Crypto Tax Australia: Here’s How Much You’ll Pay in 2024

Wondering how much tax you’ll pay on crypto in Australia? This guide will cover everything you need to know! Whether you're looking to learn about Bitcoin tax or any other cryptocurrency, we’re covering crypto Capital Gains Tax, crypto Income Tax, and how much tax you’ll need to pay. Plus, we’ll share strategies that help you avoid paying too much tax. Finally, we’ll take you on a step-by-step walkthrough on how to file your crypto tax using myTax all ahead of the 31st of October deadline. Let’s go! 🚀

How much tax do you pay on crypto in Australia?

For crypto investments in Australia, Capital Gains Tax applies. Report gains and losses in your Income Tax Return and pay Income Tax on net gains. Hold for a year and receive a 50% discount. Declare crypto in your ATO tax return if you've sold, traded, or earned it in the past financial year.

This guide is regularly updated

At Koinly Australia we keep a very close eye on the ATO's crypto asset guidance and regularly update this guide to keep you informed and tax-compliant.

19 December 2023: Updated for 2024

14 November 2023: Updated with the latest ATO guidance on spending, gambling, DeFi, and more.

23 March 2023: Updates, airdrops, and more, ready for the new tax season!

13 February 2023: The ATO sending out notices to crypto investors in 2023.

12 September 2022: The ATO releases updated guidance on airdrops & tax free initial allocation airdrops.

27 June 2022: The ATO has issued a warning advising investors to avoid wash sales.

6 June 2022: Can't afford your crypto tax bill now the bear run has hit? Get help.

22 April 2022: EOFYS is near! Guide updated for 2022.

01 Dec 2021: Tax rates 2021-2022 updated.

30 June 2021: Watch our Aussie Crypto Tax Guide here and on YouTube.

28 May 2021: The ATO issued a statement addressing crypto investors. Read it here.

13 May 2021: Guide updated for 2021.

22 June 2020: ATO warns 350,000 investors to disclose or face penalties.

24 July 2019: Welcome to your Australian cryptocurrency tax guide!

Watch our Australian crypto tax guide

Is cryptocurrency legal in Australia?

Yes, crypto is legal in Australia and is taxed as property. Crypto exchanges operating in Australia need to register with AUSTRAC as a financial service provider.

Can the ATO track crypto?

Yes, the ATO can track crypto. If you have an account with an Australian cryptocurrency designated service provider (DSP), then it's likely that the ATO already has your data.

The ATO has a data matching program with Australian exchanges.

The ATO knows who has crypto transaction data from as far back as 2014.

The ATO has the know-your-customer (KYC) information you provided when signing up for any Australian exchange or wallet.

Since 2020, hundreds of thousands of Australian crypto investors have received letters from the ATO warning that crypto is indeed taxable, and that failure to declare could result in penalties for tax evasion. In the 2021 warning letter, recipients were given 28 days to disclose their crypto trades. In 2023, the ATO sent more crypto notices, advising investors they needed to amend their lodgement. Learn more about how the ATO tracks crypto, here.

How is crypto taxed in Australia?

The Australian government does not see Bitcoin and other cryptocurrencies as money or foreign currency. Instead, the ATO classes crypto as property, and as an asset for Capital Gains Tax (CGT) purposes. This includes cryptocurrency coins, tokens, NFTs, and stablecoins. But depending on the specific transaction, crypto may also be viewed as additional income and taxed as Income Tax.

How you're taxed depends on your specific circumstances, as well as the specific transactions you're making.

Crypto investor vs. trader

Whilst there are more complex nuances in Australian tax law, the tax treatment of your crypto will typically depend on whether you're seen as an individual investor or a trader making a regular income. There are different tax rules for individual investors, and for taxpayers who make a regular income from trading.

Similarly, the ATO views crypto users as either a trader or an investor for tax purposes, but the lines can get a little fuzzy. See the advice from the ATO, but in general, the following is a good guide:

Investor: An investor is just that - an individual investing in a future return. An investor buys and sells crypto as personal investment 'stock' with the goal of gradually building wealth over an extended period of time with their profit made from long-term capital gains. In some cases, Income Tax may directly apply (i.e. outside of capital gains) - depending on how the crypto was acquired. Investors can access the 50% Capital Gains Tax discount for long-term gains, whereas traders can not. With that out the way, let's take a look at the general crypto tax rules in Australia for individual investors.

Capital Gains Tax on crypto

As a crypto investor you need to consider Capital Gains Tax (CGT) when you dispose of your cryptocurrency (CGT Event). A disposal doesn't only refer to a sale of crypto though. In general, we can think of a disposal as any time your crypto trades ownership. This includes:

Selling crypto for AUD or another fiat currency.

Swapping crypto for crypto, including stablecoins and NFTs.

Spending crypto on goods and services including spending crypto with cards (if your crypto is not a personal use asset).

Gifting crypto.

Remember - if you hold your crypto for at least one year before you make a disposal - you'll be eligible for a 50% discount on any capital gain.

Capital Gains Tax rate

In Australia, if you’re selling, trading, spending, or gifting crypto as an individual (investor), the net capital gain made is paid at your Income Tax rate. Your income tax rate depends on your total income during the tax year.

ATO Individual Income Tax Rates 2023–2024

| Income | Tax Rate |

|---|---|

| $0 - $18,200 | 0% |

| $18,201 - $45,000 | Nil + 19% of excess over $18,200 |

| $45,001 - $120,000 | $5,092 + 32.5% of excess over $45,000 |

| $120,001 - $180,000 | $29,467 + 37% of excess over $120,000 |

| $180,001+ | $51,667 + 45% of excess over $180,000 |

How to calculate crypto capital gains

Calculating capital gains works in the same way, whether you're trading regular assets or crypto assets.

A capital gain or loss is the difference in value from when you acquired your crypto to when you sold or otherwise disposed of it. If you have a profit, you have a capital gain and you'll pay Capital Gains Tax on that profit. If you have a loss from your crypto decreasing in value, then you have a capital loss and you won't pay tax.

To calculate whether you have a capital gain or loss you need to start by knowing your cost basis. Put simply, your cost basis is generally whatever it cost you (AUD equivalent) to acquire your crypto plus any related fees - like purchase or sale fees.

EXAMPLE

Craig, an individual investor, bought 1 ETH in January for $1,000 plus a fee of $100. In May of the same year, he sold his 1 ETH for $2,000 plus a fee of $100. His cost basis is thus $1,100.

His capital gain is the new value of $2,000 less the cost base of $1,100, and the new fee of $100 to arrive at a sales proceed of $800. Craig's $800 gain will be taxed according to his Income Tax rate as Capital Gains Tax. If he waited to sell after a year had passed Craig could have halved his tax liability - he'd pay only 50% of $800 thanks to the long-term Capital Gains Tax discount.

Crypto capital losses

If the proceeds from the disposal of your crypto are less than what you paid to acquire it initially, you'll see a loss. If you make a capital loss then you can deduct the loss from any capital gains, and even carry over the loss to future years. There is no time limit on how long you can carry forward a capital loss, but the losses must be used at the first available opportunity.

Losses can offset gains made on crypto investments, share investments, and even property investments. However, you can't deduct a net capital loss from your other income.

Crypto wash sale

The ATO has issued a warning to taxpayers stating they should not engage in asset wash sales to artificially increase their losses and reduce their tax bill. A wash sale involves the disposal of an asset (like crypto) and the acquisition of the same asset (or a substantially similar asset) in a short period of time. Unlike many other tax offices, the ATO doesn't have specific time periods for a wash sale - instead, it comes down to intent, if a taxpayer is seen to be deliberately creating artificial losses in order to gain a tax benefit, this would constitute a wash sale.

Assistant Commissioner Tim Loh said, “Don’t hang yourself out to dry by engaging in a wash sale. We want you to count your losses, not have them removed by the ATO.”

The ATO states taxpayers who engage in wash sales are at risk of facing swift compliance action and potentially additional tax, interest, and penalties.

Crypto tax breaks

Australian tax residents get a little breathing space with a number of tax-free thresholds and allowances that happily apply to crypto too.

Tax free threshold: You'll only start to pay Income Tax when you hit $18,200 in total income per year.

50% long-term capital gain discount: If you hold your cryptocurrency for more than a year before selling or trading it, you may be entitled to a 50% CGT discount.

Personal use asset: You may get an exemption from capital gains tax if you spend crypto which is a personal use asset. The rules around personal use assets are complex, but you can learn more in our dedicated guide on how crypto personal use assets work.

Tax on lost or stolen crypto

If you lose your private key or your crypto is stolen by a hacker or scammer, you may be able to claim a capital loss. It all depends on whether you can prove what you lost and that what you lost is irrecoverable. Learn more in our dedicated ATO lost crypto guide.

Income Tax on crypto

There are cases where crypto is treated as income and thus attracts Income Tax directly without being subject to Capital Gains, even if you're an individual investor.

Three ways that make sense from a 'labour' perspective to earn crypto is by:

Getting your salary paid in crypto

Selling NFTs you create - like an artist.

Becoming a validator and earning through PoS or PoW.

Staking or lending cryptocurrency for interest.

You're taxed differently if you're seen to be acquiring new mining tokens as a hobby miner, than as a commercial operation.

There are also various other activities, particularly in the Australian DeFi space, that may be viewed as income, including:

Receiving airdrops - excluding initial coin offerings.

Referral rewards like Binance Referral.

Learn to earn campaigns, like Coinbase Learn.

Browse to earn platforms like Brave.

Play to earn games like Axie Infinity.

DeFi - or decentralized finance - has opened a world of opportunities to use your own crypto to earn more crypto.

Earning interest through lending protocols like Compound or Aave.

Providing liquidity on decentralized exchanges like Uniswap.

Earning staking rewards from protocols like Lido.

Tax free crypto

It's not all bad news. Certain crypto activities are tax-free in Australia. But a word of caution, some provisions are straightforward - like not having to pay tax when buying or holding crypto. Other seemingly tax-free transactions can quickly blur the lines, especially when it comes to DeFi transactions, or crossing the boundary from 'investor' to trader.

Broadly speaking, here's when you won't pay tax on crypto in Australia:

Buying crypto with AUD.

Holding crypto.

Acquiring crypto as a gift.

Acquiring crypto from hobby-level crypto mining.

Transferring crypto between your own wallets - but watch out for transfer fees.

Purchasing goods and services with crypto - if the crypto is a personal use asset.

Donating crypto to registered charities with Deductible Gift Recipient (DGR) status.

Tax on buying crypto

Do you pay tax when you buy crypto in Australia? According to the ATO, it all depends on how you pay.

Buying cryptocurrency with AUD

TAX FREEYou're not taxed when you buy cryptocurrency with AUD in Australia. Crypto is also GST-free.

However, keeping accurate records of the purchase is very important so that you can calculate the cost basis of the transaction when you decide to sell or 'dispose' of your crypto - as that is the moment when you will have to pay tax.

Koinly is not just a crypto tax calculator but a crypto portfolio tracker too - the perfect tool to keep a hold on your crypto purchase and sale dates.

Buy and HODL

TAX FREEIf your strategy is to simply buy and hold your crypto, then you don’t need to pay tax on the cryptocurrency you hodl, even if the value of your portfolio increases. The taxable event is when you sell, exchange, or gift your crypto (to a DGR).

Buying crypto with crypto

CAPITAL GAINS TAXBuying, swapping, or trading one crypto for another (ex. BTC → ETH) is a taxable event in Australia. Even though you never received any dollars in hand, you still have to pay tax at AUD equivalent value if you made a gain on the disposal of the BTC.

The market value (in AUD) of the purchased coins is used to determine the capital gain. If the cryptocurrency that you received can't be valued, you will have to take into account the market value of the crypto you sold at the time of the transaction.

A stablecoin - like Dai, TrueUSD, or Australia's AUDT, is simply a class of cryptocurrency that offers price stability. That's because stablecoins are backed by a reserve asset, usually a stable fiat currency like USD or AUD. As far as the ATO is concerned however, stablecoins like TrueUSD are exactly the same as any other cryptocurrency, and so the tax treatment - Capital Gains Tax - is the same as for regular crypto to crypto exchanges.

EXAMPLE

Let's say you purchased 1 BTC for $1,000 in July 2017.

In November 2017, you exchanged 0.5 BTC for 3 ETH. Let's imagine that at this time, the market value of 3 ETH was around $2,000.

This means your capital proceeds come to $2,000 and the cost of acquisition is $500. In other words, your capital gain would be $1,500.

Tax on selling crypto

If you're investing in crypto the day will surely come when you want to - or need to - cash out any gains. How will the ATO snare you at this crucial moment? It all depends on your level of patience.

Selling crypto for fiat

CAPITAL GAINS TAXAccording to the ATO, selling crypto for fiat currency, such as the Australian dollar, is a taxable event at the time of sale.

The amount of tax you'll pay however varies a lot depending on whether you have a short-term or long-term gain. Gains from crypto held less than a year before the sale are taxed in full, while gains from crypto held more than a year before the sale receive a 50% discount.

EXAMPLE

Craig purchases 0.1 BTC in July 2017 for $1,000 and sells it in November 2017 for $2,000 Australian dollars. His total capital gain is thus $1,000.

Selling crypto for crypto

CAPITAL GAINS TAXAs with buying crypto with crypto, selling, swapping, or trading one cryptocurrency for another is a taxable event too, and Capital Gains Tax applies.

This applies to stablecoins too. Selling a coin like ETH for a stablecoin like Dai is unfortunately seen as disposal, just the same way selling ETH for BTC is.

Moving crypto between wallets, exchanges, and pools

The ATO has confirmed that when you're moving crypto around between your own wallets - this isn't seen as a disposal and you don't need to report it or pay Capital Gains Tax. However, nothing is quite so straightforward in the world of crypto, and transactions like adding and removing liquidity may get a little more confusing from a tax perspective.

Moving crypto between wallets

TAX FREEMoving crypto between different wallets that you own is not a taxable event and does not trigger Capital Gains Tax. However, watch out for transaction fees paid in crypto, which may be taxable.

Having said that, it's important to keep track of these movements as you'll need to track the cost basis of your crypto in case you later dispose of it by selling, swapping, spending, or gifting it. Automated crypto tax software like Koinly can help you track your cost basis across all the wallets you use easily.

EXAMPLE

Let's say Sam buys 4 LTC for $1,000 on Coinbase. She later moves the funds into her private LTC wallet. A few days later she transfers the LTC from her private wallet to her Binance account and sells it for $2,000, making a profit of $1,000.

If Sam wants to use Koinly to generate her crypto tax report, she will have to connect all three wallets. If she doesn't sync her private wallet but only syncs the Coinbase and Binance accounts, Koinly won't be able to identify that the funds she transferred into her Binance account are the same funds she purchased on Coinbase.

However, once Sam adds her private wallet address, Koinly can match the transfer by tracing it from Coinbase to her wallet and then from her wallet to Binance. This will help in producing an accurate tax report.

If she no longer has access to her private wallet, she will have to make some manual changes using the Koinly web interface. She will have to mark the transfer from Coinbase as ignored so that Koinly doesn't realise a gain on it and she doesn't have to pay taxes twice. She would then change the value of the incoming transaction to Binance to match the cost basis of the outgoing transaction from Coinbase.

Transfer fees

CAPITAL GAINS TAXMoving your own crypto between wallets? No doubt you'll pay a transfer fee or network fee to do so. If you're paying this in AUD, this is tax free. However, more often than not you're going to be paying for this transfer fee in cryptocurrency.

If you're using cryptocurrency to pay that fee you’re technically spending the asset - which is viewed as a disposal. This is a taxable event. So while transfers are tax free, transfer fees are not if you paid the fee in cryptocurrency. You'll need to calculate your cost basis and capital gain or loss.

The ATO has taken an official position on this: If the transfer fee was paid using crypto then that triggers Capital Gains Tax. You would need to work out the capital gain or loss for the portion of your crypto that was used to pay the transfer fee. The cost basis is the value of the fee amount at the time the fee was paid. See more on this from the ATO here and here.

EXAMPLE

You bought 1 ETH. The price of 1 ETH when you bought it is $4,385.

You decide you want to move your ETH from your Binance wallet to your MetaMask wallet. You're charged a flat fee of 0.005 ETH to do so.

You're paying in ETH - so you're disposing of your cryptocurrency. You'll need to calculate the cost basis and the fair market value of your crypto at the point of disposal. To keep it simple, let's say the price of ETH hasn't changed since you bought it.

0.005 ETH = $21.90. This is your disposal - you need to report this to the ATO as a disposal, regardless of the fact you have no capital gain or loss. Of course, doing this for every transaction can be time-consuming. Koinly can help you do this with our "treat transfer fees as disposals" setting.

Adding and removing liquidity

POTENTIAL CAPITAL GAINS TAXIf you're adding or removing liquidity from various DeFi protocols, on the surface, this doesn't look like a taxable event but the ATO is likely to view each deposit as a disposal and therefore a taxable event based on their community guidance.

However, this area is potentially complex and the tax treatment will depend on the nature of the DeFi protocols used. The ATO doesn’t yet have formal guidance on DeFi so it is advisable to read our latest Australian DeFi Tax Guide and to get tax advice from a qualified accountant. You’ll need to keep detailed records of the DeFi transactions for tax purposes.

How are airdrops and forks taxed in Australia?

Airdrops and forks are the windfalls of the cryptocurrency world, but will you need to pay tax on new assets from drops and chain splits? Will it be classed and taxed as some sort of income? Or are airdrops and forks tax free?

Receiving an airdrop

INCOME TAXThe ATO has released updated guidance on airdrops and in most instances, airdrops are considered ordinary income at the fair market value of the tokens on the date you received them.

To figure out how much Income Tax you need to pay, calculate the fair market value of your airdropped crypto on the day you receive it and apply your income tax rate.

However, there is a specific exception to this rule for initial allocation airdrops. The ATO says these airdrops are not considered ordinary income upon receipt and therefore tax free. Your cost basis is whatever you paid for the tokens, or zero if you paid nothing.

Koinly's Australian Head of Tax, Danny Talwar, says “Some examples from the previous year of Initial Allocation Airdrops that may apply include; ApeCoin (APE), Looks Rare (LOOKS), Ethereum Name Service (ENS), Optimism (OP), and Paraswap (PSP). Implications for Australian crypto investors were confusing, as this was announced in the middle of the previous tax season. For those who had already submitted their tax returns for the 2021 - 2022 financial year, there may have been an opportunity to amend your tax return, as receiving an “Initial Allocation Airdrop” is no longer taxed on income or capital basis on receipt.”

As well as this, more recently, there have been a couple of popular airdrops where users claimed tokens sometime before they were tradable - for example, the Sudoswap and Prime airdrops. Users could claim these tokens weeks before they were transferrable or tradable on decentralized exchanges, and this presents a conundrum within the existing airdrop tax guidance from the ATO. If airdrops are taxable as income at the point of receipt but have no fair market value as they're not tradable yet, should investors use a value of zero at the point of receipt, or should investors use the fair market value at the point the tokens are tradable? It's quite a grey area in existing legislation, so if you've had an airdrop like this, we recommend seeking advice from an experienced crypto tax accountant.

EXAMPLE

You receive 300 1INCH tokens from an airdrop. On the day you receive them, the fair market value per token is $3.5. Your tokens are subject to Income Tax, so you need to calculate their total worth.

$3.5 x 300 = $1,050. You report $1,050 of income on your Individual Tax Return Form.

Selling or trading your airdropped coins

CAPITAL GAINS TAXIf you sell, swap, spend, or gift your airdropped coins or tokens, the disposal is treated as a normal capital gains event.

The cost basis here is the value of the coins when they were first airdropped to you, or zero if you paid nothing for them.

EXAMPLE

You sell your 300 airdropped 1INCH tokens a couple of days later. The fair market value per token is $4, so you make $1,200. You can use the calculation above as your cost basis.

$1,200 - $1,050 = $150. You report a capital gain of $150 on your Individual Tax Return Form.

Receiving crypto from a hard fork

TAX FREEThe ATO has two rules for hard forks, also known as chain splits, and it depends on whether you’re an investor or running a cryptocurrency business. If it’s the latter, you’ll need to follow trading stock tax rules, not crypto tax rules.

If you’re an investor, you won’t pay Income Tax on any new coins received as a result of a hard fork. The cost basis for new coins from a hard fork is zero.

Selling crypto from a hard fork

CAPITAL GAINS TAXThe ATO is very clear that the cost basis for new coins from a hard fork is zero, so you’ll pay Capital Gains Tax on the total value of your coin as it’s all seen as profit.

One of the ways you can reduce this taxation is to HODL. Australian investors who hold assets for longer than a year enjoy a 50% long-term Capital Gains Tax discount when they sell, swap, spend, or gift them. This discount would apply to coins received from a fork, just as it would to any other crypto asset held for more than a year.

EXAMPLE

You received 1 BCH in 2017 when it split from BTC. Your cost basis for this new coin is $0. You sell it a couple of months later at its peak for $2,000. Because your cost basis is zero - the whole $2,000 is viewed as profit by the ATO and subject to Capital Gains Tax. But if you'd held on to your BCH for a year, you'd have received a 50% discount for a long-term gain.

Token address change

TAX FREEWhen a cryptocurrency changes its underlying tech - for example, when EOS went from the ETH blockchain to the EOS mainnet or when DAI changed its contract address and named the old coin SAI - there are no tax liabilities. You can tag these transactions with the 'swap' label in Koinly.

However, please note that if your old coins continue to hold value even after the new ones have been issued then the ATO may consider this as a fork and not a swap - this may give rise to a Capital Gains Tax event.

Crypto gifts and donations tax

Gifts and donations can often be tax efficient, but can you use crypto for donations in Australia? Broadly, gifting to a Deductible Gift Recipient (DGR) may be tax deductible, but non-DGR donations will not be. Here's what the ATO has to say about how crypto donations and gifts are taxed.

Giving a crypto gift

CAPITAL GAINS TAXThis is going to hurt. Whether your reason for gifting your crypto is altruistic or opportunistic, the ATO cares not and will happily ask you to pay Capital Gains Tax on any perceived profits from the disposal.

Receiving crypto as a gift

TAX FREEIf someone gives you crypto as a gift, consider yourself lucky for two reasons. You've just scored some crypto and you don't pay any tax.

Receiving crypto as a gift is not a taxable event. But, you will need to keep a record of the fair market value of the crypto on the day you received it. This will become your cost basis and you'll need this to calculate a potential gain or loss, should you decide to sell, or even re-gift your crypto gift.

Selling your crypto gift

CAPITAL GAINS TAXThe bad news is back. While the receiving of a crypto gift is tax free, the disposal - be it by selling, swapping, spending, or re-gifting, is taxed as a capital gain. Your cost basis will be the fair market value of the coins on the day you received them.

Donating crypto

TAX FREEIn Australia crypto donations work the same as regular donations - they're tax deductible if you're donating to a deductible gift recipient (DGR)

You can claim the donated amount (calculated as the dollar price of the cryptocurrency at the time it’s donated) as a deduction on your tax return and any associated capital gain is exempted.

Tax on mining crypto

Mining bitcoin in Australia? The ATO will tax your mining activities based on whether you're a hobby miner or a trader. The lines can get blurry - In order to determine whether you are mining crypto as a business, check out this section of ATO's website.

Mining as a hobby

TAX FREEA hobby miner is someone who participates in cryptocurrency mining as an interest or pastime and not in a business-like manner seeking commercial profits. Their investment in mining tech will be relatively insignificant - a small-scale operation at home - and intention to accumulate the rewarded coins rather than sell immediately to turn a profit.

Rewarded coins are not income but rather a capital acquisition.

The mined coins will be subject to Capital Gains Tax on disposal. No expense deductions are allowable. It's also important to remember that personal use asset exemption rules don't apply to the capital gains made on the disposal of mined cryptocurrency.

Mining as a business

INCOME TAXA person conducting their mining in a large-scale business operation is a commercial miner and most likely running a business. If this is the case, the tax treatment will follow the trading stock rules. Any proceeds you receive from a mining pool/service or your own mining rig are to be included as income. The mining equipment and associated costs may be deducible in the tax return.

Selling mined coins

CAPITAL GAINS TAXWhen you eventually sell your mined coins, you will still be subject to Capital Gains Tax on the difference between the value you declared as Income and the value at the time of the sale.

Crypto staking taxes

Wondering if your crypto staking rewards are taxable? Well, the ATO is pretty clear that they are and in fact, you may pay two kinds of tax on staking rewards depending on the transaction. Learn more in our dedicated crypto staking taxes guide.

Receiving crypto staking rewards

INCOME TAXThe ATO views crypto staking rewards as ordinary income at the point you receive them. This means you'll pay Income Tax based on the fair market value of your coins or tokens in AUD.

It's important to note that there is no guidance from the ATO yet on when staking rewards are presumed as received. For example, for ETH 2.0 stakers, although many investors have received staking rewards, up until recently investors could not withdraw these rewards. As such, there is an argument as to whether investors should declare and report ordinary income based on the fair market value on the day they received staking rewards or the day they were able to withdraw and dispose of those rewards.

Selling staking rewards

CAPITAL GAINS TAXIf you later sell, or otherwise dispose of, your staking rewards, you'll still need to pay Capital Gains Tax on any gain, just like you would if you disposed of any other crypto. You can use the fair market value you calculated when you received your crypto as your cost basis to calculate gains and losses.

Crypto margin trading, futures, and CFDs

The tax for crypto trading such as margin trading, futures, and CFDs is a little complicated, so let's break down the taxes on crypto trading.

Margin trading, futures, and derivatives

CAPITAL GAINS TAXMargin trading with crypto involves borrowing funds from an exchange to carry out your trades and then repaying the loan later. There is usually an interest payment involved as well.

The ATO does not currently provide any clear guidance on what taxes apply to cryptocurrency margin trading, futures, options, or other types of derivatives. So if you're an investor, it is worth getting professional advice.

While there is currently no guidance on how this is taxed, it is important to note that there is a clear difference between margin trading and trading with futures, so the rules that apply to futures trading/speculation may not apply to margin trades.

On a futures trade, you are speculating on the rise and fall of a coin.

On a margin trade, you are borrowing funds to carry out some trades.

Most exchanges have different platforms for both, for example, Binance allows margin trading on spot markets, whereas you have to trade on a completely different platform if you want to do futures as well - Binance Futures.

Taking this into consideration, it is important to seek professional advice from a suitably qualified tax professional.

CFDs

INCOME TAXContracts for Difference or CFDs are a complex area of taxation. The ATO has guidance - but it's quite convoluted.

In brief, in most instances, gains from a CFD will be subject to Income Tax - where the transaction is entered into as an ordinary incident of carrying on a business, or where the profit was obtained in a business operation or commercial transaction for the purpose of profit-making. In less jargon-like terms, most taxpayers trading CFDs are fairly experienced investors - regardless of their taxable status - as such, profits will be subject to Income Tax and not benefit from the various Capital Gains Tax breaks. Similarly, losses from CFDs are allowable deductions.

There are rare instances where profits from CFDs are non-taxable. This includes when a CFD is entered into for the purpose of recreational gambling - but it's very difficult to meet this bar for the ATO.

Crypto futures or options tax

CAPITAL GAINS OR INCOME TAXIn futures trading, you are not actually buying or selling any crypto. Instead, you are speculating on the rise or fall of the price of a crypto asset in the future. When you close your position you will either make a profit or a loss (P&L).

There is no guidance from the ATO on how this P&L should be taxed. However, as you only realize a gain or loss when you close your position, it's likely any profit would be subject to Capital Gains Tax.

Note: If you're using Koinly to calculate your taxes then you can control how the P&L is taxed on the Settings page.

NFT taxes Australia

NFTs are another area of crypto which have exploded in the past year. The ATO considers NFTs to be crypto assets in the same way other cryptocurrencies are, therefore they will also be considered a CGT asset for investors. This means NFTs will be subject to the same tax rules as other crypto assets. The tax treatment of the NFT will depend on your facts and circumstances including whether you are carrying on a business or are an investor.

Creating and selling NFTs

INCOME TAXThe tax implications of creating and selling NFTs will all depend on whether you're seen as partaking in a hobby, acting as an individual investor, or running a business. If it's the latter, this is akin to creating and selling any other product and therefore qualifies as business income which will be subject to Income Tax. You should check with a qualified accountant to see how the ATO may view your activities and the tax implications.

As well as this, farming NFTs for a staking reward will likely be considered to be income in the same way DeFi staking rewards would be.

Buying, selling, and trading NFTs

CAPITAL GAINS TAXFor those not deemed to be traders, you'll pay Capital Gains Tax when:

1. Buying an NFT with cryptocurrency: Capital Gains Tax due on any profit made on the cryptocurrency disposed of (unless this qualifies as personal use asset in which case no CGT will be due).

Selling an NFT for cryptocurrency or fiat currency: Capital Gains Tax due on any gain made on the NFT investment.

2. Swapping an NFT for another NFT: Capital Gains Tax due on any gain made from the NFT disposed of.

DeFi crypto taxes Australia

The ATO has at long last released guidance on the tax implications of DeFi transactions for Australian investors.

The guidance states that DeFi transactions may result in both Capital Gains Tax events or assessable income, depending on the nature of the transaction.

If you’re lending, or participating in liquidity pools, the ATO guidance treats this as a crypto to crypto transaction and any gain is subject to Capital Gains Tax.

Meanwhile, when it comes to DeFi rewards and other transactions where you're earning new tokens, this will be taxed similarly to interest income and the market value of the token(s) is assessable income.

Finally, for wrapped tokens, the ATO is clear that wrapping your crypto is a Capital Gains Tax event and any gain is taxable.

It's a confusing stance, as when it comes to wrapping, wrapped BTC and BTC are the same underlying asset so there is a question as to whether there is an economic disposal and therefore whether capital gains should be calculated when exchanged. This is particularly true when in practice, wrapping is often used to allow transactions on non-native blockchains to reduce fees - for example bidding for NFTs.

Earning interest from DeFi protocols: Income Tax if you earn new coins. Capital Gains Tax if you accrue value on LP tokens.

Borrowing from DeFi protocols: Likely no tax unless you receive tokens in return for collateral.

Paying interest in DeFi protocols: No tax unless you're paying in crypto, in which case, potentially Capital Gains Tax.

Selling or swapping NFTs: Capital Gains Tax, although if you're selling NFTs as a trader, this could be viewed as additional income, and Income Tax would apply.

Buying NFTs: Capital Gains Tax (if you buy with crypto - which is the only option for most). Tax free if you buy with AUD.

Staking on DeFi protocols: Income Tax if you earn new coins or tokens. Capital Gains Tax if tokens accrue value.

Yield farming DeFi protocols: Income Tax if you earn new coins or tokens, Capital Gains Tax if your tokens instead accrue value.

Earning liquidity tokens from DeFi protocols: Income Tax or Capital Gains tax depending on whether you're earning new coins or increasing the value of one asset.

Adding liquidity to liquidity pools: Capital Gains Tax if you receive a token in exchange for your liquidity.

Removing liquidity from liquidity pools: Capital Gains Tax if you exchange a token to remove your liquidity.

Earning through play/engage to earn DeFi protocols: Income Tax.

Profits from DeFi margin trading and options protocols: Capital Gains Tax.

We recommend speaking with an experienced crypto accountant for clear guidance on DeFi tax to remain compliant.

Earning from DeFi protocols

INCOME TAXEarning new coins or tokens from DeFi? Anytime you're seen to be 'earning' from DeFi - whether that's new coins or tokens - the ATO views this as assessable income and you'll pay Income Tax based on the fair market value of the assets in AUD on the day you received them.

Selling or swapping tokens on DeFi protocols

CAPITAL GAINS TAXAnytime you sell or swap a coin or token on a DeFi protocol, this is viewed as a disposal from a tax perspective, making any gain subject to Capital Gains Tax. You'll pay tax on any profits as a result of a disposal.

Participating in an ICO/IEO

CAPITAL GAINS TAXICOs (Initial Coin Offerings) or IEOs (Initial Exchange Offerings) refer to a situation where investors can purchase tokens/coins in a yet-to-be-released cryptocurrency/company. This purchase usually happens via an existing cryptocurrency like Bitcoin or Ethereum.

From the ATO's perspective, this amounts to a crypto-to-crypto trade. The taxable event is triggered on the date of the ICO transaction when you receive the new tokens. When you sell the new tokens at a later date, the cost base of that transaction will be the value of the cryptocurrency that you paid for it on the date of the ICO/IEO.

Signup & referral bonuses

INCOME TAXAny crypto you get in return for signing up or referring users to a service is taxed as Income. Referral bonuses are akin to the concept of commission.

Getting paid in Bitcoin

INCOME TAXWhether you are freelancing or working for a company that pays employees in crypto, you can't escape Income Tax.

Any coins received as income are taxed at market value at the time you received them so make sure you declare this income on your annual tax return or you might end up facing the tax hammer.

If an employee has a valid salary sacrifice arrangement with their employer to receive cryptocurrency as remuneration instead of Australian dollars, it is considered a fringe benefit.

Spending crypto

The ATO has some very specific rules on when spending crypto is subject to tax and tax free.

Spending crypto that is not a personal use asset

CAPITAL GAINS TAXGenerally, spending crypto is a disposal and any gain subject to capital gains tax. The only exception is if your crypto is a personal use asset.

EXAMPLE

Jasmine has been regularly keeping cryptocurrency for over six months with the intention of selling at a favourable exchange rate. She has decided to pay for new furniture with some of her cryptocurrency. Because Jasmine used the cryptocurrency as an investment initially, the cryptocurrency - and its disposal - is not a personal use asset.

Spending crypto as a personal use asset

TAX FREEThere is a specific rule that means you may be able to spend crypto tax free if it’s considered a personal use asset. You can learn about when crypto may be a personal use asset in our personal use asset guide.

EXAMPLE

Steve needs a new hoodie. His favourite store offers discounted prices for payments made in cryptocurrency. Steve pays $120 to acquire cryptocurrency with the intention to use the cryptocurrency to pay for the hoodie on the same day. Under the circumstances in which Steve acquired and used the crypto, the cryptocurrency is a personal use asset and thus does not attract Capital Gains Tax.

Spending crypto with gift or debit cards

CAPITAL GAINS TAXThe ATO just released more guidance on spending crypto with a gift or debit card specifically. The guidance states when you buy or load cards with crypto, it's considered a sale of your crypto and as such, Capital Gains Tax will apply to any gain.

Gambling and crypto winnings tax

TAX FREEThe ATO released guidance clarifying that prizes and winnings in crypto from lotteries, game shows, and so on, are not considered ordinary income. You should however keep records of the fair market value of any crypto winnings so you know your cost base if you later dispose of your crypto by selling, swapping, spending, or gifting it as any gain from a disposal would still be subject to Capital Gains Tax.

Business and trader taxes

Buying and selling crypto as a business

INCOME TAXIf you are a trader and you hold crypto for sale or exchange in the ordinary course of your business the trading stock rules apply, and not the CGT rules. This means the crypto you buy and sell is viewed as trading stock. Trading stock rules bring to account the tax value of the stock at the year's end. Profit from the sale of cryptocurrency held as trading stock in a business is ordinary income. The cost of acquiring cryptocurrency held as trading stock is deductible as a business tax deduction.

Examples of businesses that involve cryptocurrency include cryptocurrency trading businesses, cryptocurrency mining businesses, and cryptocurrency exchange businesses (including ATMs).

EXAMPLE

Jake runs a crypto trading business. On the 15th of November 2017, he bought 1,500 Bitcoin for $150,000. On the same day, he sold 1,000 Bitcoin for $200,000.

As Jake holds the cryptocurrency for sale or exchange in the ordinary course of his business, for the income year 30 June 2018, Jake can claim a deduction of $150,000 for the acquisition of his Bitcoin and declare income of $200,000 for the later sale of his Bitcoin and includes $50,000 being the value of Bitcoin on hand as assessable income in respect of the unsold bitcoin.

Crypto SMSFs

CONCESSIONAL TAX RATECapital gains on cryptocurrencies sold from an SMSF are taxed at a concessional rate of 15%, provided the fund is a ‘complying fund’ that follows the laws and rules for SMSFs. You can learn more in our Crypto SMSF Guide.

DAO taxes

A recent trend in crypto is the growth of DAOs (Decentralised Autonomous Organization). They are effectively member-owned communities without central leadership. It’s an organisational structure that allows stakeholders to make governing decisions without the need for any kind of centralised authority. Instead of a small Board of Directors making decisions about the company, DAOs enable the community of token holders (members) to vote on the future of the organisation.

A good example of this is Uniswap. Holders of UNI tokens vote on issues relating to the protocol - for example, how transaction fees are used and what new features to add.

Members of a DAO can profit from the DAO in various ways. For example, they might receive a share of the profits which result from the activities of the DAO or they might sell their DAO tokens to investors.

The ATO has no specific guidance on the taxation of DAOs. As DAOs are a complex and evolving area, it is advisable to speak with an accountant or tax lawyer if you are engaging with DAOs.

What crypto records will the ATO want?

The ATO requires you to keep detailed records of cryptocurrency transactions for 5 years after you 'prepared or obtained the records', or “completed the transactions or acts those records relate to”, whichever is later.

The ATO recommends using an Australian tax-compliant app like Koinly for record-keeping, "You can use an accountant or third-party software to help meet your record-keeping obligations and working out your tax."

How to report your crypto taxes

The ATO wants to know about your crypto activity in terms of income and capital gains. You'll need to declare both in your Annual Tax Return in the same way you report your regular income, gains, and losses.

Read next: How to do your Binance Australia taxes with Koinly

When to report your crypto taxes

The Australian tax year runs from 1 July - 30 June the following year. If you are an individual lodging your own tax return for 1 July 2023 – 30 June 2024, the tax deadline is 31 October 2024. Lodging through an accountant? You have until 15 May the following year to file.

Crypto cost basis method Australia

As an investor, you can use either FIFO, HIFO, or LIFO to calculate capital gains, as long as you can individually identify your cryptocurrency assets.

When Koinly calculates your crypto taxes for you it will use FIFO as a default - but you can change your cost basis method to other ATO-approved methods in settings.

How to calculate your crypto taxes with Koinly

Don't get stuck in the busy work. Don't get it wrong. Don't rely on your accountant to know where to look. Use Koinly to generate crypto tax reports. Here's how easy it is:

Select your base country (Australia) and currency (AUD).

Connect Koinly to your wallets and exchanges. Koinly integrates with Binance, CoinSpot, CoinJar, Kraken, Swyftx, and 750+ more. (See all)

Let Koinly crunch the numbers. Make a coffee.

Ta-da! Your data is collected and your full tax report is generated! See a sample report for Australian taxpayers.

To download your crypto tax report, upgrade to a paid plan from $59 per year.

Send your report to your crypto accountant (find one here) or complete your ATO submission yourself using the figures from your Koinly report.

How to file your crypto taxes

Whether you're filing with MyTax or with paper forms, we've got you covered.

How to file crypto taxes with myTax

Once you or your accountant have calculated your crypto tax totals, the easiest way to file your taxes in Australia is online using myTax, available from your myGov dashboard.

See our step-by-step instructions on how to file crypto taxes with myTax.

How to file crypto taxes with paper forms

You also have the option of declaring your crypto activity on paper and returning the forms by mail. You'll need 2 forms, one for income, and one for capital gains.

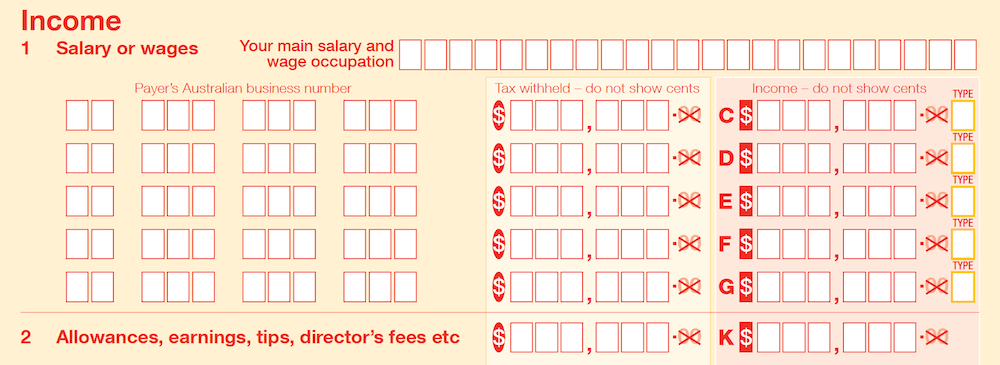

Crypto income is declared on question 2 of tax return for individuals (NAT 2541).

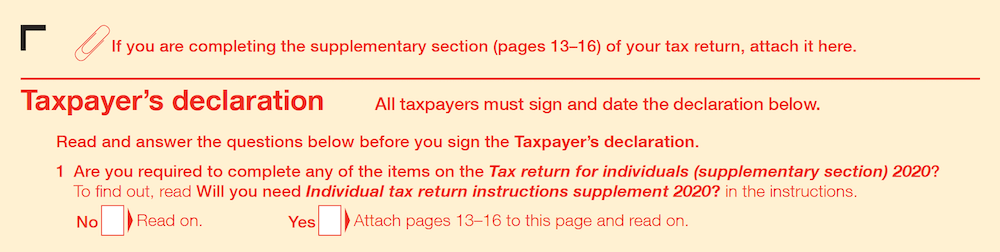

Crypto Capital Gains: You'll need to select YES on question 1 of the Taxpayer's Declaration on your tax return for individuals form (the form used for income tax).

Crypto Capital Gains: You'll need to select YES on question 1 of the Taxpayer's Declaration on your tax return for individuals form (the form used for income tax).

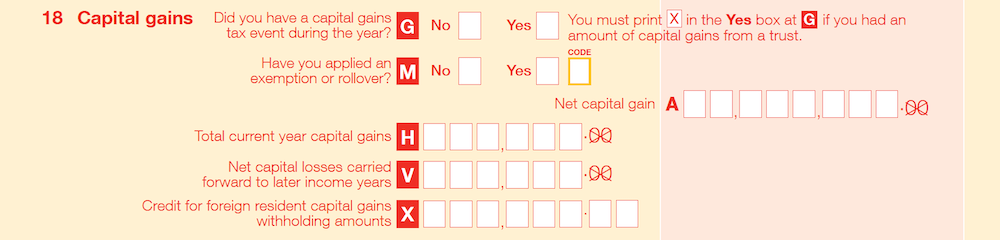

Next, complete question 18 of the Tax return for individuals (supplementary section) (NAT 2679).

Next, complete question 18 of the Tax return for individuals (supplementary section) (NAT 2679).

If you made a gain: Report the total amount under the 18H ‘Current year capital gains’ label on your tax return.

If you made a loss: Enter your total capital loss in the 18V ‘NET capital losses carried forward to later income years’ label.

This final amount is reported at the 18A ‘NET capital gain’ label

If you've earned more than $10,000, you must also complete the Capital Gains Tax Schedule.

If you've earned more than $10,000, you must also complete the Capital Gains Tax Schedule.

What if I can't afford my crypto tax bill?

First and foremost, don't just avoid the ATO and hope you can get away with not declaring your crypto. The penalties are far more severe for tax evasion than they are for filing late or being unable to pay your crypto tax bill in one.

The ATO offers a lot of support for taxpayers unable to pay on time, including payment plans. They even have a tool to help you create a payment plan you can afford and see how much interest you may be charged. It's best to speak to the ATO early if you know you'll be unable to pay on time to get the best payment plan possible. Find out more.

Who can help you calculate your crypto tax?

Crypto tax reporting is fairly new, and a road less traveled for most accountants. That doesn't mean the ATO is going to cut you any slack. Here are 3 ways you can tackle your crypto taxes and stay in the taxman's good books. We'll start with the easiest and most accurate method first.

Use crypto tax software like Koinly to create a crypto tax report of crypto activity, in a template that fits your country's tax regulations. Send the report to your accountant to complete your tax return for you. This is a smart move especially if you have DeFi earnings to consider.

Use a crypto tax calculator like Koinly to create a crypto tax report of crypto activity. Add the necessary data from your Koinly crypto tax report to your tax return and file it yourself online with myTax.

Get your accountant to work out your crypto activity by supplying transaction histories, statements, and potentially historic cryptocurrency-to-AUD conversions. Let them work it out and the file for you. Be warned - this will be a lengthy and expensive exercise.

How to pay less tax on cryptocurrency in Australia

Want to avoid tax on crypto? Well, you can't swerve your tax obligations entirely - but there are quite a few ways you can optimise your tax position before the end of the financial year to pay less tax overall.

Deducting Cryptocurrency Losses & Trading Fees

The first step towards minimising your tax liability is figuring out what losses and expenses you can offset against your taxable income. In order to do this, you first need to figure out whether you will be classified as someone who holds crypto as an investment or whether you're carrying on a crypto trading business.

Crypto trading or cryptocurrency used in business

If you're running a crypto business - be it mining, trading, or exchanging, you can claim a tax deduction for most expenses from carrying on your business, as long as they are directly related to earning your assessable income. Provided that you pass the ATO's non-commercial losses rules - which means that you're running a legitimate business.

If you hold cryptocurrency for sale or exchange in the ordinary course of your business the trading stock rules apply, and not the CGT rules. Gains from the sale of cryptocurrency held as trading stock in a business are ordinary income and the cost of acquiring cryptocurrency held as trading stock is deductible.

Also, keep in mind that the crypto you own at the end of the year is your trading stock and you have to declare its value as part of your assessable income. Check out 'simplified trading stock rules' if your turnover is under $10 million. Interestingly, you can declare the value of your crypto stock at either cost, market, or replacement value, which gives you some flexibility in terms of tax planning.

Deducting cryptocurrency mining expenses

This depends on whether you undertake mining as a business or a hobby; this can be done by looking through the Are-you-in-business section on the ATO website.

Australian Bitcoin ETFs

On 27 April 2022, a Bitcoin exchange-traded fund (ETF) launched, which can be a tax-efficient way to gain exposure to Bitcoin. ETFs track the price of Bitcoin and are aimed at individuals who wish to invest in Bitcoin without having to deal with the security and technical aspects of self-custody.

Many Bitcoin ETFs pay their investors in the form of dividend distributions so if the newly created Australian ETFs emulate this strategy, then Australian ETF investors can gain tax advantages in the form of franking credits (subject to qualifying person rules).

Franking credits arise for shareholders when certain Australian resident companies pay income tax on their taxable income and distribute their after-tax profits by way of franked dividends. These franked dividends have franking credits attached.

If an Australian company tax is already paid by the companies within an ETF, then investors don’t need to pay those taxes again at the personal level. The corporate taxes paid are passed down to the Australian investor through franking credits. These franking credits can then be used to reduce an investor’s total tax liability.

Hold onto an asset for more than 12 months

As mentioned above, you are entitled to a 50% discount on capital gains if you hold an asset for more than 12 months. So before disposing of an asset, it could pay to check how long you have held it for - if it’s close to the 12-month threshold, you could save a lot of tax by simply holding off the sale until 12 months have passed.

Offsetting your capital gain with capital losses

Capital gains from current or prior years can be used to reduce a capital gain and therefore the amount of CGT you need to pay. So always remember to report your losses - just because you don’t have tax to pay doesn’t mean you should ignore reporting these - these losses can help you in the future.

Donate your crypto to charity

You can claim an income tax deduction for gifts or donations of crypto to organisations that have the status of deductible gift recipients (DGRs). You can check the DGR status of an organisation at ABN Look-up: Deductible gift recipients

The deduction you are entitled to is equal to the market value of the crypto at the time of the donation. You will also not have to pay any capital gains taxes as a donation to a DGR is not considered to be a taxable event.

Koinly Plan

The cost of your Koinly plan can be listed as a business expense. This would go under 'other expenses'. For individuals, the cost of your Koinly plan may be deductible as ‘expenses you incur in managing your own tax affairs’

Watch out for warning letters

In 2021, the ATO issued a reminder to Australian crypto investors to report all gains on their tax returns. Approximately 100,000 taxpayers will receive a warning letter outlining their obligations and asking them to review their previously lodged returns. A further 300,000 people were prompted by pop-ups, as they lodged their 2021 tax return on myTax. To determine tax liability, the ATO is collecting data from crypto exchanges and comparing it to amounts entered on previous tax returns.

Failure to declare crypto gains can attract a penalty of 75% of the outstanding tax liability, plus the tax itself and interest on the shortfall. Read the full press release here.

In 2023, many investors received crypto notices from the ATO again - advising them to disclose any crypto transactions and amend their tax returns.

Read Next: Received a letter from the ATO? Do this now.

Your frequently asked questions

Can you claim crypto losses on taxes in Australia?

Yes (though it depends on the type of loss). If you've disposed of your crypto and made a loss, you can offset this against your gains. But if you've lost crypto due to the loss of private keys, a hack, or due to a collapsed exchange - it's not quite as clear cut. You can learn more in our blog Is Lost Crypto A Capital Loss?

Is there a Bitcoin tax in Australia?

Bitcoin is taxed the same way as other cryptocurrencies in Australia. That means it may be subject to Capital Gains Tax or Income Tax depending on your specific transactions.

Do you have to pay tax on crypto in Australia?

Yes. The ATO is clear you should pay Capital Gains Tax or Income Tax on cryptocurrency in Australia depending on your transactions.

How does Capital Gains Tax work in Australia?

There are two kinds of Capital Gains Tax in Australia - short-term Capital Gains Tax and long-term Capital Gains Tax. For assets, including crypto, you've held less than a year, you'll pay the short-term Capital Gains Tax rate which is the same as your Income Tax rate. For assets, including crypto, you've had more than a year, you'll receive a 50% discount and pay much less tax.

Does the tax free gift limit apply to crypto in Australia?

No. The tax free gift limit in Australia applies to cash, not property. As crypto is classed as a property for tax purposes in Australia, gifting crypto is a disposal and therefore subject to Capital Gains Tax.

Is swapping crypto taxable in Australia?

Yes, the ATO is clear that swapping one crypto for another - whether that's NFTs, stablecoins, or tokens - is viewed as a disposal of an asset and as such, any gain from trading one crypto for another is subject to Capital Gains Tax.