Twitter Crypto Tips Tax

Ever loved a tweet so much that you want to reward the person who wrote it? Enter Twitter tips. Twitter tips have been around for a while - except that now you can tip in both BTC and ETH. Nice - but - whether you’re sending a crypto tip or receiving one…it might have some big implications for your taxes. Read on to learn everything you need to know about Twitter crypto tips and how they’re taxed.

What are Twitter tips?

Just like you can send creators gifts on TikTok or stream donations and bits on Twitch, now you can send your favorite content creators on Twitter a tip for their best 280 characters.

Twitter tips have been around since 2021 - but it wasn’t until September 2021 that Twitter announced you could now tip in crypto.

What crypto can I tip on Twitter?

At the moment, you can tip Bitcoin and Ether. But it’s expected that this feature will expand in the next year to include more popular cryptocurrencies.

How do Twitter tips work?

Twitter tips let users add links to a third-party payment service to their Twitter profile. All you need to do is turn on tips on your profile, pick your preferred payment method and you're good to go.

If you want to tip someone, just find the tip icon in their profile and it'll take you to their preferred payment method.

At the minute Twitter supports the following payment methods:

Bandcamp

Barter

Cash App

Chipper

Ethereum Address

Paga

Patreon

Paytm

Razorpay

Wealthsimple Cash

Venmo

GoFundMe

PicPay

Strike

How do I send a Twitter crypto tip?

There are two ways to send a Twitter crypto tip and it depends on whether you’re tipping BTC or ETH.

If you want to tip ETH to a user - they’ll need to have entered their Ethereum address into their tip feature. If they have, click the tip icon and you’ll be able to copy their Ethereum address and send ETH to that address.

If you want to tip BTC - you can do this using Strike. Like above, just find a user with the Strike tip function enabled and you'll be able to send BTC tips using any Bitcoin Lightning wallet.

How do I receive a Twitter crypto tip?

You’ll need to start by enabling the Twitter tips feature on your profile. Once you’ve done this, there are two ways to get Twitter crypto tips.

If you want ETH tips, just enter your Ethereum address into the tips function and users will be able to copy your address to send you tips.

If you want BTC tips, you’ll need a Strike account. This is only available to users in the US (excluding New York and Hawaii) and El Salvador. Once you've got an account, just add your Strike username to the tips function to receive BTC tips via the Lightning Network.

Twitter crypto tip taxes

Now you know how Twitter crypto tips work - let’s get into the tax implications.

Unsurprisingly, the IRS and other tax offices haven’t released specific guidance on the tax rules surrounding Twitter crypto tips. So we need to look at the existing guidance for crypto tax.

As well as this, the tax you pay will depend on whether you’re sending a Twitter crypto tip or receiving one, so let’s break it down.

Tax on sending a Twitter crypto tip

Sending a Twitter crypto tip is best likened to gifting crypto. You’re sending crypto, with no expectation of receiving something in return.

Tax on gifting crypto depends on where you live. In the US, gifting crypto is tax free provided that your gifts given are under $16,000 in total for the 2022 tax year. So unless you’re feeling really generous, you’re likely not going to be paying any tax on your Twitter crypto tips.

However, in Australia and Canada, gifting crypto is still subject to Capital Gains Tax. Similarly in the UK, gifting crypto - excluding gifts to your spouse - is subject to Capital Gains Tax.

To calculate the tax you’ll pay, you’ll need to figure out if you’ve made a capital gain or loss from your gift. To do this, subtract your cost basis (how much it cost you to acquire the crypto) from the fair market value of your crypto on the day you gifted it. If you have a profit from the price of the crypto increasing, you have a capital gain and you’ll need to pay Capital Gains Tax on that amount.

Of course your act of generosity might make you realise a loss, and this can then be used to offset your capital gains.

So in summary, if you live in the US - sending a Twitter crypto tip is tax free. If you live elsewhere however, sending a Twitter crypto tip could be subject to Capital Gains Tax.

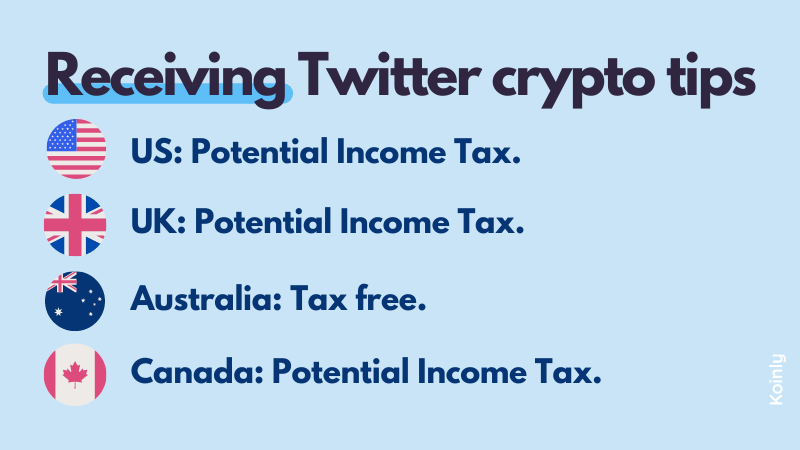

Tax on receiving Twitter crypto tips

Whether or not you pay tax on receiving Twitter crypto tips is all going to come down to where you live and why you’re receiving the tip.

In the US, the IRS is clear that tips from work are subject to Income Tax. But Twitter is (rarely!) going to be your full time job - so we need to liken it to something else.

Although we said sending a Twitter crypto gift can be seen as similar to gifting crypto - it’s not clear whether receiving a Twitter crypto tip could be seen as similar to receiving a gift. It’ll all depend on why you received the tip.

Receiving Twitter crypto tips can be seen as similar to receiving stream donations or bits on Twitch, as well as gifts on TikTok. In general, these kinds of tips are subject to Income Tax as you’re making an income as a content creator. The IRS is also pretty clear that even when it’s hobby income and you’re not a content creator full time - you still need to report it on your taxes.

If you are seen to be making an income - you’ll need to identify the fair market value of your Twitter crypto tip at the point you received it. You’ll pay Income Tax on that amount.

However, if you’re not a content creator and Twitter crypto tips aren’t a common occurrence for you - then it’s possible this could be seen as more similar to receiving a gift, which would be tax free. However, you do need to keep track of the cost basis of your Twitter crypto tip so you can calculate your capital gain or loss when you later sell, trade, spend or re-gift it.

In other countries, similar rules apply. It all comes down to whether you’re making hobby income from being a content creator or simply receiving a one-off gift from a stranger.

In the UK, you get a £1,000 allowance on trading and miscellaneous income that is tax free - so if you’re under this amount, you won’t need to pay tax.

In even better news for Australian residents, the ATO says hobby income is tax free - so provided you’re not a content creator full time, you won’t pay any Income Tax on Twitter tips.

If you’re seen to be receiving a gift of crypto instead - in general this is tax free in most countries. Although you do need to keep track of the cost basis of your Twitter crypto tip so you can calculate your capital gain or loss when you later sell, trade, spend or re-gift it. As it’s a gift, this cost basis will usually be 0 as it costs you nothing to acquire the crypto.

Remember, if you later sell your Twitter crypto tips, trade them for another cryptocurrency, spend them on goods or services or even re-gift them, you’ll need to pay Capital Gains Tax on any profit you’ve made as a result.

Remember, if you later sell your Twitter crypto tips, trade them for another cryptocurrency, spend them on goods or services or even re-gift them, you’ll need to pay Capital Gains Tax on any profit you’ve made as a result.

How do I report my Twitter crypto tips to the IRS?

If you received Twitter crypto tips and it's considered income you'll need to:

Determine the fair market value in USD of your Twitter crypto tips on the day you received them.

Report this as income on the IRS Schedule 1 (Form 1040).

If you sold, traded or spent your Twitter crypto tips, you'll also need to report these transactions on Form 8949, as well as add any capital gains or losses to your net totals on Schedule D.