Crypto Tax Profit and Loss Explained

Whether you're a hobby trader or a serious investor, knowing what your crypto profit and loss looks like is essential. Why? To make better trading decisions, to know when to cash out, and to know how to use losses strategically for tax. Let's find out what 'profit & loss' means for your cryptocurrency investments.

Also known as P&L or PNL for short, profit and loss is pretty self-explanatory at a glance. Whenever you ‘dispose’ of an asset - like a rental property or cryptocurrency - you’ll have a profit or loss, also known as a capital gain or capital loss.

If you sold your crypto for more than you bought it for, that’s a profit. If you sold your crypto for less than you bought it for, that’s a loss.

EXAMPLE

Made a profit

You buy 1 ETH for $3,000 and you sell at $4,000. You paid $200 in transaction fees. You’ve made $800 in profit.

Made a loss

You buy 1 ETH for $3,000 and you sell at $2,000. You paid $200 in transaction fees. You’ve made a loss of $1200.

Capital asset

Cryptocurrencies are seen as an asset, not a currency, so any profit from disposing of a crypto asset is subject to Capital Gains Tax and should be included in your annual profit and loss statement.

How do you calculate crypto profit and loss?

The most common way to calculate crypto profit and loss is on a transaction-by-transaction basis. To do this, you’ll need to know the cost basis of each asset.

Your cost basis is the amount you spent to acquire an asset, plus any fees associated with purchasing that asset. For example, if you bought 1 BTC for $40,000 and the transaction fee was a flat 2.5%, your cost basis would be $40,000 + $1000 for the 2.5% transaction fee, so a total of $41,000.

Cost basis methods

In the examples we used earlier, it’s easy to know what your cost basis is if you're only looking at one asset. But cost basis can get complicated for investors trading multiple assets at once.

Let's say you bought 3 ETH for $3,000 a couple of years ago. The following year you bought 1 more for $5,000. This year you sold 1 ETH for $4,000.

If you work out the cost basis based on your first investment, you make $3,000 in profit. But if you work it out based on your latest ETH investment, you make a $1,000 loss. So how do you know which cost basis to use?

Well, first off, you might not have a choice. Countries give specific guidance on the accounting methods you should use to calculate your cost basis for capital gains. This includes:

Secondly, in countries where multiple cost basis methods are allowed, your choice comes down to your trading and tax strategy. You can learn more about all of these cost basis methods in our calculating crypto taxes guide.

How is crypto profit and loss taxed?

Profits from crypto are subject to Capital Gains Tax.

Tax on a profit: When you dispose of an asset, if you have a realized profit or gain, this is subject to Capital Gains Tax. How much you’ll pay depends on how long you’ve held the asset and where you live.

Tax on a loss: When you dispose of an asset but made a loss, you won’t be taxed on this. However, you can offset these losses against any capital gains in most countries, as well as carry losses forward to offset against future gains.

The exact amount of losses you can offset in a year or carry forward depends on the country you live in. For example, in America, you can offset up to $3,000 in losses every year, but you can also carry forward net capital losses in excess of $3,000 indefinitely to offset against future gains.

When does Capital Gains Tax apply to crypto transactions?

Not all proceeds from crypto investments are seen as a capital gain or loss. Sometimes proceeds will be subject to Income Tax or even tax free. This is all dependent on where you live, so you should always check your country’s crypto tax rules. In general, though, the following rules apply:

Not all proceeds from crypto investments are seen as a capital gain or loss. Sometimes proceeds will be subject to Income Tax or even tax free. This is all dependent on where you live, so you should always check your country’s crypto tax rules. In general, though, the following rules apply:

Seen as a capital gain/loss - Capital Gains Tax

Selling crypto for fiat currency.

Swapping crypto for crypto - depending on where you live.

Spending crypto to buy things.

Gifting/donating crypto - depending on where you live.

Seen as income - Income Tax

Earning crypto.

Airdrops.

Staking.

Mining.

Forks.

Referral bonuses.

Financial products like futures or options - depending on where you live.

DeFi interest.

Tax free

Buying crypto

Moving crypto between wallets.

Wallet fees

Something to be aware of: If you’re moving assets around between your own wallets, there is no profit or loss as you’re not buying or disposing of an asset. However, if you paid a transaction fee to carry out a transfer, this fee is often subject to taxes so you may need to factor this into your P&L calculations.

How to strategize P&L

Tracking crypto P&L is the only way you’ll know how your overall portfolio is performing. To do this well you need to track both your realized P&L and unrealized P&L.

Realized P&L vs. unrealized P&L

When investors talk about unrealized P&L, it refers to an asset that has not yet been sold. This is also known as an unrealized gain or unrealized loss. You know what you've bought it for and the value of the asset has changed, but you still own it, so any loss or profit from the asset is not yet realized.

For example, if you bought 1 BTC for $30,000 and the price of BTC has increased to $40,000. You have an unrealized profit of $10,000.

Similarly, if the price of BTC dropped to $25,000, you’d have an unrealized loss of $5000.

While realized P&L is static, unrealized P&L is always changing depending on the market.

So why is this important? Tracking your realized and unrealized P&L can help you make better decisions about when to liquidate your assets depending on market changes, as well as minimize risk. This can help you strategize when to hold and when to fold.

For example, you can set clear goals like selling at a profit or loss of 20%. You can do this manually by keeping an eye on your unrealized P&L or by using stop loss and limit orders.

Tracking your realized and unrealized P&L can also help you plan a tax strategy.

P&L Tax Strategies

Crypto is now taxed in almost every country in the world and various tax authorities like ATO, HMRC, and the IRS are sending a clear message to investors that it’s time to take crypto tax seriously.

Investors should meet their tax obligations, of course, but that doesn’t mean they can’t be smart about it. Tracking crypto realized and unrealized P&L can help investors strategize to reduce their tax obligations and prepare for their tax bills. For example by:

Holding assets to benefit from long-term gains discounts.

Identifying tax loss harvesting opportunities.

Identifying capital gains offset opportunities.

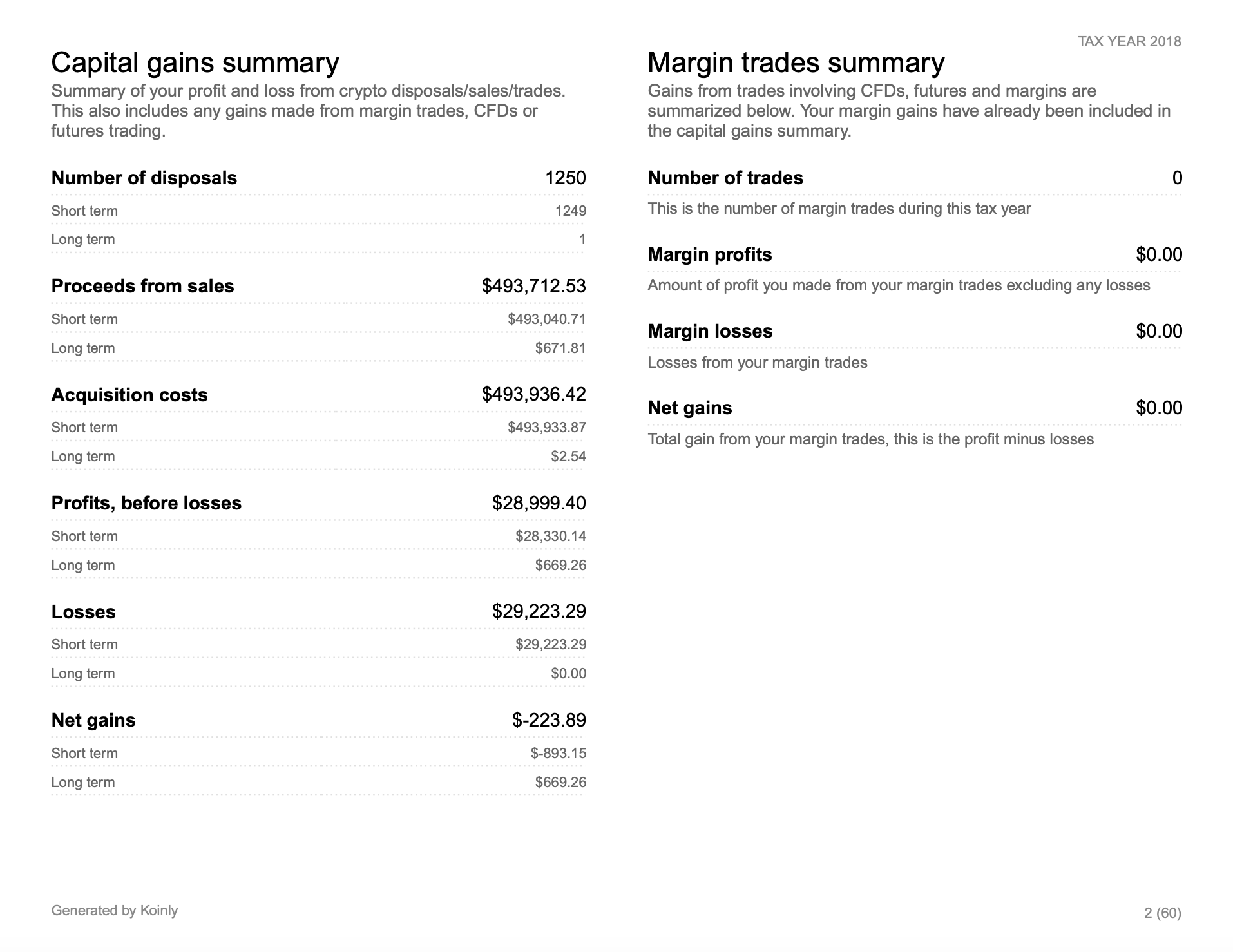

Track profit and loss with Koinly

Koinly tracks both realized P&L and unrealized P&L, across all the crypto exchanges and wallets you use. As well as this, it also calculates your crypto taxes for you.

Our crypto tax software does all the calculations on your behalf, based on the country you live in, and generates a complete tax report for you, ready to download and submit to your tax authority.

Summary

Profit and loss is also known as P&L or PNL.

Any time you dispose of a digital asset, you'll have a profit or a loss.

If you have a profit, you have a capital gain, which is subject to Capital Gains Tax.

You'll only pay tax on the profit you made, not the entire proceeds from an asset.

If you made a loss, you might be able to offset this against any capital gains.

To figure out how much you need to pay, subtract your cost basis from the value at disposal.

Tracking your realized and unrealized P&L can help you make better investment decisions.