How to File Your Wealthsimple Taxes with Koinly

Wealthsimple is a popular investment management service for Canadian investors, providing access to a range of opportunities like crypto, stocks and ETFs from a safe and regulated provider. Koinly and Wealthsimple work a little differently from other crypto exchanges as Wealthsimple & Koinly partnered to provide a bespoke tax filing service. Here's how it works.

Sign up to Koinly and choose your country (Canada) and currency (CAD)

Connect all the wallets, exchanges, and blockchains you use with Koinly

Automatically import your data from Koinly to Wealthsimple, or download your Complete Tax Report and enter your info into Wealthsimple manually

Review & submit your Wealthsimple tax report to the CRA - you're done!

Does Wealthsimple report to the CRA?

Yes - Wealthsimple isn't just a crypto exchange. The platform also provides a self-filing tax service and therefore reports to the CRA.

How do I file my Wealthsimple taxes?

When it comes to crypto taxes, Koinly & Wealthsimple are partnered to make filing your crypto taxes as easy as possible - using a combination of Koinly's smart crypto tax software and Wealthsimple's awesome tax filing service. Here's how it works, step by step - both automatically and manually.

How to file your Wealthsimple taxes with Koinly automatically

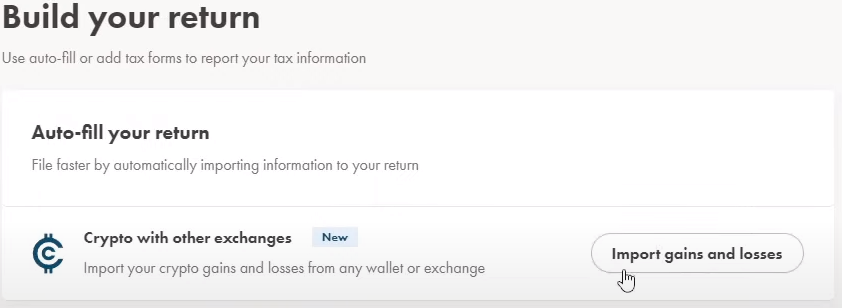

To import your Koinly data to Wealthsimple, locate the crypto section on your tax report on Wealthsimple and select import gains and losses.

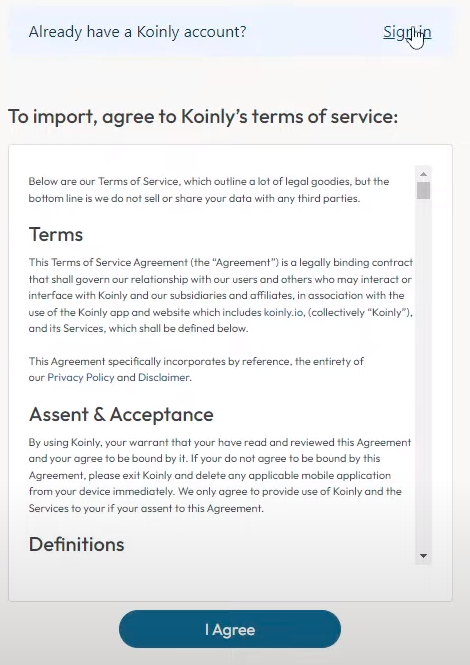

You'll then see the terms page. At the top of this page, you'll see the option to sign in to your Koinly account. This option is also accessible from the settings page within the Wealthsimple crypto tax calculator.

You'll then see the terms page. At the top of this page, you'll see the option to sign in to your Koinly account. This option is also accessible from the settings page within the Wealthsimple crypto tax calculator.

Once you have logged into Koinly from Wealthsimple, your accounts are linked and you'll be able to send the data from Koinly to Wealthsimple.

Once you have logged into Koinly from Wealthsimple, your accounts are linked and you'll be able to send the data from Koinly to Wealthsimple.

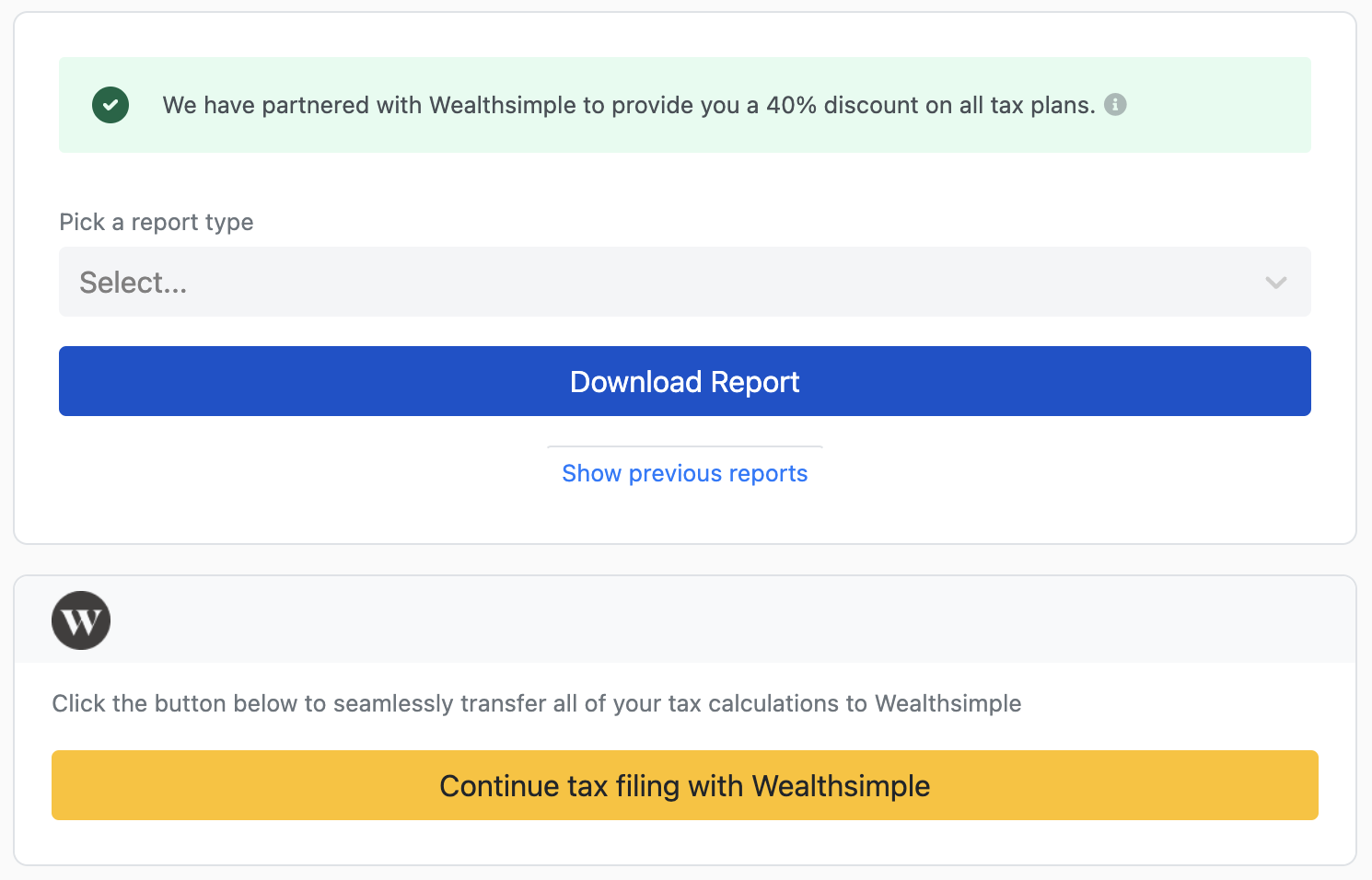

To do this, go to the tax reports page in Koinly and the yellow button that says continue tax filing with Wealthsimple (under download report). Select this button to transfer your tax calculations from Koinly to Wealthsimple. Please note that you'll need to be logged in to both accounts for this to work.

If you prefer not to connect your Koinly and Wealthsimple account, you can also find steps below on how to file manually.

How to manually report your crypto capital gains/losses in Wealthsimple

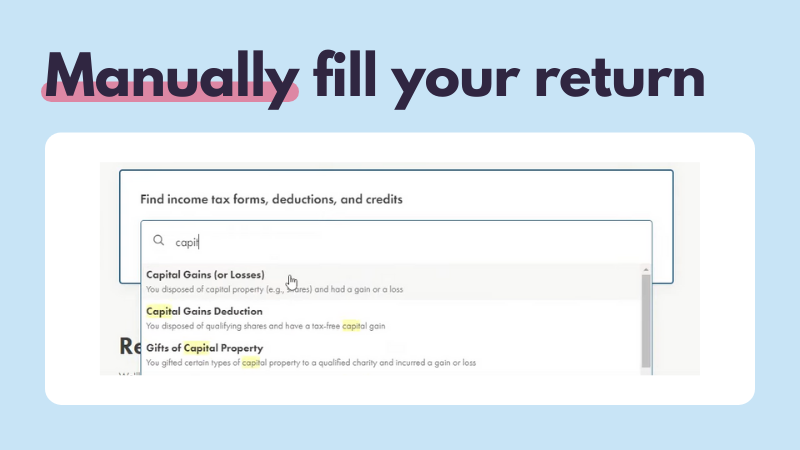

1. On Wealthsimple, under the "Build your return" section, go to the "find income tax forms, deductions and credits" and search "capital".

2. Select “Capital Gains (or Losses)”.

2. Select “Capital Gains (or Losses)”.

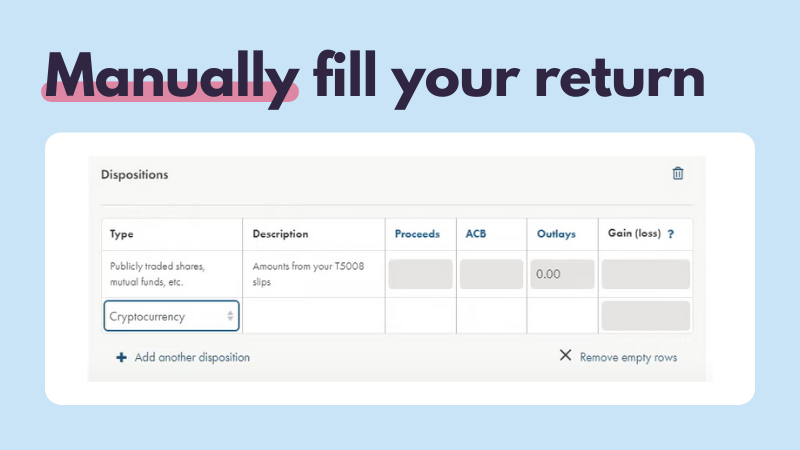

3. In the new form, take the information from your Koinly Complete Tax Report and copy and paste it into Wealthsimple as follows.

4. In the drop-down box under "type", select "cryptocurrency".

4. In the drop-down box under "type", select "cryptocurrency".

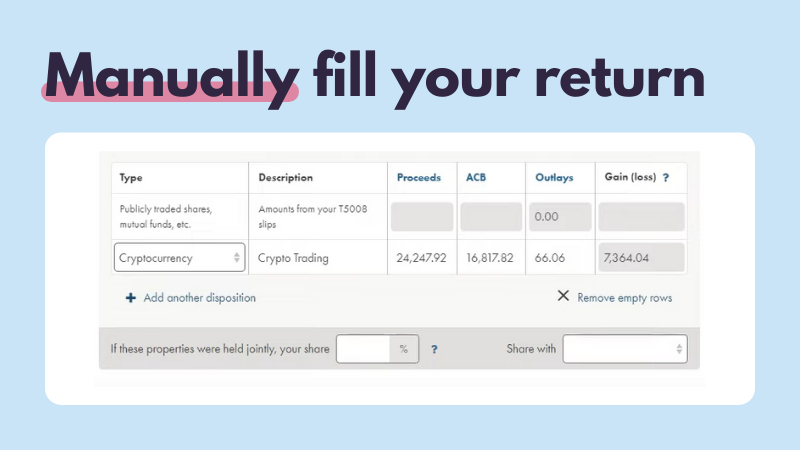

5. For “description”, enter a relevant description, for example, "crypto trading".

5. For “description”, enter a relevant description, for example, "crypto trading".

6. For "Proceeds", go to the Capital Gains Summary in your Koinly Complete Tax Report and copy and paste the figure next to "Proceeds from Sales".

7. For "ACB", go to the Capital Gains Summary in your Koinly Complete Tax Report and copy and paste the figure next to "Acquisition Costs".

8. For "Outlays", go to the Expenses section in your Koinly Complete Tax Report and copy and paste the total figure. These expenses are not costs included in your cost basis.

9. Fill out the section "if these properties were held jointly, your share" as it relates to you. You can find more information in our filing crypto taxes as a married couple Canada guide.

9. Fill out the section "if these properties were held jointly, your share" as it relates to you. You can find more information in our filing crypto taxes as a married couple Canada guide.

How to report crypto income in Wealthsimple

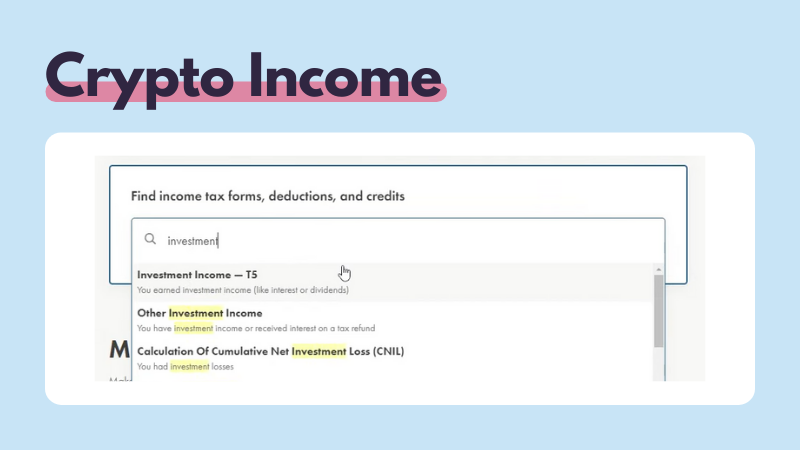

1. On Wealthsimple, under the "Build your return" section, go to the "find income tax forms, deductions and credits" and search "investment".

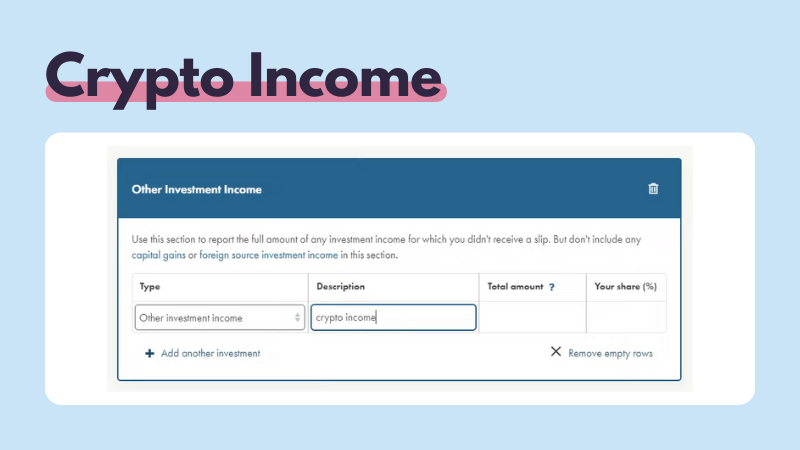

2. Under the new box titled "other investment income", take the information from your Koinly Complete Tax Report Report and copy and paste it into Wealthsimple as follows.

2. Under the new box titled "other investment income", take the information from your Koinly Complete Tax Report Report and copy and paste it into Wealthsimple as follows.

3. In the drop down box under "type", select "other investment income".

4. For "Description", enter a description of your income, for example "crypto income" or "crypto mining" as it relates to your investments. You don't need to separate out each type of income, but you can if you want to.

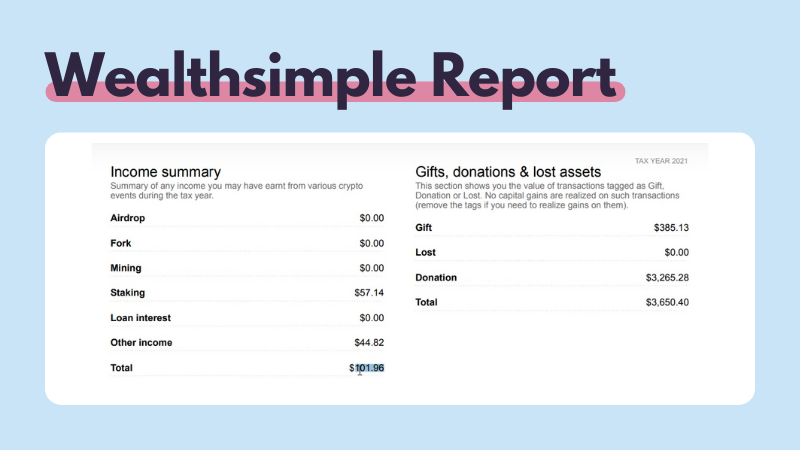

5. For "Total amount", go to the Income Summary in your Koinly Complete Tax Report and copy and paste the total figure.

5. For "Total amount", go to the Income Summary in your Koinly Complete Tax Report and copy and paste the total figure.

6. Fill out "Your share", as it relates to your personal circumstances. Refer to our filing as a married couple guide if you need help.

6. Fill out "Your share", as it relates to your personal circumstances. Refer to our filing as a married couple guide if you need help.

Finishing off your Wealthsimple crypto tax report

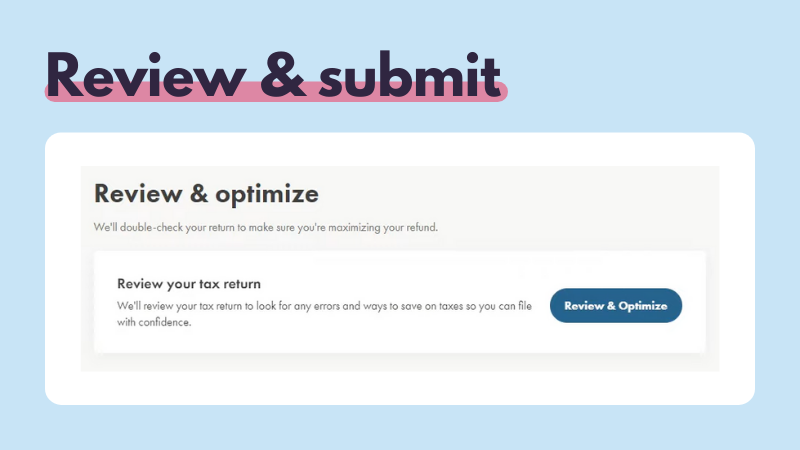

Once you've submitted your crypto capital gains and income, there are a few bits left you need to do to complete your Wealthsimple crypto tax report...

1. Head to "Review & optimize". You can find this by scrolling down or in the left-hand menu. Review your information to ensure it's correct.

2. Select submit.

2. Select submit.

3. You're done with your crypto taxes!

Your frequently asked questions

Does Wealthsimple generate tax documents?

Yes. Wealthsimple generates a range of tax documents depending on your investments and the filing service you're using. You can connect Koinly & Wealthsimple to generate a complete tax report (including crypto) and file with the CRA in no time at all.

Do I have to pay taxes on Wealthsimple?

Yes - if you have capital gains or income from investments on Wealthsimple, you're liable to pay tax on them - and you should, the CRA does not look kindly on tax evaders.

Do I need tax documents from Wealthsimple?

Yes. If you have investments on Wealthsimple - whether that's crypto, stocks or ETFs, you'll need tax documents to file with the CRA. Wealthsimple provides a tax filing service (alongside Koinly) to make this process simple!

How much are taxes on Wealthsimple?

The amount of tax you'll pay on Wealthsimple depends on your specific investments. You'll pay Income Tax (at your Federal and Provincial rate), on half of any gain, or the entirety of any income.

How do I file taxes from Wealthsimple?

When it comes to crypto, you can use Koinly & Wealthsimple's tax filing service to file your crypto taxes in no time at all, just check out our video and instructions above.