Crypto Bear Market Strategies

More than $300 billion has been wiped from the crypto market in the first month of 2022, leading many crypto investors to believe a crypto bear market is coming. The Fear and Greed Index suggests sentiment is low, with the majority experiencing extreme fear over market conditions. For seasoned investors - a crypto bear market is nothing new. There are plenty of strategies you can use to get through it relatively unscathed if you play your cards right. In fact, you can even use a bear market to your advantage when it comes to your crypto taxes. We’re looking at everything you need to know about a crypto bear market including some common FAQs, whether we’re in one, crypto bear market strategies, and tax loss harvesting.

What is a crypto bear market?

Each crypto investor will have their own opinion on what precisely a crypto bear market is. In traditional bear markets, a broad definition is any time market prices fall more than 20% from a previous high.

However, as the crypto market is no stranger to historical highs and lows on any given day - this definition isn’t as helpful. So a crypto bear market is better defined as a prolonged period of time (around 3 months) where market confidence is low, prices are falling and supply is greater than demand.

Are we in a crypto bear market in 2023?

While much of 2022 was undeniably a bear market for crypto, whether that continues into 2023 remains to be seen. We could see a continuation of the bear market - or crypto winter, depending on who you ask, or we could see some steady recovery and even a return to a bull run in 2023. In other words, watch this space. Demand may soon increase, balancing out supply and stabilizing prices or investors may continue to sell pushing the price lower.

Why do crypto bear markets happen?

It’s important to remember - even if we do enter a bear market - that bear market are as natural as bull markets. They’re a consequence of several different factors working in combination. These include:

Investors taking on too much leverage: The BTC leverage ratio hit all-time highs in January according to crypto data firm CryptoQuant. This means investors took on more risk - using debt to finance futures products. High amounts of leverage create further volatility in the market.

Lack of liquidity: Intrinsically linked to the above - when leveraged investors liquidate their assets, the overall liquidity of the market is affected. Furthermore, if a whale sells, the market is flooded with more supply than demand, pushing prices lower.

New crypto regulations: Big changes in crypto regulations cause an upset in the market. Think back to when China banned crypto mining in 2021. US investors are currently facing similar concerns over the potential new powers the US government may have over crypto investments.

Stock market trends: Crypto is often viewed as an uncorrelated asset. But in reality, crypto markets are intertwined with traditional markets. In other words, it’s common practice for investors to be involved in both the crypto market and more traditional markets like the stock market. This means changes to the stock market - like impending inflation currently - have an impact on the crypto market as portfolios diversify.

Crypto influencers: Elon Musk is the best example of a crypto influencer creating havoc in the market whenever he tweets. Fortunately, his opinion seems to be holding less value in the crypto space these days. But other celebrities - like Kim Kardashian and Floyd Mayweather - shilling shitcoins and outright scams are causing equal havoc for new investors.

Crypto security breaches: Whenever a large exchange is hacked or a blockchain security flaw is revealed, many investors panic and either move funds or sell. This puts further strain on the market, creating more volatility and investor uncertainty.

How long does a crypto bear market last?

It’s impossible to predict how long a bear market will last in a newer market. But we can look at the performance of popular cryptocurrencies in previous bear markets as an indicator.

On average it takes BTC around 1,000 days to recover from the drops we’ve seen recently. However, we also need to bear in mind the bigger picture. Though BTC is down from historic highs, it’s still up by around $10,000 from the beginning of the 2021 financial year. In other words, for long-term investors, the market isn’t quite as bleak as it might seem at a glance.

Crypto bear market strategies

Your first crypto bear market can be stomach-churning, especially if you’ve bought at some of the historic highs during the recent bull market. But for seasoned investors, it’s all part of the ride. For many experienced investors, a crypto bear market presents unique opportunities and benefits for their long-term strategy - including tax benefits. Let’s go through some of the most popular crypto bear market strategies.

Buy the dip

You’ve probably heard investors crying "buy the dip". It’s the most beloved strategy for a bear market.

Many investors hold back a reserve of stablecoins or fiat currency for the sole purpose of buying crypto assets while the price is down. It simply refers to the practice of buying a given amount of cryptocurrency when the market is sufficiently bearish.

This means when the prices return back to previous highs - or new highs - those who bought at the dip reap the rewards.

It’s not a strategy unique to the crypto market either. Stock trading icon Warren Buffet famously said, “when there’s blood on the streets, you buy.”

But use dollar-cost averaging

You can buy the dip in a single trade - like using all your funds to invest in a particular cryptocurrency. But the safer way to do this is to use dollar-cost averaging (DCA). This strategy involves separating your reserved capital into smaller sections and making several trades over the length of a bear market.

So for example, say you held 1000 USDT and you wanted to buy ETH while it was low. A strong DCA strategy would split this fund into five different sections of 200 USDT and invest in different dips of ETH. This increases the likelihood of you buying at the bottom of the dip - where the cryptocurrency has reached its lowest price before it starts climbing again.

Dollar-cost averaging generally gives much better results than if you buy early in a dip before the price has bottomed out unless you were lucky enough to go all in at the perfect point in time!

Diversify your crypto portfolio

We know in the example above we looked at just buying Ether, but the reality is the more diverse your portfolio, the lower your risk during a bear market. Different cryptocurrencies will see both larger and smaller drops. For example, while BTC and ETH dropped 40% over the last 90 days, LUNA and AVAX saw a humble rise.

This doesn’t mean go out and invest in every shitcoin you can find. It means don’t put all your eggs in one blockchain. There are more than 17,000 cryptocurrencies to pick from - not all of them will be winners, but not all of them will be losers either.

Don’t randomly invest. Use the following indicators of performance:

Previous all-time high: not guaranteed to hit this again, but it can give you an idea of the potential.

Past performance: previous performance doesn’t guarantee future performance, but it can give you a rough idea of potential in a bull market.

Roadmaps: crypto assets often see significant price rises after the arrival of a major update, like a mainnet launch.

Understand and utilize technical indicators

Technical indicators give you an idea of the performance of an asset, or indeed the wider market, based on statistical analytics. They can help you figure out the best point to both buy and sell. There are a lot of crypto technical indicators available - but some of the most popular include:

Bitcoin dominance: a measure of Bitcoin's market capitalization relative to the whole crypto market cap. Bitcoin still currently makes or breaks the crypto market as other coins follow Bitcoin trends. But during the more recent bull market - Bitcoin dominance went down as other altcoins saw huge increases in popularity. So if the total market cap is growing while Bitcoin dominance is decreasing, this can be a good indicator of better market performance.

Moving average: A moving average is the average price of a specific crypto over a period of time - most often 200, 50, or 20 days. If the price is above a long-term moving average, this indicates an upward trend. If the price is below a long-term moving average, it indicates a downward trend.

Relative strength index: RSI indicates whether a given asset is overbought or oversold - which indicates a bullish or bearish trend. Crypto is overbought if the RSI is around 70% and underbought if the RSI Is under 30%.

Stake crypto

Dwindling gains aren’t ideal for any crypto portfolio. But if you’ve got a long-term strategy to hold, you can cushion decreasing prices by staking your crypto so you earn on it.

You’ll lock your crypto into a given blockchain for a certain amount of time to generate passive income - letting you earn regardless of value. Even with the potential bear market looming, many exchanges and DeFi protocols are still offering excellent APYs for staking.

There is, of course, risk in staking too if the underlying asset is not growing in value. But even in these instances, you’ll still increase your overall assets by staking. Your best way to reduce risk is to opt for a shorter-term staking period, pick a platform where staking rewards are paid out regularly, and avoid anything that sounds too good to be true.

Consider derivatives

We’ll preface this by saying anyone who doesn’t fully understand the risks that come with derivatives and margin trading shouldn't be considering this option. First, go do your research, then contemplate whether the benefits outweigh the risks for your unique circumstances.

This said, derivatives allow many experienced investors to minimize their risk and make money even in a bear market. The most common products are futures and options and they work in a similar fashion. An investor borrows an asset - like ETH - and anticipates selling it before a given date at either a higher or lower price. They can help reduce individual risk as if the close of the position would be a loss, you simply choose not to execute it. You’ll lose a relatively small amount for purchasing the product, but protect yourself from a larger loss.

Similarly, margin trading can help experienced investors profit in a bear market by shorting - where you bet on the price of an asset decreasing. Like with derivatives, margin trading is not without its risks.

Read more in our margin trading guide.

Harvest your losses while you can

Crypto losses aren’t all bad news as you can use them to reduce your tax bill. In the US, there’s no limit on how many investment losses you can offset against your capital gains and you can carry forward any losses you don’t use indefinitely. You can even offset up to $3,000 of investment losses against income to further reduce your tax bill.

In even better news for US investors, the wash sale rule doesn’t apply to crypto (yet!). This is because crypto is classed as a property, and the wash sale rule only applies to securities. So you can sell your crypto at a loss to harvest the capital loss and reduce your tax bill and then buy it back at a lower price point.

So if you harvest your losses now, you can use these to offset any gains for the 2022 financial year when the market eventually recovers - potentially saving you thousands of dollars in Capital Gains Tax for the 2023 tax deadline.

Read more in our tax loss harvesting guide.

Keep calm and hodl

A crypto bear market is bleak - especially for new investors. But if you’ve bought at a peak during a bull market, one of the worst things you can do is panic sell.

Bull and bear markets are normal. Having a concrete plan to deal with both is the best way to manage your crypto portfolio. Just like investors get too greedy in a bull market and overleverage themselves creating losses, panicking at the thought of a bear market will end in the same result.

Come up with a long-term strategy, never invest more than you’re willing to lose, and don’t go down the rabbit hole scouring different exchanges at all hours of the day to check performance. A simple crypto portfolio tracker like Koinly can help you manage all your assets from one spot, as well as help you identify unrealized gain and loss opportunities.

Track crypto performance and taxes with Koinly

Koinly works as both a crypto portfolio tracker and a crypto tax calculator - letting you track all of your crypto investments from one platform, as well as easily calculate any crypto taxes.

All you need to do is sync all the crypto wallets and exchanges (or blockchains!) you use with Koinly via API or by importing a CSV file of your transaction history. Koinly supports more than 400 exchanges, 50 wallets, 6,000 cryptocurrencies, and many other crypto services.

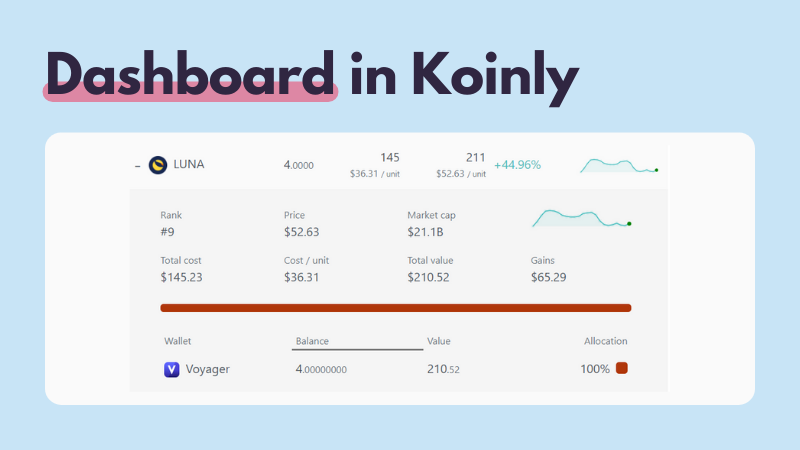

Once you’ve synced the wallets you use, you can view your crypto portfolio performance from your Koinly dashboard. This includes your total value, cost basis, and unrealized gains or losses.

You can even track individual asset performance in Koinly like so:

You can even track individual asset performance in Koinly like so:

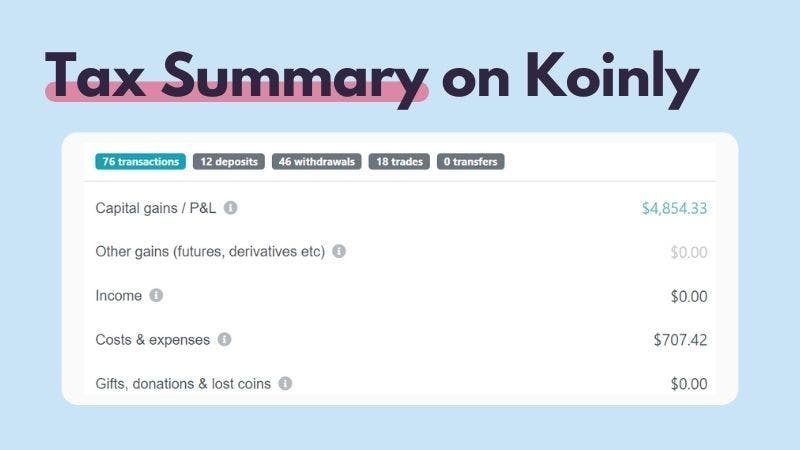

When it comes to tax time - the news is even better. Koinly calculates your capital gains, losses, income, expenses, and more. You can see all this on the tax summary page and download a pre-filled tax report for your location to make filing your crypto taxes a breeze.

When it comes to tax time - the news is even better. Koinly calculates your capital gains, losses, income, expenses, and more. You can see all this on the tax summary page and download a pre-filled tax report for your location to make filing your crypto taxes a breeze.

We support a variety of tax reports from around the world including the IRS Form 8949 and Schedule D, the ATO myTax report, and HMRC Capital Gains Summary.