🇦🇺

See how much Crypto Tax you Owe the ATO

Confused about crypto tax rules? Let Koinly track your transactions & calculate your taxes automatically.

Built to comply with Aussie tax standards

Free crypto tax preview

750+ integrations incl. Coinspot & Swyftx.

Disclaimer: Koinly is not involved in the crypto exchange business and does not pertain to purchasing, holding, or exchanging cryptocurrencies.

Behöver man skatta Bitcoins?

Kryptovalutor beskattas i de flesta länder och även i Sverige. Detta oavsett om du växlar ETH till BTC, säljer BTC till Fiat eller får krypto genom staking/lending. Vid avyttring ska det deklareras.

Men... att räkna ut vinst/förlust vid handel med kryptovalutur tar väldigt lång tid om det sker utan hjälpmedel - dessutom är det riktigt svårt.

Problemet är följande...

Exempel: Du har köpt 1 Bitcoin på Coinbase och sedan skickat den till Binance där du sedan sålde av den vid fler olika tillfällen. Hur lång tid skulle det ta att räkna ut eventuell kapitalvinst?

För en av våra medarbetare tog det 45 minuter - för 10 transaktioner. Tänk dig om du hade betydligt fler transaktioner...

The platform is excellent."The API sync process was seamless and the user interface is incredibly easy to navigate. I was recommended by a friend (also in the US), after struggling with other platforms. The TurboTax formatted report was imported instantly. I couldn't have asked for a better experience. Thanks!"

How Koinly Simplifies Your Taxes...

Your Taxes...

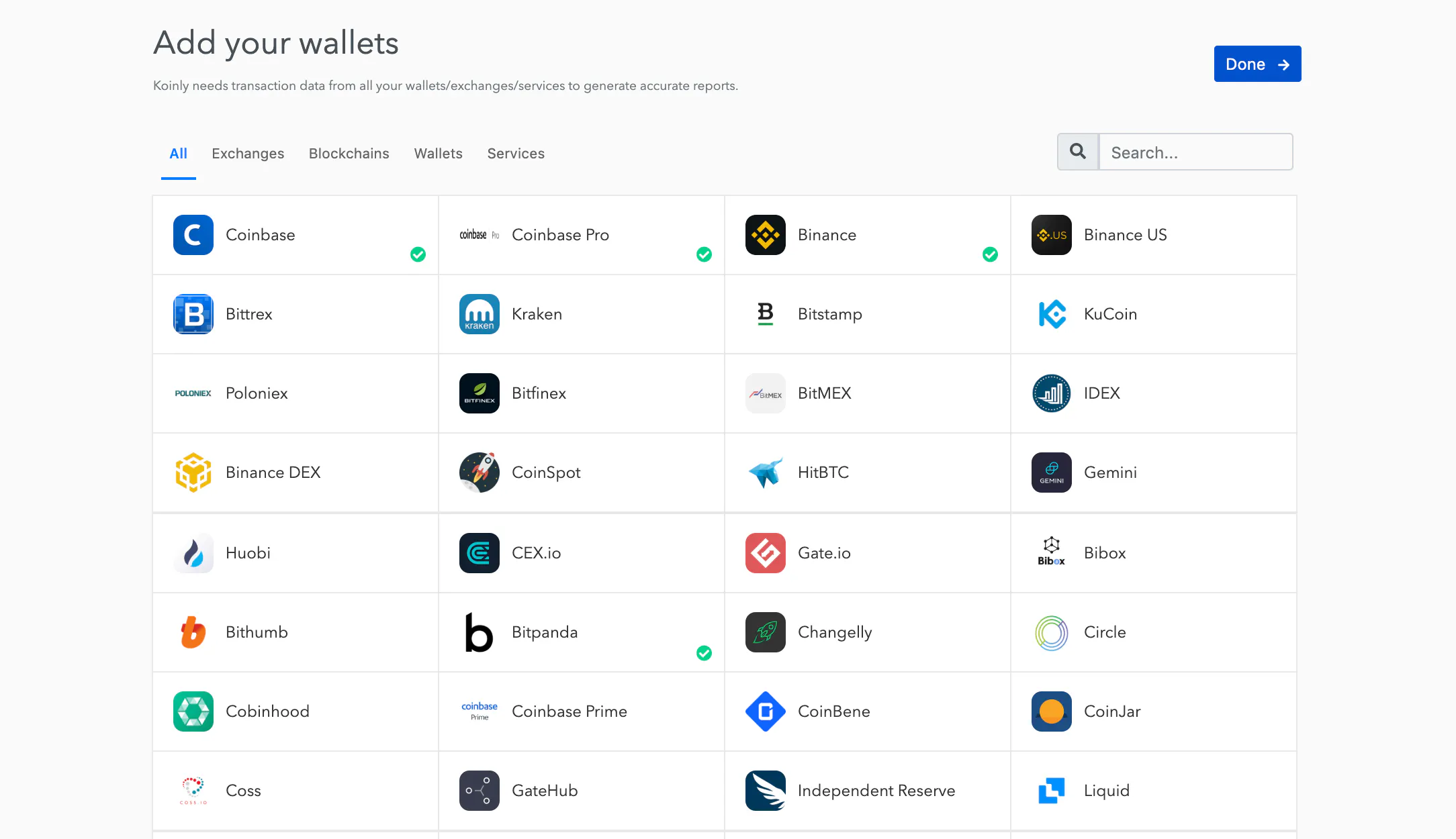

Easily import your trades

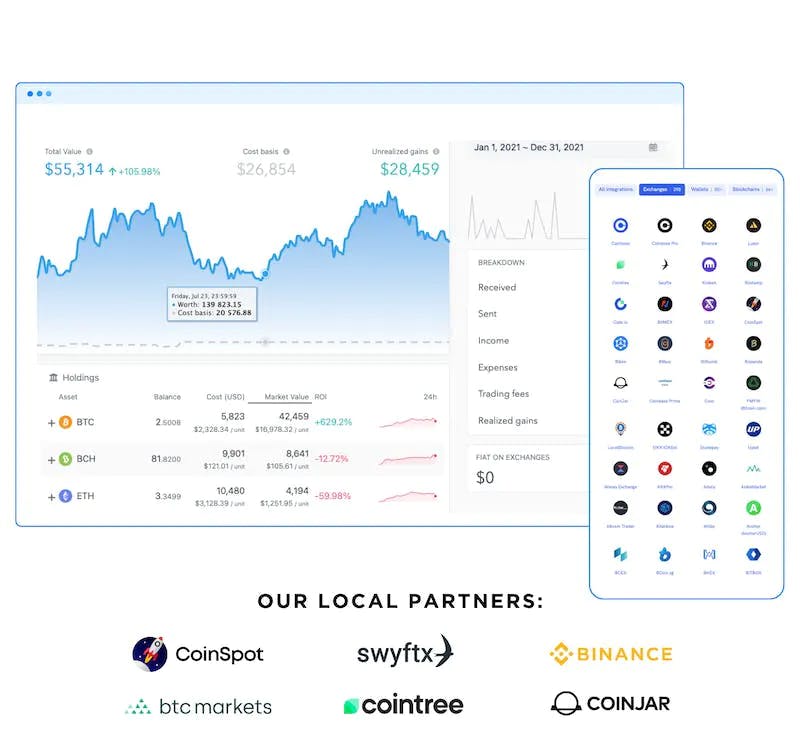

Koinly can pull data automatically from Australian exchanges like Coinspot, Swyftx, Coinjar and Independent Reserve.

DeFi, Margin trades & Futures. Whether you are staking on Kraken, lending on Nexo or going long on BitMEX. Koinly can handle it all.

Smart transfer matching. Koinly uses AI to detect transfers between your own wallets and keep track of your original cost.

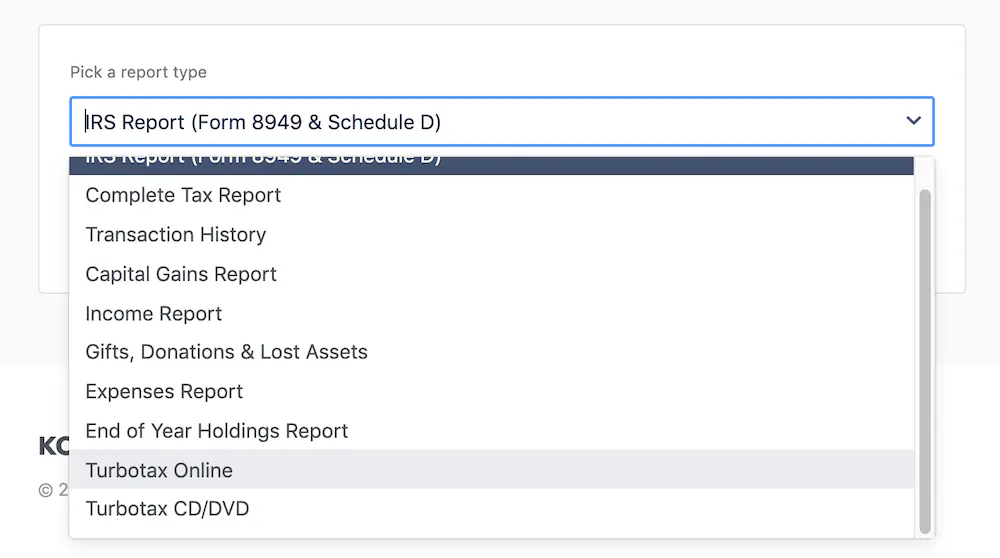

Download your tax documents

Whether you’re lodging your tax return yourself via myGov, or working with an accountant - Koinly has a range of crypto tax reports for you.

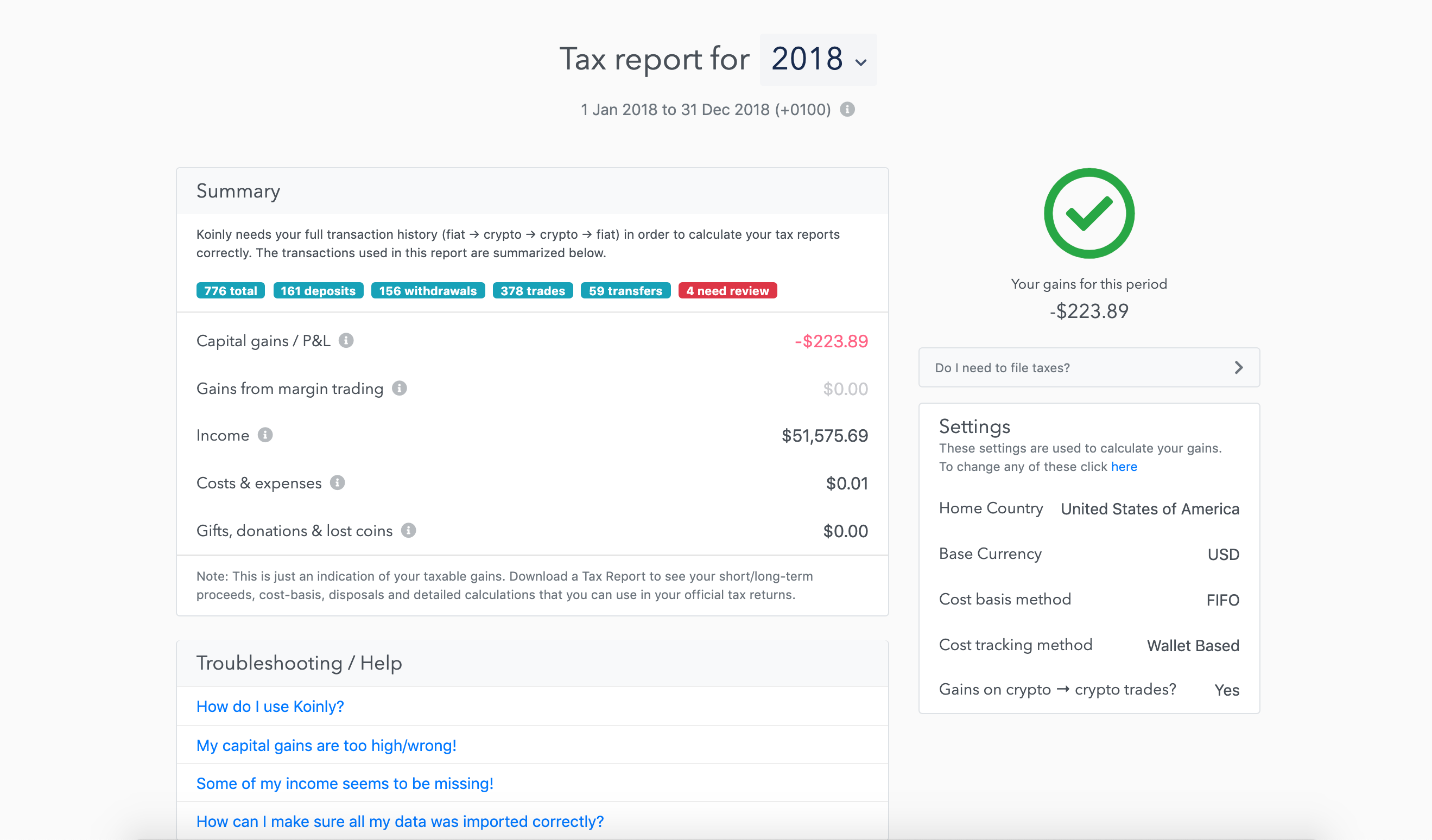

Capital gains report. Download your capital gains report, which shows all your short and long-term gains separately.

Comprehensive tax report. Generate a full crypto tax report inclusive of all your disposals.

"Huge time saver when it comes to taxes, very customizable and useful in planning next trades"

"Finally a tool that can handle DeFi operations properly! Very happy so far"

"Uploading data was very straightforward and easy. Will definitely be back next year!"