How to file your Coinbase taxes

More than 68 million people are using Coinbase to buy, sell, stake, and store their cryptocurrency assets. Whatever your crypto strategy on Coinbase, Koinly can help you do your Coinbase taxes safely, quickly, and accurately.

Sign up to Koinly and choose your country and currency

Connect Coinbase with Koinly to import all your Coinbase trades safely and securely

Koinly categorizes Coinbase transactions into gains, losses, and income

Koinly calculates your Coinbase Capital Gains Tax and Coinbase Income Tax

Download your Coinbase tax report from Koinly

File your Coinbase taxes online or with your crypto tax accountant

How to do your Coinbase taxes fast

How do I file my Coinbase taxes?

If you’ve made any income or capital gains from Coinbase, you will need to notify your country’s tax office. Generally, it will be included as part of your annual tax return.

There are a couple of ways you can identify what needs to be included in your tax return. You can either calculate it manually by yourself or you can use a crypto tax calculator like Koinly.

If you choose to do it manually, you need to identify your taxable transactions, calculate your net capital gain or loss, and the fair market value of any crypto income.

On the other hand, if you use a crypto tax calculator your taxable income will be calculated for you, and your Coinbase tax report will automatically be generated, ready to file with your tax office.

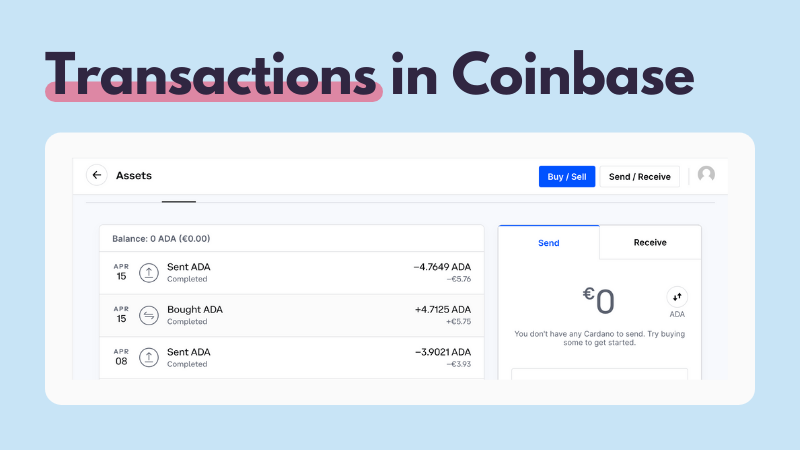

Koinly works by importing your Coinbase transaction data to analyze what's taxable, and what's not. Let's look at an example - here are some transactions in a Coinbase account.

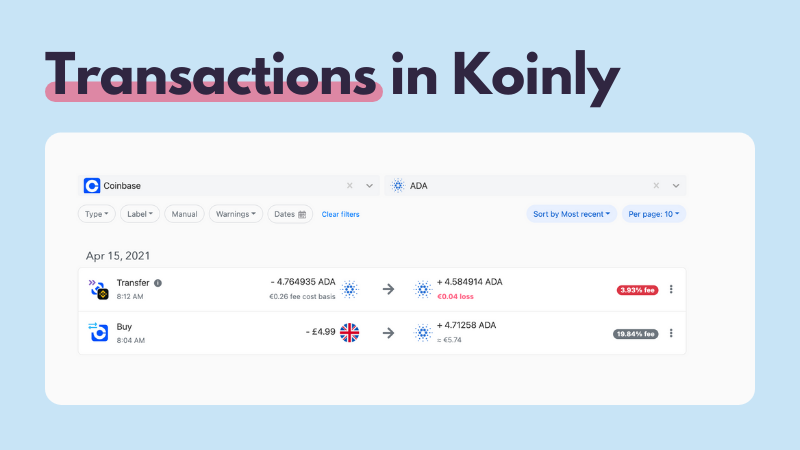

You can import your Coinbase transaction history via Koinly's API integration or by uploading CSV files of your Coinbase transaction history into Koinly. Once you've done this, you'll be able to see your Coinbase transactions in Koinly - like this.

You can import your Coinbase transaction history via Koinly's API integration or by uploading CSV files of your Coinbase transaction history into Koinly. Once you've done this, you'll be able to see your Coinbase transactions in Koinly - like this.

This lets you manage all your crypto transactions - from Coinbase and any other exchanges you use - from one single platform, making crypto tax simple. Here's how to import your Coinbase transaction data.

This lets you manage all your crypto transactions - from Coinbase and any other exchanges you use - from one single platform, making crypto tax simple. Here's how to import your Coinbase transaction data.

Koinly lets you manage all your crypto transactions - from Coinbase and any other exchanges you use - from one single platform, making crypto tax simple.

How to connect Koinly and Coinbase using API

On Koinly

Select add new wallet: Coinbase

Select set up auto-sync

The previous step will take you to the Coinbase website, sign in and authorize access for Koinly

Important

Coinbase & Coinbase Pro are merging soon. If you've previously used Coinbase Pro, you'll still need to sync your Coinbase Pro account separately with Koinly in order to get your complete transaction history - see how here.

The Coinbase API now supports the new 'advanced trade' transactions.

How to integrate Koinly and Coinbase using CSV

You'll need to start by downloading a CSV file with your full trading history from Coinbase before you can upload it to Koinly - here's how.

How to download and export your transaction history CSV file from Coinbase

Sign in to your Coinbase account

Head to your profile in the top right corner and select reports

Select generate report

Next to CSV report, select generate report

How to upload your Coinbase CSV to Koinly

Now you've got your Coinbase CSV file, here's how to upload it to Koinly.

Sign up or login into Koinly and head to the wallets page

Add a new wallet: Coinbase

Select import from file

Upload your Coinbase CSV file

Important

If you've set up 2-factor authentication, your Coinbase account may ask you to verify after you've selected send request. In some instances, it may take a couple of days for your email and attached CSV file to come through, so don't panic if you don't see it straight away.

Your Coinbase CSV file will not contain transactions to and from Coinbase Pro, so you'll need to import a separate CSV file with your Coinbase Pro transactions, if you ever used Coinbase Pro in the past.

Your frequently asked questions

How do I get Coinbase tax documents?

Does Coinbase provide financial or end of year statements?

Do I have to pay taxes on Coinbase?

How to report Coinbase rewards on taxes?

Does Coinbase report to HMRC?

What does Coinbase report to the IRS?

The IRS issued Coinbase with a John Doe summons and won back in 2016 - forcing the exchange to share customer data, though it’s not clear precisely what data was shared. Find out more in our guide on Coinbase & the IRS.

What's Coinbase EIN for taxes?

If you receive a 1099-MISC form from Coinbase to report miscellaneous income rewards from crypto on the exchange, you may need Coinbase’s tax identification number, also referred to as an employer identification number (EIN), which is 45-5293997. See more information in Coinbase’s help article.

Does Coinbase have Proof of Reserves?

Coinbase is unique compared to other exchanges as it is publicly listed on the Nasdaq. This means they have to regularly report their assets and liabilities to the market - proving their users’ deposits are held 1:1 by conducting regular audits by an external third party every quarter. See a list of their financial statements here.

For more information, read our post about Proof of Reserves and why it matters to you as a crypto investor.

Do you get a 1099 from Coinbase?

Yes, some users will receive IRS 1099 Forms from Coinbase. Currently, Coinbase only issues 1099-MISC forms to US residents with more than $600 in income on the exchange in a single financial year.

Does Coinbase send tax forms?

The only tax document Coinbase provides users with currently is the 1099-MISC Form. This form is for US residents only, with more than $600 in income. Find out more about Coinbase 1099 forms. Otherwise, you'll need to use your Coinbase transaction history to generate your Coinbase tax documents.