Ireland Crypto Tax Guide 2024

Wondering how much tax you'll pay on crypto in Ireland? Our Ireland crypto tax guide covers everything you need to know, including crypto Capital Gains Tax, Income Tax, Gift Tax, how to calculate and report your crypto taxes to Revenue and even how to help you avoid paying tax on crypto ahead of the 31st of October tax deadline!

Do you have to pay tax on cryptocurrency in Ireland?

Yes - you pay tax on crypto in Ireland. The Revenue Commissioners, or just Revenue, is clear that crypto in Ireland is subject to Income Tax and Capital Gains Tax. As well as this, Corporation Tax may apply for companies dealing in cryptocurrency transactions, and in some specific circumstances, Capital Acquisitions Tax may also apply to crypto.

How much tax do you pay on crypto in Ireland?

The amount of tax you'll pay on crypto depends on the specific transaction you've made, the tax that applies, and how much you earn. For transactions subject to Income Tax, you'll pay Income Tax at either 20% or 40% depending on which Income Tax band you fall into. Meanwhile, for transactions subject to Capital Gains Tax, there is a flat rate of 33%.

This guide is regularly updated

One last thing before we start - Revenue guidance on crypto tax is always being updated. At Koinly we keep a very close eye on Revenue's crypto policies and regularly update this guide to keep you informed and tax compliant.

19 December 2023: Updated for 2024

24 August 2022: Updated with new Revenue guidance.

15 February 2022: Updated to include proposed EU directive.

24 May 2021: Welcome to your Irish cryptocurrency tax guide!

Can Revenue track crypto?

Yes - Revenue can track crypto and their recently updated guidance shows they're making crypto tax a focus. If you have an account with a European digital currency exchange, it's likely Revenue already has your data.

Under an EU Anti-Money Laundering Directive, every company that provides financial services to cryptocurrency customers and businesses must have Know Your Customer (KYC) processes. The data collected by KYC processes is made available between EU member states in a bid to stamp out money laundering and illegal activities.

As well as this, there is a new EU directive on data sharing - Dac8 - which is likely to take effect later this year. Under the proposed directive - it's likely that Revenue will have the ability to check whether someone owns crypto, as well as have the authority to look into crypto companies' accounts and gain insight into crypto asset investments.

Is any crypto tax free?

Yes - it's not all bad news, you won't always pay tax on crypto in Ireland. There are a number of transactions that are tax free, including:

Buying crypto with EUR.

Hodling crypto.

Transferring crypto between your own wallets (although gas or transfer fees may constitute a disposal).

With the simple transactions out of the way... let's get into the complicated stuff.

How is crypto taxed in Ireland?

The clue is in the name. Revenue refers to cryptocurrencies - including tokens, NFTs, and stablecoins - as crypto assets and, unsurprisingly, views them as a kind of asset, like a property or shares.

The tax you'll pay depends on the specific transaction you're making, but there are a few different taxes that may apply including:

Capital Gains Tax.

Income Tax.

Capital Acquisition Tax.

As well as this, companies with transactions involving crypto assets would be liable for Corporation Tax. However, for this guide, we're focusing on individual taxes. Let's take a look at each.

Crypto Capital Gains Tax

You'll pay Capital Gains Tax in Ireland anytime you make a gain (profit) from disposing of an asset - including crypto. Though it might be unfamiliar terminology, the simplest way to think of a disposal is anytime an asset changes hands. For crypto, this includes:

Selling crypto for Euros or another fiat currency.

Swapping or exchanging one crypto for another.

Spending crypto on goods and services.

Gifting crypto - excluding to your spouse or civil partner in most instances.

If you received compensation or an insurance payout for a crypto asset.

If you have a chargeable gain from a disposal of crypto, you'll pay Capital Gains Tax on that gain.

Capital Gains Tax Rate Ireland

The Capital Gains Tax rate in Ireland is 33%, so you'll pay a flat 33% tax on any capital gain over the personal exemption amount. Each tax year, the first €1,270 of your capital gains (or your gains after deducting losses) are exempt from Capital Gains Tax. Both residents and non-residents are entitled to this exemption.

Crypto capital losses

We've focused on gains so far, but most crypto investors know that investments don't always pan out that way. If you've made a loss from disposing of crypto - meaning its value at the point of disposal is lower than the price you acquired it at - then you have an allowable loss. But capital losses aren't all bad news, you can use them to lower your Capital Gains Tax bill. This is because you can offset capital losses against capital gains.

As well as this, if you have no gains to offset your losses against, you may carry these losses forward to offset against gains in future financial years.

You may also transfer allowable losses to your spouse or civil partner to offset against their capital gains.

An exception to this rule is for assets acquired and disposed of within four weeks. Losses from these assets may not be offset against gains generally, unless those gains were made from an asset of the same kind also acquired and disposed of within four weeks.

Lost or stolen crypto

Many investors have lost crypto - whether it's to a scammer, hacker, or due to a rug pull. In most instances, it's nigh on impossible to get your crypto back - but you might be wondering whether you can at least claim your lost or stolen crypto as a capital loss.

Well, Revenue doesn't have any specific guidance when it comes to lost or stolen crypto. However, they do have guidance on disposals where assets lost or destroyed become of negligible value, which may apply to crypto assets.

This guidance states that where property is destroyed, there may be a consideration for a capital loss equal to its market value at that time. The guidance also states that where assets have become of a negligible value, there may be a consideration for a capital loss equal to the market value provided there is no ready mechanism available to the investor to dispose of the asset.

All claims for a capital loss or negligible value claim are decided on a case-by-case basis by a Revenue inspector. You should speak to a tax advisor or Revenue for more information.

How to calculate crypto gains and losses

Calculating capital gains and losses works the same way for crypto as it does for trading more traditional assets.

A capital gain or loss is the difference in value from when you acquired your crypto asset to when you sold or otherwise disposed of it. If the value has increased, you have a capital gain. If the value has decreased, you have an allowable loss.

To calculate this, you need to know the asset's original value - also known as the cost basis. The cost basis is generally whatever your asset cost you (in EUR) plus any related fees, like purchase or sale fees. If you otherwise acquired your asset - for example, via a trade of crypto - identify the fair market value in EUR of the asset on the day you acquired it.

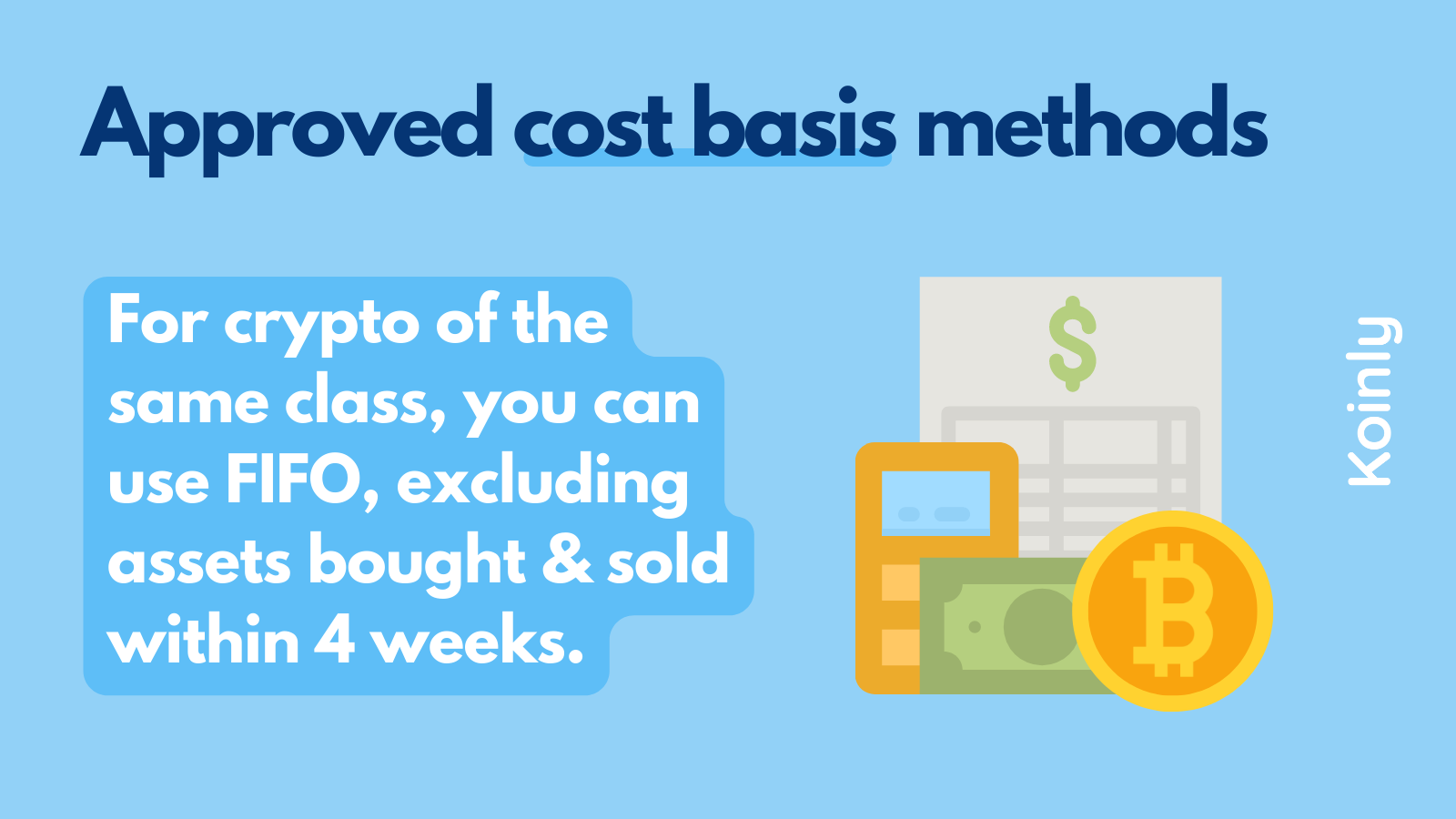

Crypto cost basis method

Though the above sounds simple, the reality is most crypto investors hold multiple crypto assets and have made many disposals throughout a single financial year.

For example, if you owned 3 BTC all acquired on different dates and for different prices and you sold 1 BTC in a financial year - how do you know which cost basis to use?

Revenue doesn't have specific guidance for this when it comes to cryptocurrency, however, there is extensive guidance for identifying cost basis and calculating CGT for shares and it's likely this guidance would apply to cryptocurrencies as well as other capital assets.

For cryptocurrencies of the same class (for example, multiple units of ETH) that you acquired on different dates and have disposed of, you should use what's known as the First In First Out (FIFO) accounting method. Using FIFO, your cost basis for assets is calculated using the cost of the asset you bought or acquired first. So for example, if you held 3 ETH, bought in January, April, and August respectively, and sold 1 ETH that financial year, you'd use the cost basis from your ETH purchase in January to calculate your capital gain or loss from your disposal.

An important exception to the FIFO rule applies to crypto assets bought and disposed of within four weeks. If you bought and disposed of crypto within four weeks, the crypto sold or disposed of is deemed to be the most recently acquired asset - even if you may have assets of a similar kind acquired before this date. In other words, you'll need to use the cost basis for the asset(s) you bought within the last four weeks if you dispose of the same kind of asset within four weeks.

If these assets are sold or disposed of at a loss, you may only offset the loss from a gain made on the disposal from the same class of assets acquired within the four weeks. So, you can't offset your losses from assets acquired and disposed of within four weeks against gains unless you also made a gain from a disposal from an asset you acquired and disposed of within four weeks. Quite a mouthful - but this rule is to stop investors from creating artificial losses to reduce their Capital Gains Tax bill.

Income Tax on crypto

As we mentioned earlier, there are also transactions where crypto will be subject to Income Tax upon receipt - as well as Capital Gains Tax if you later dispose of your crypto.

It's important to note that Revenue hasn't released any guidance on which specific crypto transactions may be subject to Income Tax upon receipt, however, it is likely that like other tax offices, crypto will be subject to Income Tax when you're seen to be earning an additional income in cryptocurrency. This could include:

Getting paid in crypto.

Mining rewards.

Staking rewards.

Airdrops of crypto.

Potentially a variety of DeFi activities where you earn new coins or tokens.

Creating and selling NFTs as an artist.

Income Tax Rate Ireland

Ireland has two Income Tax rates. The rate you'll pay depends on how much you earn and your individual circumstances - whether you're single, married, have children, and so forth.

| Tax Rate | Individuals with no dependent children | Individuals qualifying for Single Person Child Carer Credit | Married couples |

|---|---|---|---|

| 20% | €0 – €36,800 | €0 – €40,800 | €0 – €45,800 |

| 40% | €36,801+ | €40,801+ | €45,801+ |

As you can see, the amount of Income Tax you'll pay on crypto will be either 20% or 40% depending on your total earnings for the year.

There are a variety of Income Tax credits, allowances, and reliefs available depending on your circumstances. For example, all single taxpayers receive a €1,775 allowance. You can see the full list of Income Tax credits, allowances, and reliefs on Revenue.ie.

How to calculate crypto income

To calculate how much crypto income you have and are liable to pay tax on, you must identify the fair market value of the crypto in EUR on the day you received it. You'll then pay tax at either 20% or 40% on this amount.

Capital Acquisition Tax on crypto

In their most recent guidance, Revenue states that Capital Acquisitions Tax (CAT) may apply when crypto is received by way of gifts or inheritance and that the value of the crypto received is the EUR equivalent at the time of the gift or inheritance - but the guidance ends there!

The general CAT guidance states that Capital Acquisitions Tax applies to many gifts and inheritances, although each individual may receive gifts and inheritances up to a set value over their lifetime before being liable to pay CAT. Once CAT is due, you'll pay a flat 33% rate.

There are multiple CAT 'groups' each with a different lifetime limit before CAT applies. You can see more about this on Revenue.ie, but in brief Group A is gifts from parents, Group B is gifts from other immediate family members or lineal ancestors, and Group C is any disponer not covered in groups A or B.

For gifts not from parents or immediate family members that fall into group C, the lifetime tax free threshold for gifts is €16,250. For group B, the lifetime tax free threshold is €32,500 and for group A, the lifetime tax free threshold is €335,000. In other words, if you receive a gift of crypto and you have received gifts in value over these thresholds throughout your lifetime, you will be liable to pay CAT at 33%.

It's important to note that you will not pay CAT on a gift or inheritance of crypto if it is given to you by your spouse or civil partner.

You will also not pay CAT on a gift with a value of less than €3,000 from any one person in any one financial year.

DeFi taxes

As the DeFi market is relatively new, Revenue has no specific guidance for DeFi taxes. Before you celebrate though - this doesn't mean you won't pay taxes on your DeFi investments. Instead, you'll need to interpret the current guidance and determine whether you have a capital gain via a disposal, or whether you have income.

As such, we would always recommend seeking the advice of an experienced crypto accountant in Ireland if you have DeFi investments - we can even help you find one via our Ireland crypto accountants directory.

This said, from interpreting the current guidance - we can infer some potential tax treatment. It will all come down to how your specific protocol works.

Most DeFi protocols utilise liquidity pools - whether that's a dex, a lending protocol, or a staking protocol. It's how this pool functions - that will define the tax treatment. For example, if you're making a trade on a dex like Uniswap, this is pretty straightforward - you're disposing of one crypto asset and as such you need to calculate a capital gain or loss. But some transactions are a little more confusing - like if you're adding to liquidity pools in order to earn a reward. In many instances, when you add capital to a liquidity pool, you'll receive a liquidity pool token in return. This could be viewed as a crypto to crypto trade and as such a capital gain or loss must be recognised.

How your rewards are paid out matters too. If you're earning rewards through a token accruing value - like a liquidity pool token - you won't realise a gain until such a point that you make the transaction to remove your capital. As such, this could be viewed as more akin to a disposal and a capital gain or loss must be calculated. However, not all rewards are paid out like this. Some DeFi protocols instead pay out new tokens as a reward - and in fact, some DeFi protocols utilise both liquidity pool tokens and new tokens. If you're earning new tokens, this could be viewed as more akin to additional income, and as such you may need to identify the fair market value of the tokens in EUR on the day you received them and pay Income Tax on that amount.

NFT taxes

Though non-fungible tokens are unique by nature, from a tax perspective - they're treated exactly the same as any other crypto asset. This means when you dispose of an NFT by selling, swapping, spending, or gifting it, you'll pay Capital Gains Tax on any profit.

Meanwhile, if you're creating and selling NFTs - like an artist - you may be viewed as making an additional income and be liable for Income Tax on those earnings. There is no guidance on whether the Artist's Income Tax Exemption would apply to NFTs and we would encourage any NFT creators to speak to an experienced tax advisor.

Margin trading, derivatives, and other CFDs

Like with DeFi, Revenue has no specific guidance on the tax implications of crypto margin trading, crypto derivatives, or other crypto CFDs and in fact, the guidance on margin trades, derivatives, and other CFDs in more traditional financial markets is sparse too. As such, we recommend seeking the advice of an experienced accountant if you're involved in any of these trades to ensure you remain compliant.

It is important to note the difference between margin and derivative trading though as the tax implications may be quite different. On a margin trade, you're borrowing funds (or leverage) to carry out a trade, while for derivatives like futures, you are speculating on the price of an asset at a given point in time - like a bet.

With a lack of clear guidance, the conservative approach is to treat any profit at the time you close your position as a capital gain and pay Capital Gains Tax on any chargeable gains. However, if you're doing this at scale, you may be considered to be earning an income and as such may need to follow sole trader tax guidance.

With the foundations out the way... let's take a look at a variety of transactions and the kind of tax that would apply.

Which transactions are subject to Capital Gains Tax?

Selling crypto for EUR

CAPITAL GAINS TAXAny profit from selling crypto for euros is subject to Capital Gains Tax at 33% if it's over the personal exemption amount of €1,270.

EXAMPLE

You bought 1 BTC in January for €30,000 and paid a 0.05% fee, making your total cost basis for the asset €30,015. You sold 1 BTC in July for €35,000.

To calculate your gain or loss, subtract your cost basis from your sale price.

€35,000 - €30,015 = €4985. You have a capital gain of €4985 and you'll need to pay Capital Gains Tax at 33% on this amount.

Trading crypto for crypto

CAPITAL GAINS TAXSwapping one crypto for another crypto is a disposal and any gain is subject to Capital Gains Tax at 33%. This includes swapping cryptocurrency for stablecoins and NFTs. It may also include swapping cryptocurrency for liquidity pool tokens, though Revenue has not released guidance on this yet.

EXAMPLE

You bought 1 ETH for €2,000 in June. You decide to swap your 1 ETH for USDT in September. You swap your 1 ETH for 2490 USDT. Let's do the calculations.

At the time of the transaction, the fair market value of 1 ETH is €2,500. Subtract your cost basis from the fair market value at the time of the disposal.

€2,500 - €2,000 = €500. You have a capital gain of €500 which you may need to pay Capital Gains Tax at 33% on if you're over your personal exemption amount of €1,270 for the year.

As for your new USDT assets, you need to identify your cost basis for the assets so you can calculate any subsequent capital gain or loss in the future. USDT is pegged at a 1:1 ratio with the US dollar, so we know 2490 USDT is equivalent to $2490. However, you need your cost basis to be in euros, which is €2,500 at the time of the transaction. To identify the individual cost basis of each USDT unit should you dispose of them individually, divide your total figure by the amount of units.

Spending crypto on goods or services

CAPITAL GAINS TAXRevenue is clear in their updated guidance that using crypto to purchase goods is a disposal for CGT purposes and any gain or loss arising must be calculated.

EXAMPLE

You use a crypto debit card to buy a PS5 at Currys using BTC. The price is €499. On the day of the purchase, €499 is equivalent to 0.025 BTC.

On the day you originally purchased BTC, 0.025 BTC was valued at €550. Subtract the fair market value on the day of the purchase from your cost basis.

€499 - €550 = - €51. You have a capital loss of €51 which you may offset against any gains over the personal exemption amount, or carry forward if you have no gains over the amount.

Gifting crypto

CAPITAL GAINS TAXGifting crypto assets is seen as a disposal for CGT purposes.

However, there is an exemption that states an asset transferred between spouses or civil partners is usually exempt from CGT, this includes divorced spouses and separated or former civil partners. This exemption does not apply where you transfer trading stock of a business carried on by you to your spouse or civil partner, if you transfer an asset to your spouse or civil partner who is a non-resident, or if you transfer an asset to your former spouse or civil partner that is not covered by a court order.

The bad news keeps on coming, because the recipient of your gift may also be liable for Capital Acquisition Tax depending on your relation to them and their circumstances.

Which transactions are subject to Income Tax?

Getting paid in crypto

INCOME TAXGetting paid in crypto is seen as any other kind of salary or income, and as such it's subject to Income Tax. You'll need to identify the fair market value of any crypto on the day you received it in EUR to calculate your income. This figure will be subject to Income Tax.

Crypto mining

INCOME TAXMining rewards may be subject to Income Tax upon receipt, unless you're mining as a business in which case you'll pay Corporation Tax instead. Not only this, but you'll also pay Capital Gains Tax on any gain if you later sell, swap, spend, or gift mined coins.

There's a small silver lining though - you may be able to deduct a variety of allowable expenses related to mining such as electricity costs.

Crypto staking

INCOME TAXStaking rewards - whether received as a result of direct participation in a PoS mechanism or received as a result of third-party staking or staking through DeFi protocols - are likely subject to Income Tax upon receipt.

Crypto airdrops

INCOME TAXAirdrops of crypto - whether that's through participation in an event or for undertaking a specific activity are also likely subject to Income Tax upon receipt. You'll need to identify the fair market value in EUR of any airdropped crypto on the day you receive it to calculate your income.

Which transactions are subject to Capital Acquisition Tax?

Receiving a gift of crypto

CAPITAL ACQUISITION TAXIf you receive a gift of crypto that is worth more than €3,000 - that is not from your spouse or civil partner - and you're over the lifetime tax free threshold for the group you receive your gift from, you'll need to pay Capital Acquisition Tax at 33%.

Which transactions are tax free?

Buying crypto with EUR

It's not all bad news, buying crypto with euros is tax free. Although you should keep track of your cost basis (and any allowable expenses!) to make it easy to calculate your subsequent capital gains or losses in the future.

Hodling crypto

You'll be rewarded for diamond hands in Ireland because hodling crypto is tax free.

TAX FREETransferring crypto between your own wallets

Need to move your crypto from a hot to a cold wallet? Fortunately, transfers of crypto between your own wallets are tax free.

A caveat though - the transfer fees associated with these transactions might not be. Though Revenue has no specific guidance on this yet, there is the potential that transfer fees may be viewed as spending crypto and therefore a disposal.

When to report your crypto taxes

There are a few tax deadlines in Ireland that you need to know about when it comes to your crypto taxes.

The financial year in Ireland runs from the 1st of January to the 31st of December each year - but for Capital Gains Tax, there are actually two different periods you need to know about.

The first period runs from the 1st of January until November the 30th. If you made a profit from crypto disposals, you must pay the tax due before the 15th of December of the same year.

The second period runs from December the 1st until December the 31st. If you made a profit from crypto disposals, you must pay the tax due before January 31st of the following year.

Finally, the tax return where you declare all your gains from crypto for the financial year (as well as any crypto income) is due October 31st of the following year.

This means you're currently reporting on the 2023 financial year. You'll pay any CGT tax due on the 30th of November 2023 and the 31st of January 2024 from the 2023 financial year, but you need to declare your gains (or losses) to Revenue by the 31st of October 2024.

How to file your crypto taxes

All your taxable gains and income from crypto must be reported in your annual tax return by the 31st of October.

You can do this using the Revenue Online Service (ROS) or myAccount. You'll need to register for Revenue Online Service if you haven't previously used it. Learn how to register on Revenue.ie.

If you prefer to file by paper, there are two forms you may need - depending on whether you're a PAYE worker or self-employed.

PAYE workers should use Form CG1 (Capital Gains Tax Return and Self-Assessment).

Self-employed or chargeable persons should use Form 11 (Income Tax Return and Self-Assessment). A chargeable person is an individual with either; net assessable non-PAYE income of €5,000 or more in a year, or total gross income from non-PAYE sources of €30,000 or more in a year.

How to calculate your crypto taxes with Koinly

Now you know how crypto is taxed, as well as when and how to report your crypto to Revenue, you need to know how to calculate your crypto taxes to get all the information you need.

There are two ways to do this - DIY or using a crypto tax calculator, but the latter is much easier.

If you're doing it solo, you'll need to identify each taxable transaction of crypto - so anytime you made a disposal or earned income. You'll then need to calculate each capital gain or loss, as well as identify the fair market value of any crypto income in EUR on the day you received it. If you're an active trader - this is a lot of work, which is why the majority of Irish crypto investors opt to use a cryptocurrency tax calculator like Koinly.

Don't get stuck in the busy work. Don't get it wrong. Don't rely on your accountant to know where to look. Use Koinly to generate crypto tax reports. Here's how easy it is:

Select your base country (Ireland), currency (EUR), and cost basis method (FIFO).

Connect Koinly to your wallets and exchanges. Koinly integrates with Binance, Coinbase, Kraken, and hundreds more. (See all)

Let Koinly crunch the numbers. Make a coffee.

Ta-da! Your data is collected and your full Complete Crypto Tax Report is generated!

To download your crypto tax report, upgrade to a paid plan from €39 per year.

Send your report to your accountant, or complete your Revenue submission yourself using the figures from your Koinly report.

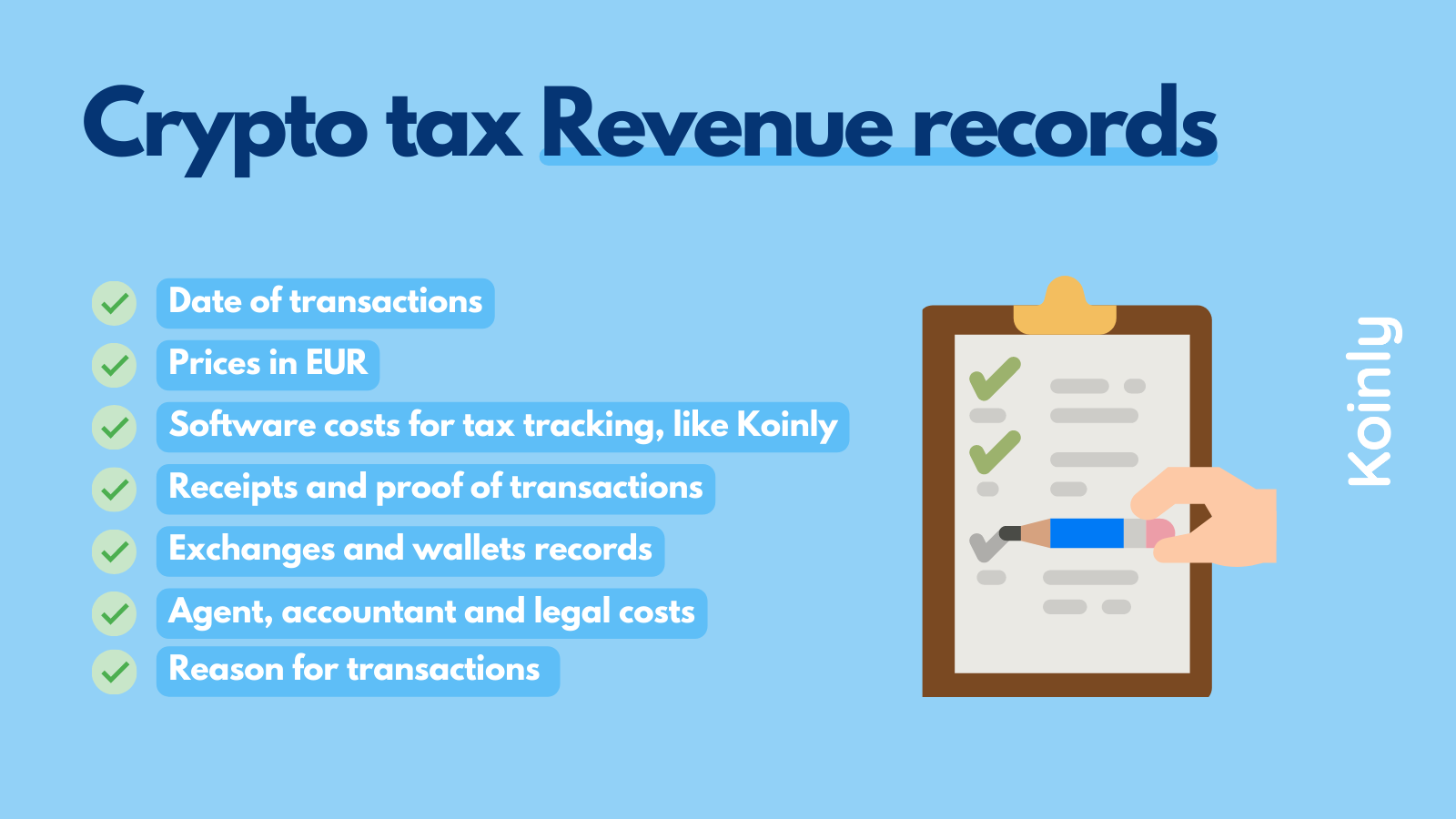

What records do Revenue want for crypto taxes?

Revenue is clear about its record-keeping provisions for cryptocurrencies. As a minimum, you'll need to keep records of:

Dates of the transactions.

Details about the asset (the kind of cryptocurrency).

The value (in EUR) of the asset at the time of the transaction.

Details of those involved in the transaction (i.e. wallet address) and the reason for the transaction.

It's really important you keep records as the tax office is clear that when requested, records must be made available to Revenue. You'll also need to retain your records dating back 6 years in line with legislation.

Koinly can help with your crypto record-keeping too. Many exchanges only keep your transaction data for a limited time, but Koinly stores your historical transaction data, so should you ever get a request from Revenue to share your records, you can easily get what you need from Koinly.

How to reduce your crypto tax bill in Ireland

The question on everyone's mind - how do I avoid paying tax on crypto in Ireland? For starters, you can't outright avoid crypto taxes - and you shouldn't. The penalties for tax evasion and avoidance in Ireland are severe - a fine of up to €126,970 and a prison sentence of up to 5 years!

This said, there are a number of steps and strategies you can take to reduce your crypto tax bill legally, including:

Utilise personal tax credits, allowances, and reliefs

There are a number of Income Tax credits, allowances, and reliefs available for all kinds of personal circumstances in Ireland - make sure you're getting all the credits, allowances, and reliefs you're entitled to. You can check the full list on Revenue.ie.

Utilise the personal exemption amount

Each investor gets a personal exemption amount from Capital Gains Tax each year. The first €1,270 of your capital gains, or your gains after deducting losses, are exempt from Capital Gains Tax.

Track and deduct allowable expenses

Tracking your precise cost basis can make a huge difference to your tax bill.

The majority of crypto exchanges charge trading fees whenever you buy, sell, or trade crypto, and you'll also pay gas fees (transaction fees) when you use DeFi protocols. Provided your fee is directly related to acquiring a crypto asset or disposing of a crypto asset - you can add these costs to your cost basis and then deduct them from your disposal price.

Koinly makes this simple by identifying your costs and fees for you.

Harvest unrealised losses and offset against gains

There are two kinds of losses - realised and unrealised losses. Realised losses are losses after you've disposed of an asset. Unrealised losses are when an asset you hold has depreciated in value, but you've not yet realised the loss as you still hold the asset.

Tracking and identifying these unrealised losses ahead of the end of the financial year can help you offset a large tax bill as you can harvest them (realise them by disposing of your asset) and reduce your gains down to your personal exemption amount.

Koinly can help you with this as not only is it a crypto tax tool, but you can also track the performance of your assets in your Koinly dashboard, including your unrealised losses and gains.