#1 Crypto Tax Software in the United States

Don't get stung! Let Koinly calculate your crypto taxes & reduce your IRS tax bill. Simple & Reliable.

IRS compliant

Free report preview

Form 8949, Turbotax

Disclaimer: Koinly is not involved in the crypto exchange business and does not pertain to purchasing, holding, or exchanging cryptocurrencies.

Feeling clueless?

✅ Traded on lots of exchanges? ✅ coins spread across multiple wallets? ✅ no record of anything? We've been there too and that's why we built Koinly!

No more wasting hours downloading CSV files, formatting data, figuring out market prices, getting the tax calculations right etc.

No more. ✌

With Koinly you can import your ETH, BTC, Tezos and other transactions directly from the ledger, sync all your exchange trading history in one-click and get a ready-to-file tax report -- all in a matter of minutes!

The platform is excellent."The API sync process was seamless and the user interface is incredibly easy to navigate. I was recommended by a friend (also in the US), after struggling with other platforms. The TurboTax formatted report was imported instantly. I couldn't have asked for a better experience. Thanks!"

How Koinly Simplifies Your Taxes...

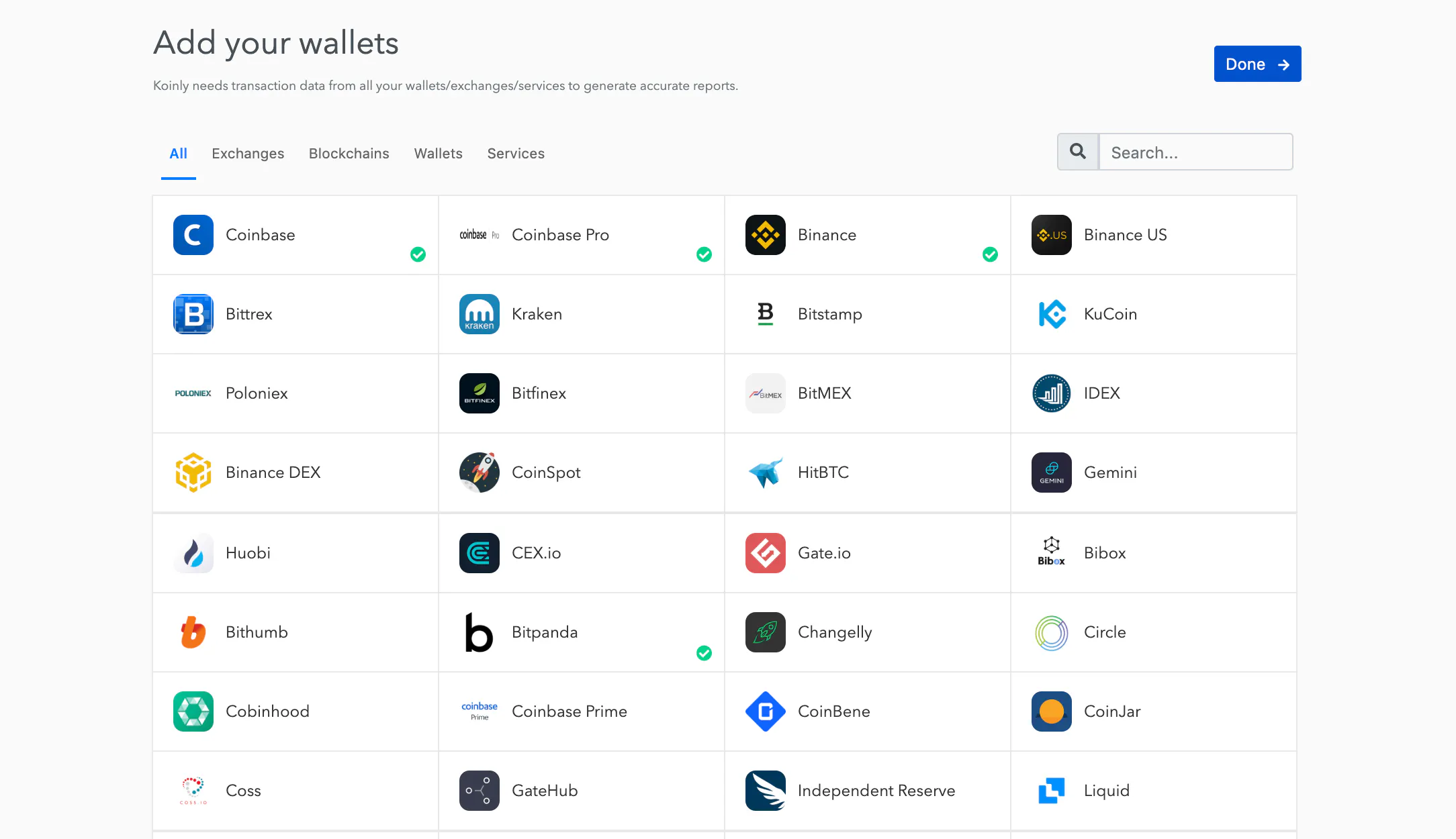

Easily import your trades

Add your exchange accounts via API or CSV files and connect your blockchain wallets using public addresses.

DeFi, Margin trades & Futures. Whether you are staking on Kraken, lending on Nexo or going long on BitMEX. Koinly can handle it all.

Smart transfer matching. Koinly uses AI to detect transfers between your own wallets and keep track of your original cost.

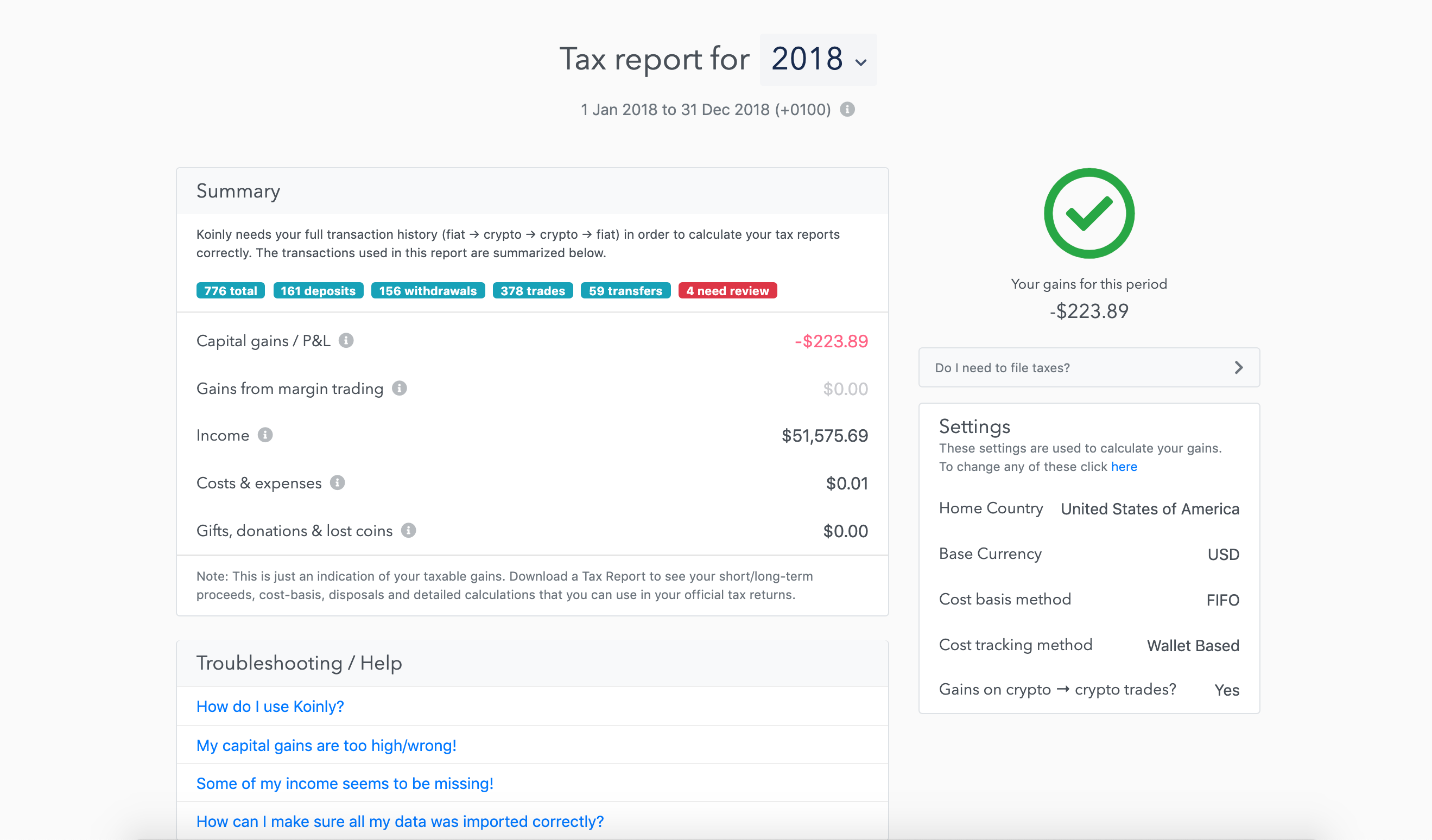

Preview your capital gains

Get a glimpse of your profit/loss for any tax year - for free!

Portfolio tracking. See your total holdings, ROI and growth over time on a beautiful dashboard.

Profit/loss & capital gains. Easily see how much you are up or down. View realized and unrealized capital gains.

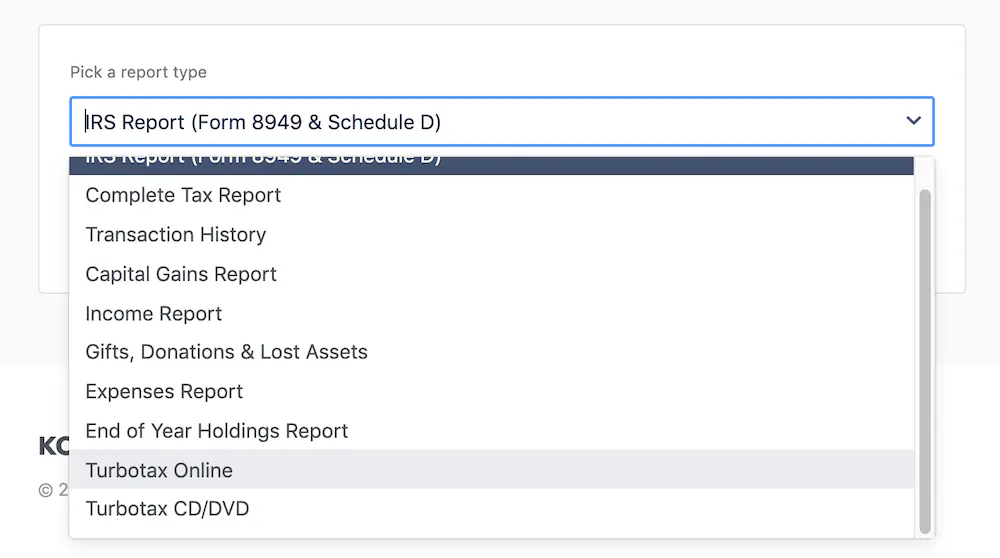

Download your tax documents

Whether you are filing yourself, using a tax software like TurboTax or working with an accountant. Koinly can generate the right crypto tax reports for you.

Form 8949, Schedule D. If you are filing in the US, Koinly can generate filled-in IRS tax forms.

Comprehensive tax report. Generate a full crypto tax report with all your long/short term disposals. Guaranteed to pass audits.

"I switched to Koinly last month and really loving it so far. Much better than cointracking. Good job!"

"It was easy to sync my accounts, the tax report was in good format and approved by BZSt. Great support."

"Team is very supportive, helped me import my Bibox transactions and guided me all the way. I have invited some of my friends to Koinly too and they are thanking me :D"