Spain Crypto Tax Guide 2024

Curious about how much tax you'll pay on crypto in Spain? This guide will provide you with all the information you need to know! Whether you're interested in learning about Bitcoin tax or any other cryptocurrency, we'll discuss how crypto is taxed and the amount of tax you'll be required to pay. Additionally, we'll share strategies that can help you minimize your tax burden. Lastly, we'll provide a step-by-step walkthrough on how to file your crypto tax using the appropriate platform before June 30. Let's get started!

Crypto is taxed in Spain. You’ll pay up to 28% on capital gains (savings income and investments income)

You’ll pay up to 47% tax on other kinds of crypto income like mining

Spanish investors must file crypto taxes using Form 100 (Modelo 100) by June 30

You may also be subject to Wealth Tax if your net wealth is over the threshold in your region

You must report crypto holdings over €50,000 held abroad from 2023 onward using Model 721

Is cryptocurrency taxed in Spain?

Yes, cryptocurrency in Spain is taxable. The Agencia Tributaria views it as a kind of capital asset, and views gains from crypto transactions as savings income generally subject to taxation under Personal Income Tax (PIT). Tax rates vary based on transaction type and the taxpayer's individual circumstances. You'll need to report your crypto profits as part of your tax return.

Gains from selling, swapping, or spending crypto are viewed as savings income.

The tax you'll pay on crypto gains is 19% to 28%.

Mining rewards are seen as a freelance business activity and are subject to Income Tax.

Staking rewards are viewed as investment income and are taxed between 19% to 28%.

Crypto may be subject to Wealth Tax depending on your region and how much your crypto portfolio is worth.

Spanish taxpayers must report crypto holdings over €50,000 held abroad from 2023 onward using Model 721.

This guide is regularly updated

Spain's crypto tax rules are constantly changing. Our guide is updated and fact-checked to keep you informed and compliant with Agencia Tributaria's policies.

16 April 2024: Updated with new rates, guidance, and more.

19 December 2023: Updated for 2024

30 May 2023: Updated with new rates, guidance, and more.

28 December 2022: Modelo 721 submission is delayed until March 2024.

29 June 2022: Spanish Treasury creates Model 721 to submit information about crypto assets over €50,000.

24 March 2022: Spanish Treasury confirms Model 720 does not apply to crypto assets.

15 February 2022: Updated to include Dac8 directive.

29 November 2021: Updated for the 2022 tax year.

19 June 2021: Welcome to your Spain cryptocurrency tax guide!

Can the Agencia Tributaria track crypto?

Yes - the Agencia Tributaria will know about your crypto. Here's how:

In July 2021, the Spanish Government approved the Law on Measures to Prevent and Combat Tax Fraud. This ruling forces centralized crypto exchanges like Binance, Coinbase, and many more to share customer information with the Spanish government.

Previously, the Agencia Tributaria sent notices to approximately a million Spanish tax residents in their Income Tax data profile informing them they'd invested in crypto and urging them to declare any profits. It's important to note though, that many investors who received these notices may not have had taxable transactions, but may have simply bought or held cryptocurrencies.

Under the European Union’s Sixth Anti-Money Laundering Directive, every company that provides financial services to cryptocurrency customers and businesses will have to comply with much tougher regulations about when and how they identify customers. Data is made available between EU member states in a bid to stamp out money laundering and illegal activities.

In addition to this, the new proposed EU directive on data sharing - Dac8 means it's likely the Agencia Tributaria will have the ability to check whether an individual owns crypto, as well as look into crypto companies' accounts and gain insight into crypto assets.

All this to say - you should declare any gains or income you have from crypto investments. The penalties for crypto tax evasion are steep - up to five times higher than the amount you failed to declare and potentially prison time too.

How does Spain tax cryptocurrency?

In summary, crypto in Spain may be subject to three different taxes depending on the transaction:

Income Tax - this covers subcategories of income like savings income, investment income, and business activities.

Wealth Tax

Inheritance and Donations Tax

Let's go through each different kind of tax and how and when it'll apply to your crypto, as well as how much you'll pay.

Savings income from crypto

Your capital gains from crypto are viewed as savings income. You have a capital gain whenever you dispose of your crypto - so whenever it changes hands. This would include:

Selling crypto for EUR

Trading crypto for another cryptocurrency

You'll pay between 19% to 26% in tax depending on how large a net profit you've made and the financial year.

Savings income tax rate

Savings income has a particular tax rate (Base Imponible del Ahorro), which is a progressive tax rate calculated as follows:

| Tax Rate | Profit |

|---|---|

| 19% | Profits up to €6,000 |

| 21% | Profits between €6,000 and €50,000 |

| 23% | Profits between €50,000 and €200,000 |

| 27% | Profits between €200,000 - €300,000 |

| 28% | Profits over €300,000 |

This tax rate is progressive. This means that you won't pay the same tax rate on the entire amount. For example, if you had a €60,000 net capital gain, you wouldn't pay 23% on all of it. Instead, you'd pay 19% for the first €6,000, 21% for the next €44,000, and 23% on the remaining net profit.

How to calculate your crypto capital gains

First, determine your cost basis, which is the purchase price of your crypto along with any associated acquisition or disposal costs. If you received your crypto through other means, use the fair market value on the day of receipt.

Report the total amount in your annual personal income tax return.

If you have a capital loss:

You can offset losses against gains of a similar kind. So if you've got crypto gains (or other capital gains), you could offset your crypto losses against these gains. If you have no gains to offset your losses against or if your losses exceed your gains, you can carry this forward to future tax years. Unused losses can be carried forward for four years to offset against other capital gains. If you still have unutilized losses after this point, and other income savings (Rendimientos del capital mobiliario) like dividends, interest, bonds, and so on, then you can also offset up to 25% of this income.

Good to know

Formerly, there was a particular rule around capital/investment losses and wash sales. It stated that capital losses should be integrated with capital gains, except in the event that the taxpayer had acquired homogeneous financial assets within the two months before or after said transfers, in which case, said capital losses will be integrated as the financial assets that remain in the patrimony of the taxpayer are transferred. While this rule remains in force for shares and was previously used for crypto in the 2021 tax return, there is a new section for crypto assets specifically in the 2022 tax return, in which this requirement has disappeared, and the Agencia Tributaria deleted this option in the crypto form. As such, it looks like this rule no longer applies to crypto assets.

Income Tax rates on crypto

Spanish Income Tax is complicated - as several sub-categories of income fall under the general tax scale (base imponible general), including freelancer, rental income and the 17 different autonomous community tax rates and more, as well as base imponible del ahorro - which is the tax rate for savings income, investment income, and capital gains.

What about other kinds of crypto income?

The guidance from the AEAT currently is limited, but here are some other common transactions and how they're taxed in Spain:

Staking income: Staking rewards - and any other income derived from the deposit of tokens - are considered investment income. It should be included in cell 0033 in the Income Tax Return for 2023, at the fair market value in EUR on the day the rewards/income was received. Investors cannot deduct expenses, and the same tax rate for savings income applies.

Airdrops or referral rewards: Airdrops, or other kinds of referral rewards, are viewed as a kind of gift and not regular capital. They should be reported in cell 0304 of the Income Tax Return for 2023 and taxed at the same rate as any other freelance income in the General Taxation Scale.

Crypto mining: There are several pieces of guidance from the General Directorate of Taxes regarding crypto mining, which state crypto mining should be considered a business activity. As such, anyone mining crypto should register as a freelancer (autónomo) under business activity code 832.9 (otros servicios financieros). This income will be taxed within the General Taxation Scale.

Read next: Want to learn about crypto and earn crypto? See our learn and earn guide, including guidance on how your rewards may be taxed.

Wealth tax

Most regions of Spain charge a Wealth Tax, and the EUR value of any crypto must be considered for Wealth Tax calculations. The Wealth Tax rates and minimum exempt amount vary depending on your region but often start at around €700,000 with rates ranging from 0.2% to over 3%.

You can see the regional Wealth Tax rates below:

Catalonia: between 0.21% and 3.48% tax.

Asturias: between 0.22% and 3% tax.

Region of Murcia: between 0.24% and 3% tax.

Andalusia: between 0.20% and 2.5% tax. (This is due to change to the same scheme as Madrid in 2023)

Cantabria: between 0.24% and 3.03% tax

Community of Valencia: between 0.25% and 3.5% tax.

Balearics: between 0.28% and 3.45% tax.

Extremadura: between 0.30% and 3.75% tax.

Madrid is the only autonomous community that does not impose a Wealth Tax currently. However, you need to submit a Wealth Tax Return for information purposes if your total assets are worth more than €2 million.

If you own assets over the exemption limit, you'll need to make a Wealth Tax declaration and include the value of your cryptocurrencies in EUR based on the market price on 31 December of the corresponding tax year.

Inheritance and Donations Tax

If a person receives an inheritance including cryptocurrencies, this must be included in the ISD statement.

Like with the Wealth Tax, the tax you'll pay on inherited or gifted crypto will vary depending on how much you received and where you live. Each Autonomous Community sets its own tax rate for inherited and gifted assets. But in general, the taxable rate will vary between 7% to 36.5%.

Tax Free

You won't always pay tax on your crypto, there are a few crypto transactions that are tax free in Spain, including:

Buying crypto.

Holding crypto - unless subject to Wealth Tax.

Transferring crypto between your own wallets.

Want to learn more about crypto tax free countries like neighbouring Portugal?

How to report crypto taxes in Spain

The AEAT (Agencia Tributaria) wants to know about your crypto activity in terms of income and capital gains. You'll need to declare both in your annual Income Tax Return.

How to file crypto taxes in Spain

If you are a Spanish tax resident, complete Form 100 (Modelo 100) in order to make a Spanish income tax declaration.

Once you, or your accountant, have calculated your crypto tax (we have an app for that!), the easiest way to file your taxes is via the AEAT's Renta Online.

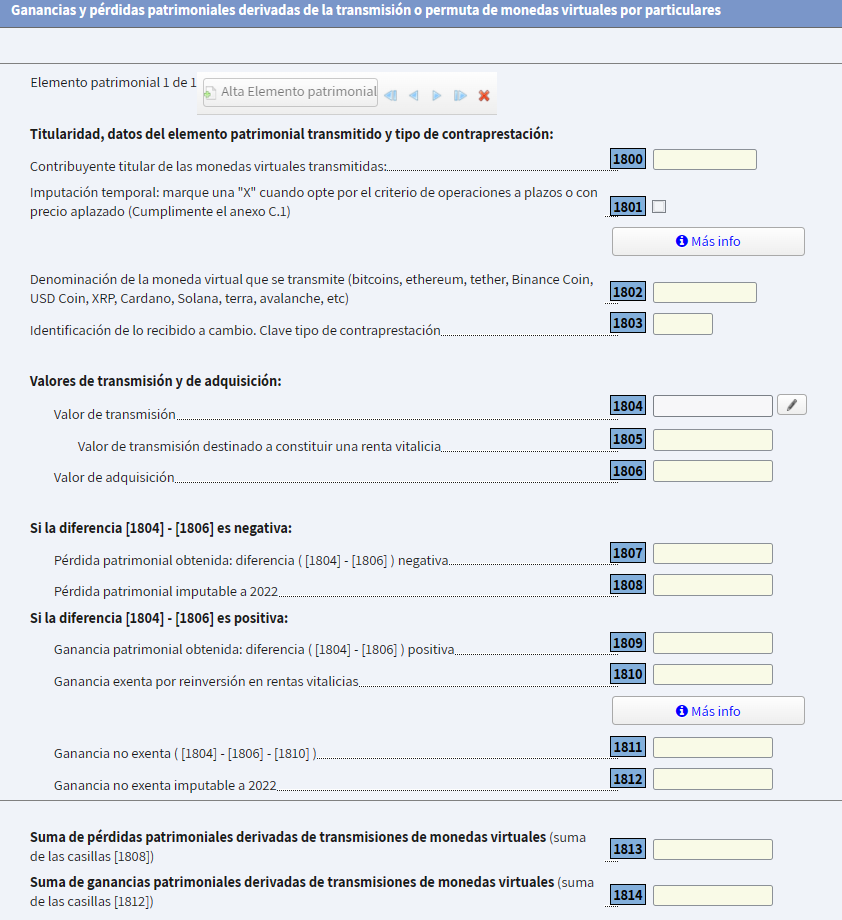

A couple of years ago, the Agencia Tributaria created a new specific page to include all the relevant information about cryptocurrency transactions, which you can see below:

Spain tax deadline

The Spanish tax year runs from the 1st of January to the 31st of December each year - just like the calendar year.

Spanish income tax returns start every year in early April and must be filed by 30 June for the preceding year. This means you will need to submit your tax return for the 2023 tax year by June 30, 2024.

Model 720 Declaration and crypto

The Model 720 Declaration is used to inform the tax agency about your assets abroad, so you can pay Wealth Tax accordingly (both the Wealth Tax declaration and the Model 720 must be aligned). It is used to declare holdings abroad of more than €50,000 such as properties, bank accounts, deposits, savings, shares, or life insurance. It was previously believed that the Model 720 applied to cryptocurrency, however recently the Spanish treasury has confirmed that this is not the case. However, if you have other financial assets held abroad that are more than €50,000 in value, you would need to file the Model 720 declaration.

Model 721 Declaration and crypto

The Model 721 Declaration is an informational tax form, created as part of the reform of the Spanish Tax Laws around anti-fraud measures in July 2021 - and the reform means the form applies to cryptocurrencies held abroad.

Under the reform, individuals who own crypto with a portfolio value of at least €50,000 must submit Model 721 between January 1 and March 31. The first year this is applicable is the 2023 tax year, meaning the first year you may have to submit Model 721 under the circumstances outlined is 2024.

To value your cryptocurrency, you'll need to calculate it using the average price as of December 31 of each financial year. For investors who held more than €50,000 at any time during the financial year but did not hold €50,000 as of December 31, you'll need to provide information about the date on which your crypto portfolio lost this value.

Investors who are required to submit Model 721 but fail to do so by the deadline so will face a penalty of €200. Investors who submit Model 721 incorrectly will face a penalty of €150.

Which accounting method for crypto tax in Spain?

In Spain, crypto tax is calculated using the FIFO method (first in, first out) when calculating your crypto taxes. This assumes the first asset you bought is the first asset you sold and you'll calculate your crypto taxes based on this cost basis. To understand more about how FIFO works, check out this article.

Taxable Transactions

Not sure when or what tax you'll pay on your crypto in Spain? Here are the most common examples.

Selling crypto for EUR

SAVINGS INCOMEWhen you sell your crypto for euros (or any other fiat currency), you'll need to pay tax on any savings income (capital gains) you have as a result.

EXAMPLE

You buy 1 ETH for €3,000 and pay 2% in transaction fees, making your cost basis €3,060.

You later sell your 1 ETH for €3,400. Subtract your cost basis to figure out your gain.

€3,400 - €3,060 = €340. You have a €340 capital gain, which you'll need to pay tax on.

Trading crypto for crypto

SAVINGS INCOMEWhen you trade crypto for another crypto - this is seen as a disposal and you'll need to pay tax on any gain you have as a result. It's not the "purchase" of another crypto that the Spanish tax office is interested in taxing, it's the disposal of your original asset.

EXAMPLE

You buy 0.5 BTC for €20,000. You later decide to trade your 0.5 BTC for ETH.

On the day you trade your BTC, the fair market value of 0.5 BTC is €21,000. Subtract your cost basis from the fair market value of your BTC on the day you traded it for ETH.

€21,000 - €20,000 = €1,000. You have a capital gain of €1,000 which you'll need to pay tax on.

You'll also need to note the fair market value of ETH on the day you acquired it to track your cost basis in the future should you later dispose of your ETH.

Getting paid in crypto

GENERAL TAX SCALEGetting paid in crypto is taxable - but the tax you may be liable to pay depends on your specific circumstances. If you're employed by a company and being paid in crypto, any company in Spain that pays its employees with cryptocurrencies has to include these payments in the standard informational tax form about salaries. So all you'd need to do as the employee is check online your work income report for accuracy.

Meanwhile, if you're a contractor being paid in crypto, you'd need to exchange that value to the EUR equivalent and create an invoice for tax purposes to determine your future freelance income or Rendimientos de Actividades Económicas.

Mining crypto

GENERAL TAX SCALEMining crypto is viewed as a business activity under the current guidance from the AEAT. Anyone mining crypto must register as a freelancer (autónomo) - specifically business activity code 832.9 (otros servicios financieros). Any income from your mining activities will be subject to General Income Tax.

This said, if and when you later dispose of your mining rewards, this would be viewed as savings income and taxed in the same way as any other disposal of crypto.

Hodling crypto

WEALTH TAXIf you're hodling for the moon and you're over the Wealth Tax threshold in your autonomous region - you'll need to calculate the total value of your crypto assets and add this figure to your overall total assets sum.

Gifting crypto

GIFT TAXWant to give the gift of crypto? Bad news, this is seen as a kind of disposal and you'll need to pay Inheritance and Gift Tax. The exact amount you'll pay varies depending on the autonomous region that you live in.

Do I need to keep records of my crypto transactions?

Yes, the AEAT requires you to keep detailed records of cryptocurrency transactions for 5 years after you “prepared or obtained the records”, or “completed the transactions or acts those records relate to”, whichever is later. You need to keep the following records:

the date of your crypto transactions

the value of the cryptocurrency in Euros at the time of the transaction (which can be taken from a reputable online exchange.)

what the transaction was for and who the other party was (even if it’s just a wallet address).

Who can help you calculate your crypto tax?

Crypto tax reporting is fairly new, and a road less traveled for most accountants, but that doesn't mean the AEAT is going to cut you any slack. Here are 4 ways you can tackle your crypto taxes and keep them in the taxman's good books. We'll start with the easiest and most accurate method first.

Use a crypto tax calculator like Koinly to create a crypto tax report. Send the report to your accountant to complete your tax return. Super accurate, super easy.

Use a crypto tax calculator like Koinly to create a crypto tax report. Add the necessary data to your tax return and file it yourself. Accurate, and easy, if you know what you're doing.

Get an accountant to work out your crypto activity by supplying a transaction history for each crypto exchange, wallet, or blockchain you use. Let them work it out and file it for you.

Work out your activity yourself, and file yourself. Best of luck to you.

How to use a crypto tax app like Koinly

Don't get stuck in the busy work. Don't get it wrong. Don't rely on your accountant to know where to look. Use Koinly. Here's how easy it is:

Sign up for a FREE account. You only need a paid plan at the point you download your chosen crypto tax report.

Select your country (Spain), currency (euro), and accounting method (FIFO).

Connect Koinly to your wallets and exchanges via API or by importing a CSV file of your transaction history. Koinly integrates with Binance, Coinbase, Kraken, and 700+ more. (See all)

Let Koinly crunch the numbers. Make a coffee.

Ta-da! Your data is collected and your full tax report is generated!

To download your crypto tax report, upgrade to a paid plan.

Send your report to your accountant, or complete your AEAT income tax submission yourself, using the figures from your Koinly report. Done!