How To Get Your Gemini Tax Documents With Koinly

How to do your Gemini taxes with Koinly

Gemini is a user-friendly, popular crypto exchange, ideal for investors of all experiences with a huge range of investment options available including P2P trading, Gemini Earn, and the ActiveTrader platform for more experienced investors. Whatever your Gemini investments, Koinly can help you do your Gemini taxes safely, quickly, and accurately.

Follow these steps to sync your Gemini data automatically to Koinly:

- Log in to Gemini.

- In the top right corner, select account.

- From the drop-down menu, select settings.

- On the left-hand menu, select API.

- Select create new API key.

- Under the scope drop-down menu, select primary.

- Select next.

- Name your API key, for example, "Koinly".

- Under API settings, check the Auditor box.

- Copy your API key and API secret.

- Check the API secret acknowledgement box.

- Select create API key.

- Add your API key into Koinly.

On Koinly:

- Create a free account on Koinly

- Complete onboarding until you get to the Wallets page and find Gemini in the list

- Select API > Paste the API keys you copied above in the appropriate box

- Hit Import and wait for Koinly to sync your data. This can take a few minutes

- Review your transactions on the Transactions page to ensure everything is tagged correctly and no missing data

- Go to the Tax Reports page to view your tax liability!

- Head over to our help center

- Hit up our discussion boards - we might have already answered your question

- Ask us on social media - we're on Twitter and Reddit

- Contact us on email or live chat

- Got a feature request? Give us feedback on Canny

How do I file my Gemini taxes?

The first thing you need to do is calculate any income or capital gains you made from Gemini investment activity. Then, you can report it to your country’s tax office. For most people, this happens as part of your annual tax return.

You can either do it yourself, by manually identifying your taxable transactions, calculating your net capital gain or loss, and any crypto income you have made.

Or, you can use a crypto tax calculator like Koinly, which will calculate your taxable income for you, and generate any Gemini tax reporting you need, ready to file with your tax office.

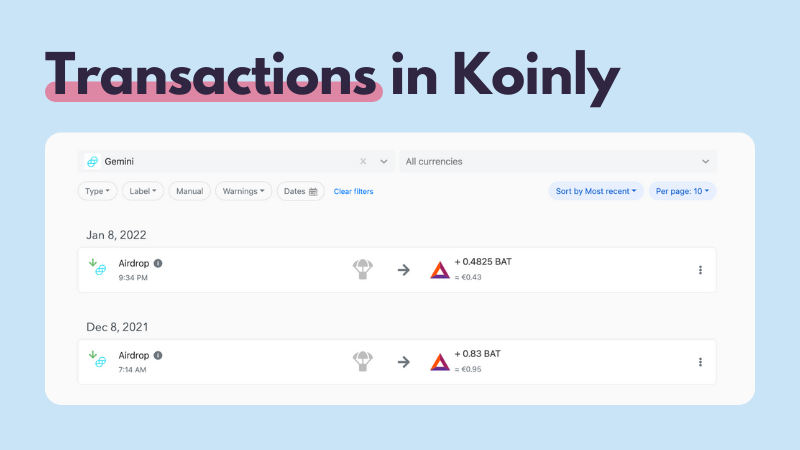

Koinly works by importing your Gemini transaction data. Let's look at an example - here are some transactions in a Gemini account.

You can import your Gemini transaction history via API integration or by uploading CSV files of your Gemini transaction history. Once you've done this, you'll be able to see your Gemini transactions in Koinly - like this.

You can import your Gemini transaction history via API integration or by uploading CSV files of your Gemini transaction history. Once you've done this, you'll be able to see your Gemini transactions in Koinly - like this.

This lets you manage all your crypto transactions - from Gemini and any other exchanges you use - from one single platform, making crypto tax simple.

This lets you manage all your crypto transactions - from Gemini and any other exchanges you use - from one single platform, making crypto tax simple.

Your frequently asked questions

Does Gemini provide tax documents?

Gemini provides some tax documents for US users - including Form 1099-MISC. If you're outside the US, or need to report more than your income from Gemini, you'll need to get your complete transaction history from Gemini instead and either calculate your Gemini taxes yourself, or use a crypto tax calculator like Koinly to do it for you.

How do I get a Gemini tax statement?

The easiest way to get your Gemini tax documents is to connect to crypto tax software. You can either do this via API or by uploading a CSV file of your transaction history. Your crypto tax calculator will then calculate your Gemini taxes for you and generate your Gemini tax documents.

Do you get a Gemini tax 1099?

Gemini provides some tax documents for US users - including Form 1099-MISC. A 1099-MISC form is issued to US users who have earned more than $600 in income throughout the calendar year and are issued by the end of January the following year. Previously, Gemini issued Form 1099-K, but have since stopped issuing these to users.

Does Gemini provide financial or end of year statements?

No, Gemini doesn't provide financial or end of year statements specifically, but you can use your Gemini transaction history as a financial or end of year statement for tax reporting purposes.

Do I have to pay tax on Gemini?

Yes - if you have capital gains or income as a result of your crypto investment activities on Gemini, you'll need to report these to your tax office and pay taxes on them.

What does Gemini report to the IRS?

Gemini issues Forms 1099-MISC (for reporting other income) for non-exempt U.S. exchange account holders who have earned more than $600 (USD equivalent) in income during the calendar year. Additionally, starting on 1/1/2023 Gemini will also issue form 1099-B (or similar forms designed specifically for digital assets).

How do Gemini earn taxes work?

Generally, Gemini Earn rewards will be viewed as additional income by most tax offices and subject to Income Tax upon receipt based on the fair market value of your rewards on the day you receive them (in your fiat currency).

When will I get a 1099 form?

If you’re going to receive a 1099 form from Gemini, you should receive this by February of the following financial year at the latest.

Is Gemini safe?

Yes. Gemini is a secure crypto exchange that follows best security practices and most fiat assets stored in Gemini are FDIC insured. However, you should always store assets in a cold wallet that you’re not actively trading.

Does Gemini have proof of reserves?

Gemini has some exposure to FTX due to its relationship with Genesis Lending and has paused Gemini Earn withdrawals as a result. The exchange says operations will resume as usual soon and has committed to publishing a Merkle Tree proof of reserves audit in the future.