How to Mine Crypto at Home

Crypto mining is big business, attracting thousands of investors, with huge crypto mining farms set up around the world. This comes with a downside though - it’s made the space competitive. The average hobby miner can’t compete with crypto mining farms and the start-up costs for mining equipment can be huge. It’s not a total loss though, there are still many ways to mine crypto at home, without spending thousands on mining equipment. We’re looking at how to mine crypto at home and what the taxman will want to know about your crypto mining income.

Crypto Mining 101

Ever since Bitcoin boomed, crypto mining has increased in popularity. It’s an easy way to earn new coins, in the hopes they later soar in value just as BTC and ETH have.

Ever since Bitcoin boomed, crypto mining has increased in popularity. It’s an easy way to earn new coins, in the hopes they later soar in value just as BTC and ETH have.

But this has made the mining space more and more competitive. Proof-of-work - the process behind mining - is done on a first-come, first served basis. So whoever solves the proof-of-work puzzle first reaps the rewards. With mining farms with hundreds of mining rigs in the mix, it means hobby miners at home rarely stand a chance of solving it first and being rewarded.

To further convolute the issue, due to the competitive nature of crypto mining, many cryptocurrencies - like Bitcoin - are increasing proof-of-work difficulty to stop coins being mined too quickly. This means the equipment necessary for mining needs to be more powerful, which makes it more expensive. A decent Bitcoin mining rig is around $3,000 now, while the top-of-the-line mining rigs are closer to $10,000.

It’s for these reasons that you often hear those in the crypto space saying that Bitcoin mining is no longer profitable for many investors. The setup costs combined with the competitive market means the chance of a reward is slimmer than ever.

But this isn’t always the case. There are ways to reap the rewards of crypto mining without spending thousands to get started.

How to mine crypto at home

So you don’t have a crypto mining rig lying around - how can you get started mining crypto?

There are quite a few options for you to start mining crypto at home, these include:

Mining altcoins

Mining pools

Mining apps

Let’s take a look at each with examples.

Mine altcoins

Bitcoin mining might have become so competitive that the average Joe can’t get a look in - but that doesn’t mean it’s the case for all cryptocurrencies.

There are plenty of altcoins that you can mine at home using a decent home computer or even a laptop. This includes:

Dogecoin (DOGE)

Monero (XMR)

RavenCoin (RVN)

Litecoin (LTC)

Ethereum Classic (ETC)

Zcash (ZEC)

Grin (GRIN)

Dash (DASH)

Of course, you’ll need more computing power to mine some of these coins than for others. You’ll also need to figure out the electricity costs to ensure it’s worthwhile and profitable for you to mine. If you live in an area with high electricity costs, this may not be the case, so use a crypto mining calculator to check.

Join a mining pool

Crypto mining pools came about in response to crypto mining farms. As the mining market became more competitive, it became increasingly apparent that even with decent equipment, solo miners couldn’t compete.

Crypto mining pools are groups of miners who combine their hash power (computing power) to increase the chances of their group solving the proof-of-work puzzle and receiving the reward. The reward is then proportionally distributed between members of the mining pool.

Pretty much anyone can join a crypto mining pool, although some require that you have a certain amount of hash power to join. But if you’ve got an okay home computer setup - like a gaming PC or similar, there are plenty of mining pools that are open to you.

Some of the most popular crypto mining pools include:

Slush Pool

ViaBTC

AntPool

BTC.com

Each crypto mining pool works slightly differently and pays out different rewards - so if you're considering joining one make sure you do your research to find one that suits you.

Mining apps

There are dozens of mining apps available now - so you can even mine crypto on the go on your phone!

One of the most popular examples of this is Pi Network. You can download the Pi Network app on Android or IOS and mine Pi coins on your smartphone as you go about your day. It's worth noting you cannot yet sell or trade these coins on any crypto exchange just yet - so whether they eventually have value remains to be seen.

You should always be wary of new crypto mining apps. Many scammers are using these to add malware to devices and steal crypto and other funds - so do your due diligence and beware of anything that sounds too good to be true.

Alternative mining software

There are some more niche crypto services that allow investors access to mining without the expensive setup.

One such example is NiceHash. NiceHash is a cryptocurrency hash power broker. You can either earn money by connecting your CPU or GPU and mining, or by buying hash power from other users connected to NiceHash.

This shouldn’t be confused with cloud mining. Cloud mining in some rare instances can be legitimate - but it is a very popular scam.

When you mine through NiceHash and similar sites - you don’t need any dedicated software to do so. This can make it really appealing for those totally new to crypto mining.

Other popular sites like NiceHash include Mining Rig Rentals and Better Hash.

What about tax on mining crypto at home?

Of course, whichever of the options you choose from above - the taxman will want to know about it.

Most tax offices have given guidance on crypto mining and how it’s taxed - so it doesn’t matter whether you’re mining Doge, using a mining pool, a mining app or even mining software - it’ll all be taxed the same.

However, quite a lot of the way crypto mining is taxed depends on the scale at which you’re mining. It wouldn’t be fair for huge crypto mining farms earning thousands a month to be taxed in the same way as crypto hobby miners, so some tax offices apply Income Tax to crypto mining, while others won’t apply Income Tax. For example:

USA: Income Tax on the fair market value of your mined coins in USD on the day you receive them.

UK: Income Tax on the fair market value of your mined coins in GBP on the day you receive them.

Australia: Hobby miners don't pay Income Tax on mined coins.

Canada: Hobby miners don't pay Income Tax on mined coins.

However, all tax offices will charge you Capital Gains Tax when you later sell, swap, spend, or gift (in most countries) mined coins. So, in some instances, you’ll be paying tax twice on mined crypto.

You can learn more about mining tax in our crypto mining taxes guide.

How Koinly can help with crypto mining taxes

Koinly can track all of your crypto transactions - including mining transactions - so that when it comes to tax time, you can sort it in minutes.

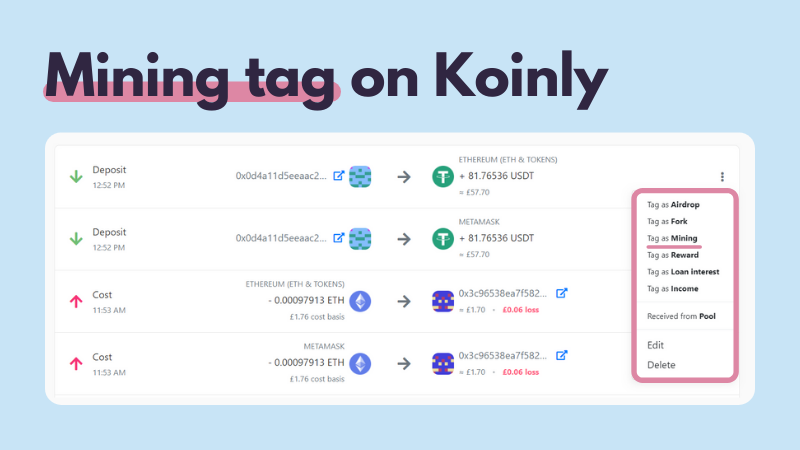

All you need to do is use API or CSV file import to sync the various wallets you hold your mined coins in - as well as any exchanges you later sell or swap them on - with Koinly. Your mined coins should be automatically tagged as such, but if not you can easily tag them manually in Koinly.

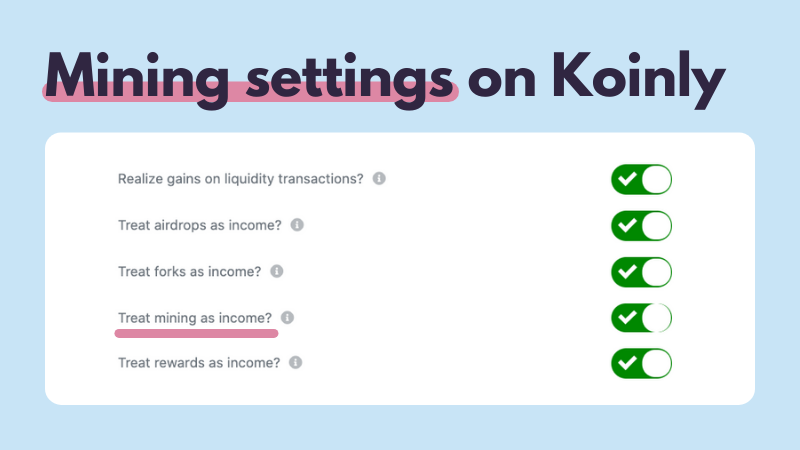

You can then choose whether to treat mining as income in your Koinly settings based on your country’s tax rules.

You can then choose whether to treat mining as income in your Koinly settings based on your country’s tax rules.

Once you’re set-up, head to the tax reports page and you’ll have a complete summary of your crypto capital gains, losses, income, and expenses. You can download your Koinly crypto tax report and find a complete breakdown of your transactions - including your mining income or capital gains.

Once you’re set-up, head to the tax reports page and you’ll have a complete summary of your crypto capital gains, losses, income, and expenses. You can download your Koinly crypto tax report and find a complete breakdown of your transactions - including your mining income or capital gains.