Crypto bull market strategies

Crypto bull markets are a thrilling time for investors, especially if it’s your first rodeo. But when prices are soaring and the gains are higher than ever, the tax man will want to know about it. Here’s how to make the most of a crypto bull market and reduce your tax bill.

What is a crypto bull market?

When the crypto market is good, you’ll likely hear other investors calling it a bull market or a bull run. A bull market is best defined as a strong upward trajectory of price movements - so cryptocurrency prices reaching new all-time highs.

This happens because of a flurry of investment in the market, with high demand and low supply. Crypto bull markets are also normally associated with strong economic conditions globally - although as the pandemic proved, this isn’t always the case.

Are we in a crypto bull market in 2023?

The start of 2022 was turbulent for investors to say the least. Many investors believe crypto is entering a bear market - which is the opposite of a bull market.

There isn’t a specific metric to identify a bull market, but we can say in general it’s when historic prices rise by more than 20% for a prolonged period of time. Most agree crypto was in a bull run for the majority of 2020 and 2021 - where investors saw BTC, ETH, and many more cryptocurrencies reach historic highs, while much of 2022 was a bear market.

What to expect in 2023? Your guess is as good as ours.

The important thing to remember is that markets are cyclical. This means bull and bear markets happen and beyond having a strategy for both, there’s little else investors can do but ride them out.

Why do crypto bull markets happen?

Crypto bull markets happen due to a variety of factors working in combination.

Normally, investor sentiment in the Fear and Greed Index will be high and there are often strong economic conditions in other markets - particularly the stock market.

There is also normally positive news in the industry - whether that’s confirmation governments aren't looking to regulate the industry or a long-awaited blockchain development, like when Ethereum finally moved to proof of stake on September 15.

How long does a crypto bull market last?

We’d all love to think a bull market will last forever - but the reality is that what goes up will often come crashing down again later.

In general, bull runs for other markets tend to last an average of four years according to historical data. As the crypto market is so new and is only just seeing widespread adoption, it’s impossible to predict how long a bull run could last. Most investors agree that crypto has been in a bull run since late 2020, with the market only changing in the last few months to less favorable conditions.

Crypto bull market strategies

Regardless of whether we’re in a bear market or a bull market - you need a strategy to help you make the most of the market conditions and reduce your crypto tax bill. Although investors tend to fear bear markets, bull markets can cause just as many problems if you get too greedy and don’t plan ahead. Let’s go through some of the most popular crypto bull market strategies.

Spot a bull run early with technical indicators

Technical indicators give you an idea of the performance of an asset and the wider market - helping you predict where a market may be heading. There are dozens of crypto technical indicators available, but some of the most popular include:

Bitcoin dominance: Bitcoin is still king in crypto - but there are a lot of other cryptocurrencies. During the recent bull market, Bitcoin dominance dropped, while other cryptocurrencies saw huge rises in price and popularity. So if the total market cap is growing while Bitcoin dominance is decreasing, this can be a strong indicator of a bull market.

Relative strength index (RSI): RSI is used to assess whether a specific asset is overbought or undersold - indicating a wider bullish or bearish trend. Crypto is overbought if the RSI is around 70% and underbought if the RSI Is under 30%.

Moving average: This statistic is simply the average price of a specific crypto over a period of time - normally 200, 50, or 20 days. If the price is above a long-term moving average, this indicates a bullish upward trend.

Buy early in the bull run

It’s difficult to gauge when the start of a bull run is as we’ve all seen crypto market conditions can change quickly. However, if you’ve looked at the technical indicators and the market sentiment is high - this often indicates the start of a bull run. The sooner you buy in a bull run, the higher you can sell for.

Take profits regularly with sell limit orders

We’d all love to see BTC hit $100,000, but the reality is no one knows when it’s going to happen. In a bull market, investors are often worried about selling too early and missing out on higher gains. But what’s worse is leaving it too late and missing out on the peak altogether.

Avoid FOMO and take regular profits. Sell portions of assets and hold another portion for later down the line. The easiest way to do this without spending your days with your nose glued to a portfolio tracker is to use sell-limit orders. Utilizing sell limit orders lets you automatically sell your crypto once it reaches a given price in the market.

HODL, but earn interest

HODLing comes with the huge perk of avoiding Capital Gains Tax on your crypto. High sale prices mean a high Capital Gains Tax bill. The easiest way to avoid it is to hodl your crypto.

This doesn’t mean you can’t earn from your assets though. There’s a huge variety of ways to earn passive income from the crypto you hodl - such as staking, lending, and providing liquidity.

Be warned though - you want to be careful to use the right DeFi protocol to earn from as some can trigger Capital Gains Tax events even if you don’t dispose of them. For example, DeFi protocols like UniSwap, PancakeSwap and SushiSwap where you receive liquidity pool tokens in exchange for your added capital could trigger a Capital Gains Tax event. Meanwhile, other DeFi protocols like Maker are less likely to trigger a Capital Gains Tax event.

Multiply your gains with leveraged trading

Derivatives, margin trading, and leveraged tokens are an appealing option during a bull market - but you need to do your research first and ensure that the potential benefits outweigh the risks of the potential losses for you.

Essentially, all these products allow you to multiply your gains by a given amount by increasing your exposure to the underlying asset - provided the market goes the right way.

You can learn more about margin trading, derivatives trading and leveraged tokens in our guides.

Take profits in stablecoins

This isn’t always possible - but where it is, consider investing in options that let you get paid out in stablecoins. There are a lot of products offering this including various vaults that pay interest in stablecoins, as well as dozens of DeFi options.

Taking your profits in stablecoins comes with significant Capital Gains Tax benefits because the difference between your cost basis and your sale/trade price is always going to be almost non-existent. As you’re only taxed on the profit when you sell, trade, or spend it, stablecoins present an appealing opportunity to minimize your tax bill.

Of course, in some instances depending on the specific product you’re using, you may still be liable for Income Tax on earnings. But even then you’ll still minimize the double taxation that crypto is often subjected to by sticking to assets with a pegged value.

Reduce gains with HIFO accounting

The Highest In First Out accounting method lets you calculate your capital gains by disposing of the coins you paid the highest amount for first - effectively minimizing your capital gains and your subsequent tax bill. Many countries allow HIFO, including the US under specific conditions. You'll need detailed records showing for the IRS including:

The date and time each asset was acquired.

Your cost basis and the FMV of each asset when you bought it.

The date and time each asset was sold.

The FMV of each asset when you sold, traded, or spent it.

You can learn more about crypto cost basis in our guide.

Diversity your portfolio

A diverse portfolio reduces risk and opens you up to new opportunities. After all, it’s difficult to predict which coins and tokens will take off and which won’t - both in bull and bear markets. You can use the following indicators of performance to help you pick which assets to invest in.

Previous all-time high.

Past performance.

Roadmaps.

Have an exit strategy

All good things must come to an end - including bull markets. It’s important you have an exit strategy for the bull market.

What this looks like for each investor will vary. In general, you want your exit strategy to ensure you’ve at least made back your initial investment by the end of the bull run and that you have a variety of assets held for the future.

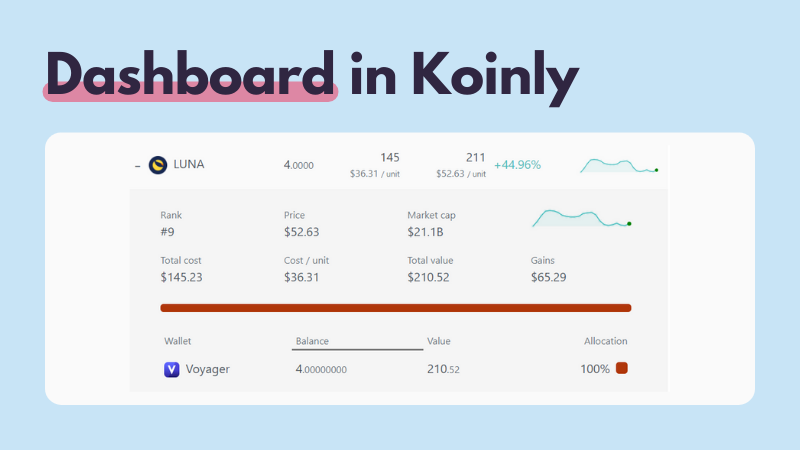

Track crypto performance and taxes with Koinly

The best way to manage a bull market is to utilize a crypto portfolio tracker, as well as keep track of any potential impending tax bills so you know how much to put aside come the deadline.

Koinly works as both a crypto portfolio tracker and a crypto tax calculator - letting you track all of your crypto investments from one platform, as well as easily calculate any crypto taxes.

All you need to do is sync all the crypto wallets and exchanges (or blockchains!) you use with Koinly via API or by importing a CSV file of your transaction history. Koinly supports more than 400 exchanges, 50 wallets, 6,000 cryptocurrencies, and many other crypto services.

Once you’ve synced the wallets you use, you can view your crypto portfolio performance from your Koinly dashboard. This includes your total value, cost basis, and unrealized gains or losses.

You can even track individual asset performance in Koinly like so:

You can even track individual asset performance in Koinly like so:

When it comes to tax time - the news is even better. Koinly calculates your capital gains, losses, income, expenses, and more. You can see all this on the tax summary page and download a pre-filled tax report for your location to make filing your crypto taxes a breeze.

When it comes to tax time - the news is even better. Koinly calculates your capital gains, losses, income, expenses, and more. You can see all this on the tax summary page and download a pre-filled tax report for your location to make filing your crypto taxes a breeze.

We support a variety of tax reports from around the world including the IRS Form 8949 and Schedule D, the ATO myTax report and HMRC Capital Gains Summary.

We support a variety of tax reports from around the world including the IRS Form 8949 and Schedule D, the ATO myTax report and HMRC Capital Gains Summary.