How to Get More Accounting Clients With Crypto in Australia

Want to grow your accountancy firm? At least 1 million Australians own or have owned crypto cryptocurrencies. In other words, there's never been more demand for crypto accountants and CPAs than right now! Not sure how to get in on the action? Koinly Head of Tax, Danny Tarwal, shares 6 strategies you can use to get more accounting clients with crypto in Australia.

How big is the crypto market in Australia?

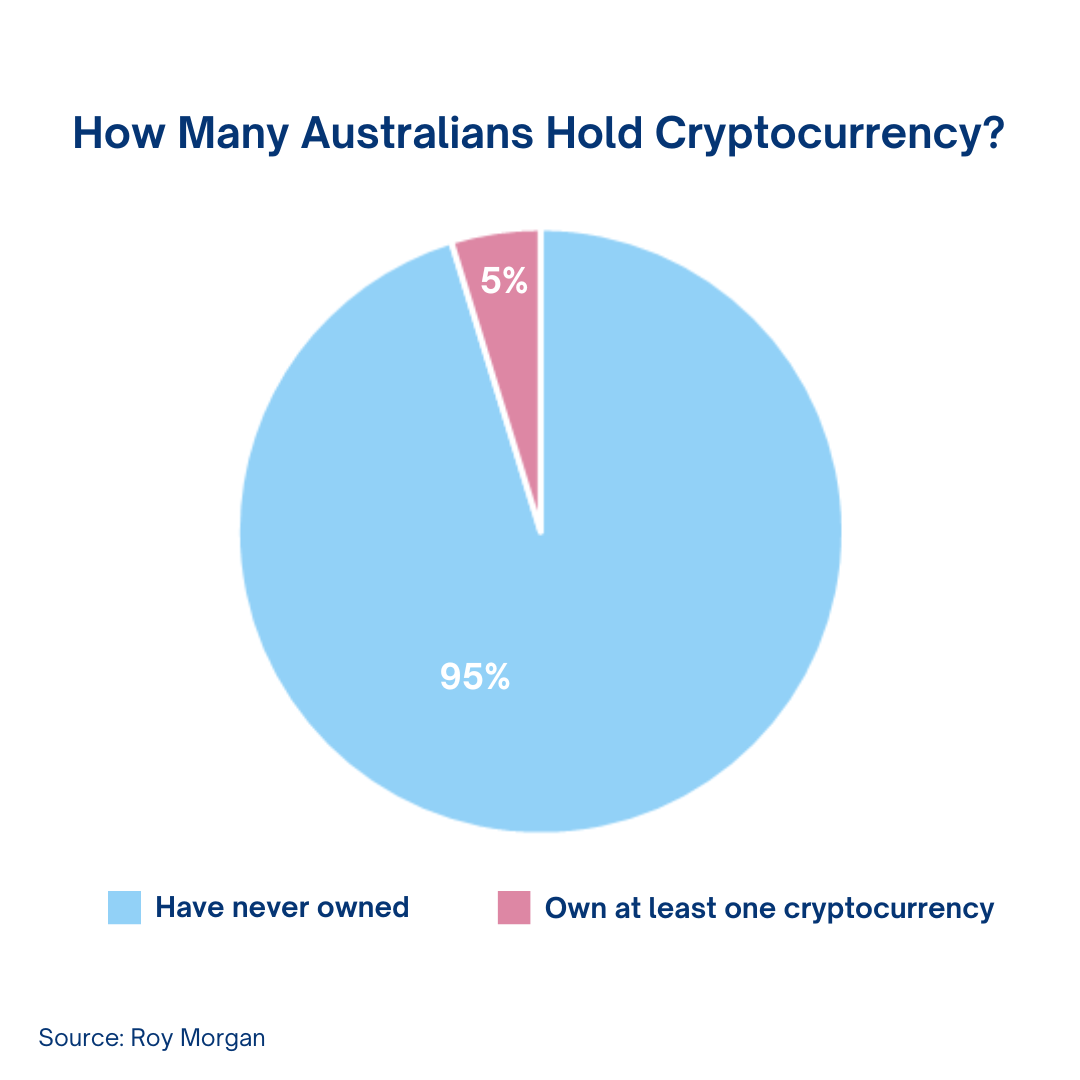

Big - and it’s only getting bigger. According to Roy Morgan research, 5% of Australians own cryptocurrency - putting the total figure of crypto investors in Australia at an estimated 1 million. That’s a considerable amount of people who need to declare their cryptocurrency holdings, and movements to the ATO, come tax time.

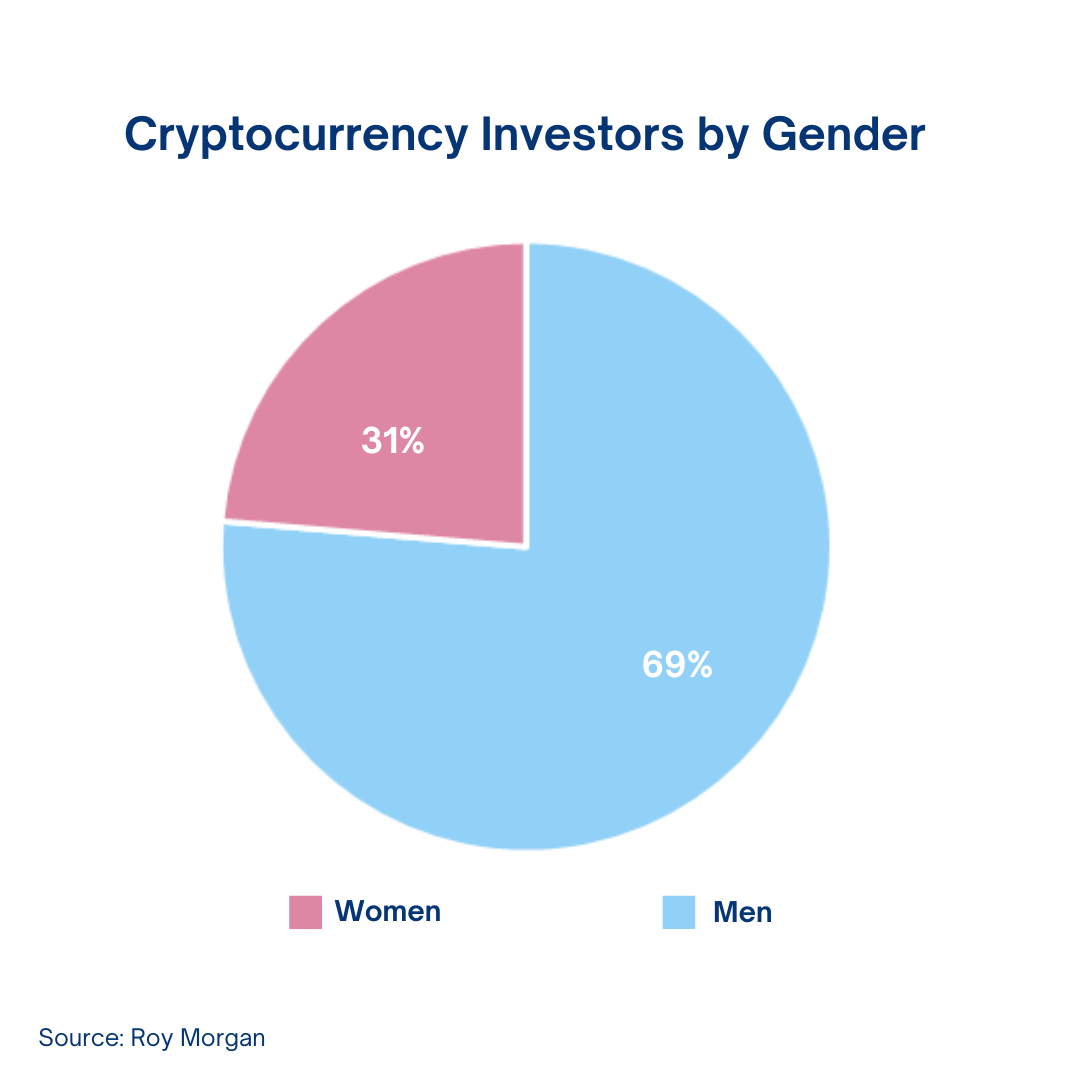

So what does the average Australian crypto client look like? Interestingly, over two-thirds of Australian cryptocurrency investors are men, compared to one-third being women. This indicates a significant gender difference in cryptocurrency investments.

So what does the average Australian crypto client look like? Interestingly, over two-thirds of Australian cryptocurrency investors are men, compared to one-third being women. This indicates a significant gender difference in cryptocurrency investments.

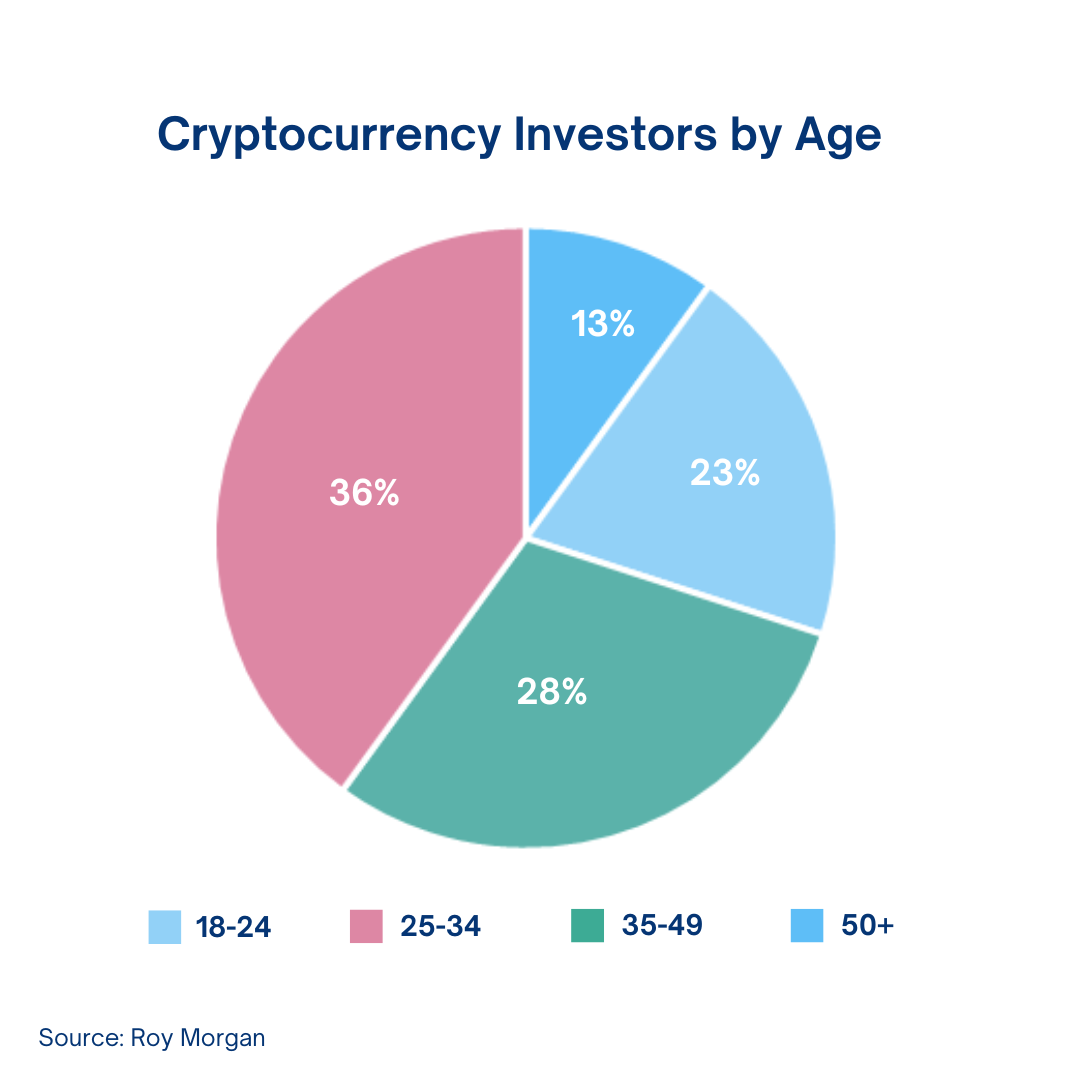

A study of cryptocurrency investors by age indicates that most holders of cryptocurrencies are under 35, with over one in ten members of this age group investing in crypto. Of all crypto investors, 36% are aged 25-34, and 23% are aged 18-24.

A study of cryptocurrency investors by age indicates that most holders of cryptocurrencies are under 35, with over one in ten members of this age group investing in crypto. Of all crypto investors, 36% are aged 25-34, and 23% are aged 18-24.

Australians over 35 are less likely to be invested in cryptocurrency but still comprise over 40% of the total investor market including 28% aged 35-49 and 13% aged 50+.

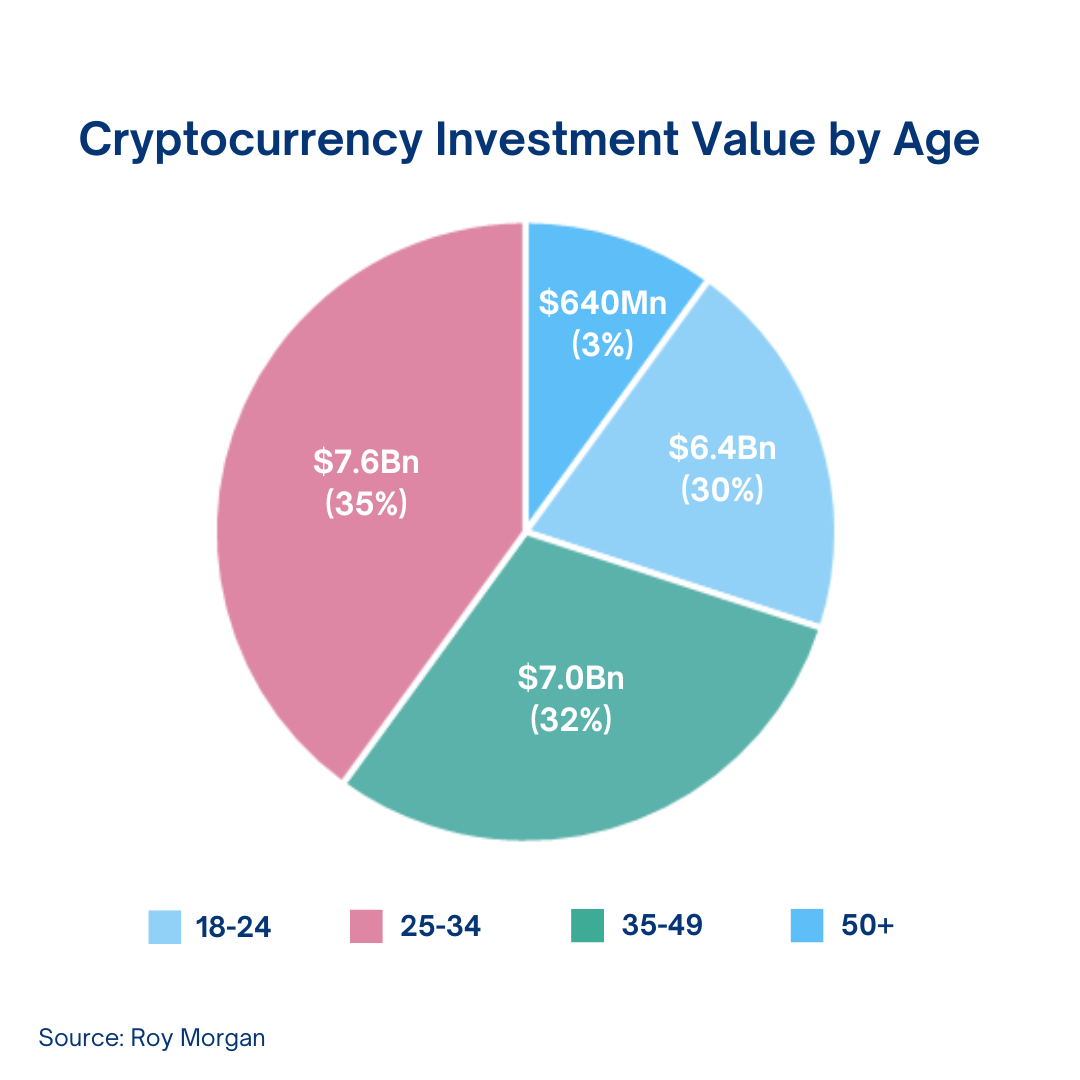

Of course, clients are less likely to look for an accountant if they can't afford one - so knowing what average profits look like is important. With an average investment value of around $56,200, Australians aged 50+ have the largest cryptocurrency investments. This means the value of all cryptocurrency holdings for people over 50 is around $7.6 billion – higher than any other age group, and over 35% of the total market.

Of course, clients are less likely to look for an accountant if they can't afford one - so knowing what average profits look like is important. With an average investment value of around $56,200, Australians aged 50+ have the largest cryptocurrency investments. This means the value of all cryptocurrency holdings for people over 50 is around $7.6 billion – higher than any other age group, and over 35% of the total market.

In contrast, although they are most likely to be investors in the market, Australians aged 18-24 hold an average investment of only $2,600. This means the total value of all cryptocurrency investments for this age group is only $630 million – about 3% of Australians' total cryptocurrency market.

The investment profiles of Australians aged 25-34 and 35-49 are similar. People aged 25-34 have an average cryptocurrency investment of $18,200 while for those aged 35-49, it is slightly higher at $21,600.

Because they are more likely to be investors in cryptocurrency the size of the market for those aged 25-34 is slightly larger at $7 billion (32% of the market) than for those aged 35-49 at $6.4 billion (30%).

Do people really need professional crypto tax help?

Yes. There are more than 1 million Australian crypto clients that need help declaring their crypto taxes to the ATO every year, and that number is likely to increase. Added to this, we know that 74% of Australians seek the help of an accounting professional come the tax deadline. Owing to the complexity that crypto tax presents to the layman, crypto investors are even more likely to seek your help.

It’s a boom for blockchain, but equally a boom for accountants and CPAs - death and taxes after all. Yet a quick whip around Google and you’ll see how the demand for crypto tax experts far outstrips the supply.

Could crypto tax be a pot of gold for your accountant business? Here’s how your firm can get a slice of the Bitcoin pie in 6 simple steps.

Bridge your knowledge gaps

Worried that you don't understand how crypto tax works? Fret not. While crypto might feel like a whole new universe (or metaverse for that matter), but when it comes to tax - the rules are all too familiar.

In summary - the ATO views crypto as a kind of asset, and as such, it's subject to Capital Gains Tax or Income Tax - depending on the specific transaction. Selling, swapping, spending, or gifting cryptocurrency is seen as a disposal of an asset, and any profits are subject to Capital Gains Tax. Meanwhile, earning new cryptocurrency coins and tokens - through activities like mining or staking - is generally seen as income, and therefore profits are subject to Income Tax.

The ATO has extensive guidance on how crypto is taxed, and we've got a dedicated Australian Accountant's Guide to Crypto Tax from our Head of Tax, Danny Talwar too! Simply follow our guide and you'll be up to speed in no time.

Completely lost on all the different crypto jargon? We've also got a crypto glossary for that.

Learn by doing

It's not essential to invest in cryptocurrency to understand the tax implications of it. Basic actions like buying and selling on an Austrac registered exchanges like Binance Australia for example, are covered by standard capital gains tax rules.

But with so many different investment opportunities out there - from crypto margin trading, to futures, yield farming, and so on, it certainly helps if you have firsthand experience.

Investing even just a few dollars to help you understand how exchanges, wallets, and blockchains work can help translate the complicated jargon into simple transactions with clear tax implications. Especially if you're looking to attract crypto clients investing in the DeFi market - we'd recommend spending some precious hours interacting with various protocols to understand how each investment works.

Not sure where to start? Check out our roundup of the best Australian crypto exchanges for security and take a deeper dive into DeFi by reading Koinly's Australia DeFi Crypto Taxes Guide.

Stand out in a crowd

Once you feel ready to handle crypto taxes - tell the world. Australian crypto investors are looking for experienced, trustworthy crypto accountants online. So make sure you can be found with a website that promotes your crypto accounting services in detail.

"Crypto accountant near me" is a popular search term - meaning investors are hunting on Google for someone to help. Be the accountant they pick by ensuring a page of your website is dedicated to your crypto accounting services.

Better still, create in-depth content for your website that tackles a variety of common questions around cryptocurrency, for example:

How is crypto taxed in Australia?

How do you report crypto taxes to the ATO?

How to calculate crypto capital gains

How to calculate crypto income

You can even build your authority on the subject by creating trustworthy resources where the ATO is yet to release specific guidance - say articles on specific transactions like yield farming or liquidity mining.

Finally, don’t forget to add Crypto Tax to your Google Business listing - or create a Google Business listing if you don't have one already!

Join industry bodies

If you're not yet participating in the crypto community on a professional level, it pays to belong, especially when the talent pool is still in its infancy. There's a stack of industry groups that your accounting firm could join today, further spreading the word that your practice is ready to do crypto taxes. Here are two of them:

Blockchain Australia: Blockchain Australia members represent businesses from across the country. Ranging from startups and scaleups, education institutions, consultants, digital asset exchanges, financial industry service providers, and the builders coding our future success. Apply to become a member.

Australian Bitcoin Industry Body: The Australian Bitcoin Industry's mission is to serve as a voice for the Australian Bitcoin Industry. Browse their membership page to find Bitcoin communities online, and in Melbourne, Sydney, Brisbane, Adelaide, and Perth.

Get listed on Koinly

If you'd like to attract even more clients - whether you're an experienced crypto accountant or a relative newcomer - you can also get listed on Koinly's accountant directory. We have a dedicated Australia crypto accountants directory to help Australian crypto investors find reputable and trustworthy crypto accountants. It's easy - and free - to get listed. Apply today.

Use the right tools for the job

While the foundations of crypto tax are pretty straight-forward, due to the sheer amount of assets a client may hold and the volume of transactions they may have made in a single financial year, the real challenge for crypto accountants is the manpower needed to process and calculate client's crypto tax liability.

This is why almost all crypto accountants opt to use the right tools for the job, in the form of a cryptocurrency tax calculator - like Koinly

Crypto tax software does all the calculations on your (and your clients' behalf). It imports transactions from all the exchanges, wallets, or blockchains a given investor uses, identifies the cost basis of those transactions (or the fair market value on the day of the transaction), and converts it into AUD - saving hours of spreadsheets and manual calculations. In even better news, Koinly generates a variety of ATO-compliant crypto tax reports, ready to help your client file, or you to file on their behalf.

Koinly offers licenses for crypto accountants managing every step on behalf of their clients, or your client can simply give you access to their existing Koinly account via their settings. Find out more about Koinly's crypto tax solutions for accountants, here.