Are Tax Preparation Fees Deductible?

We get it - nobody likes having to pay for the privilege of doing their taxes. Not only have you got to pay for whatever tax app you use to file, but now you have to pay for a crypto tax app too! Well, there might be a silver lining to the tax cloud - in some specific instances, you may be able to deduct Koinly and other tax preparation fees as an expense when filing your taxes.

Are tax preparation fees deductible?

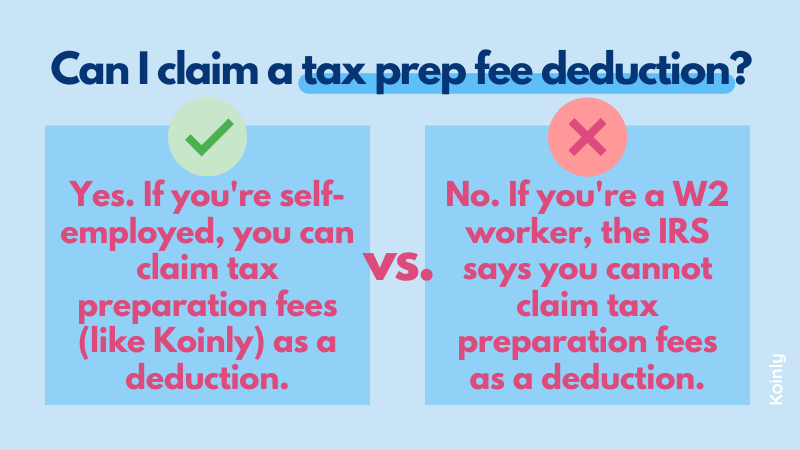

We'll start with the bad news - not all US taxpayers can deduct tax preparation fees according to the most recent IRS rules.

In fact, unfortunately, for many investors, the cost of your tax preparation software will not be tax deductible if you want to play it safe with the IRS.

If you're confused because you've previously deducted tax preparation fees, then you're not the only one. The IRS recently issued new guidance on this - so if you’re confused as you’ve previously deducted your tax preparation expenses, then here’s what you need to know.

The IRS recently imposed a rule that W2 employees - so salaried workers - cannot deduct tax preparation fees from their annual tax return. But they say that self-employed workers can.

Are crypto tax preparation fees deductible?

Of course, when it comes to crypto investors, this may feel like a grey area. Many crypto investors argue that their investment activities are separate from their W2 employment, effectively making them self-employed when they’re not working in their regular employed role.

There is some merit to this as if investors are earning through creating and selling NFTs or play to earn gaming, there is an argument that this is like a second job in which they’re their own boss.

As a result, many investors are making the argument they can deduct their tax prep fees as in theory, they’re running their own self-employed business, as well as being a W2 employee.

Because these rules have only changed recently - nobody has actually tested this precedent yet. So we don’t know whether the IRS would agree with this position that crypto investments can be seen as similar to self-employed business activities.

All this to say, if you want to be cautious - it is wise not to attempt to take a tax preparation fee deduction. The IRS may not agree with the argument that crypto investments could be seen as self-employment activities.

However, if it’s clear that you are self-employed (even if that’s unrelated to your crypto investments!) then you can claim the tax preparation fee deduction.

How to claim a tax preparation fee deduction

How to claim your tax preparation fee deduction depends on how you’re filing.

If you’re self-employed and using paper forms, you can deduct tax preparation fees on Schedule C in the legal and professional fees section.

If you (like most people) are using a tax app, you’ll be able to do this in the expenses section of your tax app. For example, on TurboTax, in the deductions and credits section, under other deductions and credits, you'll find the tax preparation fees section to complete. You just need to enter the amount your tax preparation fees cost you and submit.

Should you need proof of your fees, Koinly can provide you with an invoice of your expenses. Just go to settings, then invoices.