Accountant’s Australia Crypto Tax Guide

The ATO has made it crystal clear that cryptocurrency tax is a priority and that very specific rules apply to when and how crypto is taxed. As always, the onus is on the individual, together with their tax professional, to get the numbers right. But anyone who appreciates the complexities of crypto will know that crypto reporting is far from straightforward and that the chances of under or even over-reporting, are great. Crypto tax is a tricky business indeed - but not with our Australian Accountant’s Crypto Tax Guide.

How should an accountant navigate cryptocurrency tax? What do you need to know now to keep your clients safe and your firm in good standing? How do you go about reporting the really complicated stuff, like DeFi, margin trading, and futures?

To get you equipped we’ve pulled together everything you need to know in our Accountant’s Guide to Australian Cryptocurrency Tax. This guide follows the latest guidance issued by the ATO - albeit the guidance is still somewhat limited, particularly in regard to DeFi investments.

We’ve also rounded up additional resources available from the Koinly Crypto Tax Academy. We recommend that you bookmark these pages for future reference.

Another excellent resource is our list of blog posts devoted to understanding the statements and transaction history available from Australia’s most popular crypto exchanges including Binance Australia and CoinSpot. We’ve linked these at the bottom of this page.

Finally, before we get started, our Ultimate Cryptocurrency Tax Guide Australia is a great read for beginners, or for clients wanting to get up to speed on how their crypto assets are taxed. We recommend sending a link to prospective crypto tax clients as a helpful way of starting off on the same page.

So with the housekeeping out of the way, let’s dive in…

Just how big is crypto in Australia?

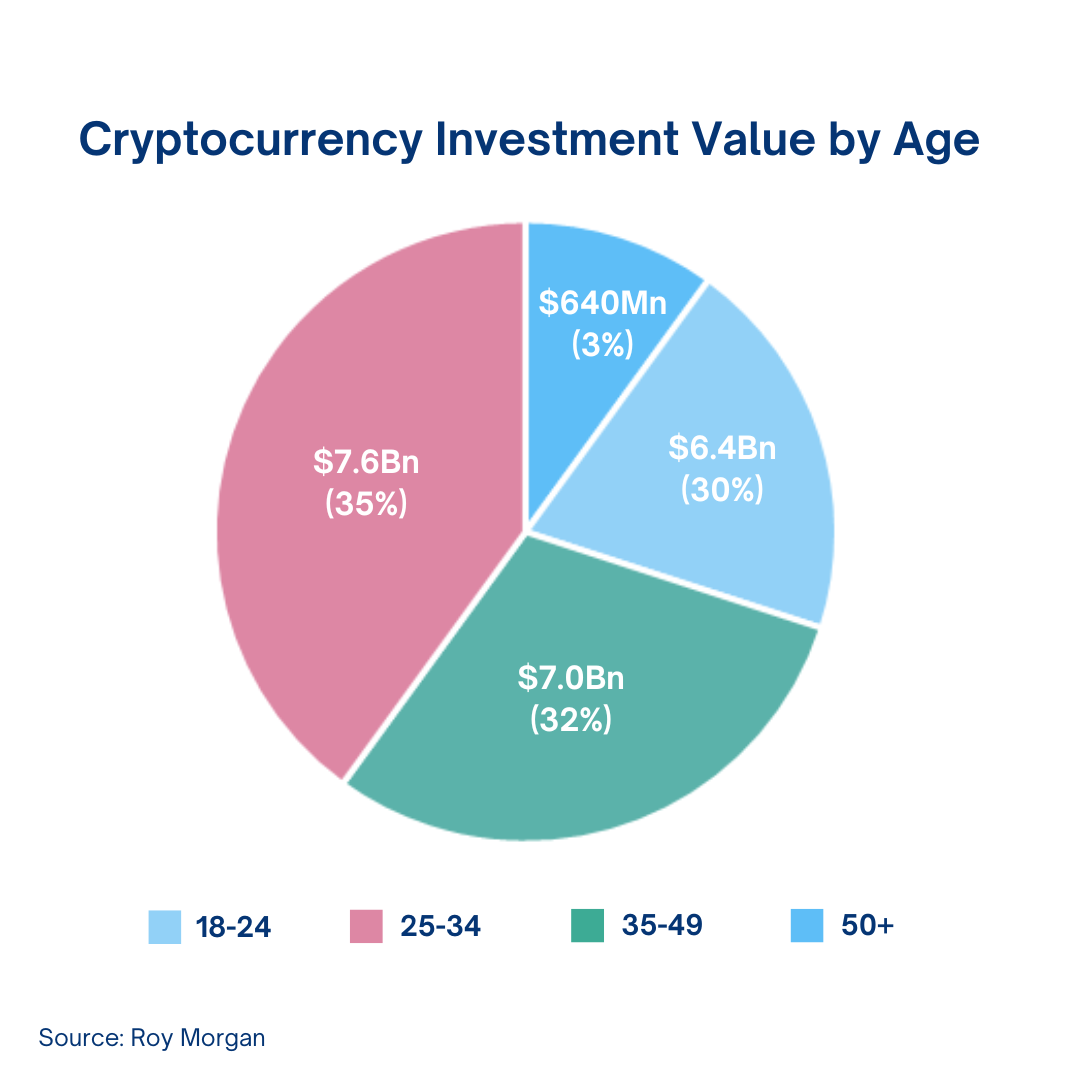

Latest surveys show that an estimated 1 million Australians hold cryptocurrency, or about 5% of the population according to a Roy Morgan poll of 16,000 in April 2022.

That’s a considerable amount of people (that continues to grow) who need to declare their cryptocurrency holdings, and movements, to the ATO come tax time.

Just like any typical investor, cryptocurrency investors range in both their holdings and their aptitude for reporting their own earnings. From degens to day traders - there’s a world of clients out there.

Just like any typical investor, cryptocurrency investors range in both their holdings and their aptitude for reporting their own earnings. From degens to day traders - there’s a world of clients out there.

We do know that 74% of Australians turn to professionals at tax time, but with tricky crypto taxes to contend with - crypto investors are even more likely to do so. We know this thanks to the huge popularity of Koinly’s ‘invite-your-accountant’ feature, which enables users to share their Koinly portfolio tracker and earnings reports directly with their tax agent or accountant.

In other words, at least one million Australians need to report their crypto this year and next - and they’ll be looking at you to help them. Here’s everything you need to know, whether you’re just dipping your toe into the crypto tax market or you already have crypto clients and want to learn more.

How does the ATO view cryptocurrency?

We’ll keep this brief, with further detail to follow, but let’s look first at how the ATO treats crypto cryptocurrency - in a ten-point nutshell:

The ATO refers to cryptocurrency as crypto assets.

Crypto assets are any form of digital representation of value that you can transfer, store, or trade electronically, including NFTs.

Tax-wise, crypto assets are not regarded as foreign currency.

Crypto assets can be acquired or sold through a crypto trading platform, or directly through a digital wallet or hardware wallet. Crypto assets can be exchanged for other crypto assets, fiat currency, or spent on goods and services.

The tax treatment of crypto assets generally depends on whether someone is an investor or carrying on a business (noting there are some complexities such as isolated profit-making transactions)

In general, for investors: crypto assets are CGT assets, including self-managed super funds (SMSFs) investing in crypto.

Rewards for staking crypto are ordinary income.

Occasionally, crypto assets are not kept mainly for investment purposes but rather for personal use. As personal use assets, crypto assets are not subject to CGT if certain specific conditions are met - in most cases, the personal use asset rule will not apply.

Businesses transacting in crypto assets need to account for crypto under the trading stock rules.

While you can hold different types of crypto assets in the same wallet, for tax purposes you need to treat each crypto asset as a separate CGT asset.

This guide below focuses on CGT for individual investors. For traders holding or earning crypto assets in the ordinary course of business, the trading stock rules apply in a similar way to share traders. Trading stock rules bring to account the tax value of the stock at the year's end. Profit from the sale of cryptocurrency held as trading stock in a business is ordinary income. The cost of acquiring crypto held as trading stock is deductible as a business tax deduction.

When does crypto trigger a CGT event?

For investors, a crypto asset disposal looks the same as any other CGT asset class disposal, namely, to sell, swap, spend, or gift. In terms of cryptocurrency transactions, a disposal can look like this:

Selling crypto for AUD.

Swapping crypto for crypto, including stablecoins and NFTs.

Spending crypto to purchase goods and services (when not seen as a personal use asset).

Gifting crypto.

We’ll look at each scenario in depth, a little further down. One point to note which is easy to miss - often transferring crypto from an exchange to your own wallet won’t trigger a disposal, but paying for a transaction fee with crypto will trigger a disposal.

Fair market value and cost basis

As crypto is typically a capital asset, the first thing to consider from an accounting perspective is what is the fair market value in AUD of that asset. Even those new to the world of cryptocurrency are aware of the volatility of the marketplace. Fortunately, the ATO is quite clear on this.

To calculate whether your client has a capital gain or loss, you need to start by knowing the cost basis of their crypto asset. The cost basis is the AUD equivalent of whatever it costs to acquire the crypto, plus any related fees - like purchase or sale fees.

Of course, there are some transactions where there isn’t an obvious fiat market value - like in crypto to crypto trades.

When your client exchanges one crypto asset for another crypto asset, they dispose of one capital asset and acquire another. As a result, a CGT event happens to their original crypto asset.

As your client received property instead of money, you’ll need to calculate the fair market value of the crypto asset in Australian dollars, on the day your client acquired it.

If you are unable to determine the value of a crypto asset your client received from a crypto asset exchange, you’ll then use the market value of the crypto asset they're disposing of to work out the capital proceeds.

And the cost basis method?

The above examples make crypto accounting seem pretty simple - but the reality is the majority of Australian crypto investors have traded multiple crypto assets throughout the financial year - which is why investors must choose and follow an allowable accounting method where multiple assets are concerned.

For individual taxpayers, the following accounting methods are permissible:

First In, First Out (FIFO).

Last In, Last Out (LIFO).

Highest In, First Out (HIFO).

An indication is provided in the context of disposal of shares, where Taxation Determination (TD) 33 outlines that the taxpayers can choose the method of identification of shares being disposed of, where the cost base is not distinguishable.

With all this out the way - let’s take a look at the various CGT disposal events for investors with examples and the tax implications of these disposals.

Selling crypto for AUD

Selling crypto for AUD is one of the most common CGT events. Each crypto coin or token is viewed as a separate CGT asset similar to shares.

Investors can sell crypto a number of ways - but most commonly they’ll sell either via a centralized crypto exchange - like Binance, CoinSpot, or CoinJar - or directly via their own non-custodial wallet - like Ledger.

Regardless of how the crypto is sold, this is viewed as a disposal and as such it triggers a Capital Gains Tax event A1. To calculate the capital gain or loss, take the cost basis of the asset (or fair market value in AUD on the day the asset was acquired) and subtract it from the sale price in AUD.

Let’s take a look at a few examples.

Example 1

A client bought 1 ETH on CoinSpot in December for $3,490 (AUD) and paid a 1% fee for the transaction using their instant buy/sell feature. This would make the cost basis of the ETH:

$3,490 + $34.90 = $3,524.90.

The client later sold 1 ETH in May for $4,927.27 and paid another 1% transaction fee of $49.27. The latter fee can be added to the cost basis, giving a total cost basis of $3,574.17. To calculate the capital gain or loss, subtract the cost basis of the ETH from the sale price.

$4,927.27 - $3,574.17 = $1,353.10. The client made a capital gain of $1,353.10 which will be included in their net capital gains amount along with any other gains or losses made in the year. Net capital gains are taxed at the same rate as their regular Income Tax rate on this profit. If the client had instead made a loss, this would be a capital loss and they would be allowed to offset it against any net capital gain for the year, as well as carry it forward to offset in the future if unutilised.

Example 2

A client bought 1 BTC in March 2020 for $7,224.95 (AUD) directly from their Ledger hardware wallet using Ledger Live and paid a 0.25% fee, so $18.06, making the cost basis for their BTC $7,243.01.

The client later sold their 1 BTC in May 2022 for $40,051.46, with another 0.25% fee. This $100.12 sale fee can be added to the cost basis, giving a cost basis of $7,325.07. To calculate the capital gain or loss, subtract the cost basis of the BTC from the sale price:

$40,051.46 - $7,325.07 = $32,726.39. The client made a capital gain of $32,726.39. As they owned the asset for more than a year before disposing of it, they’ll receive a 50% CGT discount.

If the client had instead made a loss, this would be a capital loss and they would be allowed to offset it against any net capital gain for the year, as well as carry it forward to offset in the future if unutilised.

Beware the wash sale rule

The ATO has issued a reminder in 2022 that crypto is subject to the wash sale rules and taxpayers should not engage in asset wash sales to artificially increase losses and reduce gains.

A wash sale involves the disposal of an asset and the acquisition of the same asset (or a substantially similar asset) in a short period of time. The ATO has no specific time period for a wash sale and instead focuses on intent. If a taxpayer is seen to be deliberately creating a capital loss with the intention of claiming a capital loss and repurchasing the same asset quickly, these transactions would be considered wash sales and any losses created could be denied by the ATO.

This means if an investor, for example, sells ETH at a loss and then repurchases ETH on the same day, that capital loss may constitute a loss sale.

Swapping crypto for crypto

Many investors are unaware - but swapping one cryptocurrency for another is considered a disposal and as such triggers a Capital Gains Tax event as well. This includes swapping stablecoins for another cryptocurrency, as well as swapping fungible cryptocurrency tokens for a non-fungible token (NFT).

The disposal relates to the asset no longer held, not the acquired asset. So all calculations should focus on the asset disposed of, although investors will still need to know the fair AUD market value of the asset acquired on the date they acquired it to calculate their cost basis.

There are a number of transactions where from a tax perspective, despite the investment activity, clients are essentially swapping one cryptocurrency for another. The ATO hasn't given specific guidance on a number of transactions that may constitute a swap (disposal) yet, but by interpreting the current limited guidance and guidance within the ATO community forum, this may include:

Trading one cryptocurrency for another (including stablecoins), on both centralised and decentralised crypto exchanges via non-custodial wallets.

Liquidity mining - and potentially any DeFi investment activity where a token(s) is received in return for capital. Although there is no official guidance on this, some guidance has been suggested in the ATO community forum.

Swapping fungible crypto tokens for non-fungible token(s), or NFTs.

Let’s take a look at some easy examples to explain in-depth.

Example 1

A client bought 1 ETH for $3,450 (AUD) and later decided to trade their 1 ETH for Tether (USDT). Tether is a stablecoin, a kind of cryptocurrency pegged at a 1:1 ratio to the USD and backed with fiat reserves to maintain stability.

At the time of the trade, the fair market value of 1 ETH is $3,900 (AUD). It is the disposal of the ETH constitutes a Capital Gains Tax event - so to calculate the capital gain or loss, subtract the cost basis of the ETH from the fair market AUD value of the ETH on the day of the trade:

$3,900 - $3,450 = $450. The client has a capital gain of $450 which must be included in their net capital gains calculation...

As for the new USDT assets, at the time of the trade $3,900 AUD was equivalent to the fair market value of 2,755 USDT. This figure makes up the cost basis for the new asset. Despite the asset being pegged to the value of USD, all calculations relating to cost basis and fair market value must be in AUD.

Example 2

There are hundreds of DeFi protocols available (we have lots of helpful guides on many of these and exactly how they work), but from a tax perspective, accountants must interpret the available guidance from the ATO and apply it to the specific transaction. It all comes down to how that protocol works. In most instances, DeFi protocols utilise what’s known as a liquidity pool and liquidity pool tokens in order to function.

A liquidity pool is simply a collection of investor funds, locked in via a smart contract. Other investors use these funds to conduct a number of transactions - whether that’s trading one crypto for another, lending crypto, borrowing crypto, or a number of other transactions.

When an investor adds to one of these liquidity pools, they’ll get rewards in return - usually a proportional percentage of any transaction fees relating to the pool. It is how these rewards are paid out that dictates the tax treatment, and in general, they’re paid out via liquidity pool tokens.

Liquidity pool tokens (LP tokens) are a unique kind of token an investor receives when they add their capital to the pool. They’ll get a proportional amount of LP tokens in return, representing their capital. The majority of liquidity pools don’t pay out new tokens as rewards, instead, the liquidity pool tokens accrue value. It is only when the capital is removed from the pool by trading the liquidity pool tokens back that a profit is realised.

For example, a client invests in a PancakeSwap (a decentralised exchange) liquidity pool. The client adds BUSD and BNB to the pool and receives BUSD-BNB LP tokens in return, representing their capital in the pool. From a tax perspective, this could be considered a disposal and a CGT event, although there is no official guidance on this from the ATO, but there is some guidance in the ATO community forum. The client will need to subtract the cost basis of their assets from the fair market value of their BUSD & BNB tokens on the day they swapped them for their LP tokens. Similarly, sometime later when the client wishes to remove their liquidity from the pool, they’ll trade their BUSD-BNB LP tokens back for their capital in the pool. Their BUSD-BNB LP tokens will have accrued value as this is how this protocol works, so they’ll need to take the fair market value of their BUSD-BNB LP tokens on the day they swapped them and subtract the fair market value of the BUSD-BNB LP tokens on the day they received them to calculate their capital gain or loss.

It’s important to note here that while the majority of DeFi protocols work this way, not all do. Some protocols instead pay out rewards in the form of new tokens, and some actually pay out both with new tokens and with tokens representing capital assets that accrue value. So whether your client is staking, liquidity mining or yield farming, you’ll need to consider how the specific DeFi protocol works to interpret the tax implications of that protocol, but if LP tokens are received in exchange for capital, this is likely a disposal and therefore a CGT event.

For DeFi protocols that pay out new tokens, we’ll cover this in more depth below, but under the current guidance earning new tokens is more likely subject to Income Tax.

Example 3

A client uses ETH to purchase a CryptoPunk NFT on OpenSea using their MetaMask wallet. The NFT in question is priced at 6.97 ETH.

On the day of the transaction, the fair market value of 6.97 ETH is $13,924.01. The client also pays $10 in network (gas) fees to process the transaction on the Ethereum blockchain. This fee can be added to their cost basis for the NFT.

The client already owned 6.97 ETH, and the original cost basis for their ETH was $11,203. They’ll need to calculate their capital gain or loss:

$13,924.01 - $11,203 = $2,721.01. The client has made a capital gain of $2,721.01 and will need to pay Capital Gains Tax on that profit.

As for their new CryptoPunk NFT, the cost basis for that is how much it cost to acquire the asset plus any fees, so $13,934. If they later sell their asset, they will need this figure to calculate their capital gain or loss.

Spending crypto

Spending crypto is seen as a disposal and as such, triggers a CGT event.

As crypto becomes increasingly more mainstream, there are many ways to spend crypto now. Many retailers across Australia are now accepting cryptocurrencies as a means of payment, including online retailers like Zumi, Pet Parlour, Cheap Air, and a growing number of smaller, independent businesses from Brisbane to Perth. As well as this, Gobbill now helps Australians pay their bills with ease using crypto.

To calculate any capital gain or loss, taxpayers need to subtract their cost basis from the fair market value of their crypto on the day they spent it.

Let’s take a look at an example.

Example

A client uses Cointree and Gobbill to pay their phone bill. They use BTC to pay and their phone bill is $30 a month.

When they pay a bill using Gobbill and Cointree, Cointree calculates the conversion based on fair market value for them. On the day they pay their bill, $30 is equivalent to 0.0010 BTC. So they need to identify the cost basis for that BTC and calculate whether they made a capital gain or loss since they acquired that BTC.

When they acquired their BTC, they bought 0.5 BTC for $25,000, making 0.0010 BTC worth $50.

$50 - $30 = -$20. The client has made a capital loss of $20 as Bitcoin has depreciated in value, and they can offset this loss against any capital gains.

Wondering about personal use assets?

Got a client asking whether they can utilise the personal use asset rule and reap the tax break?

Well, it’s not good news. While crypto can be considered a personal use asset - the bar to be considered a personal use asset is high and in most instances, crypto isn’t likely to meet it.

It all comes down to how long the client has held the crypto and their intentions. If the crypto has been held for some time before any such transactions are made, or if only a small portion of the crypto is used to make some transactions, it's unlikely that the crypto is a personal use asset (it is more likely to be an investment). However, if crypto is acquired for the sole purpose of spending on personal goods and services, and not held for a period of time, it may be considered a personal use asset and therefore exempt from Capital Gains Tax - provided the transaction is less than $10,000.

Learn more about personal use assets and crypto.

Gifting crypto

Though it may come as a surprise to many clients - despite the potentially philanthropic act - gifting crypto comes at a price. Gifting crypto to another person, whether that’s a spouse, family member, friend, or total stranger, is considered a disposal and triggers a CGT event.

The exemption to this rule would be gifting (donating) crypto to a deductible gift recipient (DGR), where the gifted amount would be tax deductible. A non-DGR gift will fall under regular CGT rules

Let’s take a look at an example.

Example

A client gifts 500 DOGE to a friend. At the time of the donation, the fair market value of 500 DOGE is $43.45.

When the client bought the DOGE, DOGE was trading at $0.2541, meaning 500 DOGE was worth $127.05. To calculate a capital gain or loss, subtract the cost basis from the fair market value on the day of the disposal:

$43.45 - $127.05 = -$83.60. The client made a capital loss of $83.60. This loss may be offset against any capital gain for the financial year or carried forward to future tax years if there’s no gain to offset it against.

When does crypto trigger Income Tax?

With CGT events covered - it’s time to cover Income Tax. In some cases, holding capital assets can also give rise to income tax obligations outside of CGT.

Earning new crypto coins or tokens can be subject to Income Tax even though the coins or tokens themselves are CGT assets. The ATO guidance suggests that staking rewards and most airdrops are taxable as ordinary income at market value when received. Subsequently, when these assets are sold, there will be a CGT event.

There are a number of ways investors can earn new tokens (not all of these are covered in the ATO guidance yet), including:

Staking crypto as part of a proof of stake consensus mechanism.

Mining crypto as part of a proof of work consensus mechanism.

Staking crypto using centralised crypto exchanges or DeFi protocols.

Liquidity mining - if the DeFi protocol works in such a way that new tokens are paid out, as opposed to LP tokens.

Getting paid in cryptocurrency - whether that’s an entire salary, part of a salary, or as tips.

Yield farming - if the farming protocol works in such a way that new tokens are paid out, as opposed to LP tokens.

Earning interest on crypto - by loaning it with centralised exchanges and decentralised lending protocols (although the latter may opt to utilise liquidity pool tokens instead).

Receiving an airdrop of crypto - unless that crypto is received as a result of a hard fork, or as part of an initial allocation airdrop.

Minting and selling NFTs as a business.

Engaging with earning platforms like play-to-earn games, learn-to-earn programs, ads-to-earn browsers, and more.

An important note that clients often forget when Income Tax applies is that just because they’ve already paid Income Tax on their crypto, doesn’t mean it’ll be exempt from tax again later on should they later trigger a CGT event.

Let’s take a look at a few common examples of when crypto is considered ordinary income by the ATO.

Example 1

A client is staking ADA using Daedalus. This is staking as part of a proof of stake consensus mechanism for the Cardano blockchain. As a reward for securing and validating transactions on the blockchain, the client is rewarded with ADA tokens. As the client is receiving new tokens, this is likely to be seen as a kind of additional income and subject to Income Tax. To calculate the amount of income, take the fair market value of the ADA tokens on the day the client receives them and convert them to AUD. This amount will be subject to Income Tax.

Example 2

Crypto mining rewards may be subject to Income Tax - it all depends on whether the activities are seen as business-like or more akin to a hobby.

The line between hobby and business activities can get blurred - which is why many crypto investors need a crypto accountant to help them navigate their tax obligations relating to crypto mining.

The ATO states that there is no single factor that determines whether a taxpayer is in business, but some factors to consider include:

If an investor has registered a business name or obtained an ABN.

If an investor intends to make a profit - or genuinely believes they will make a profit, even if unlikely to do so in the short term.

If an investor repeats similar types of activities.

If the size of scale of an investor's activity is consistent with other businesses in that industry.

If an investor's activity is planned, organised, and carried out in a business-like manner - for example, if they keep records and account books, have a separate business bank account, or operate from business premises.

In regard to crypto mining, there could be two potential types of miners - hobby miners and investors who mine as a trade, and it all comes down to intent. For example, an investor mining Monero on their home computer, who earns irregular rewards as they are mining solo and holds those rewards long-term as they support the aims and goals of the blockchain is unlikely to be seen to be conducting business activities. Therefore their mining rewards would not be subject to Income Tax upon receipt - though they would still be subject to tax on any profits if they later triggered a CGT event by disposing of their rewards.

Meanwhile, an investor mining Bitcoin with a specialised ASIC mining rig and cooling equipment, who is part of a crypto mining pool and earns regular rewards and sells those rewards for fiat currency is likely to be seen to be conducting business activities as they intend to make a profit and would pay Income Tax upon receipt of mining rewards, based on the fair market value in AUD on the day they received them. The investor would still be subject to tax on any profit if they later sold, swapped, spent, or gifted mining rewards and triggered a CGT event.

Investors vs. sole traders vs. businesses

There is a wide variety of crypto clients for experienced accountants in Australia - from individual taxpayers to traders to businesses - each with a different kind of tax treatment.

Individual investors

From newbies to degens - there’s a whole spectrum of investors who are in dire need of help filing their crypto taxes with the ATO, each with a variety of investment activities and volumes. Many Australian taxpayers are entirely unfamiliar with Capital Gains Tax and are unaware of the various allowances to reduce tax obligations. On the other hand, many investors are aware crypto is taxed but don’t fully understand the potential tax implications around specific transactions and wrongly assume some transactions are tax free.

Koinly helps investors, and accountants every step of the way. We’ve got our ultimate Australia crypto tax guide to help investors navigate the complicated world of crypto tax, our Australian crypto accountants directory to help investors find a great crypto accountant who can help them calculate and file accurately, and, of course, our incredible crypto tax tool that helps save hours for investors - and their accountants!

Sole traders

The tax implications for crypto sole traders are very different from the tax obligations of individual investors. In general, their profits will be taxed as income - but the silver lining is that far more deductions are available, as well as potentially being able to access small business tax concessions.

Keeping records of transactions as a sole trader is hard work and as such, the majority of crypto sole traders opt to use a crypto tax software like Koinly, alongside an experienced accountant. In fact, Koinly allows clients to share their Koinly account with their accountant, as well as track their portfolio and profits. For clients (or accountants!) wanting to learn more, we’ve also got our Australian crypto sole traders tax guide.

Crypto businesses

Finally, we have crypto businesses - of which there are a multitude! From crypto mining as a business to day trading, Koinly can help calculate and handle it all. The top Koinly plan supports up to 10,000 transactions - but if that’s not enough, no worries! You can purchase additional transactions in the Koinly app and Koinly is able to support more than 100,000 transactions.

How crypto accountants can help investors

All accountants know that preparing for tax deadlines takes a lot of prep - and crypto taxes are no exception to this rule!

Crypto accountants can help their clients with a range of strategies to optimise their taxable position before the end of the financial year - including tax loss harvesting and utilising the best cost basis method available. Koinly can help with all of this as you can track your client’s realised and unrealised gains all from one spot. Koinly also supports a range of allowable crypto accounting methods including FIFO, LIFO, and HIFO.

Once optimised, accountants can help clients check their crypto tax reports in Koinly for accuracy ahead of the 31st of October deadline for the self-filing deadline, or the 15th of May deadline for clients lodging through an accountant.

How to calculate and report clients’ crypto taxes

In general, for investors subject to CGT, there are five steps to calculating and reporting crypto taxes with the ATO:

Calculate the cost basis of each crypto asset, or the fair market value (FMV) of the crypto asset in AUD on the day it was acquired.

Identify each taxable transaction and the type of tax that would apply - whether that’s Income Tax or Capital Gains Tax.

Calculate capital gains and losses from each disposal of crypto, including separating short-term and long-term capital gains. Tally up capital gains, minus any losses or discounts for the net capital gain.

Identify the fair market value in AUD of any crypto income on the day it was received.

Report these final figures to the ATO using the online myTax service.

The forms needed to file crypto taxes will vary slightly depending on each client and their specific investments. Clients may need:

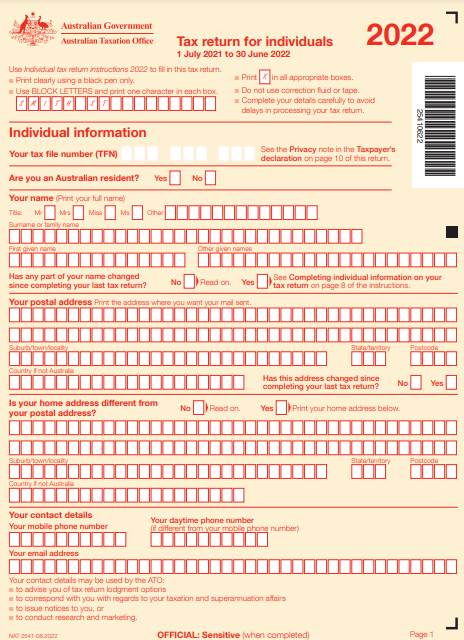

Tax Return for Individuals (NAT 2541). Crypto income should be declared in question 2. If they have capital gains, they'll also need to select yes on question 1.

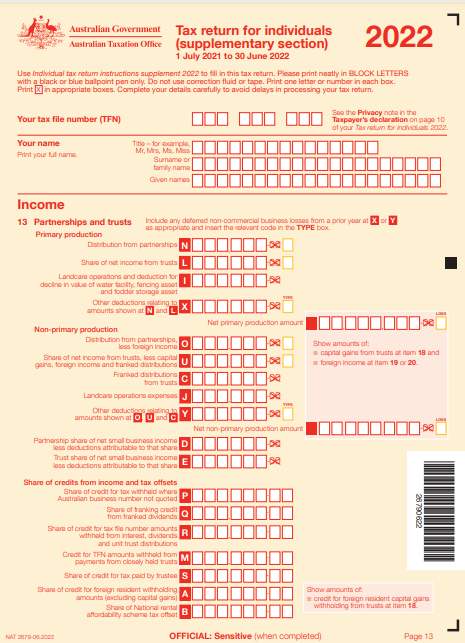

Tax Return for Individuals Supplementary Section (NAT 2679). Crypto capital gains should be reported under 18H, while losses are reported under 18V, and the final figure reported under 18A.

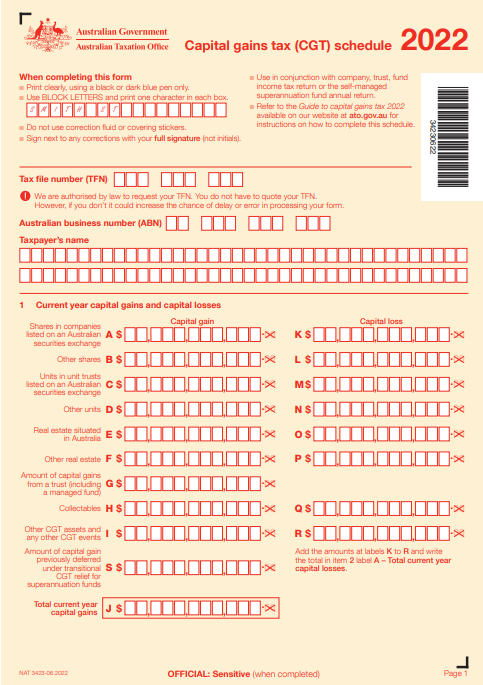

Capital Gains Tax (CGT) Schedule. If a client has gains or losses greater than $10,000 - they must also complete this form.

You can see the forms below.

Tax Return for Individuals (NAT 2541): View form

Tax Return For Individuals (Supplementary Section) (NAT 2679): View form

Capital Gains Tax (CGT) Schedule: View form

The best crypto tax tool for Australian Accountants

Koinly is the most trusted crypto tax tool for Australian crypto accountants. We help save you, and your clients, hours of calculations and spreadsheets.

All you, or your client, need to do with Koinly is add the crypto exchanges, wallets, or blockchains they use via API or by uploading CSV files of their transactions. Koinly then gets to work calculating everything needed to file crypto taxes with the ATO. Once it’s worked its magic, check your clients’ Koinly account and generate the ATO myTax report or Complete Tax Report, ready to file with the ATO come tax time.

For accountants, Koinly lets you manage multiple clients all from one spot, with a user-friendly platform and an amazing support team to help you troubleshoot any issues as you go. Crypto accountants can sign up for a free Koinly account in minutes.

Koinly also helps connect crypto accountants with crypto investors who need help calculating and filing their ATO taxes. Our Australian crypto accountant directory offers accountants an easy way for clients to find them. Get listed.