What is the Superficial Loss Rule in Canada?

Got gains and want to offset the tax bill by creating some losses? Tax loss harvesting is legal in Canada - but beware of the superficial loss rule. This rule exists to stop investors from artificially reducing their tax liability. Learn everything you need to know about the superficial loss rule and how to stick to the CRA rules when calculating your crypto taxes in Canada.

What's the problem with average cost basis?

To understand the superficial loss rule - you need to start by understanding the average cost basis rule.

We've got lots more info on the average & adjusted cost basis methods in our cost basis guide, but in brief, the CRA says when you're dealing with identical capital properties (like crypto), the only allowable accounting method is Average Cost Basis. This method states you calculate the average cost of the property to calculate any subsequent gains or losses. To do this, take the total cost of a group of identical crypto assets (i.e. ETH or BTC) and divide it by the number of assets you own.

So let's say you own 3 ETH. 2 ETH has an adjusted cost basis of $500, while 1 ETH has an adjusted cost basis of $3,000. Using the ACB method, you'll add up the total cost of your ETH, so $4,000, and divide this by the total amount of ETH owned, resulting in an average cost basis of $1,333.34. You'll then use this cost basis to calculate any subsequent gains or losses when you sell, swap, spend, or gift your ETH.

Simple, right?

But there's a problem with the average cost basis method - investors can easily manipulate it to create artificial losses, also known as wash sales.

The Superficial Loss Rule

In theory, investors could simply sell multiple assets at a loss in a given pool and immediately buy them back to create artificial losses to reduce their tax bill. This is what's known as a wash sale and it's why the CRA has a specific rule to prevent it - the superficial loss rule.

Say, for instance, it’s close to the end of the tax year, and an investor has so far made substantial capital gains on their crypto, which tax will be due on. However, they are also holding an asset that has lost value. They want to keep holding this asset (because they believe it will appreciate in the long run), but they also want to take advantage of the loss made so far to reduce their capital gains taxes.

So they decide to sell the asset - this is a taxable event that triggers a capital loss that can be allocated against their capital gains for the year, reducing their overall taxes. But because they want to continue holding the asset, they buy it back the next day for the same price they sold it for.

The superficial loss rule prevents these scenarios. The CRA says the superficial loss rule kicks in when both of these conditions are met:

The taxpayer (or someone acting on their behalf) acquires cryptocurrency that is identical to the one that they dispose of, either 30 days before or after the disposal, and

At the end of that period, the taxpayer or a person affiliated with the taxpayer owns or has a right to acquire the identical property.

Let's take a look at an example to explain.

EXAMPLE

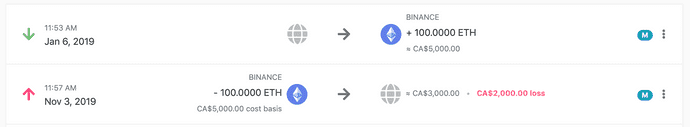

John buys 100 ETH on the 6th of Jan 2019 for a total price of $5,000. In November of the same year, he sells them at a loss, for $3,000.

To spare you the math here, we will simply enter these transactions into Koinly which will calculate the gains:

So, John made a loss of $2,000 (who would have guessed?!)

So, John made a loss of $2,000 (who would have guessed?!)

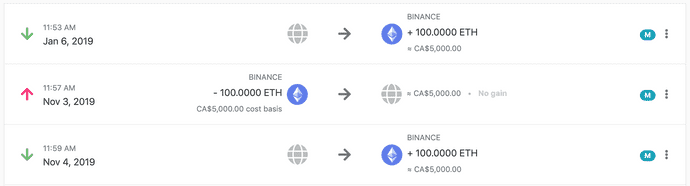

Now, John thinks he is pretty clever so he decides to buy the ETH back the next day (for the same price) but... you guessed it.

The superficial loss rule zeroes out his loss from the previous day.

The superficial loss rule zeroes out his loss from the previous day.

Basically what has happened is that the $2000 loss John made on the 3rd of November was added to his cost basis for the coins he repurchased the following day. This effectively nullifies any tax advantage that John thought was possible by selling at a loss before quickly rebuying.

In order to avoid the application of the superficial loss rule, John would have to wait 30 days following the sale on the 3rd November before rebuying his ETH.

How Koinly Can Help

Hopefully, you now have a better idea of ACB and the Superficial Loss Rule and how it applies to your tax returns. If you’re looking for more details on crypto taxes in Canada, you can check out our free Crypto Tax Guide for Canada. It not only discusses all the crypto-related tax provisions but also advises you on how you can plan your taxes better and legally reduce your tax bill. For insights into specific strategies read our guide on paying less crypto tax in Canada.

If you are planning on filing your taxes then make sure you also try out Koinly - which is a crypto tax calculator that fully complies with the CRA's crypto tax guidance. Koinly calculates all your crypto taxes for you using the ACB method and taking into consideration the superficial loss rule.