How to Report Crypto on Taxes: Crypto Tax Forms 8949 & Schedule D

Navigate how to report your cryptocurrency on taxes confidently with Koinly's complete guide on crypto tax forms. From IRS Schedule D to Form 8949 to Schedule 1, we've got you covered with the latest requirements and how to generate Form 8949, Schedule D, and other crypto tax forms with Koinly.

The IRS requires American crypto investors to report their cryptocurrency transactions, including gains, losses, and income, by April 15. With the IRS tracking crypto transactions through exchanges and issuing warnings, accurate reporting of your crypto activities is crucial. But exactly which tax forms are needed for crypto? Let's take a look at the crypto tax forms every U.S. crypto trader should know.

Which crypto tax forms?

| Form | Who needs it? | What's included? | View form |

|---|---|---|---|

| Form 8949 | Anyone with capital gains or losses from crypto | Report each disposal of crypto | Form 8949 |

| Schedule D | Anyone with capital gains or losses from crypto | Report your net gain or loss from crypto | Schedule D |

| Schedule C | Self-employed investors earning income from crypto | Report gross income and profit from crypto | Schedule C |

| Schedule 1 (Form 1040) | Anyone with additional income from crypto | Report crypto income in part 1, line 8 | Schedule 1 |

You might not need all of these forms, it all depends on the type of crypto investments and transactions you’ve made. Typically, your crypto capital gains and losses are reported using IRS Form 8949, Schedule D, and Form 1040. Your crypto income is reported using Schedule 1 (Form 1040) or Schedule C if you're self-employed.

Let's break down each form step-by-step.

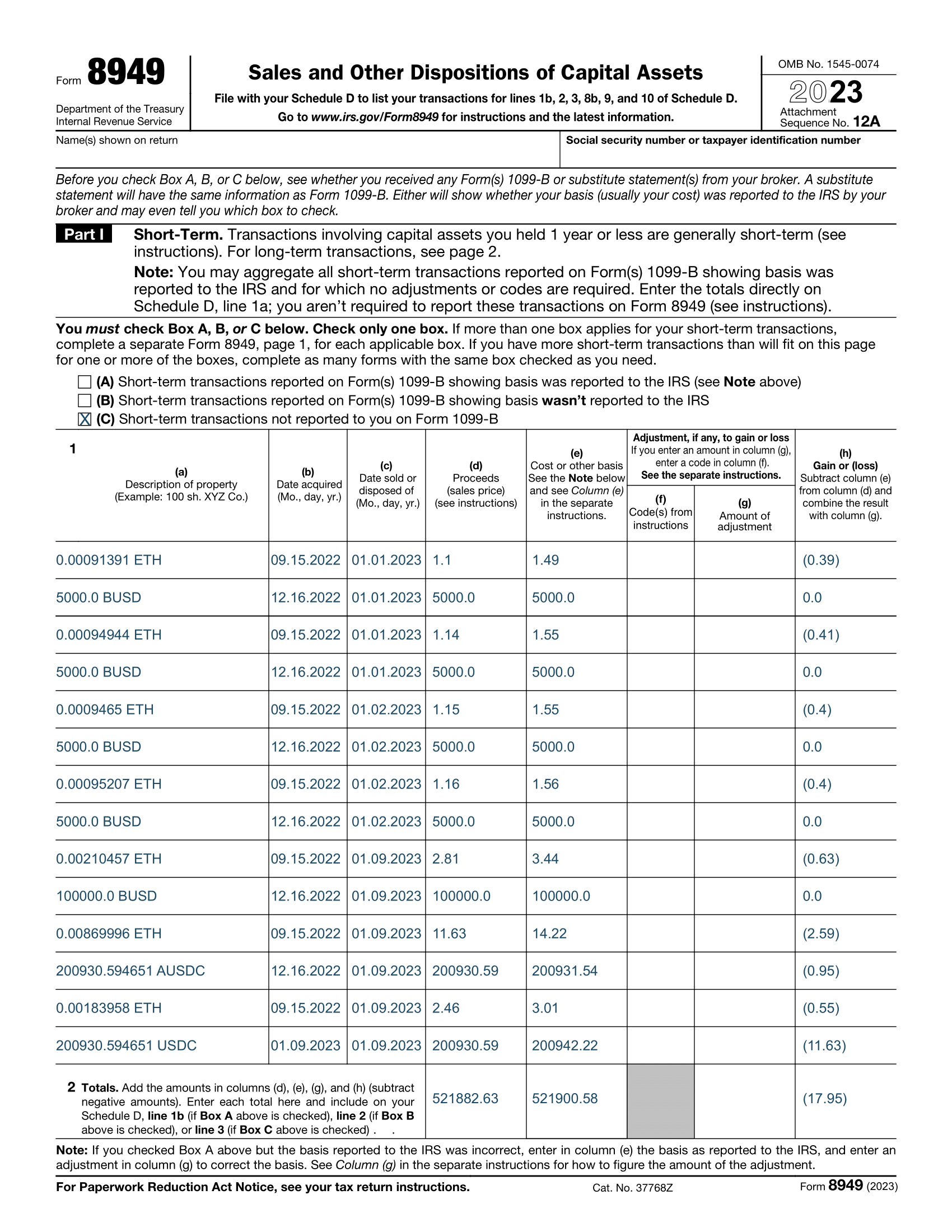

Form 8949 example for crypto short and long-term capital gains

Do you need to report crypto gains in your upcoming federal tax return? IRS Form 8949 is a supplementary form for the 1040 Schedule D. This form is used to report any disposals of capital assets - in this instance, cryptocurrency.

So anytime you’ve ‘disposed’ of crypto by selling it, swapping it, or spending it - you’ll include it on this form. For each disposal, you’ll need the following information:

A description of the asset - for example, 0.5 BTC.

The date you acquired the asset - for example, 15th May 2022.

The date you disposed of the asset - for example, 20th August 2022.

The sale price at fair market value - for example, $30,000.

The cost basis of the asset at fair market value - for example, $20,000 + $50 in transaction fees.

You shouldn’t need this column.

You shouldn’t need this column.

Your capital gain or loss - for example, $9,950.

The second part is your long-term disposals. This applies to any asset you’ve held for more than a year before disposing of it. These are taxed at a much lower rate than short-term disposals. You can find out more about long and short-term crypto tax rates in our US Crypto Tax Rate 2024 Guide.

For both sections, you’ll need to fill out your total gains at the bottom of the page. You'll need to calculate your:

Total proceeds

Total cost basis

Total gain or loss

For part 1 (short-term), check box A, B, or C as it applies to you.

Once you’ve completed Form 8949, you can move on to the next form - Schedule D (Form 1040).

Form 8949 example filled out

What if I have too many transactions on Form 8949?

Some crypto investors end up with thousands of transactions in a given financial year depending on their level of investment activity, and some filing platforms have a limit on the maximum number of transactions supported. Fortunately, the IRS allows for a consolidated summary for short-term gains/losses and another for long-term gains/losses in these instances. If you do this, you’ll need to attach a statement that provides a detailed breakdown alongside your consolidated summary. Koinly can provide both a complete and consolidated summary of Form 8949 for investors.

Schedule D for crypto net capital gains

Schedule D (Form 1040) is the form you’ll report your net capital gain or loss from all investments. This includes your crypto activity, as well as any gains or losses from businesses, estates, and trusts.

Like Form 8949, Schedule D is split into three sections - for your short-term capital gains and losses, your long-term capital gains and losses, and a summary.

For part 1 (short-term capital gains and losses), fill out either line 1a, 1b, 2, or 3. Refer back to the box you checked in Form 8949.

Then you'll need to fill out column D, E, and H:

d) Total proceeds

e) Total cost basis

h) Total gain or loss.

Once you’ve done this, head to line 7 - net short-term capital gain or loss. Report your net capital gain or loss from all investments here.

For part 2 (long-term capital gains and losses), fill out either line 8a, 8b, 9, or 10. Refer back to the box you checked in Form 8949.

You'll need to fill out column D, E, and H:

d) Total proceeds

e) Total cost basis

h) Total gain or loss

Once you’ve filled out this, go to line 15 to report your long-term net capital gain or loss.

Now head to Part 3 (Summary).

On line 16 - combine line 7 and line 15 and enter the result.

If you have a net capital gain: You'll also need to fill out lines 17 through 20.

If you have a net capital loss: Skip ahead to line 21.

In either instance, you'll need to report these figures on line 7 of Form 1040 (more on how to fill this out below).

Remember, you can only offset a maximum $3,000 net capital loss against your personal income or capital gains.

Schedule 1 for crypto income

Not all of your crypto investments will be viewed as a capital gain or loss. In some instances, your crypto investments will be seen as a kind of income - just like a salary or a bonus. You can see how different crypto investments are viewed by the IRS in our US Crypto Tax Guide.

The form you use to report your crypto income will be either:

Schedule 1 (Form 1040)

Schedule C (Form 1040)

You may or may not need all of these forms. It all depends on the type of crypto transactions you’ve made. We’ll look at each form in turn.

IRS Schedule 1 (Form 1040)

If you’ve earned crypto from airdrops, forks, bonuses, or crypto hobby income - you’ll generally report this on Schedule 1 (Form 1040) as ‘other income’.

You’ll find this in part 1, line 8.

IRS Schedule C (Form 1040)

If you’re self-employed and earn income through crypto, you should use Schedule C (Form 1040) to report your crypto income. Even if you have a regular job, you might be considered self-employed if you were running a crypto mining operation or other activities at a similar scale.

If your crypto income activities do amount to that of a self-employed taxpayer, you’ll need to fill out Schedule C (Form 1040), as well as pay self-employment taxes. These taxes account for Medicare and Social Security taxes usually accounted for in employee paychecks.

You’ll report your gross income and profit in part 1 of Schedule C.

If you’re seen to be running a business, you can also deduct any expenses related to the business (like mining equipment) in line 30, part 2 of Schedule C.

How to report virtual currency on your individual tax return (Form 1040)

Last, but by no means least, is Form 1040. This is your Individual Income Tax Return Form.

You’ll need to add all of the forms you’ve completed to your Form 1040.

Then on your Form 1040, you'll need to fill out the following lines as they relate to your previous forms.

On line 7 - report your net capital gain or loss from Schedule D.

On line 8 - report your other income from Schedule 1.

US taxpayers need to attach all these forms to their Individual Income Tax Return Schedule 1 (Form 1040) by April 15.

How to calculate your crypto tax

Before you can report your crypto tax to the IRS, you need to calculate your crypto totals. This means you’ll need to calculate your:

Capital losses from crypto

Any expenses relating to your investments

As you can see, reporting your crypto taxes to the IRS can be time-consuming. For investors with many disposals, filling out Form 8949 alone is a huge amount of work. But Koinly can help.

How to report crypto on your tax return with Koinly

If you’re using crypto tax software like Koinly then calculating your crypto tax liability is a breeze because Koinly is a Form 8949 (and Schedule D) generator for crypto, that can also help you report any crypto income as well.

All you need to do is import your crypto transaction history from your various wallets, exchanges, or blockchains using API or CSV files. Koinly will then calculate your capital gains, losses, income, and expenses. Once it’s worked its magic, you can just head to the tax report page in your Koinly account where you’ll find a simple summary of your crypto taxes.

For US investors using a third-party service to file their tax report Koinly can also generate specific reports for TurboTax and TaxAct reports - you just upload our report to your chosen tax app.