What is a Multi-Signature Wallet?

Crypto thefts are a painfully common occurrence - with an estimated $1.9 billion stolen in 2021 alone. Many crypto investors - especially those holding high-value crypto like Bitcoin or Ether - want a means to keep their crypto safer and multi-signature wallets do just that. We’re looking at what multisig wallets are, how multisig wallets work, the pros and cons of multisig wallets, popular multisig wallets, and the tax implications of using multisig wallets.

What is a multi-signature wallet?

The name should be a dead giveaway. Multi-signature wallets (or multisig wallets) are crypto wallets that require two or more private keys to sign and confirm a transaction. There are many reasons someone might use a multi-sig wallet, including:

Enhanced security.

Control access to joint funds.

For escrow transactions.

The amount of signatures depends on the multisig wallet you’re using. Most multisig wallets let you choose the amount of signatures you’d like to confirm a transaction.

Often multisig wallets are shared wallets, for those involved in group investments or those in business together. Co-owners and signatories who share a multi-sig wallet are also known as co-payers. Often, the number of signatures for a given multisig wallet will reflect the number of co-payers.

How do multisig wallets work?

Let’s say you want to leave money in a bank vault. You’re unlikely to leave it with a bank where the vault has only one key or where only one person holds that key. What if the key is lost or stolen? Your money will be gone.

It’s a simple analogy, but it works. Think of a multisig wallet as a secure bank vault - there’s more than one key required to open it and you can choose how many people can access it.

When you want to make a transaction - like transferring crypto out of your multisig wallet to a hot wallet - you’ll need to get each signature to do so.

If you’re sharing a wallet with other co-payers, most multisig wallets let every co-payer have access to oversee the funds and transactions related to the wallet.

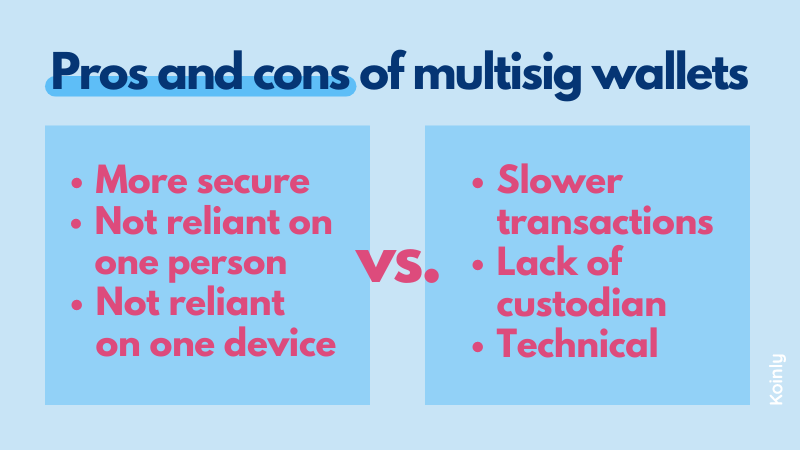

Pros and cons of multisig wallets

There’s good news and bad news when it comes to multisig wallets. The most obvious pro is the increased security compared to single-key wallets. It’s much harder for hackers to get hold of several keys than it is of one. But the benefits of multisig wallets extend beyond this.

Multisig wallets also reduce dependency on one person. The best example of this is QuadrigaCX. The founder, Gerald Cotten, died unexpectedly in 2018. Cotten was the only person who held the private keys for the QuadrigaCX exchange wallet - which held $190 million in investor funds. Investigations are on-going and funds have yet to be returned. Had a multisig wallet been used with several co-payers across the company, this situation could have been entirely avoided.

Just like multisig wallets reduce the dependency on one person - they also reduce the dependency on one device. We all know to keep our private keys secure, but if you’ve stored your private key on a desktop and it breaks, you may have lost it forever. Whereas you can store multisig keys across several different devices to reduce the dependency on just one.

Of course, multisig wallets have disadvantages too. Setting up a multisig wallet initially required quite a bit of technical knowledge, although with more multisig providers this is less of a problem now.

Because of the amount of signatures required, transactions can be slow. Multisig depends on other devices or another party to sign the transaction. As most people are using multisig wallets to hold high-value crypto, this often isn’t an immediate problem. But if you want to make transactions using a multisig wallet regularly, it can become frustrating.

Perhaps the biggest disadvantage of multisig wallets is the lack of a custodian. Let’s go back to the bank analogy. If you have a joint account with another person who takes all of the funds out of the account unexpectedly, you have legal recourse. The bank is the custodian of the funds. Multisig wallets are a new concept and, like the rest of the crypto market, unregulated. If co-payers act unethically or illegally, getting legal help may prove difficult.

Popular multisig wallets

If you’re thinking of using a multisig wallet - it’s good to know which multisig wallets are the most trusted and secure. Some of the most popular multisig wallets include:

Electrum

Electrum was founded back in crypto’s infancy in 2011, so it’s one of the oldest and most trusted multisig wallets available.

Electrum is a Bitcoin-only wallet. It’s open-source, free to use, and has come a long way since its early days. You used to need quite a lot of technical knowledge to know how to use Electrum, but now it exists as a lightweight desktop wallet for Bitcoin, with increased security compared to non-multisig wallets.

BitGo

BitGo is a desktop, mobile, and web wallet that supports multisig features. It’s ideal for those wanting to securely store Bitcoin with no other involved parties.

BitGo protects users from a single point of failure by offering a client key, a host key, and a backup key. The client key is the key you’ll use to initiate and sign transactions from your end. The host key is a key BitGo holds to sign off transactions once the client has signed them off and they meet BitGo policies. Finally, the backup key is stored offline by the client for recovery purposes.

Armory

Armory is actually a full-node Bitcoin wallet client - that offers multisig wallet addresses. You can have up to 7 keys, making Armory a popular choice for companies predominantly dealing with Bitcoin.

Like Electrum, it’s free, open source and you can only hold Bitcoin in it. Armory offers other features that will please Bitcoin miners like Replaced By Fee (RBF) and Child Pays For Parent (CPFP).

How are multisig wallets taxed?

Multisig wallets themselves aren’t taxed. It’s the transactions you make related to your multisig wallet that may trigger a taxable event. Let’s break it down.

Crypto taxation varies depending on where you live (so you should check out your country’s specific crypto rules). This said, in general - tax offices have taken a fairly uniform approach to crypto taxes. Crypto is subject to either Income Tax or Capital Gains Tax - depending on the specific transaction.

Capital Gains Tax applies whenever you dispose of your crypto by selling it, spending it, trading it for another crypto, or gifting it (in most countries). This is because crypto is seen as a capital asset. So when you dispose of a capital asset, you make a capital gain or loss. If you have a capital gain from disposing of crypto, you’ll pay Capital Gains Tax on that profit.

Meanwhile, Income Tax applies when you ‘earn’ crypto - like regular income. Tax offices differ a lot more in when they consider crypto to be income, but generally speaking, you’ll pay Income Tax on crypto when you:

But not all crypto transactions are taxed in most countries. It’s only when you’re seen to be making an income or you dispose of a crypto asset that you’ll pay tax. So tax free crypto transactions include:

Buying crypto with fiat currency - like USD or AUD.

Holding crypto.

Transferring crypto between wallets.

In many countries, donating crypto to a registered charity, as well as gifting crypto is tax free too. You can see our crypto tax country guides to learn more about the rules in your country.

So as you can see from the above - it isn’t the wallet that matters when it comes to crypto tax, it’s the specific kind of transaction.

As most people are using multisig wallets to store and hodl crypto, in a lot of instances you’re not going to be paying tax related to your multisig wallet.

As most people are using multisig wallets to store and hodl crypto, in a lot of instances you’re not going to be paying tax related to your multisig wallet.

However, in some instances, you can use multisig wallets to both buy and sell crypto so let’s break down each transaction and the subsequent tax.

Buying crypto with crypto from a multisig wallet: Capital Gains Tax (trading crypto).

Selling crypto held in a multisig wallet: Capital Gains Tax.

Spending crypto held in a multisig wallet: Capital Gains Tax.

Gifting crypto held in a multisig wallet: Capital Gains Tax depending on location.

Transferring crypto to/from a multisig wallet: Tax free - though transfer fees may not be.

Holding crypto in a multisig wallet: Tax free.

Remember, if you’re transferring crypto income - like from staking, mining or interest - into a multisig wallet, you’ll need to pay Income Tax on this crypto in most countries.

Koinly keeps crypto tax simple

As you can see from the above, crypto tax is a pain. Especially as the reality for most crypto investors isn’t that they’re using one wallet for all their transactions. More likely, crypto is spread across several different wallets, exchanges, and blockchains. Figuring out the taxable transactions you’ve made across these various platforms can take days.

But if you use a crypto tax app like Koinly - you can get your crypto taxes done in no time at all. All you need to do is sync the crypto wallets, exchanges or blockchains you use with Koinly using API, or import your transaction history using CSV files. Once Koinly has your transaction data, it identifies each taxable transaction and calculates your capital gains, capital losses, income, and any expenses. All this information is available in a simple tax summary. You can then download a tax report specific to your country - for example, IRS Form 8949 and Schedule D or the ATO myTax report - ready to hand over to your tax office.

When it comes to multisig wallets, Koinly integrates with many popular multisig wallets like Electrum, BitGo, and Armory (and plenty more!) using CSV file import.