How to file your Crypto.com taxes with Koinly

Crypto.com is one of the largest crypto exchanges going - offering investors a huge variety of opportunities including NFTs, DeFi staking, and crypto Visa cards. The company was founded in 2016 and raised more than $25 million in ICO funding in 2017. It's since grown to a top 20 exchange by daily trading volume - with millions traded daily. Crypto.com helps investors buy, sell, and trade a wide variety of cryptocurrencies, from market leaders like Bitcoin to lesser-known tokens and memecoins like SHIB.

Also available as a mobile app, one of the many reasons for the exchange's success is the wide variety of features and products available all via a user-friendly interface. Investors can trade NFTs, yield farm, take out loans against their crypto, earn crypto through staking, leverage trades with margin trading, and more.

Whatever your investments - doing your Crypto.com taxes with Koinly is easy. You just need to connect via API or by uploading a CSV file. Once you're connected, Koinly will calculate your gains, losses, and income from Crypto.com and generate your crypto tax report, ready to file or hand over to your accountant.

Follow these steps to sync your Crypto.com data automatically to Koinly:

- Log in to Crypto.com.

- From your dashboard, select settings from the menu on the left.

- Select the API Keys tab.

- Select Create a new API key.

- Enter a label, for example, "Koinly".

- Complete 2FA.

- Copy your API key and API secret key. Paste them into the fields in Koinly.

The API is limited to the most recent 6 months of trading. Remember to export your CSV files to import any older trades.

On Koinly:

- Create a free account on Koinly

- Complete onboarding until you get to the Wallets page and find Crypto.com in the list

- Select API > Paste the API keys you copied above in the appropriate box

- Hit Import and wait for Koinly to sync your data. This can take a few minutes

- Review your transactions on the Transactions page to ensure everything is tagged correctly and no missing data

- Go to the Tax Reports page to view your tax liability!

The Crypto.com API only provides trades from the last 6 months. Older trades will need to be added using CSV files

- Head over to our help center

- Hit up our discussion boards - we might have already answered your question

- Ask us on social media - we're on Twitter and Reddit

- Contact us on email or live chat

- Got a feature request? Give us feedback on Canny

Please note, that you'll need to connect Crypto.com and the Crypto.com app separately with Koinly. See step-by-step instructions on how to get your Crypto.com app CSV files below.

Follow these steps to download your Crypto.com App data:

You may need to import a few files from your Crypto.com App.

Crypto Wallet file

- Open your Crypto.com app.

- Select accounts at the bottom of the screen.

- Select the clock icon (transaction history) in the top right corner.

- Select the export icon in the top right corner.

- Select crypto wallet.

- Select a start and end date (maximum of 3 years). Koinly needs your entire transaction history so you may need to export multiple CSV files.

- Select export to CSV.

- Select download once your file is generated.

Fiat wallet and Crypto.com Visa Card

If you use the Crypto.com app fiat wallet or the Crypto.com Visa Card, you'll need to download CSV files for these too.

- Open your Crypto.com app.

- Select accounts at the bottom of the screen.

- Select the clock icon (transaction history) in the top right corner.

- Select the export icon in the top right corner.

- Select fiat wallet or crypto.com visa card.

- Select a start and end date (maximum of 3 years). Koinly needs your entire transaction history so you may need to export multiple CSV files.

- Select export to CSV.

- Select download once your file is generated.

On Koinly:

- Create a free account on Koinly

- Complete onboarding until you get to the Wallets page and find Crypto.com App in the list

- Click on it and select "File import" in the import options screen

- Upload the files you downloaded from Crypto.com App (one at a time) and click on Import

- Review your transactions on the Transactions page to ensure everything is tagged correctly and no missing data

- Go to the Tax Reports page to view your tax liability!

NFTs are not included in Crypto.com's files and therefore need to be added manually

- Head over to our help center

- Hit up our discussion boards - we might have already answered your question

- Ask us on social media - we're on Twitter and Reddit

- Contact us on email or live chat

- Got a feature request? Give us feedback on Canny

How are Crypto.com transactions taxed?

Crypto tax varies depending on where you live (so read our crypto tax guides for information on where you live). But generally speaking, your Crypto.com transactions will be subject to either Income Tax or Capital Gains Tax - it all depends on the transactions you've made:

Income Tax: If your crypto is viewed as a kind of additional income - you'll pay Income Tax upon receipt.

Capital Gains Tax: When you dispose of crypto by selling, swapping, spending, or sometimes gifting it (depending on where you live), you realize a capital gain or loss. If you have a capital gain you'll generally pay Capital Gains Tax on that gain.

Selling and trading crypto on Crypto.com

If you've sold or swapped crypto on Crypto.com, this is a disposal and you'll need to calculate a capital gain or loss. This doesn't just apply to coins either - it's all kinds of crypto assets, including NFTs, stablecoins, and tokens. From a tax perspective, they're all the same!

Crypto.com Earn rewards

Crypto.com Earn rewards and other staking rewards are generally viewed as a kind of additional income by most tax offices. As such, if you've received Earn rewards on Crypto.com, you'll need to identify the fair market value of your rewards in your fiat currency and may have to pay Income Tax on that amount.

Crypto.com Visa Card

Although you can spend crypto like cash with a Crypto.com credit card -the tax implications are very different. When you spend crypto using your Crypto.com Visa Card, you're actually converting your crypto for cash. This is a disposal as you're selling crypto for fiat currency and as such, you'll realize a capital gain or loss. If you have a gain, you'll pay Capital Gains Tax on that amount.

Crypto.com NFTs

From a tax perspective, NFTs are treated largely the same as other crypto assets. You'll generally pay Capital Gains Tax on any gain if you dispose of an NFT by selling or swapping it. This said, if you're creating NFTs and selling them - like an artist - then your profits may instead be viewed as a kind of income and subject to Income Tax instead depending on where you live.

Crypto.com margin trading

Most tax offices haven't released guidance on crypto margin trading specifically, and the tax treatment can vary, so you should check the rules where you live. However, generally speaking, you'll only pay tax on a margin trade at the point you close a position and realize a gain. As for liquidations, as your capital is sold, this is likely to be viewed as a disposal from a tax perspective.

Does Crypto.com report to the IRS?

Yes, Crypto.com does report crypto activity to the IRS. US users who earn $600 or more in rewards from Crypto.com from Staking, Earn, Referrals, or certain other activities will receive a 1099-MISC tax form and the same form will be sent to the IRS.

How to get Crypto.com tax documents

You need to report any gains, losses, or income from your Crypto.com investments to your tax office. This is usually done as part of your annual tax return.

You can do this yourself - but it’s time-consuming. You’ll need to identify your taxable transactions, calculate your net capital gain or loss using an approved accounting method and identify the fair market value of any crypto income on the day you received it in your fiat currency.

This is why most crypto investors opt to use a crypto tax calculator like Koinly. Koinly does all this for you and generates your crypto tax report, ready to file with your tax office.

Just connect automatically via API, or upload a CSV file - depending on whether you’re using the Crypto.com desktop or app. Here’s how it works.

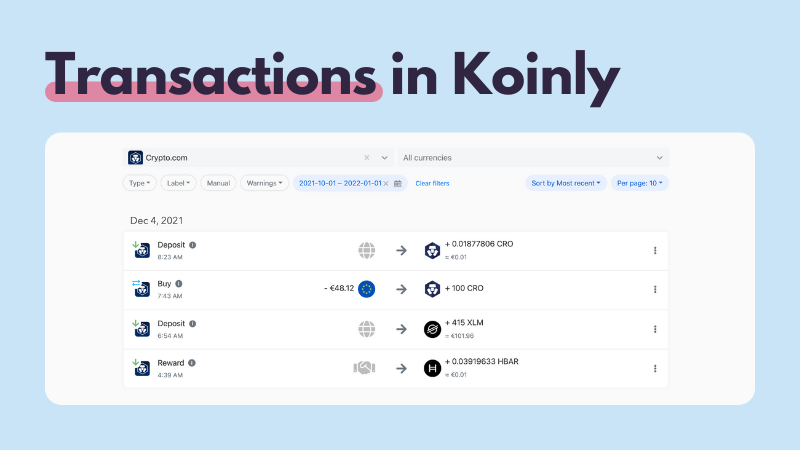

Koinly works by importing your Crypto.com transaction data so that you can calculate your taxes in under 20 minutes. Let's look at an example - here's some transactions in a Crypto.com account.

You can import your Crypto.com transaction history via API integration or by uploading CSV files of your Crypto.com transaction history. Once you've done this, you'll be able to see your Crypto.com transactions in Koinly - like this.

You can import your Crypto.com transaction history via API integration or by uploading CSV files of your Crypto.com transaction history. Once you've done this, you'll be able to see your Crypto.com transactions in Koinly - like this.

This lets you manage all your crypto transactions - from Crypto.com and any other exchanges you use - from one single platform, making crypto tax simple.

This lets you manage all your crypto transactions - from Crypto.com and any other exchanges you use - from one single platform, making crypto tax simple.

Your frequently asked questions

Does Crypto.com provide tax forms?

How to get tax documents from Crypto.com

Is Crypto.com tax legit?

Is Crypto.com safe?

Does Crypto.com issue 1099 forms?

How to get a 1099 from Crypto.com

Does Crypto.com report to HMRC?

Does Crypto.com have Proof of Reserves?

Crypto.com has provided a list of addresses they hold user deposits via their blog. Crypto.com’s Proof of Reserves can also be viewed on a Nansen dashboard that tracks these wallet addresses. For more information about what Proof of Reserves are and why they matter - check out our blog post.