What is Crypto Interest & How is it Taxed?

Earning interest is a great way to put idle crypto assets to good use, but it has big implications for your tax bill. Learn more in our crypto interest tax guide.

HODLing for the moon is a common strategy in crypto - but what if you could do more with your idle assets?

Both centralized and decentralized crypto exchanges and other DeFi apps offer a variety of opportunities for crypto investors to earn interest on their held assets.

We’re looking at what crypto interest is, how you can earn interest on your crypto, and what it means for you come tax time.

What is crypto interest?

Just like you could deposit fiat currency into a savings account with a bank and earn interest - and even compound interest - you can do the same with your crypto.

The key difference is that in most instances, instead of earning interest in fiat currency - you’ll earn it in cryptocurrency. In some instances, this will be the same currency as the asset you’ve deposited into a given account. In other instances, it will be in a different cryptocurrency, like a stablecoin or a liquidity pool token.

You can either hold these interest earnings and further invest them or you can sell them for fiat currency when you receive them.

From the other end of the perspective - you’ll also pay interest, often in crypto, whenever you take out a crypto loan. You can find out more about the tax implications of crypto lending in our guide.

How can you earn interest on crypto?

Centralized exchanges have offered ways for crypto investors to earn interest for some time now. For example, you can:

Earn interest by lending your crypto - like on Binance.

Open a crypto interest account - like on BlockFi.

Open a crypto savings account - like on Coinbase.

These various options offered great interest rates - often much higher than you’d see from traditional financial institutions like a bank.

But crypto investors are always looking for the biggest gains - which is where crypto DeFi comes in. DeFi has been revolutionizing the crypto space, offering new ways for investors to earn interest on idle assets. Some examples include:

Adding assets to liquidity pools on DeFi lending apps - like Aave.

Adding assets to liquidity pools on DeFi exchanges - like Curve.

Staking assets in yield farming protocols - like Yearn.

Because they don’t have the overhead costs centralized exchanges face - and because they don’t have to follow regulations - DeFi apps are often offering much higher interest rates. Yield farmers (investors who chase the highest gains on DeFi apps) are seeing returns of up to 20% APY (annual percentage yield) by combining several DeFi protocols and reaping the rewards in compound interest. This kind of return is practically unheard of in traditional financial markets.

Because they don’t have the overhead costs centralized exchanges face - and because they don’t have to follow regulations - DeFi apps are often offering much higher interest rates. Yield farmers (investors who chase the highest gains on DeFi apps) are seeing returns of up to 20% APY (annual percentage yield) by combining several DeFi protocols and reaping the rewards in compound interest. This kind of return is practically unheard of in traditional financial markets.

As well as this, crypto DeFi is constantly evolving and creating new opportunities and means for crypto investors to make passive income. In other words, watch this space.

Suffice it to say, it has investors excited, but when the gains are this big so are the tax implications.

How is crypto interest taxed?

From a tax perspective, crypto is seen in one of two ways - either as income or as a capital gain.

When it comes to crypto interest, in most instances, tax offices are going to see this as a type of income - similar to a dividend or a bonus - and apply Income Tax. This would be the case when you’re earning new coins or tokens due to an interest-bearing protocol or service. To calculate what you’ve earned and your subsequent taxes, you simply use the fair market value (FMV) of the crypto asset on the day you received it and report this as additional/miscellaneous income in your annual tax return.

When it comes to crypto interest, in most instances, tax offices are going to see this as a type of income - similar to a dividend or a bonus - and apply Income Tax. This would be the case when you’re earning new coins or tokens due to an interest-bearing protocol or service. To calculate what you’ve earned and your subsequent taxes, you simply use the fair market value (FMV) of the crypto asset on the day you received it and report this as additional/miscellaneous income in your annual tax return.

While crypto interest is subject to Income Tax, when you later ‘dispose’ of it by selling it, swapping it, spending it, or gifting it - any profit from this will also be subject to Capital Gains Tax. This is because crypto is seen as an asset - like a stock - and whenever you make a disposal of an asset, it’s viewed as a capital gain or loss from a tax perspective. Let’s look at an example.

EXAMPLE

You deposit 1 BTC into a crypto interest account, offering 9% APY and leave it there for a year. Let’s say BTC holds firm at around $60,000 for the whole year to keep things simple.

You earn 0.09 in BTC in interest throughout the year - so a total of $5,400.

You’d report $5,400 of additional income to your tax office. This would be taxed at your normal Income Tax rate.

The price of BTC rises, so you later sell your 0.09 BTC for $6,000. You use the FMV of your asset on the day you received it as your cost base. Then subtract your cost base from the price you sold the asset for to figure out your capital gain.

$6,000 - $5,400 = $600. You’ve made a capital gain of $600 and you’d pay Capital Gains Tax on this.

To make matters more complicated, you’ll only be ‘earning’ crypto when you’re seen to be earning new coins or tokens. This matters because most DeFi apps have changed the way you ‘earn’ through liquidity pools.

Instead of earning new tokens, when you add your capital to a liquidity pool, you'll receive liquidity pool tokens (LP tokens) in return. Instead of paying out new tokens, these LP tokens then accrue value - so the value of your tokens increases based on the rewards you're getting from your capital being in the pool.

In these instances, you might not be seen to be earning an income. After all, you’re not getting any new tokens or coins. Instead, you may have triggered a Capital Gains Tax event when you added and removed your tokens, exchanging them for LP tokens. This could be viewed as more akin to a crypto to crypto swap, which in most countries is subject to Capital Gains Tax, not Income Tax.

You should speak to an experienced accountant for more advice on how to report these transactions to your tax authority. You can also look for more specific advice on DeFi taxes in your country in our crypto tax guides.

How Koinly calculates interest and crypto taxes

Koinly makes crypto taxes simple, including any crypto interest taxes. All you need to do is import your crypto transactions, including any transactions relating to crypto interest. We support a huge variety of centralized exchanges, wallets, and blockchains to make this easy for our users.

Koinly will automatically identify your different transactions and tag them accordingly. So for example, if you import your BlockFi history - this should include your interest transaction history. Koinly will then automatically tag this as income and include it in your tax summary.

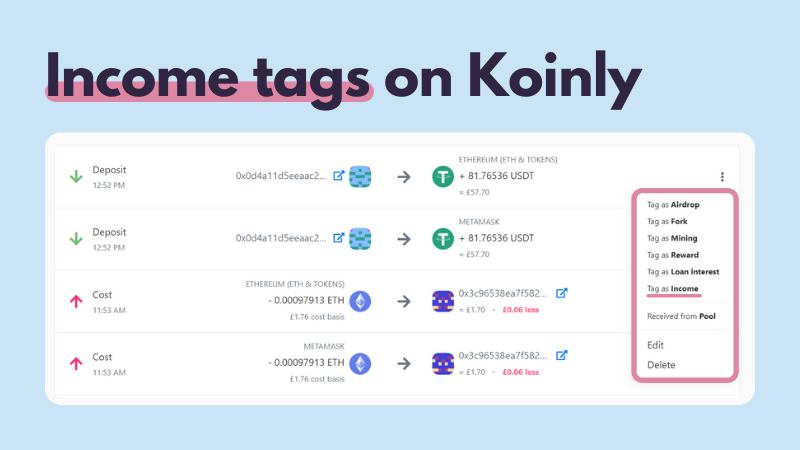

If for any reason your transaction history is incorrect, don’t worry, you can also tag income manually. Just find the transaction(s) you know are income and tag them using the three dots on the right hand side.

If for any reason your transaction history is incorrect, don’t worry, you can also tag income manually. Just find the transaction(s) you know are income and tag them using the three dots on the right hand side.

Koinly makes crypto tax easy. Get started for free today.

Koinly makes crypto tax easy. Get started for free today.

TLDR;

You can earn interest in crypto from your held crypto assets.

Centralized exchanges let you lend crypto and earn interest, as well as offer interest and savings accounts.

DeFi apps offer many different ways to earn interest on your crypto and often higher interest rates.

In most instances, crypto interest is viewed as income and subject to Income Tax.

However, there are some DeFi apps that pay in a way that could be seen as a capital gain instead.

You'll pay Capital Gains Tax if you later sell, swap, spend, or gift crypto earned through interest.