Do You Pay Tax When Moving Crypto Between Wallets?

Moving crypto between cold and hot wallets to ensure your investments are secure is one of the most common transactions investors make. But do you need to pay taxes when you move your crypto between wallets?

Smart crypto investors know assets they want to HODL are safest in cold wallets and moved into hot wallets only when they intend to spend, swap, or sell their crypto.

Many crypto exchanges charge a transfer fee when you want to move your crypto to another wallet. Because of this, this can leave many crypto investors scratching their heads and wondering if this transaction is taxable or even whether they can subtract the transfer fee as a loss.

Is transferring crypto between wallets taxable?

In short, no.

This is because the vast majority of countries don’t view crypto as a currency. They view it as an asset - like a rental property or a share. Because of this, tax offices only tax transactions when they view it as income or when you ‘dispose’ of your asset by selling, swapping, spending, or (sometimes) gifting it.

When you move crypto between your own wallets, you still hold onto the asset. So this wouldn’t count as a disposal and therefore wouldn’t be subject to Capital Gains Tax.

This is why it’s so important investors keep meticulous records of their crypto transactions, so tax offices can distinguish between transfers and disposals. Using crypto tax software can help you do this hassle-free.

Are transfer fees tax deductible?

In most countries, when you’re trading crypto, you can deduct any transaction fees when calculating your cost basis. This allows investors to more accurately calculate what their exact profit from selling, swapping, or spending a specific asset was and allows them to pay less in tax.

This is because transaction fees are seen as a kind of sales commission. But what about transfer fees?

It’s not so clear-cut. Most countries haven’t issued clear guidance on whether crypto transfer fees are tax deductible.

Transfer fees could be considered an investment expense and therefore not tax deductible in many countries.

This is further complicated by the fact that because transfer fees are often taken in the currency you’re transferring, you’re technically spending the asset - which could be viewed as a disposal.

How does Koinly deal with crypto transfer fees

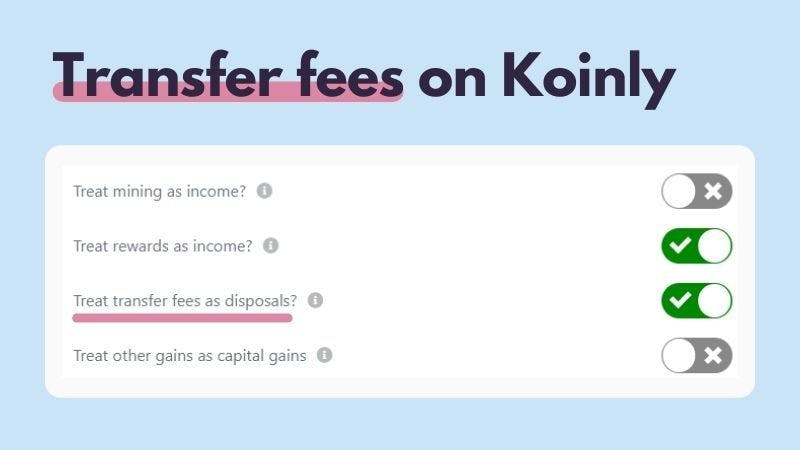

To make crypto tax reporting simple, we let you decide how you want to treat your transfer fees. In our settings, we have an option to treat transfer fees as disposals.

This way, you can pick whether you’d like to view your transfer fees as taxable or non-taxable. This gives you complete control over how conservative you’d like to be with your crypto tax reporting.

This way, you can pick whether you’d like to view your transfer fees as taxable or non-taxable. This gives you complete control over how conservative you’d like to be with your crypto tax reporting.

There is no wrong or right answer until tax offices issue clearer guidance on crypto transfer fee taxation. However, with tax authorities around the world cracking down on crypto, we recommend taking a conservative approach to your crypto tax reporting and assuming transfer fees will be viewed as disposals.

You can find more information on crypto tax around the world in our quick crypto tax guide.

Summary

Transferring crypto between wallets is not taxed.

Tax offices haven’t issued guidance on the taxation of crypto transfer fees yet.

Therefore, transfer fees might be seen as a disposal.

Transfer fees may be seen as an investment expense, not a cost.