What Are Ethereum Gas Fees & How Are They Taxed?

Anytime you use the Ethereum blockchain to make a transaction, you’ll pay a gas fee in gwei. Learn more about how gas fees work and what they mean for your taxes.

Gas prices are rocketing as crypto DeFi apps surge in popularity. For many investors, it's left them wondering what these high fees mean for their taxes - and whether they even be used to reduce their tax bill.

We're looking at what gas fees are, why they're so high and what gas fees mean for your tax bill.

What are gas fees in crypto?

Gas refers to the fee you’ll pay anytime you make a transaction on the Ethereum blockchain platform. This network transaction fee covers the computational expenses associated with a given transaction. This makes sure users validating and processing transactions on the Ethereum network are rewarded.

What is gwei?

Gas is measured in gwei. Gwei is a denomination of ETH - the cryptocurrency used on the Ethereum network. Similar to how 100 cents make up a dollar, a billion gwei makes up 1 ETH.

Gwei is also known as a nanoether or nano - due to it being the ninth power of the fractional ETH:

1 ether = 1,000,000,000 gwei.

1 gwei = 0.000000001 ether.

As you can see from the above, using gwei to specify gas fees makes it much simpler. So instead of saying your gas was 0.000000001 ether, you can say it cost 1 gwei.

Gwei isn’t actually the smallest unit of Ether - wei is. Weirdly, gwei is also sometimes known as Shannon. In fact, all the denominations of ETH have nicknames - as a nod to the ‘founding fathers’ of cryptography.

Why are gas fees so high?

So you pay gas in gwei anytime you make a transaction - simple enough. But if you’ve ever used the Ethereum blockchain before, you’ll notice that gas fees vary per transaction.

This is because gas varies based on supply and demand. The busier the Ethereum blockchain is, the higher the fee will go.

Ethereum stakers (formerly miners) verify and process everything on the network. They’re awarded this fee in exchange for providing this service. The more transactions there are to get through the more in demand their services are and the more power they’ll have to use.

Users can actually set a gas price limit for a given transaction. Then miners can look through the transactions and decide which are worth their time and resources. If the gas price limit the user sets is low, it’s likely to be ignored. When the network is very busy, users will set higher gas price limits and the price of gas will rocket up.

So the price of gas depends on the movements in the wider market at the time. As investors have flocked to crypto DeFi apps, the average gas price has been much higher than usual as interest in the market grows.

It's hoped that following the move to proof of stake during the Ethereum Merge on September 15 2022, gas prices will decrease as the network improves efficiency and scalability. Transactions should be easier and faster to process, as well as use less computational power.

How are gas fees taxed? Are they tax deductible?

It’s good news when it comes to gas fees because in some instances - gas fees are tax deductible. In others - the guidance is less clear.

Tax offices haven’t given specific guidance on gas fees, but many of them have given guidance on transaction fees in general. All this to say - whether your gas fee is tax deductible depends on the specific transaction you’re making. Let’s break it down.

Capital gains and cost basis

Cryptocurrencies aren’t actually seen as a currency in almost all countries. Instead, they’re seen as an asset - just like a stock. Because they’re seen as an asset, this makes them subject to Capital Gains Tax. Anytime you sell, swap, spend, or gift (in most countries) an asset, you’ll pay Capital Gains Tax on any ‘gain’ or profit you make from the transaction.

So how do you figure out how much you pay?

You figure out the cost basis. The cost basis is whatever it cost you to acquire an asset plus any transaction fees.

Buying, selling, and trading crypto gas fees

This ones pretty straightforward because these fees are all associated with a transaction - whether that's a purchase, sale, or trade. Capital Gains Tax rules allow for you to add transaction fees to the cost basis of an asset. So whenever you buy, sell, or trade crypto on the Ethereum blockchain and pay a gas fee - you can add this to your cost base. This will reduce the amount of tax you owe on a given asset by giving a more realistic picture of what it actually cost you.

EXAMPLE

You buy 1 ETH for $3,000. The gas fee is $100. Your current cost basis is $3,000 + $100 = $3100.

You later sell your 1 ETH for $4,000. The gas fee is another $100. Add this to your cost basis so $3,200. Now calculate your capital gain.

$4,000 - $3,200 = $800. You’d pay tax on $800.

Yield farming, staking, and airdrop rewards gas fees

There are lots of ways to earn rewards on the Ethereum blockchain through crypto DeFi apps. For example:

But in most instances, you’ll pay a gas fee whenever you want to claim your reward - whether that's by adding or removing your liquidity pool tokens, or withdrawing reward tokens when you're no longer using a protocol.

Whether or not you can add this to your cost basis depends on how the transaction is viewed from a tax perspective. For example, in many countries like the UK, adding and removing liquidity is seen as a crypto to crypto swap, as you receive LP tokens in return. In these instances, as you're making a capital gains disposal, you may well be able to add related gas fees to your cost basis.

However, in other instances depending on the protocol you're using, you may be receiving new tokens as a reward - like COMP tokens. When you want to withdraw these COMP tokens, you may pay a gas fee. However, these tokens likely aren't seen as a capital gain. As you're earning new tokens, they're more likely to be viewed as income in most countries. So your cost basis is the fair market value at the point you received the asset.

So in these instances, it is highly likely that gas fees would not be tax deductible as you cannot add them to your cost basis.

However, if you later went on to sell, swap, or spend these assets, you could add any gas fees involved in those transactions to your overall cost basis for the asset.

Transfer gas fees

Sometimes when you transfer assets between wallets, you’ll pay a gas fee. However, the Capital Gains Tax guidance in most countries is quite clear that you can only add fees associated with acquiring or disposing of an asset to your cost basis. You’re not doing this when you make a transfer.

There isn’t any clear guidance on this yet from any tax office. So you can choose to take a conservative or a more aggressive approach to your crypto taxes:

A conservative approach would be to treat this as a taxable event. You’re spending ETH - like on a good or a service - so it’s subject to Capital Gains Tax.

A more measured approach is to claim it as spent, but not recognize any capital gain or loss from the transaction. Simply deduct the fee from your the overall amount of the asset you were transferring.

Finally, an aggressive approach would be to add it to your cost basis.

We recommend a conservative approach to transfer fees as other approaches may not stand up to scrutiny by tax authorities.

Can you use gas fees to offset income?

No. Individuals can’t offset expenses against their income. However, if you’re viewed to be trading as a crypto business due to the volume or activities you’re conducting - you may be able to deduct gas fees as business expenses. You should look up your specific business crypto tax laws in your country or speak to a tax advisor before doing this.

What about tax on failed gas fees?

Sometimes transactions fail on the Ethereum blockchain for a variety of reasons, for example, if you didn’t include sufficient gas to cover the transaction fee. In these instances, the ETH you pay isn’t refunded.

If you’ve lost ETH to gas fees, you could recognize this as a capital loss. You have spent ETH on goods or services, which means you need to calculate any resulting capital gain or loss. You would subtract your cost basis from the price you disposed of the asset for, which in this instance is $0 - so you’ll always have a capital loss in these instances.

You can later offset your capital losses against your capital gains to pay less Capital Gains Tax.

Calculate gas taxes with Koinly

Make crypto taxes simple with Koinly. Koinly can help you calculate your crypto taxes - including the taxation of any gas fees. When you import your transaction history to Koinly, it automatically adds transaction fees to your cost and calculates your cost basis and any subsequent gains or losses.

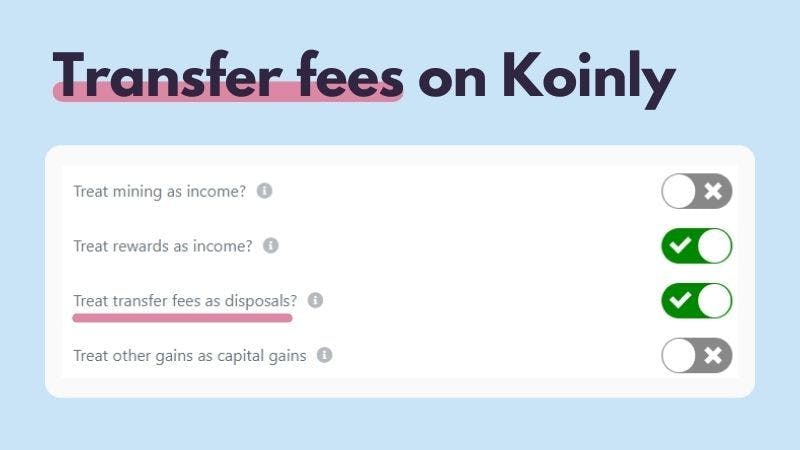

For transfer fees, we take a conservative approach by default and treat these as disposals. However, you can change this in the settings by turning ‘treat transfer fees as disposals’ off.

Koinly makes crypto tax easy. Get started for free today.

Koinly makes crypto tax easy. Get started for free today.

Summary

Gas refers to the fee you pay anytime you make a transaction on the Ethereum blockchain.

The gas fee is given to users who validate and process transactions on the network.

Gas is measured in Gwei - a denomination of ETH.

Gas prices fluctuation due to supply and demand.

Gas fees may be tax deductible - it depends on the transaction you're making.

If you're buying, selling or trading crypto - you can add the gas fee to your cost basis.

If you're earning rewards and paying gas fees - you cannot add the gas fee to your cost basis.

Gas fees from transfers have no clear tax guidance, but we recommend you treat it as a taxable event.