Crypto Tax Audit? Here's How to Prepare

Have you received one of the hundreds of thousands of letters the IRS has sent to crypto investors reminding them to report and pay their crypto taxes? You’re not alone if that’s the case. In fact, you might be grateful for the notice in the long run as it gives you time to prepare for a potential crypto tax audit. The IRS has made one thing clear in recent years - they’re cracking down on crypto and IRS crypto audits are on the rise. So if you’re one of the many investors who has received a notice or an audit request, don’t panic. We’ve got everything you need to know about preparing for an IRS crypto tax audit.

Should I be worried about a crypto tax audit?

Even if you’ve not received a nudge letter or a notice of audit from the IRS, you might still be worrying about it. Or conversely, maybe you’re not worrying about it at all - but perhaps you should be.

The IRS has made it clear they’re increasing audits on taxpayers involved in crypto. That much was obvious when they included the question “At any time during 2021, did you receive, sell, exchange or otherwise dispose of any financial interest in any virtual currency?” on the Form 1040 Individual Tax Return for 2020. They've since expanded this question in the draft for the 2022 tax return into a digital assets section that must be completed by all taxpayers in the US. As well as this, the IRS got a huge budget increase ($80 billion!) in order to hire more agents to improve enforcement - including for crypto investors.

But your tax return isn't the only way the IRS will know about your crypto. They’ve also been putting pressure on crypto exchanges operating in the US to share KYC information with John Doe Summons as part of Operation Hidden Treasure.

As well as this, the IRS has just published information on the ‘tax gap’ in 2023. The tax gap is the difference between the amount of tax collected and the amount of tax expected to be collected - and it’s a staggering $688 billion! While this might not seem all too relevant for crypto investors - it is, because the IRS specifically referenced crypto being a factor in the tax gap, and even stated the gap may be wider. All this to say, given the above, the IRS is likely to increase crypto tax audits in 2023 and 2024.

Operation Hidden Treasure & John Doe Summons

Operation Hidden Treasure is an enforcement initiative launched in March 2021 by the IRS to identify tax violations relating to cryptocurrency.

Of course, the appeal of crypto for many is anonymity. This anonymity makes it hard for the IRS to learn about a given taxpayer’s crypto transactions. To get around this, they’ve turned to the legal system.

The IRS has petitioned federal court for what’s known as a John Doe summons. This summons compels crypto exchanges to share user data with the IRS, so it can be used to identify, audit, and prosecute taxpayers avoiding crypto taxes.

The IRS already won a John Doe summons against Coinbase back in 2016, after Coinbase refused to share customer data. Since then, the IRS won a John Doe Summons against both Kraken and Poloniex.

With the successful summons against crypto exchanges so far, the IRS has asked for KYC records on individuals engaging in transactions of $20,000 or more in a financial year. In the case of Coinbase specifically, more than 10,000 letters were sent out to Coinbase users warning they had failed to report additional income and many crypto tax audits arose as a result.

The legal success of these summons suggests that many crypto exchanges operating in the US may face the same summons in the future. To avoid this, many crypto exchanges are attempting to comply with the current non-crypto-specific guidance on financial services reporting requirements and issuing 1099 forms to users. These forms are sent out to US investors with specific transactions, and whenever you receive a copy, the IRS does too.

All this to say, if the IRS wants to know about your crypto transactions - they have many means to do so. They use previous tax returns, your financial records, and any KYC data they have access to to identify you and audit you.

What are the signs that an IRS crypto audit is coming?

The most common way you know an IRS crypto audit is impending is due to a notice from the IRS. The IRS has been sending out these letters since 2019 and there are three different versions - letter 6174, 6174-A and 6173.

Letter 6174 was the initial notice letter sent out to crypto investors, informing them that crypto is subject to taxes and explaining how to report their taxes. These were also known as nudge letters.

Letter 6174-A followed the initial nudge letters. The language changed to include that the IRS may take potential enforcement action. Those who received these letters are likely to face a crypto tax audit should they not seek advice from an accountant to review and report their transactions.

Finally, letter 6173 was sent out to taxpayers the IRS believes to be under-reporting or avoiding their crypto taxes. This letter contains a deadline for the recipient to respond or face charges of perjury. Those who receive this letter should act urgently and respond with a letter detailing how they met their reporting obligations or an amended tax return.

Regardless of which letter you may have received, all recipients of these letters should prepare for a crypto tax audit.

Even if you haven’t received a letter and you’ve not used an exchange that has been summoned by the IRS, the IRS may still audit your crypto investments.

The virtual assets question included in the tax return may be all the IRS requires to want to know more about your investments - especially if your financial records don’t match up with your tax return. If your financial records don’t match up with your reported income, you can bet the IRS is going to be interested in finding out more.

So what exactly does an IRS crypto audit look like?

What does an IRS crypto audit look like?

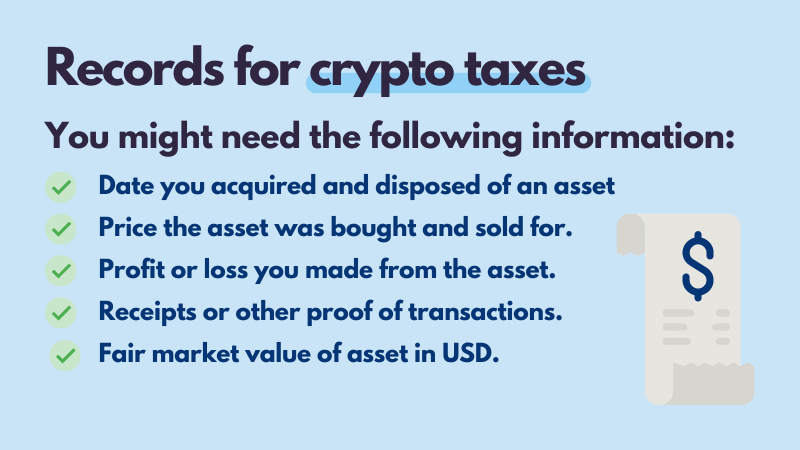

IRS crypto audit requests can vary in regard to the precise questions you’re asked. This said, there are some similarities between all of them. You will be asked to disclose:

All wallet IDs and blockchain addresses

All digital currency exchange accounts and P2P facilitator accounts.

As well as this, for each individual transaction, you’ll need:

The date and time each crypto asset was acquired.

The cost basis and FMV of each crypto asset at the point of acquisition.

The date and time each crypto asset was sold or otherwise disposed of.

The sale price or FMV of each crypto asset at the point of sale or disposal.

An explanation of the cost basis accounting method used for each crypto transaction.

The IRS may also ask further questions and for further information including records of all correspondence with counterparties relating to crypto transactions, for example, emails confirming transactions and so on.

How long does a tax audit take?

This depends on the depth of the audit. If you have fairly simple crypto transactions - for example, you’re only using a few exchanges for basic trades - your crypto tax audit won’t take long.

However, if you have thousands of transactions throughout a financial year, including more complex transactions like liquidity mining, yield farming, staking, and so on - then your crypto tax audit will take much longer.

The audit examiner will review all the documents they’ve initially requested and go through these documents with more experienced crypto experts. From here, they may have more questions if the audit reveals discrepancies in your tax reports.

Once the audit is over, you’ll receive a letter explaining the crypto audit findings with the applicable amount you may owe in taxes. You’ll have 30 days to appeal this decision. However, if the IRS finds you have evaded taxes or you’ve committed tax fraud - you may instead be referred to the Department of Justice for criminal proceedings.

How far back can tax audits go?

According to the IRS, a standard tax audit may include the last three financial years. If they believe there are ‘substantial errors’ - this can be extended to six years. However, if the IRS believes a fraudulent tax return has been filed or if no tax return has been filed - there is no limit on how far back the IRS can audit.

What this means for crypto investors is that you should keep excellent records of your crypto transactions, so you have any information the IRS may request available.

The easiest way to do this is to be prepared with a crypto tax app like Koinly.

How to prepare for an IRS crypto audit

There are actually two ways you can prepare for a crypto tax audit and one is much easier than the other - but we’ll cover both.

Manually create crypto tax records: You’ll need to create a spreadsheet detailing all of your crypto transactions for at least the past three financial years. For each individual transaction, you’ll need the date, time, FMV, cost basis, and more. It’s a lot of work, so we recommend option two.

Use a crypto tax app: If you use a crypto tax app, the app does all of the above for you. All you need to do is sync all the wallets, exchanges or blockchains you use with your chosen crypto tax app using either API or import your transaction history using a CSV file. If you’re using API - in most instances - this will include your complete transaction history with a given wallet or exchange. For CSV file import, you can simply download these from your chosen wallet or exchange and upload the file to your crypto tax app. The app then calculates your cost basis, gains, losses, income, and expenses and generates a Complete Tax Report including each individual transaction with all the information the IRS may wish to see. You can download multiple reports to cover every financial year the IRS is interested in auditing.

How do I avoid a crypto tax audit?

There is no way to ensure you don’t have an unwelcome crypto tax audit, but there are plenty of ways to make it less likely.

First up - accurately report your crypto capital gains, losses, and income. The IRS has made the reporting requirements for crypto very clear. You need to include your crypto capital gains and losses in Form 8949 and Schedule D along with your Form 1040 Tax Return. For crypto income, you need to include this in Schedule 1 along with your Form 1040 Tax Return.

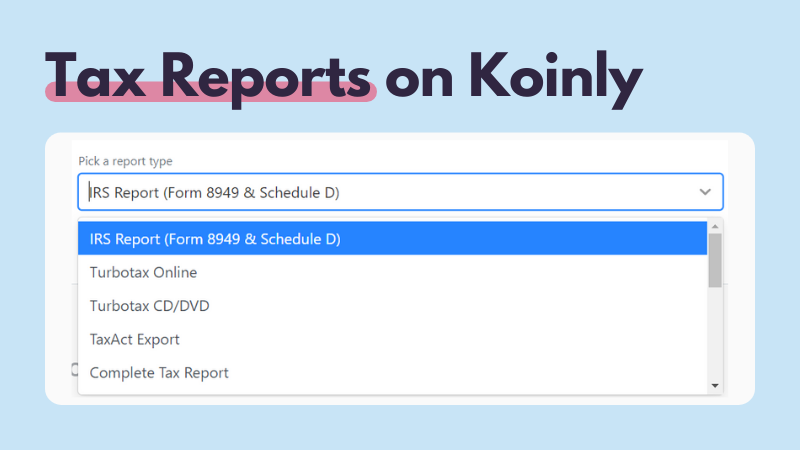

It’s a lot of forms and a lot of math if you’re an active crypto investor - but using a crypto tax app like Koinly makes this simple. Koinly calculates all your crypto taxes for you and generates a pre-filled Form 8949 and Schedule D - saving you hours of spreadsheets and calculations.

You should also ensure if you have any significant rises or falls in income that you include paperwork to explain these with your tax return. The IRS is interested in any change in circumstances in regard to income - the more information you provide, the less likely they are to ask further questions.

When you’re filing your tax return, make sure you check for any mistakes. Regardless of whether you’re calculating your crypto taxes manually or using a crypto tax app - you need to double-check the calculations to ensure you don’t pay too little (or too much!) tax on your crypto.

If you’re mining and registered as a business, you might be tempted to utilize as many business-related deductions as possible. You should utilize tax deductions but don’t overdo it. Unusually large tax deductions are a surefire way to interest the IRS.

Should I speak to an accountant?

Yes - if you're facing a crypto tax audit, you should speak to an accountant.

Crypto tax in the US is complicated and the taxation of many transactions is unclear - particularly newer concepts like DeFi transactions. While a crypto tax app can calculate your capital gains, losses, and income based on current guidance from the IRS - it is not tax advice. If you have been notified of an IRS crypto audit or you suspect you may have an audit, you should seek professional tax advice to ensure you’re compliant.

Make sure you pick an accountant experienced with cryptocurrency - you can use our accountant directory to find crypto accountants in the USA.

Want a simple way to track your crypto taxes?

The best way to be prepared for a crypto tax audit is to track, calculate, and pay your crypto taxes accurately. You can do this easily with Koinly.

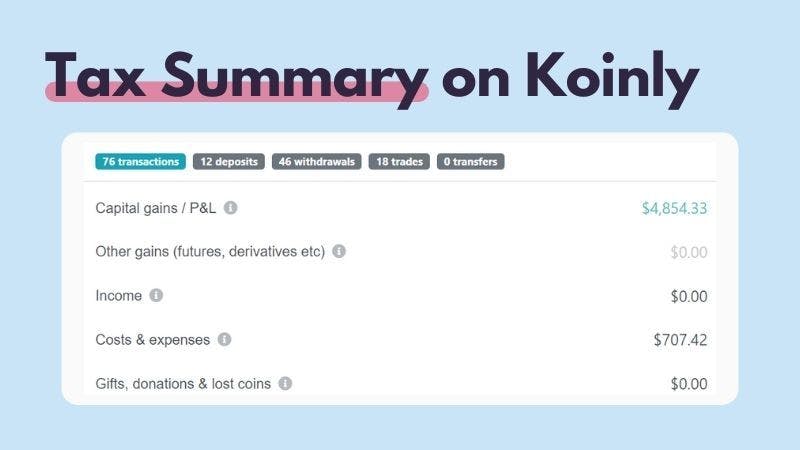

Koinly lets you sync all the crypto wallets, exchanges, or blockchains you use via API integration or through CSV file import. You can include your complete transaction history for each wallet and Koinly will keep track of all your crypto transactions for you including your capital gains, losses, income, and expenses. You can view all of this in your dashboard and your tax summary.

When the tax deadline rolls around, you can simply download the specific tax report you need. For US users, this includes Form 8949 and Schedule D for capital gains and losses and Schedule 1 for income. As well as this, if you’re filing using a tax app - we provide reports for the most popular tax apps including TurboTax and TaxAct.

When the tax deadline rolls around, you can simply download the specific tax report you need. For US users, this includes Form 8949 and Schedule D for capital gains and losses and Schedule 1 for income. As well as this, if you’re filing using a tax app - we provide reports for the most popular tax apps including TurboTax and TaxAct.

If the worst should happen and you face a crypto tax audit from the IRS, you can simply download your Complete Tax Report from Koinly with all the information the IRS may need about all your crypto transactions across each platform you use to trade on.

If the worst should happen and you face a crypto tax audit from the IRS, you can simply download your Complete Tax Report from Koinly with all the information the IRS may need about all your crypto transactions across each platform you use to trade on.