How to File an IRS Tax Extension | 2024

Missed the April 2024 tax deadline? Don't worry! Our IRS tax extension guide shows you how to file late without penalties.

Get an extension by April 15, 2024 and have until October 15, 2024 to file your taxes

Can I get an IRS tax extension?

Yes. You request an extension with the IRS to file your tax return - but there are two important points you need to consider:

Extensions must be filed prior to the April 15 tax deadline. So if you know you’re going to file late due to needing more time to go over your paperwork, file for an extension before the deadline.

You cannot delay paying any tax due with an extension. If your payment is later than the deadline, the IRS will charge interest on the unpaid balance. So you should always pay on time, even if you file an extension.

How do I file for an IRS tax extension?

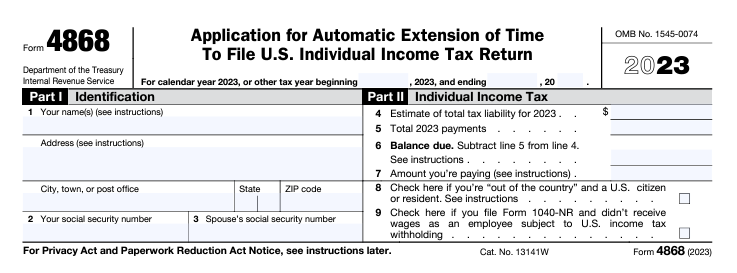

You can get an automatic tax extension by filing Form 4868. This generally extends your due date by 6 months to October 15.

You can file Form 4868 online using a variety of tax apps or by posting a paper form.

What if I can’t pay my taxes by the deadline?

If you can’t pay your taxes in time, the IRS will subject you to interest as well as potential tax penalties.

If you know ahead of the payment deadline that you’ll be unable to pay, you should contact the IRS. You may be able to agree to a payment instalment plan ahead of time. Find out more.

Got complicated circumstances or struggling to figure out what you owe? Speak to a tax professional. You can find experienced US crypto accountants in our directory.

Do I need to file a tax extension for my state taxes?

The answer to this question varies from state to state, but yes, there are some states that will require you to file another tax extension alongside Form 4868.

Can I file a second tax extension?

Generally speaking, no. You cannot file for a second tax extension, although US taxpayers living outside the country may be able to request an additional 4 months. See the IRS guidance.

Can I file an IRS tax extension with TurboTax?

Yes. You can file both a federal and state extension, if needed, using TurboTax. Just go to the extension option in TurboTax and follow the instructions to file. But make sure you do this ahead of the tax deadline in order to avoid penalties for late filing!

What can I do to avoid missing the tax deadline?

We harp on about this a lot - but prep. Taxes take preparation. In fact, preparing your taxes ahead of time can actually help you optimize your tax position and reduce your tax liability.

One of the simplest things you can do is keep good records. Whether that’s because of your personal circumstances, or by using a crypto tax calculator like Koinly to help you keep track of your crypto tax liability throughout the financial year - so you’re not stuck facing a large tax bill you can’t afford to pay when the deadline rolls around.

What if I didn't report crypto in my return?

Accidentally avoided crypto tax by failing to report your crypto? Here's what you can do to reduce potential fines and penalties:

Amend your return using Form 1040X if you can.

File a voluntary disclosure using Form 14457 - there's a specific section for virtual currency.