How the America COMPETES Act Could Affect Crypto

After the Infrastructure Bill was finally passed in late 2021, US crypto investors have been panicking about the legislation to follow. Though many clarifications on crypto regulation and crypto tax were expected in the Build Back Better Bill, investors got a surprise in the form of yet another omnibus bill seeking to monitor and prohibit crypto - the America COMPETES Act 2022. We’ve got everything you need to know about how the America COMPETES Act will impact the crypto industry and your investments.

What is the America COMPETES Act 2022?

The America Competes Act 2022 was filed in Congress on the 25th of January 2022 and it’s yet another omnibus bill - like the Infrastructure Bill. An omnibus bill is a single document that packages together several different measures, which end up affecting multiple industries and markets.

In this instance, deep within the 2,912 pages - the America COMPETES Act has potentially huge ramifications for the crypto industry, giving the US Treasury unlimited powers over crypto exchanges.

To save you hours of digging through the document, we’re breaking down what you need to know about the America COMPETES Act and how it affects crypto.

To save you hours of digging through the document, we’re breaking down what you need to know about the America COMPETES Act and how it affects crypto.

How does the America COMPETES Act impact crypto?

Substantially - and it’s not good news.

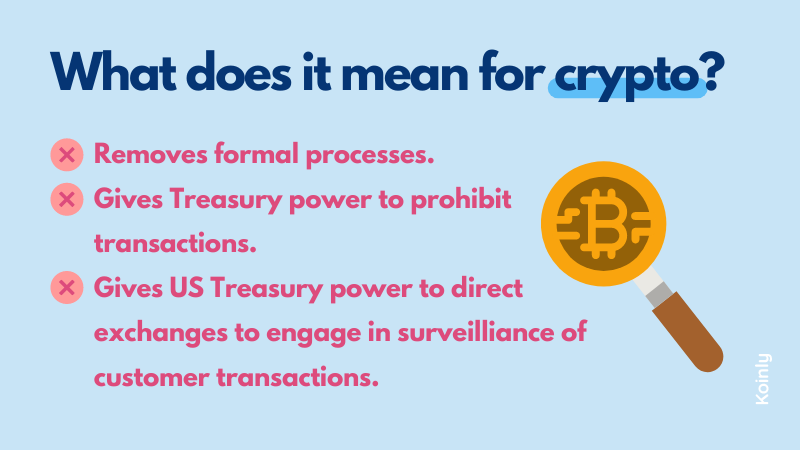

At the moment, the US Treasury can’t take unilateral action to block crypto transactions. They have to follow a public process which includes giving formal notice and a 120 day period to challenge decisions.

The new bill changes all that. It gives the US Treasury the power to block any crypto transactions without any formal process. The language used in the bill grants the Treasury unilateral power.

This isn’t the first time this kind of addendum has been slipped into an omnibus bill, but it was removed last year (thankfully!) due to opposition.

There are five measures included within the bill that directly impact the crypto industry. The first four grant the Secretary of the US Treasury the ability to direct financial institutions - including crypto exchanges - to engage in extensive surveillance and recordkeeping of customer transactions. The final fifth measure grants the Secretary of the US Treasury the ability to direct financial institutions - including crypto exchanges - to prohibit customer transactions altogether**.**

In other words, at its own whim, the US Treasury - including its largest department the IRS - can decide whether to monitor your crypto transactions and even block them based on their assumptions about your behavior.

Crypto industry reaction

Coincenter, a non-profit focused on crypto policy issues, says the inclusion in the bill would hand the US Treasury a blank check to ban crypto at exchanges and that the policy severely damages the privacy and constitutional rights of crypto users. They state the language used in the current proposed bill removes all formal controls, time limits and public notice requirements that currently exist.

This means the US Treasury wouldn’t even need to notify you if they were surveilling your transactions, your transactions can be blocked without notice and a ban can be indefinite.

On a larger scale, it also means the US Treasury would have the power to halt crypto exchanges from operating in the US without notice. Though the language focuses around money laundering concerns - the catch-all language makes this concern arbitrary. The US Treasury has the power to decide what is of concern and the actions taken - setting a dangerous precedent.

This bill, alongside the far-reaching inclusions in the Infrastructure Bill, spells bad news for the crypto market. But it hasn’t passed yet.

In better news many senators - including Senator Cynthia Lummis - are already opposing the inclusion, stating it’s a direct attack on the crypto industry. Alongside non-profits like CoinCenter, these kinds of inclusions have previously been removed from omnibus bills. It’s also been reported that Joe Biden is planning executive action for federal agencies to regulate cryptocurrencies.

In conclusion - watch this space.

What can you do in the meantime to stay compliant?

As crypto tax experts, we keep a keen eye on any developments around crypto tax and legislation around the world - including the US. Our software is designed to make crypto tax reporting as simple as possible, whether you report to the IRS or another tax office.

The best thing you can do in the meantime while Congress tries to figure out what they’re doing is report your crypto taxes accurately under the currency guidelines, helping you avoid unwelcome scrutiny. You should also keep good records of your crypto transactions to ensure you’re ready for any changes to crypto reporting requirements.

Koinly helps you do both - working as both a crypto tax calculator and crypto portfolio tracker. You can see our full guide on US Crypto Tax to see exactly how Koinly works.