How to Get More Accounting Clients With Crypto in the USA

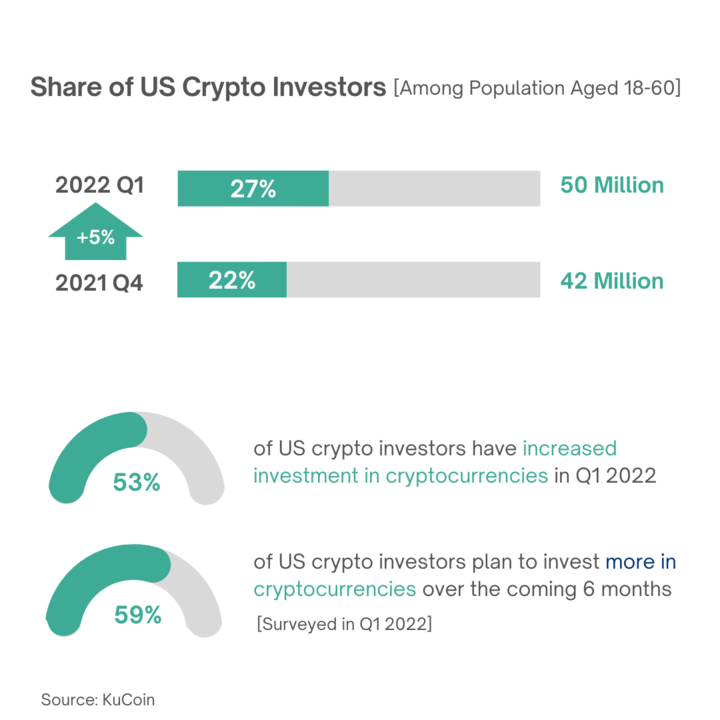

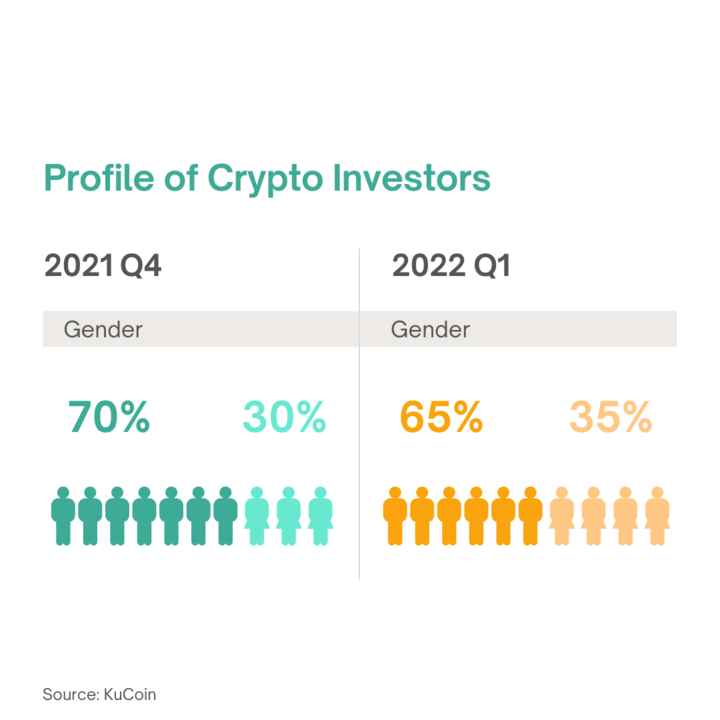

1 in every 4 US adults has invested in cryptocurrency and as of March 2022, there are more than 50 million crypto investors in the USA. In other words, there's never been more demand for crypto accountants than there is currently! Not sure how to attract your new crypto clients to your business? Here's our 6-step guide on how to get more accounting clients with crypto in the USA.

How large is the crypto market in the USA?

Large - and it's still growing even in the turbulent market this year.

According to KuCoin's Into the Cryptoverse report, 1 in every 4 US adults has invested in cryptocurrencies in 2022, rising 5% from the last quarter of 2021. This means as of March 2022, there are an estimated 50 million crypto investors - all of whom need help navigating their tax obligations with the IRS.

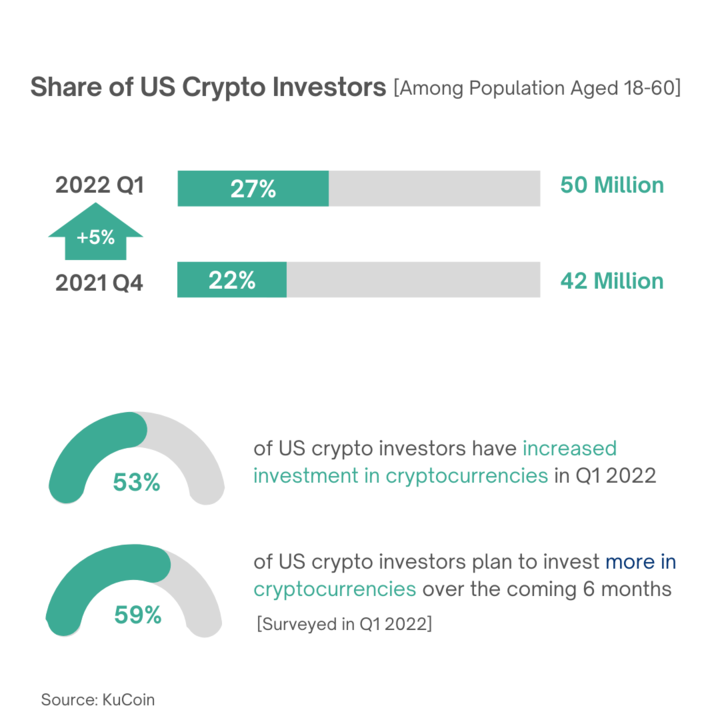

The demographics of these potential clients might surprise you as well. As crypto moves closer and closer to mass adoption, the demographics have shifted considerably.

The demographics of these potential clients might surprise you as well. As crypto moves closer and closer to mass adoption, the demographics have shifted considerably.

While Millennials and Gen Z still make up the largest percentage of crypto investors, the percentage of Gen X investors grew by 7% over the first quarter of 2022.

While Millennials and Gen Z still make up the largest percentage of crypto investors, the percentage of Gen X investors grew by 7% over the first quarter of 2022.

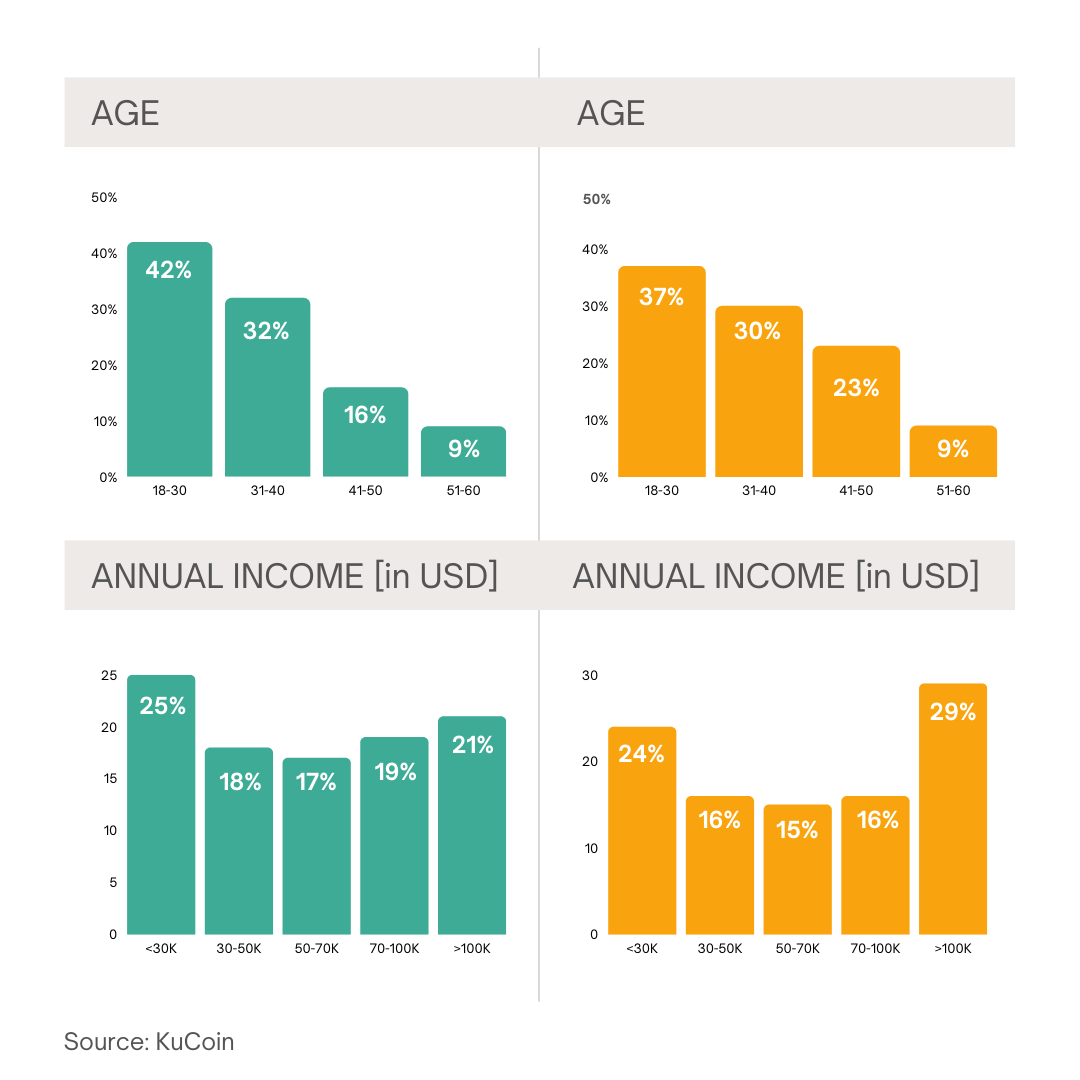

The gender split between male and female crypto investors is surprisingly uneven, with the gap widening from the last quarter of 2021 into the first quarter of 2022.

The gender split between male and female crypto investors is surprisingly uneven, with the gap widening from the last quarter of 2021 into the first quarter of 2022.

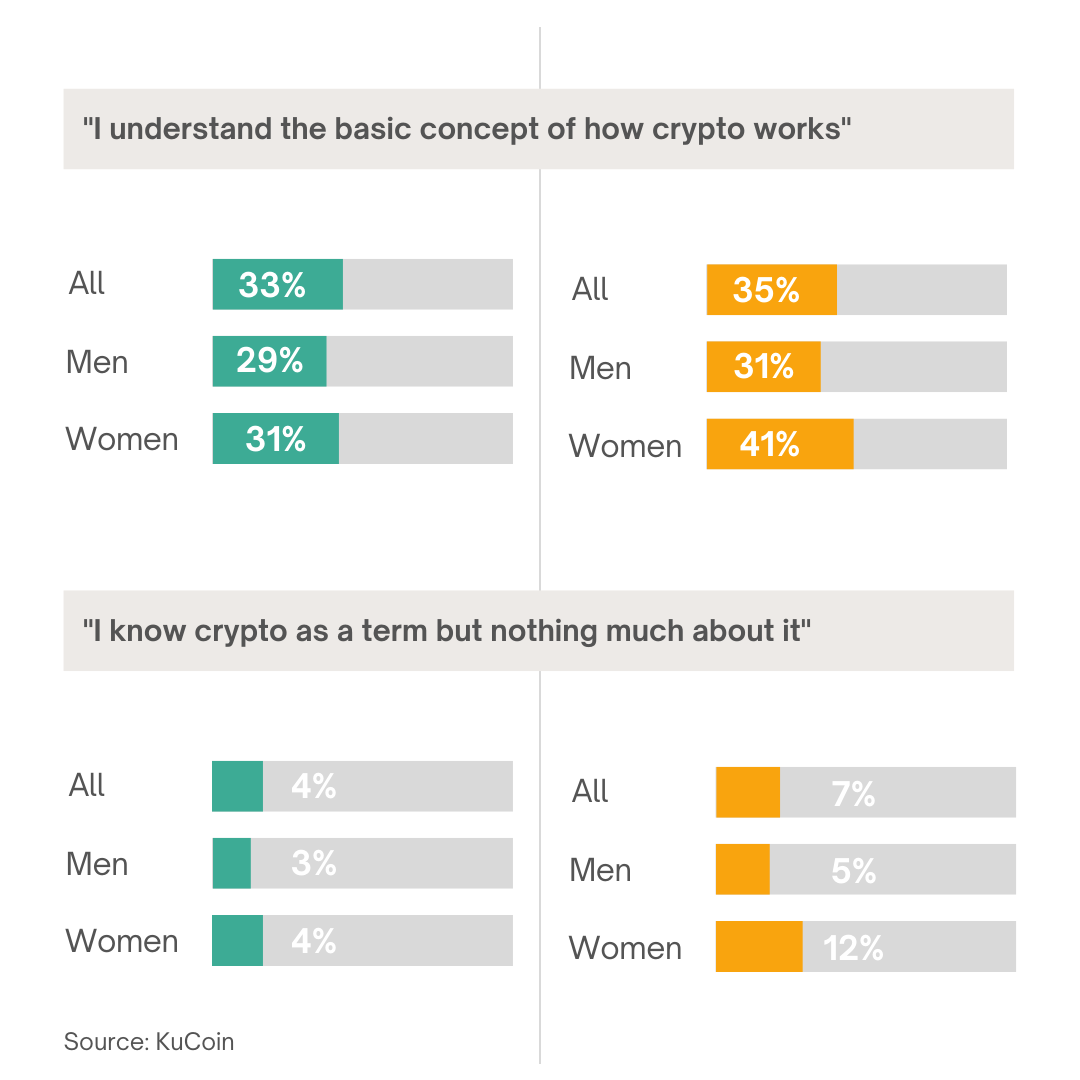

Despite the growth of cryptocurrency, the report reveals that as the market has grown, crypto literacy has declined, with 58% of US investors stating they understand how cryptocurrency works. It is highly likely that a similar percentage are unaware of the complex tax implications of their investments as well.

Despite the growth of cryptocurrency, the report reveals that as the market has grown, crypto literacy has declined, with 58% of US investors stating they understand how cryptocurrency works. It is highly likely that a similar percentage are unaware of the complex tax implications of their investments as well.

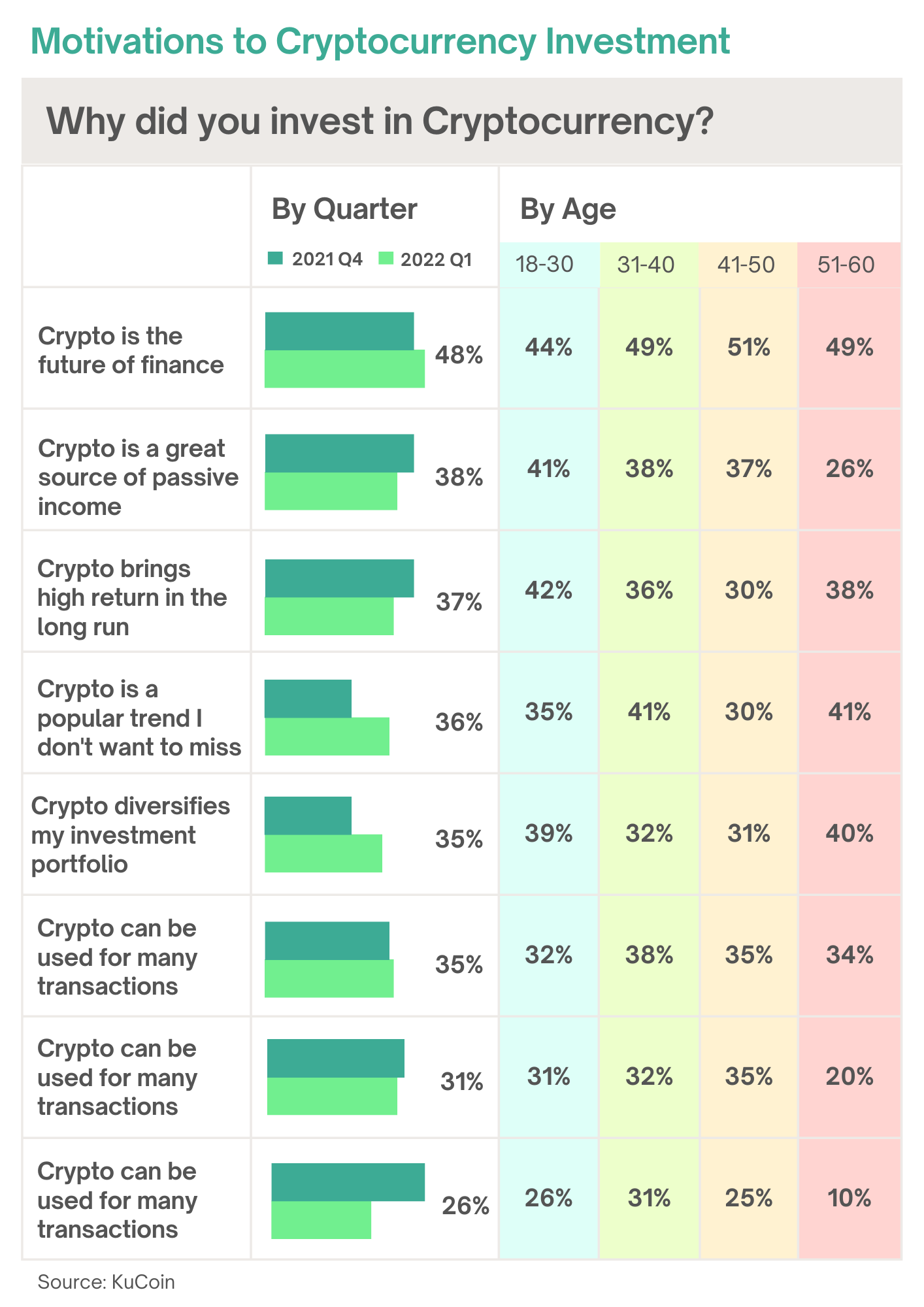

And for the future of the market? Well, 48% of US investors say they believe crypto is the future of finance, while a further 35% say they use crypto to diversify their investment portfolio - showing the market is increasing authority and trustworthiness.

And for the future of the market? Well, 48% of US investors say they believe crypto is the future of finance, while a further 35% say they use crypto to diversify their investment portfolio - showing the market is increasing authority and trustworthiness.

Now you know how big the market is, let's look at how to get stuck in in 6 simple steps.

Now you know how big the market is, let's look at how to get stuck in in 6 simple steps.

Crypto tax? Not that complicated

The technologies and jargon involved in cryptocurrency can be daunting for those entirely new to the market - but from a tax perspective, the rules are pretty familiar.

The IRS has guidance on how crypto is taxed. They state that cryptocurrency is a kind of virtual currency and that virtual currency is treated as property for tax purposes.

As such, cryptocurrency may be subject to Capital Gains Tax or Income Tax - depending on the specific transaction.

Selling, swapping, or spending cryptocurrency triggers a Capital Gains Tax event, and a capital gain or loss must be recognized. Meanwhile, earning new cryptocurrency coins and tokens through investment activities like crypto mining or staking is generally seen as additional income and would be subject to Income Tax upon receipt as well.

To learn more, read our USA Accountant's Crypto Tax Guide and check out our crypto glossary for a breakdown of all the jargon.

Learn by investing

You don't have to invest in crypto to understand the tax implications of it... but it definitely helps! There's a world of investment opportunities out there, which are constantly growing thanks to the innovation of the DeFi market. Knowing and understanding these more niche investments firsthand can help your clients trust you and feel more at ease.

You don't have to invest much either - even just a few dollars on different centralized and decentralized exchanges can help translate the complicated jargon into transactions with obvious tax implications.

If you're looking to attract DeFi investors, this step is a must. Spend some precious hours interacting with popular DeFi protocols like Uniswap, Curve, Lido, Compound, and Aave to get a good understanding of how they work and the tax implications of each transaction.

Stand out in a crowd

Once you're ready to tackle crypto clients, tell the world.

There is a shortage of experienced crypto accountants in the USA, and crypto investors of all kinds are constantly looking for knowledgeable and helpful accountants online to help them navigate their tax liability. Google Trends - a tool to show the popularity of search trends - reveals searches of "crypto accountants" have exploded in popularity over the last two years. In other words, make sure you can be found with a website that promotes your crypto accounting services in detail.

You'll also want a dedicated page on your website, offering crypto accounting services online and locally. Even better, craft dedicated supporting content that tackles FAQs around cryptocurrency taxes, like:

How is crypto taxed in the USA?

How do you report crypto taxes to the IRS?

How to calculate crypto capital gains

How to calculate crypto income

Finally, don’t forget to add crypto tax to your Google Business listing - or create a Google Business listing if you don't have one already!

Join industry bodies

It pays to be a part of the industry when it comes to crypto, so joining industry groups can help you build authority and attract more clients with cryptocurrency. Here's a couple of big industry bodies to consider:

Blockchain Industry Group: Blockchain Industry Group represents businesses from around the world. Ranging from startups and scaleups, education institutions, consultants, digital asset exchanges, financial industry service providers, and the builders coding our future success. Apply to become a member.

American Blockchain & Cryptocurrency Association: ABCA's mission is to serve as a voice for the US blockchain industry. Members receive significant benefits, including free participation in webinars.

Get listed

Want to attract even more crypto clients?

Koinly's crypto accountant directory can help with that. We list trusted and experienced crypto accountants in the USA (and around the world) and the directory has proven to be hugely popular for Koinly users.

Get listed on our dedicated USA crypto accountants directory.

Use the right tools for the job

While crypto tax is pretty straightforward once you get to grips with it, one of the main issues crypto accountants (and investors) face is compiling all their data into a single spot. The majority of crypto investors use multiple crypto exchanges and wallets and hold crypto assets across a variety of blockchains - making tracking cost basis an admin nightmare. As well as this, many investors may have thousands of taxable transactions to calculate in a single financial year. So the real challenge for many accountants is the sheer manpower and time needed to process, calculate, and report a client's crypto tax liability.

This is why almost all crypto accountants opt to use the right tools for the job, in the form of a crypto tax calculator - like Koinly

Crypto tax software saves you, and your clients, hours. It imports transactions from all the exchanges, wallets, or blockchains a given investor uses, identifies the cost basis of those transactions (or the fair market value on the day of the transaction), and converts it into USD - saving hours of spreadsheets and manual calculations. In even better news, Koinly generates a variety of IRS-compliant crypto tax reports, ready to help your client file, or you to file on their behalf - including Form 8949 and Schedule D, the Complete Tax Report, and the TurboTax Report.

Koinly offers CPA licenses for crypto accountants managing every step on behalf of their clients, or your client can simply give you access to their existing Koinly account via their settings.