🇦🇺

Crypto Tax Calculator for Australia

Calculate Your Crypto, DeFi and NFT Taxes in as little as 20 minutes. Quick, simple and reliable.

Built to comply with ATO tax standards

Free crypto tax preview

850+ integrations incl. Coinspot & Swyftx

We work hard to ensure we are compliant with Aussie tax rules - that’s why we’ve had our FIFO calculations reviewed by a reputable Australian third-party accounting firm. Read more

How Koinly Simplifies  Your Taxes...

Your Taxes...

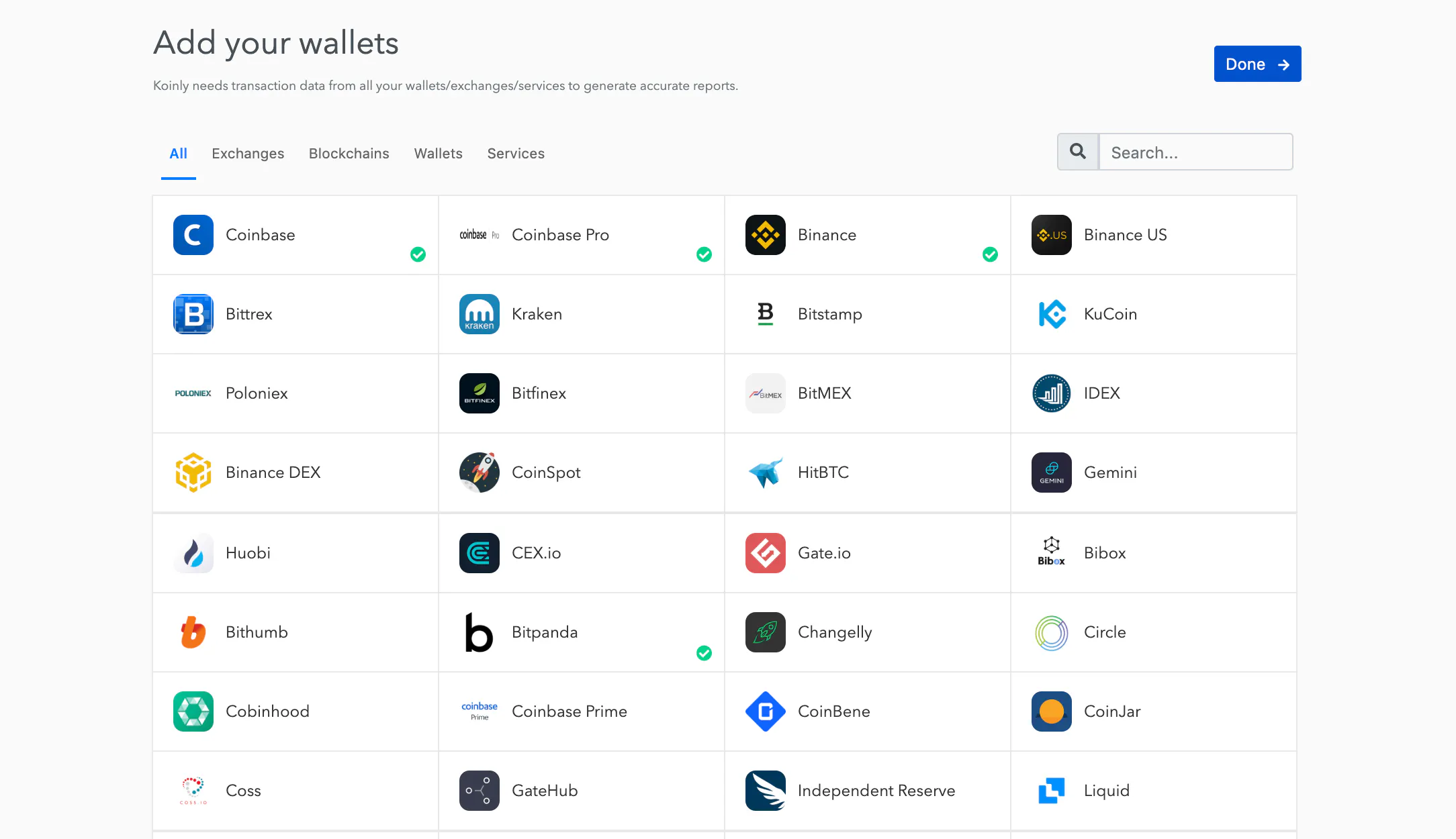

Easily import your trades

Koinly can pull data automatically from Australian exchanges like Coinspot, Swyftx, Coinjar and Independent Reserve.

DeFi, Margin trades & Futures. Whether you are staking on Kraken, lending on Nexo or going long on BitMEX. Koinly can handle it all.

Smart transfer matching. Koinly uses AI to detect transfers between your own wallets and keep track of your original cost.

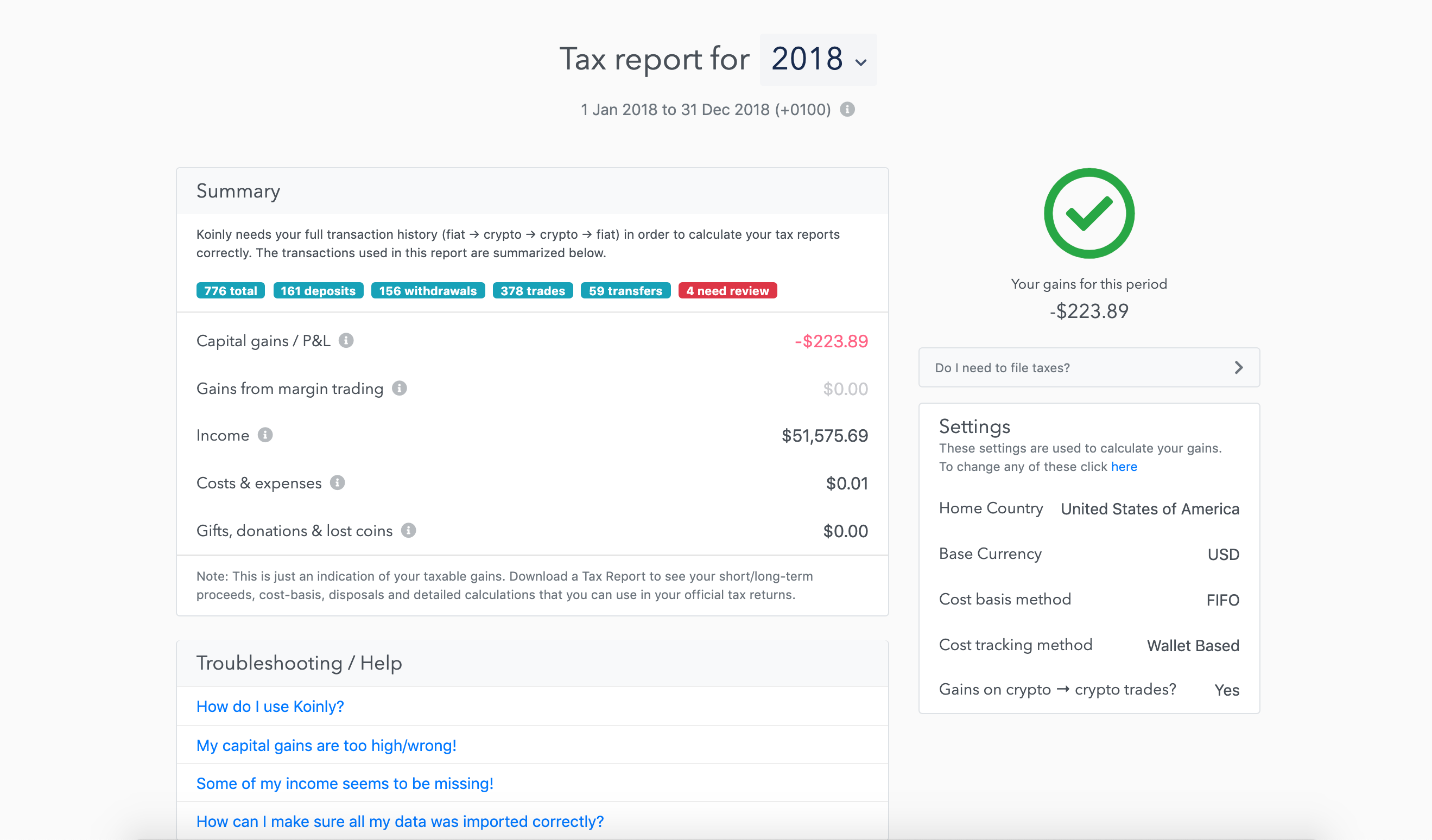

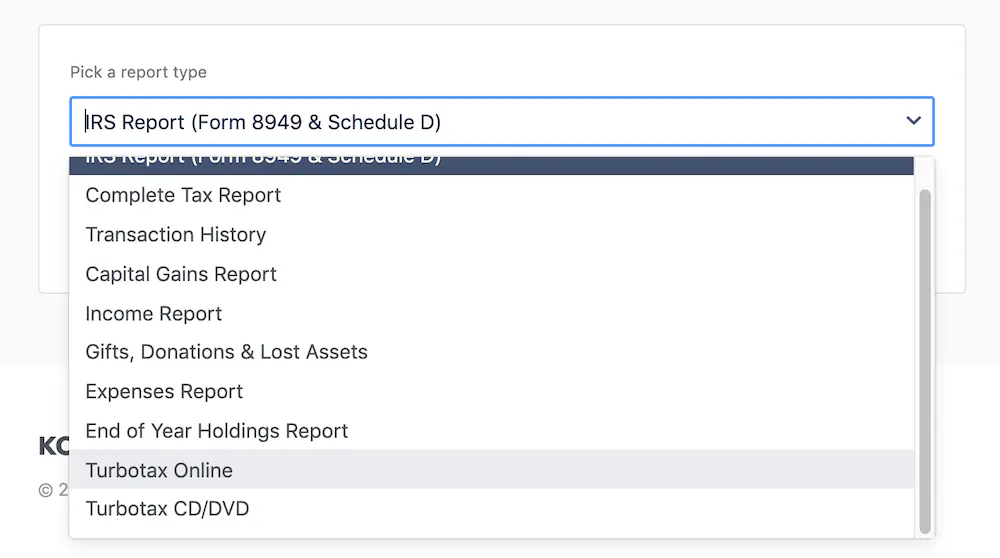

Download your tax documents

Whether you’re lodging your tax return yourself via myGov, or working with an accountant - Koinly has a range of crypto tax reports for you.

Capital gains report. Download your capital gains report, which shows all your short and long-term gains separately.

Comprehensive tax report. Generate a full crypto tax report inclusive of all your disposals.

"Huge time saver when it comes to taxes, very customizable and useful in planning next trades"

"Finally a tool that can handle DeFi operations properly! Very happy so far"

"Uploading data was very straightforward and easy. Will definitely be back next year!"

Crypto is on the ATO's radar again.

The ATO has put crypto holders on notice, stating crypto, DeFi and NFT trading activities are in the ATO’s crosshairs. If you’ve traded any crypto over the past financial year, it can be daunting trying to get all your transactions in one place. Koinly is designed to help cryptocurrency investors get their taxes in order quickly and easily.