10 Best Learn and Earn Crypto Programs for 2024

The crypto market is a minefield, full of unique terminology, jargon, and concepts that don’t really exist outside the crypto realm. This means for newbies - it can be a bit daunting when you’re first starting out, especially when you’re figuring out your first investments. Fortunately, there are some awesome learn and earn crypto programs that let you earn crypto while learning! We’re covering the 10 best learn and earn options - including Coinbase learn and earn, Binance learn and CoinMarketCap learn. Plus, we'll fill you in on what your tax office will want to know about it!

10 best learn and earn crypto programs

Coinbase learn and earn

Binance learn and learn

CoinMarketCap earn

Phemex learn and earn

Cake DeFi learn and earn

Revolut learn and earn

Bitdegree learn drops

CoinGecko earn

Robinhood crypto learn and earn

NFTb learn and earn

What are learn and earn crypto programs?

Wondering how to make money with Bitcoin? Want to earn cryptocurrency for watching videos? Being paid in crypto just for learning about it can sound too good to be true, but that’s not the case.

Why do these learn to earn programs exist?

To promote various exchanges and different cryptocurrencies. Most large centralized exchanges offer learn and earn programs including Binance, Coinbase, and many more. They offer a small incentive to encourage you to use their platform when you eventually do start trading crypto.

As well as this, they can create partnerships with different cryptocurrencies with dedicated modules where you’ll learn about a specific new coin or token and earn a small amount of that token as a reward. This raises awareness about the coin, decentralizes ownership from the creators, and increases initial trading volume - much like an airdrop.

Watch: most popular learn and earn crypto programs

Coinbase learn and earn

One of the largest crypto exchanges in the world, Coinbase has an excellent learn and earn crypto program where you can earn free crypto on Coinbase. All you need to do to take part is sign up for a Coinbase account, then you can start learning by watching videos and answering quiz questions. You'll earn crypto in your Coinbase account for every quiz you complete.

GRT

AMP

NEAR

Coinbase learn and earn has had a great reception from users - the platform offers engaging and uncomplicated modules with a straightforward structure. For each module, you'll watch a short video (or videos) on your chosen crypto then take a quick quiz or assignment to test your knowledge.

Once you've passed the quiz, you're rewarded with your crypto in your Coinbase Earn account. You can earn between $3 to $6 in crypto on average from each of these modules - so get studying. See more about how it works here:

To get started on Coinbase learn and earn - you'll need a verified account (KYC verification including photo ID) and to live in a country eligible for Coinbase learn and earn. Currently, eligible countries include:

Austria, Australia, Belgium, Bulgaria, Canada, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Greece, Hong Kong, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, The Netherlands, Norway, New Zealand, Poland, Portugal, Romania, Singapore, Slovakia, Slovenia, Spain, Sweden, Switzerland, Taiwan, Turkey, the United Kingdom, and the United States.

Coinbase is adding more countries all the time - so make sure to check back if where you live isn't on there just yet.

In even better news - you can earn even more crypto using Coinbase learn and earn by referring others to the program using a referral link. Every time someone joins Coinbase learn and earn and completes at least one module, you'll earn more crypto! Users around the world have earned more than $100 million from Coinbase learn and earn so far.

A final note, the Coinbase learn and earn program isn't always live - so you'll need to check back from time to time to see when they have active campaigns and quizzes.

Binance learn and earn

As the biggest crypto exchange in the world, Binance has a great learn and earn crypto program. You can earn crypto while learning on Binance, but there are a couple of conditions. Binance learn and earn program is only available to new Binance users and the exchange doesn't always have a live learn and earn campaign running, so you'll have to check back regularly to catch a live learn and earn program. Binance regularly updates its program with new and popular coins, but some of the coins and tokens available previously include:

A word to the wise though - a lot of the Binance learn and earn programs have other requirements for you to get your crypto. So while a quick quiz might be part of it, you may also need to buy a given amount of crypto before you're eligible for the learn and earn rewards. Don't worry if you're not looking to invest your own funds - this varies a lot depending on the campaign. For other crypto campaigns, requirements could include sharing a social media post as opposed to investing or trading a given volume. Keep an eye out on the Binance blog announcements as they have new learn and earn campaigns frequently.

CoinMarketCap earn

CoinMarketCap isn’t a crypto exchange - but it is the leading crypto price tracking website. It’s visited by millions of users every day looking for a variety of popular and less common coins and tokens to see how they're performing in the market.

You can earn crypto through CoinMarketCap earn. They partner with a variety of new cryptocurrencies and protocols trying to get their name out there. Previous learn and earn programs have included:

You should check in regularly as their learn and earn campaigns often only last a couple of weeks and often only pay out a given amount total before concluding the campaign.

Phemex learn and earn

Phemex has an awesome crypto learn and earn program. Phemex Learn works a little differently from the above programs. You’ll still watch videos, complete quizzes, and get your rewards. But instead of getting a specific cryptocurrency - you’ll get trading bonuses or other credits to your Phemex account for you to invest in a cryptocurrency of your choice!

At the minute, the programs you can complete are:

Fiat currency vs. cryptocurrency

How to buy or transfer crypto on Phemex

How to spot trade on Phemex

What are crypto derivatives

How to trade perpetual contracts on Phemex

Phemex earn & launchpad

Phemex learn and earn is a great option for those who’d like a little more freedom with the crypto they invest in.

Bake learn and earn

Next up is Bake learn and earn (formerly Cake DeFi)

Like all of the above, you’ll complete modules to earn different cryptocurrencies. At the the time of writing, you can earn:

DFI

BTC-DEFI

ETH-DFI

Both existing and new Bake users are eligible, but you'll need to complete KYC verification to receive your rewards. Rewards will be sent directly to the freezer and locked for 1 month, at which point you can defrost it.

Revolut learn and earn

Revolut is a popular and secure payment app that also supports crypto. To help investors into the crypto market, Revolut has a great learn and earn program within their app that's easy to use. At the time of writing, Revolut has had a number of learn and earn programs, including:

DOT

1INCH

ALGO

NEAR

AVAX

All you need to do is navigate to the crypto section of the Revolut app and select the learn and earn course you'd like to do. Your learn and earn rewards will then be credited to your account.

Bitdegree learndrops

BitDegree is more than just a learn and earn program - the whole platform is dedicated to helping anyone, anywhere learn about cryptocurrency and blockchain technology, whether they want to further their career or simply want to learn more about an investment.

BitDegree Learndrops monetize learning about crypto by letting you earn crypto by watching videos and completing quizzes. Previous and current courses include:

FIO Protocol Learndrop

PrimeXBT Learndrop

KyberSwap Learndrop

The Mysterium Network Learndrop

The Engines of Fury Learndrop

The Crust Network Learndrop

The Web3 Identity Unstoppable Domains Learndrop

Learn YouHodler

Learn Changex

Learn Lighthouse

CoinGecko earn

Similar to one of our learn and earn program offerings above, CoinGecko is an independent cryptocurrency data aggregator, tracking more than 12,000 cryptocurrencies over 600 exchanges. The CoinGecko learn and earn program lets you watch videos, complete missions, and get rewarded for doing so. The courses are updated regularly, but some previous and current courses include:

Best Crypto Security Practices

What is KyberSwap?

What is NYM?

What is Tezos?

Robinhood crypto learn and earn

Robinhood is a trading platform that lets investors trade everything from crypto to stocks to exchange-traded funds. It's one of the most popular crypto exchanges in the US and offers a crypto learn and earn program to help investors learn more about crypto while being rewarded for it!

To get your learn and earn rewards from Robinhood, you'll take a quick lesson (usually about a specific token or protocol) and then a quiz. If you pass, you'll get tokens as a reward. Robinhood learn and earn courses change regularly and depending on availability, but previous reward tokens have included popular investments like AVAX.

NFTb learn and earn

NFTb is a multi-chain NFT & DeFi trading platform, letting investors around the world trade and collect NFTs and find DeFi investment opportunities.

NFTb learn and earn lets investors earn free crypto tokens in exchange for learning about projects on NFTb. These courses are regularly updated, but previous courses and courses coming soon include:

LBL

DNL

HIMO

You can also subscribe to get alerts about new lessons via email, making sure you're always first in the queue to earn new tokens before availability runs out.

How is learn and earn crypto taxed?

Learn and earn crypto programs are a fairly new concept - so most tax offices around the world haven’t yet released guidance on them.

However, that doesn’t mean you won’t be taxed - in fact, the current guidance on earning new crypto is fairly clear that in most countries, you’ll pay Income Tax when you earn coins or tokens in exchange for a service or when you receive crypto as a reward. Though you’re not providing a service, many tax offices even consider things like sharing a social media post to earn an airdrop an exchange of services and tax it as income now.

With this view, it is likely that you learn and earn crypto will be seen as additional income and taxed under Income Tax.

Of course, the amount you’ll earn from a learn and earn crypto program is going to be negligible. In most instances, you’ll be earning a couple of dollars worth of a given token per course.

Many countries have an allowance for additional income - so you’ll be able to earn a few hundred dollars in income on top of your regular job income before it’ll be taxed. For example in the UK, you can earn £1,000 in additional income tax free, so you wouldn’t need to report learn and earn crypto Income to HMRC if this was your only additional income.

All this to say, in lots of instances, you may not need to report your learn and earn crypto income. However, if you’ve got other crypto investments that you’re earning income from, it’s still really important you report this to your tax office and pay the relevant taxes.

When you later spend, sell, swap, or gift (in most countries) your learn and earn crypto tokens - any profits will be subject to Capital Gains Tax. This is based on the difference in value between when you acquired the crypto and when you disposed of it.

Let’s take a quick look at how learn and earn crypto might be taxed around the world.

Learn and earn crypto tax in the US

The IRS has no specific guidance on learn and earn crypto tax as of yet. However, considering they view airdrops and even coins from hard forks as a form of income and apply Income Tax - it’s very likely learn and earn crypto would be subject to the same tax treatment.

There is no additional income allowance in the US, so you will need to report it to the IRS - even if it's a very small amount of additional income.

When you spend, sell, or swap crypto in the US - you’ll pay Capital Gains Tax. This includes when you sell, spend, or swap coins from a learn and earn crypto program.

Learn more about US Crypto Tax.

Learn and earn crypto tax in the UK

HMRC has no specific guidance on learn and earn crypto tax. However, airdrops in exchange for a service - for example sharing a social media post - are considered income and subject to Income Tax. With this view in mind - it’s very likely that rewards from learn and earn crypto programs would be subject to Income Tax.

There is, however, an additional income allowance in the UK. This means you can earn up to £1,000 in additional income and it won’t be subject to Income Tax. This is known as the trading and property allowance - but it also applies to miscellaneous income.

Of course, it’s very unlikely you’re going to be earning more than this amount in rewards from learn and earn crypto programs. However, if you have other crypto income - for example from airdrops, mining, or staking - that put you over this allowance threshold, you’ll need to report this to HMRC and pay Income Tax.

When you sell, swap, spend, or gift crypto in the UK - you’ll pay Capital Gains Tax. This includes when you sell, spend, swap, or gift coins from a learn and earn crypto program.

Learn more about UK Crypto Tax.

Learn and earn crypto tax in Australia

The ATO has no specific guidance on learn and earn crypto tax. However, they’re a bit more lax about when crypto is viewed as income than other tax offices. For example, if you’re only mining on a hobby level - the ATO won’t charge you Income Tax on mining, whereas most other countries will. It’s only when you’re operating as a business that the ATO applies Income Tax to mining.

This said, the ATO does consider most airdrops as income and applies Income Tax. So with this mixed view, it’s not entirely clear what the stance on learn and earn crypto rewards may be.

When you sell, swap, spend, or gift crypto in Australia - you’ll pay Capital Gains Tax. This includes when you sell, spend, swap, or gift coins from a learn and earn crypto program.

Learn more about Crypto Tax in Australia.

Learn and earn crypto tax in Canada

The CRA has no specific guidance on learn and earn crypto tax. However, the CRA is only interested in taxing crypto as income if you’re considered to be conducting ‘business-like activities’. They don’t tax hobby mining as income and it is unlikely for them to tax airdrops as income either.

With this view, it’s unlikely the CRA would be interested in applying Income Tax to the small amounts of crypto you can earn from learn and earn crypto programs.

However, when you later sell, spend, swap, or gift your crypto in Canada - you’ll pay Capital Gains Tax. This includes when you sell, spend, swap, or gift coins from a learn and earn crypto program.

Learn more about Crypto Tax in Canada or check out our other country crypto tax guides.

How Koinly can help with crypto income taxes

Koinly crypto tax software helps make crypto taxes simple. All you need to do is sync the various wallets and exchanges you use with Koinly, and Koinly will calculate your capital gains, losses, and crypto income.

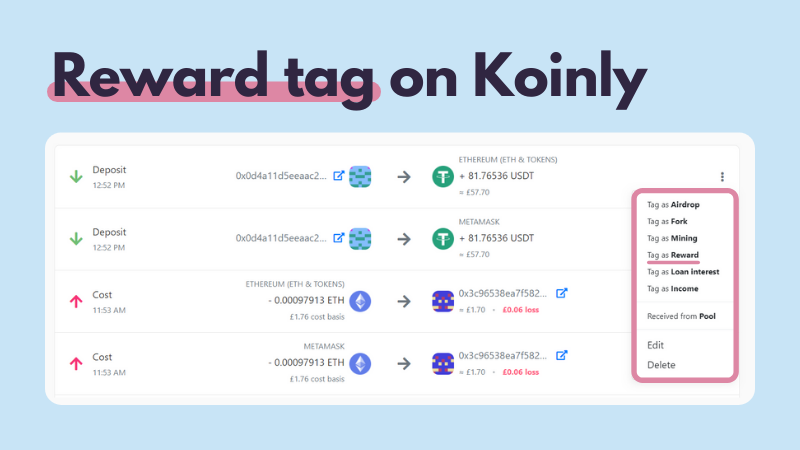

When it comes to learn to earn crypto, these transactions will usually be automatically tagged as rewards. But you can always tag these manually as rewards if not by finding the specific transaction in Koinly and selecting 'tag as reward'.

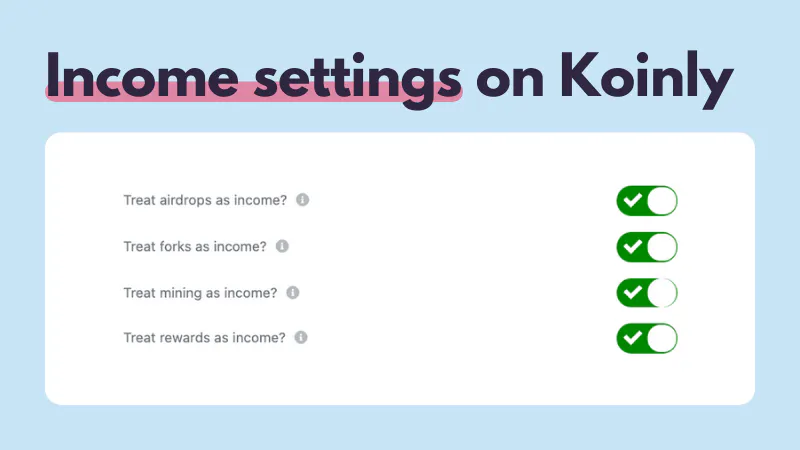

From here, you can choose to treat rewards as income or not based on your country’s crypto tax rules under Koinly settings.

From here, you can choose to treat rewards as income or not based on your country’s crypto tax rules under Koinly settings.

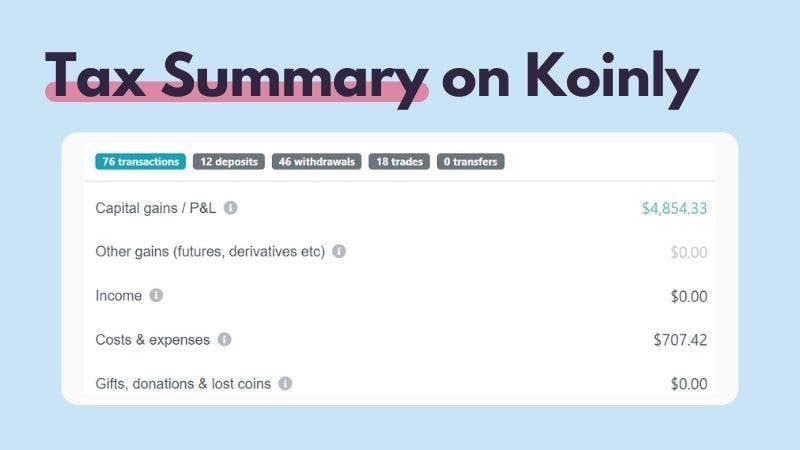

Once you’ve set everything up, just head to the tax reports page in Koinly for a full summary of your crypto taxes including capital gains, capital losses, income, expenses, and more.

Once you’ve set everything up, just head to the tax reports page in Koinly for a full summary of your crypto taxes including capital gains, capital losses, income, expenses, and more.

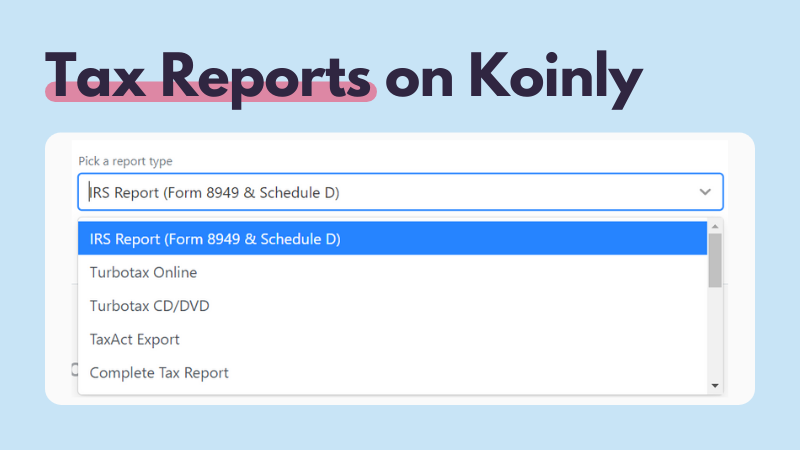

You can then download a tax report based on your specific location. For example, the IRS Form 8949 and Schedule D for US investors, the ATO myTax report for Australian investors, or the HMRC Capital Gains Summary for UK investors.

You can then download a tax report based on your specific location. For example, the IRS Form 8949 and Schedule D for US investors, the ATO myTax report for Australian investors, or the HMRC Capital Gains Summary for UK investors.

Liked this article? You'll enjoy our 15 ways to earn free crypto guide.

Liked this article? You'll enjoy our 15 ways to earn free crypto guide.