What is a Crypto Asset and How is it Taxed?

Is cryptocurrency money, like dollars and pounds, or is it something different all together? What about the term 'crypto asset' - is that the same thing? And how are cryptos like bitcoin and dogecoin even taxed?

Assets in accounting

An asset is a resource that is owned and can be tangible or intangible.

Tangible assets are physical such as property. Intangible assets are non-physical. Like, bonds, stocks, digital currencies, and intellectual property. Accounting-wise, we distinguish fixed assets from current assets.

Some of these are fixed assets, as it's hard to convert them to cash. Current assets on the other hand include cash itself and other assets that can be converted to cash a year.

Definition of a crypto asset

A crypto asset is a digital representation of value that is not issued by a central bank, but is traded, transferred, and stored electronically by natural and legal persons for the purpose of payment, investment, and other forms of utility and applies cryptography techniques in the underlying technology

A crypto asset and a cryptocurrency have the same definition from an accounting perspective. While most of us understand crypto to be a digital currency in its own right, cryptocurrencies are not considered money in most parts of the world, as it does not have legal tender. Instead, crypto is classified as property in most countries, and property is an ‘asset’ for tax purposes.

Examples of crypto assets are Bitcoin and Ethereum.

Different types of crypto assets

Crypto assets can be categorized by their features and purposes.

Coins: include Bitcoin and altcoins like ETH, DOGE, SOL, and XRP.

Stablecoins: the value of a stablecoin is pegged to a fiat currency like the U.S. dollar. Tether was the first cryptocurrency marketed as a stablecoin — a breed of crypto known as fiat-collateralized stablecoins.

Tokens: are programmable assets that live within the blockchain of a given platform. Includes utility tokens like BAT and CRO.

How are crypto assets taxed?

We know that crypto is viewed as an asset by most tax authorities around the world.

When that asset changes hands - either by sale, swap, or as a gift - this event is what's known as a disposal. If there is a profit at the point of disposal, the profit can be taxed as a capital gain. Before you can arrive at a profit, you need to know what your Cost Basis was - in essence what the cost of the crypto asset was.

Cost Basis

Cost Base = cost of the crypto you bought + any fee that was involved in the acquisition of that asset, like a brokerage fee or a transaction fee.

Capital Gains Tax

A capital gain is the profit or loss you make from trading or selling any asset, including crypto:

Capital gain = selling price - buying price - fees

Your buying price + associated fees are also known as the cost-basis or just basis in accounting lingo.

When do you pay CGT?

In order to pay Capital Gains Tax you need to realize a gain, which typically happens when you sell your crypto asset and make a profit. But a sale is not the only way that you might realize a gain. Each time an asset changes ownership it triggers a taxable event called a disposal. CGT kicks in at the point of disposal - when there's a profit.

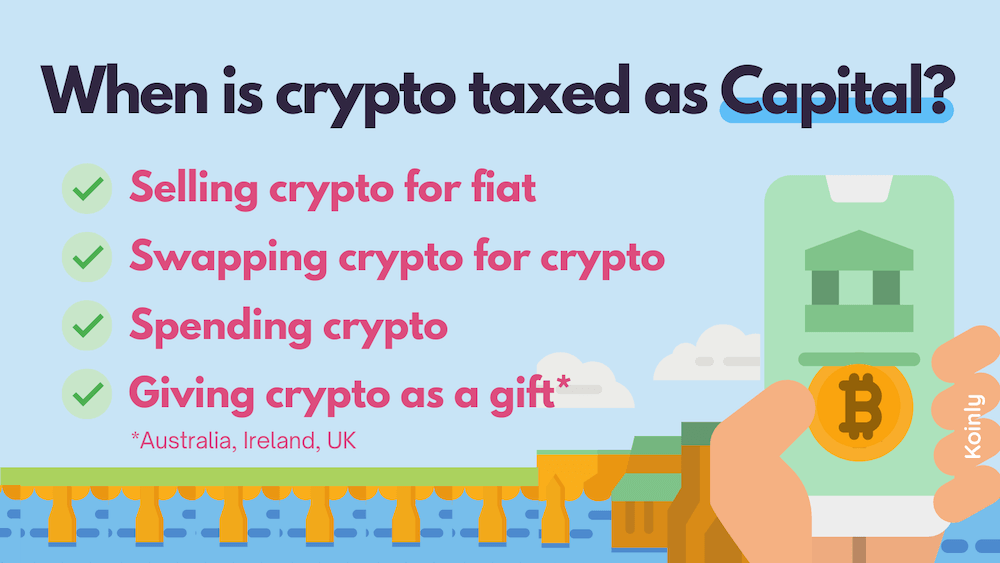

In most, but not all countries, you could pay CGT on your crypto disposals in these situations:

Selling: Profits from selling crypto for Fiat = CGT

Swapping: Profits from swapping crypto with crypto = CGT

Spending: Using cryptocurrency to purchase goods and services = CGT

Gifting*: Perceived profits made from gifting crypto = CGT

Gifting crypto is taxed in Australia and Ireland.

In the UK, crypto gifts can be given tax-free to a spouse or civil partner.

US taxpayers don't pay Capital Gains Tax on gifts valued at $17,000 or less.

How much do you pay?

Wondering how much tax you need to pay on your crypto asset? Typically, the amount of capital gains tax owed on crypto depends on how long you’ve held your assets for, and in which income tax bracket you are. Typically, the higher your income, the greater the percentage of tax you'll pay on capital gains.

Allowances and tax-breaks

Some countries will allow a certain amount of capital gains to be tax-free. In Germany for example, total capital gains under €600 per year are tax-free, and crypto sold after a holding period of one year is tax-free. Australia offers a 50% Capital Gains Tax discount on crypto held for a year or more.

Short-term Capital Gains Tax

Typically, any gain made from the disposal of a crypto asset - held less than a year - is taxed at the same rate as your personal income tax rate.

Long-term Capital Gains Tax

It pays to HODL. Many countries allow special treatment for gains made on crypto assets that were held for at least one year for example:

Germany does not tax capital gains on crypto held for more than 1 year.

Australia allows a 50% capital gains discount

USA applies a reduced capital gains tax rate of 0%, 15%, or 20% tax depending on individual or combined marital income.

What is a capital loss?

Just as your crypto disposals can raise a profit, they can also introduce a loss. Most countries allow investors to carry their capital loss forward, to offset against capital gains in later years. Koinly can track this for you, potentially saving you on future tax bills.

When do you pay Income Tax?

Crypto asset transactions that are classified as income are taxed at your regular Income Tax bracket. Remember, the day that you dispose of the crypto income you earnt you will very likely be up for Capital Gains Tax upon disposal.

Crypto asset transactions that are classified as income are taxed at your regular Income Tax bracket. Remember, the day that you dispose of the crypto income you earnt you will very likely be up for Capital Gains Tax upon disposal.

Income can come from:

Getting paid in crypto - like a salary.

Staking rewards and liquidity pools - like dividends.

Forks - excluding soft forks when no new coin is received.

Mining tokens - like income.

Airdrops - like bonuses.

DeFi interest - like bank account interest.

Referral bonus - like commission.

How do you report your crypto asset tax?

A crypto tax calculator like Koinly will show you gains from coins that were sold after 1 year of purchase as long-term capital gains in your tax report. This makes it easy to apply a reduced capital gains tax rate or discount on such assets.