Quarterly Taxes on Crypto

Living in the US? It might surprise you to know you may need to pay quarterly taxes on your crypto. Whether you’re mining, staking, or trading- if you earn over a certain amount, you need to let the IRS know about it to avoid any penalties. Learn about the US pay-as-you-go tax system and how to do quarterly taxes for crypto.

What are quarterly taxes?

Quarterly taxes are also known as estimated taxes and they’re part of the American pay-as-you-go tax system.

When you’re employed, you pay tax on income as you earn. It’s taken out of your paycheck automatically by your employer.

It’s your responsibility to calculate any additional income from crypto and pay tax on it.

Who needs to pay quarterly taxes on crypto?

The pay-as-you-go tax system makes sure American taxpayers don’t end up with a huge tax bill at the end of the financial year that they can’t afford to pay.

The quarterly tax system (or estimated tax system) aims to do the same thing.

The IRS says any taxpayer who expects to owe tax of more than $1,000 when their annual tax return is filed should pay quarterly taxes and you expect your withholding and tax credits to be less than the smaller of:

a) 90% of the tax to be shown on your current tax return.

b) 100% of the tax shown on last year's tax return. Your last tax return must cover all 12 months.

If this applies to you, you’ll need to submit quarterly tax payments for income earned in each period below:

| Payment Period | Due Date |

|---|---|

| January 1 - March 31 | April 15 |

| April 1 - May 31 | June 15 |

| June 1 - August 31 | September 15 |

| September 1 - December 31 | January 15 the following year |

You pay your estimated taxes using Form 1040-ES and you can pay online or by mailing a check.

Wait, I need to pay tax on crypto?

Yes - depending on the specific transaction you’re making you might need to pay Income Tax or Capital Gains Tax on crypto.

It breaks down like this - when you sell, trade, or spend crypto, you’ll pay Capital Gains Tax on any profit. But there are many other crypto transactions that might be subject to Income Tax instead.

The IRS is very clear that crypto mining, airdrops, hard forks, and getting paid in crypto are all subject to Income Tax - but the rest is a little foggier as they’ve not released clear guidance. However, in general, most tax experts agree that when you’re seen to be earning new coins, this would likely be subject to Income Tax. This could include staking, yield farming, liquidity mining, and more.

So how do you know if you need to pay quarterly taxes on your crypto?

So how do you know if you need to pay quarterly taxes on your crypto?

You can learn more about how crypto is taxed in our US crypto tax guide.

How do I calculate quarterly taxes on crypto?

The IRS Form 1040-ES has a worksheet to help you calculate your estimated taxes. But we all know crypto taxes can get complicated. You’ll need to know the fair market value in USD on the day you received it of any crypto viewed as income, as well as any capital gains.

You can use crypto tax software (like Koinly!) to help you with this. But if you have a variety of sources of income - like crypto, rental income, business income, and so on - then we recommend getting a qualified accountant to help you with your quarterly taxes to ensure you pay the right amount.

What happens if I don’t pay quarterly taxes?

If you fail to pay quarterly taxes when you should have - you may be faced with an underpayment penalty when filing your annual tax return the following year. However, there is a 'safe harbor' rule for this. It varies depending on how much you earn:

Income of less than $150,000: You will not face underpayment penalties if your estimated tax payments amount to 90% or more of your current year's tax liability or 100% of last year's tax liability (whichever is smaller).

Income more than $150,000: You will not face underpayment penalties if your estimated tax payments amount to 110% of last year's tax liability or 100% of your current year's tax liability (whichever is smaller).

If I’ve paid quarterly taxes, what do I report on my annual tax return?

Even if you pay quarterly taxes, you'll still need to file an annual tax return too. The IRS Form 1040 includes a line for you to report how much you've paid in estimated tax throughout the year. This figure will be subtracted from your financial tax liability for the year. So if you've filed your quarterly taxes correctly then you should have a minimal tax liability for the year, and potentially even a tax refund!

How can Koinly help with crypto taxes

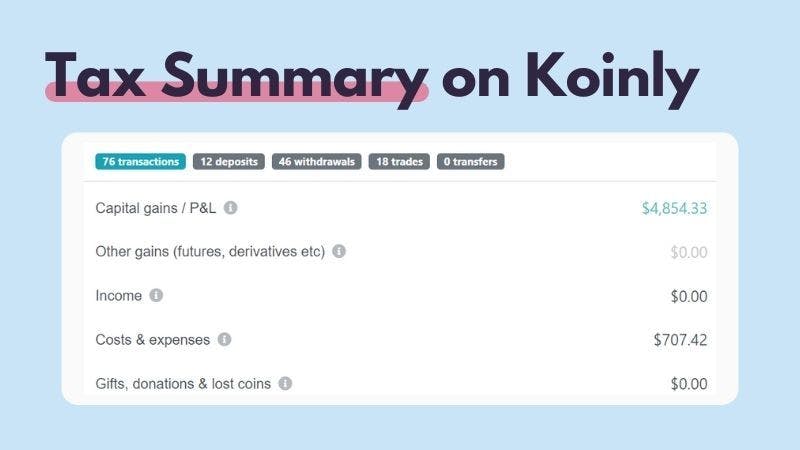

Keeping track of all your crypto assets - like your cost basis, the fair market value of crypto in USD on the day you received it, and the various transactions you’re making - is difficult. But Koinly makes it much simpler by letting you keep track of all your crypto transactions and taxes from one spot.

All you need to do with Koinly is sync all the crypto exchanges and wallets you use via API or CSV file. Once you’ve done this, all your crypto transaction data will be available for you to see in Koinly. Koinly will identify the fair market value in USD for you, as well as calculate any capital gains or losses. You can track these in real-time and keep track of your tax liability throughout the financial year, helping you make accurate estimated quarterly payments if you need to.

When it comes to reports - Koinly’s got a huge variety of tax reports available for you to pick from depending on your needs. For US investors we offer:

When it comes to reports - Koinly’s got a huge variety of tax reports available for you to pick from depending on your needs. For US investors we offer:

IRS Report (Form 8949 and Schedule D)

TurboTax Online Report

TurboTax CD/DVD Report

TaxAct Report

Complete Tax Report

Capital Gains Tax Report

Income Report

Other Gains Report

Gifts, Donations, and Lost Assets Report

Expenses Report

End of Year Holdings Report

Highest Balance Report

Buy/Sell Report

Transaction History CSV

FAQs

Got more burning questions? Here are some of our most frequently asked questions on quarterly taxes.

Do I need to pay estimated taxes on capital gains?

Potentially. According to IRS guidance, you'll need to make a quarterly estimated tax payment if you expect to owe at least $1,000 in tax for the current tax year after subtracting your refundable credits and withholding and if you expect your withholding and refundable credits to be less than the smaller of 90% of the tax shown on your current year's tax return or 100% of the prior year's tax return. Find out more on the IRS website.

Do you pay capital gains tax quarterly?

Even if you're a salaried worker, you may need to pay estimated quarterly taxes on capital gains if you have a sizeable gain for the current tax year and you meet certain other requirements. See the IRS guidance.

Does TurboTax do quarterly taxes?

Yes. You can use the TurboTax Self-Employed service to file quarterly taxes.