Your Taxes...

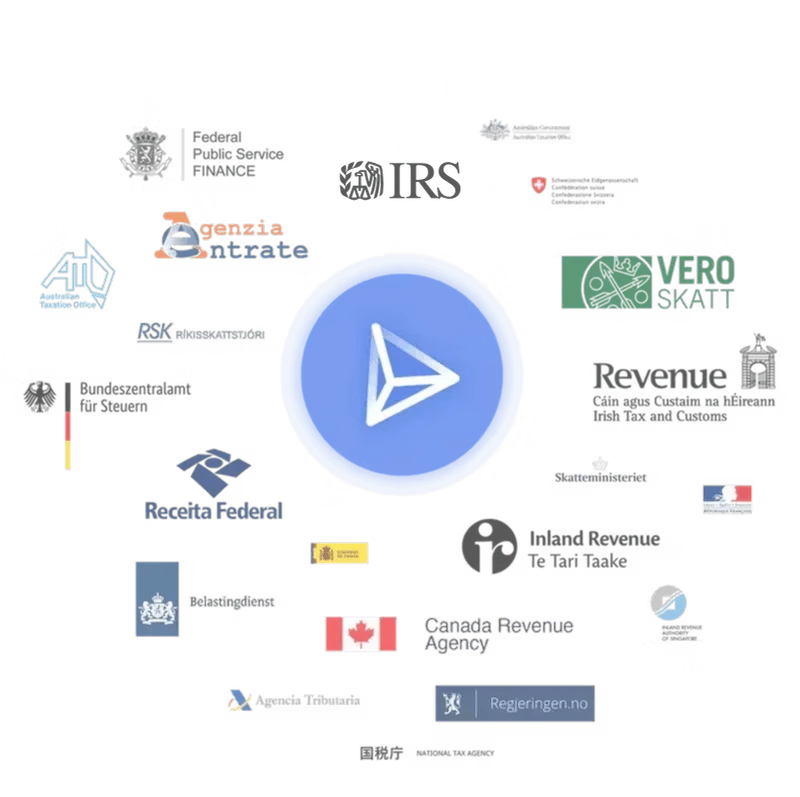

Easily import your trades

Add your exchange accounts via API or CSV files and connect your blockchain wallets using public addresses.

DeFi & NFTs. Whether you are staking on Solana, lending on Curve or providing liquidity on Polygon - Koinly can handle it all.

Smart transfer matching. Transfers between your own wallets are tracked automatically so you will never lose sight of your original cost basis.

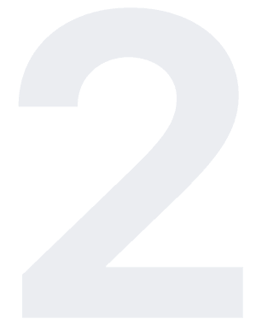

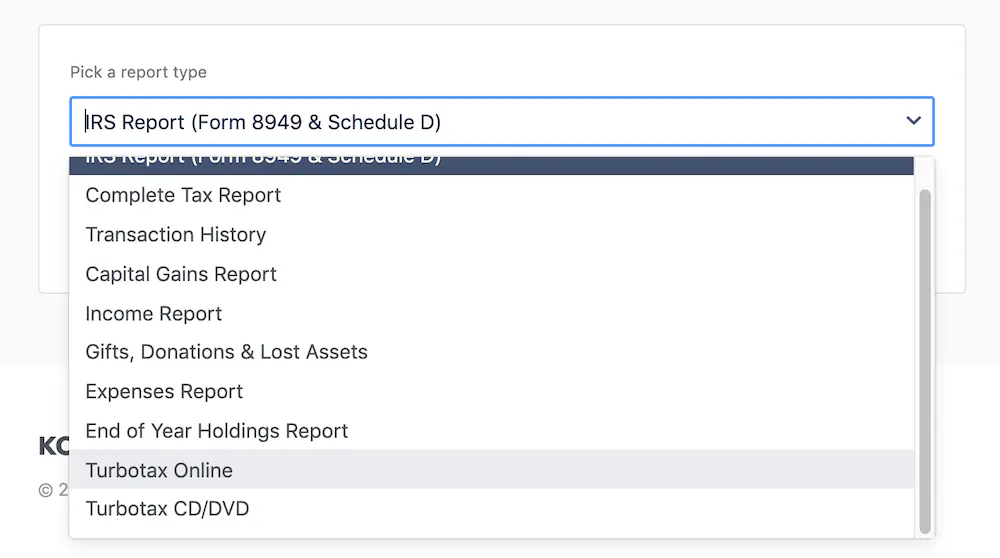

Download your tax documents

Whether you are filing yourself, using a tax software like TurboTax or working with an accountant. Koinly can generate the right crypto tax reports for you.

Form 8949, Schedule D. If you are filing in the US, Koinly can generate filled-in IRS tax forms.

Comprehensive tax report. Generate a full crypto tax report with all your short/long term disposals, capital gains and income.

"I switched to Koinly last month and really loving it so far. Much better than cointracking. Good job!"

"It was easy to sync my accounts, the tax report was in good format and approved by BZSt. Great support."

"Team is very supportive, helped me import my Bibox transactions and guided me all the way. I have invited some of my friends to Koinly too and they are thanking me :D"

Popular questions

How do cryptocurrency taxes work?

I only made a loss on cryptocurrencies, do I still have to file taxes?

Are crypto to crypto trades taxed?

How are Mining, Staking & Hard Forks taxed?

How can I avoid paying tax on my Bitcoin trades?

How can Koinly help?

Koinly syncs your transactions from Coinbase, Kraken, Solana, Eth and any other exchanges or blockchains that you traded on. It then finds the market price at the time of your trades, matches transfers between your own wallets and calculates your crypto capital gains!